RiverNorthPhotography/iStock Unreleased via Getty Images

Introduction

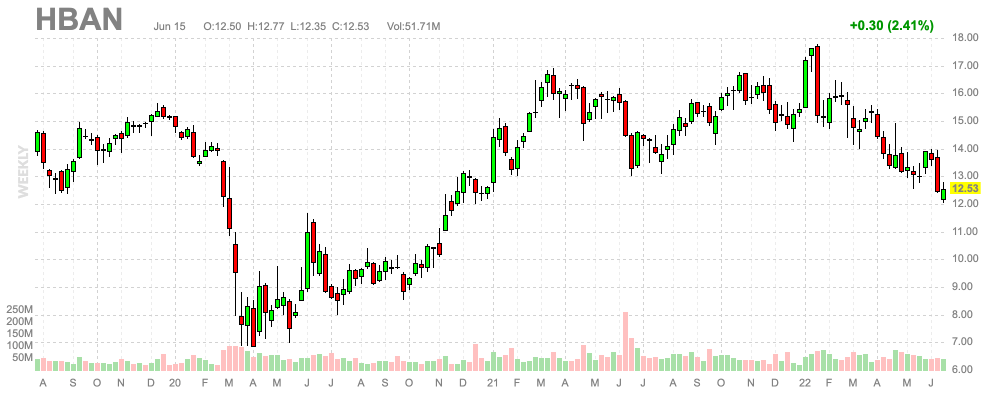

On March 10, 2022, I wrote my most recent article covering my only banking stock, Huntington Bancshares (NASDAQ:HBAN). As much as I liked the bank, I recommend investors to stay away:

[…] my advice will be to not allocate money to HBAN for the time being. It’s not worth it for the yield alone.

I would like to see the price between $12-$13 to advise people to buy. That would make the risk/reward better and lift the yield to more attractive levels.

Thanks to the market selloff, HBAN is now down 20% year-to-date, which puts the price right in the middle of my target range.

FINVIZ

Not only that, but also the stock’s valuation is now attractive, giving us a risk/reward that makes sense for an entry and/or additional buys to expand existing positions.

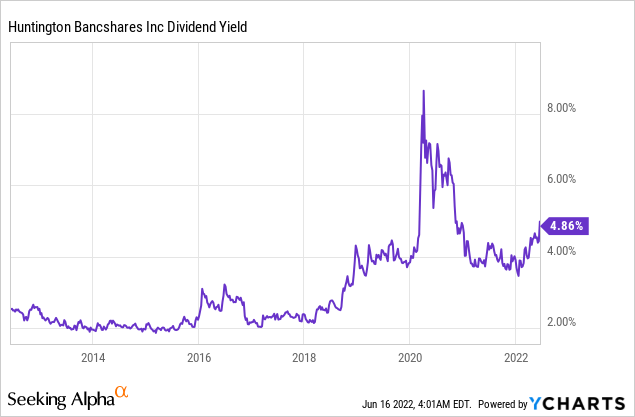

The best thing is that HBAN is now yielding 4.9% again. While dividend growth has been a big disappointment since the pandemic, the company is one of my favorite banking stocks. Its business model is solid and further improving, investors and traders have priced in a lot of weakness, and management upgraded guidance.

In this article, I will discuss all of these things from a dividend investor’s point of view.

So, bear with me!

A Decent Dividend Scorecard – With One Flaw

The article I referred to in the introduction was titled “Why I’m Not Selling Huntington Bancshares”. Basically, I considered selling my only bank holding as dividend growth was slow and because it’s a high-yield play with subdued capital growth expectations. Generally speaking, I try to avoid these companies.

However, a healthy mix between high(er) growth and high(er) yielding stocks makes sense. That’s exactly where HBAN shines.

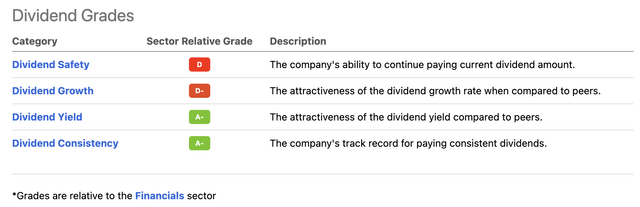

Starting with the dividend scorecard below – provided by Seeking Alpha – we see that the company scores high on dividend yield and dividend consistency. In both categories, the company is among the leaders compared to its financial sector peers. Dividend safety and dividend growth, however, show two ugly grades.

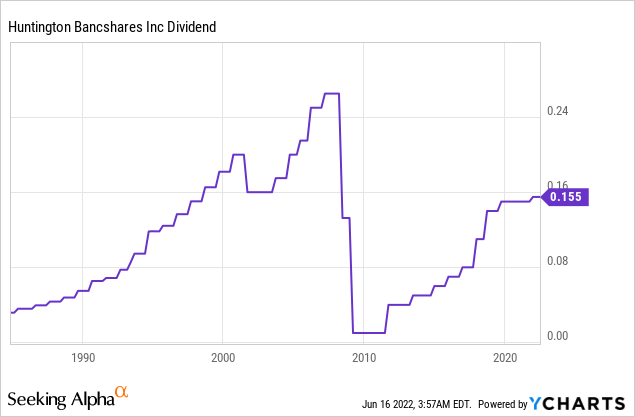

