G0d4ather/iStock via Getty Images

Thesis

The credit markets are in full-fledged panic mode – wide bid/ask spreads, thin liquidity, yields shooting higher for even the best credits (you can now pick up 3-year mint BB companies bonds for 7%+ yields) and nobody is buying. Have we seen this picture before? Yes, it was March 2020 and bid/ask for HY went to 7 even 10 points – bid/ask !!! Today’s market is a bit more functional but still exposes the same issue – herd mentality and propensity for everybody to exit through the same narrow door. The massive shift in the HY market from an over the counter traded segment to the exchange traded bond ETFs that require constant liquidity and marks has created a herd mentality and propensity for items to gap down. High yield does not trade in size and when everybody tries to liquidate it puts undue pressure on the underlying bonds.

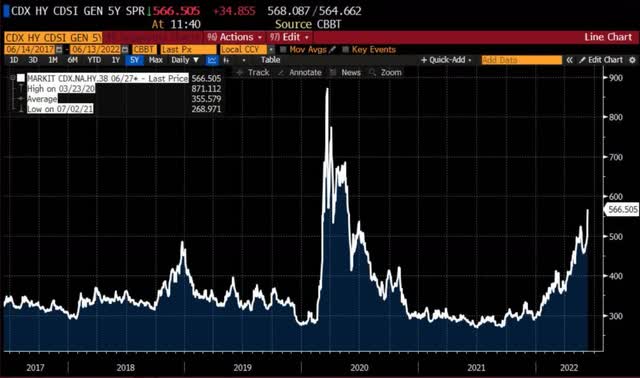

We are not arguing by any metric that a recession is not coming. It is. The Fed has made sure of that. If they cannot fight oil and agricultural commodities prices then they will slash the demand side of the equation by creating a mild recession. However, we also strongly feel the corporate balance sheets are in much better shape today than 3 years ago and the debt maturity wall that during other periods of time might be of concern is not an issue this time around. A debt maturity wall is the structural issue associated with a high amount of debentures coming due in the short term, thus hampering the ability of all market participants to refinance debt. With 5-year HY CDS levels closing in on their 2020 levels (600bps now vs. 700 to 900 in the midst of the Covid crisis) all financial instruments are screaming panic.

We do not think the move is fundamentally warranted and it has more to do with re-balancing and investors shying away from risk in any format. Yes default rates are going to tick up and bankruptcies are going to re-appear but not at the current implied levels. For example, S&P now predicts that the speculative credits default rate could reach 3% by the end of 2023. The market is implying 6% in 2022. Some of the rating agencies offer a tool that gives investors a market implied probability of default. A “live” probability of default (PD) can be extracted from the credit spreads of traded debentures. Utilizing CDS pricing technology a probability of default can be extracted from said levels. Market based PDs have shot up indiscriminately even if fundamentally it is almost impossible for certain companies to go bust. Let us take an example – your current writer holds a 2025 debenture from EnLink Midstream Partners, a natural gas MLP that has been recently upgraded. We will go below in more detail regarding the capital structure of this issuer but the takeaway for the thesis portion of this article is that this particular HY bonds has lost more than 10% of its price in the past 3 weeks, now traded at a 7%+ yield, while fundamentally the company has only improved.

We are not advising to go all-in HY right now via this article, but merely trying to highlight that we have seen this picture before and when panic sets in nobody wants to touch risk, risk gets extremely mispriced and that is when the best buying opportunities reside. Buying opportunities do not reside in the periods when rates are zero and everybody is refinancing at lower rates any all investors pile in HY at ever lower spreads. On that note we feel that investors should start layering into New America High Income Fund (NYSE:HYB) via weekly purchases and set a 3-month time-frame to average into a position into this CEF.

Current Market

As we speak HY spreads are literally blowing up:

From a market implied probability of default we are already in a severe recession that will see annualized default rates above 6-7%.

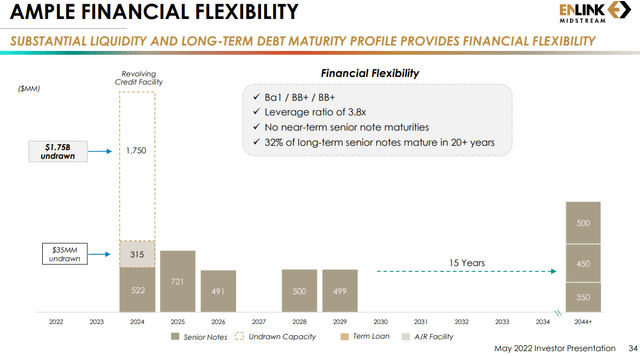

To go back to our single name example, and specifically the EnLink Midstream Partners, 4.15% 1jun2025 bond. This issuance was trading at par around three weeks ago. It is now at roughly 90 cents on the dollar with an implied yield of above 7%. Let us have a close look at the fundamentals of EnLink (ENLC) which has seen a massive benefit to its pipeline business from rise in natural gas prices. Firstly, from a fundamental default perspective let us look at the company’s maturity wall:

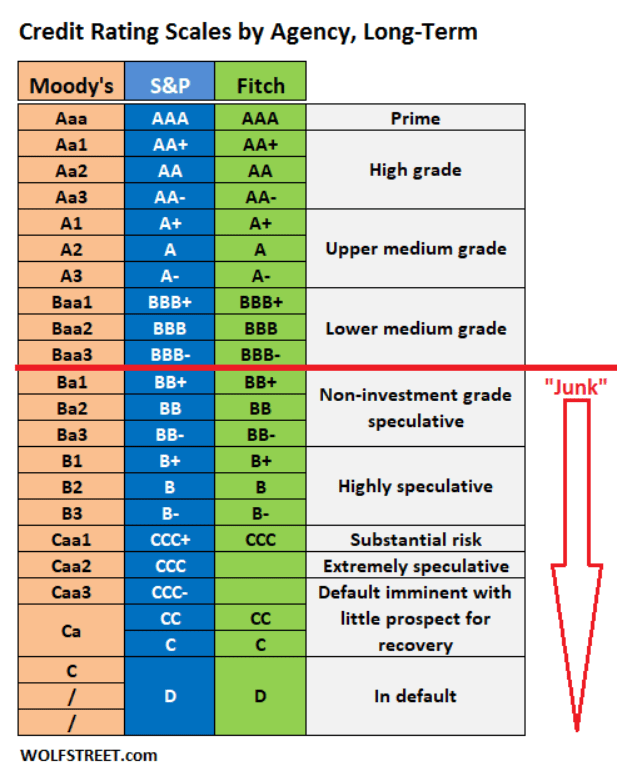

As we can see from a May 2022 investor presentation there is only one slice of debt ahead of the 2025 bonds. The company was upgraded by Moody’s in April 2022 back to a Ba1 rating. The Ba1 rating is the best non-investment grade rating possible:

Ratings (WolfStreet)

The company went from a 4% yield to a 7%+ yield on its 3-year debt. Yes, risk-free rates have risen, but not by 300 bps in the 3-year tenor point. The rest is fear. The company has a massive $1.75 bil unutilized revolver that will get rolled over (as it did during the Covid pandemic nonetheless !) and will easily take out its small 2024 debt piece. Fundamentally, ENLC is set to benefit from the natural gas revolution driven by the Russian invasion of Ukraine and the need for LNG in Europe. That natural gas has to go through some sort of pipes to arrive at an LNG facility!

Is the company sound fundamentally? Yes. Are the fundamentals set to improve? Yes. Is the probability of default for this corporate as high as 21% for the 3-year debt? Absolutely not.

We are witnessing another massive market dislocation, especially for short dated HY debt. Buy funds that invest in short maturity HY. It represents a great value proposition right now:

Holdings

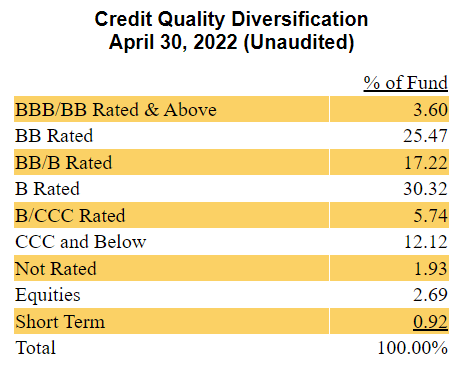

The fund has a bar-belled approach to credits, with a large BB allocation but also a sizable CCC bucket:

Credit Quality (Fund Fact Sheet)

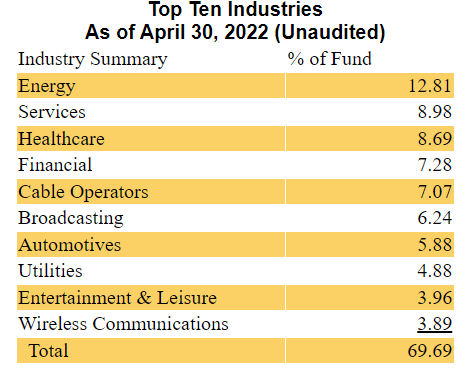

The fund is well diversified across industries:

Industries (Fund Fact Sheet)

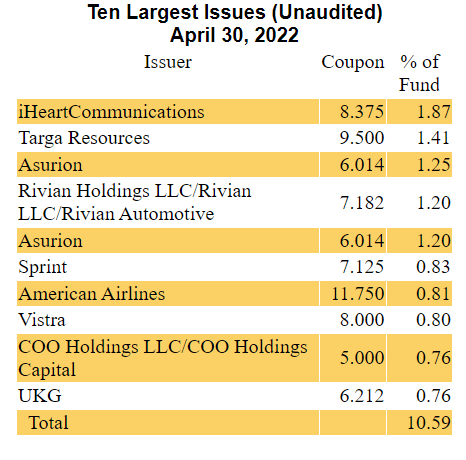

The fund does not expose any issuer concentration either:

Largest Issuers (Fund Fact Sheet)

Conclusion

HYB is a robust HY CEF with low leverage (sub 30%). The fund is currently experiencing a massive re-pricing on the back of higher rates and market avoidance of risk. We took the example of a very robust HY issuer (EnLink) and saw how short dated bonds have collapsed in price with no fundamentals behind it. Credit spreads are repricing higher while fundamentals are not deteriorating for many credits. It is an ideal time to start layering into HY credits on the back of a mild recession ahead of us induced by the Fed and credit spreads which are pricing very severe corporate defaults.

Be the first to comment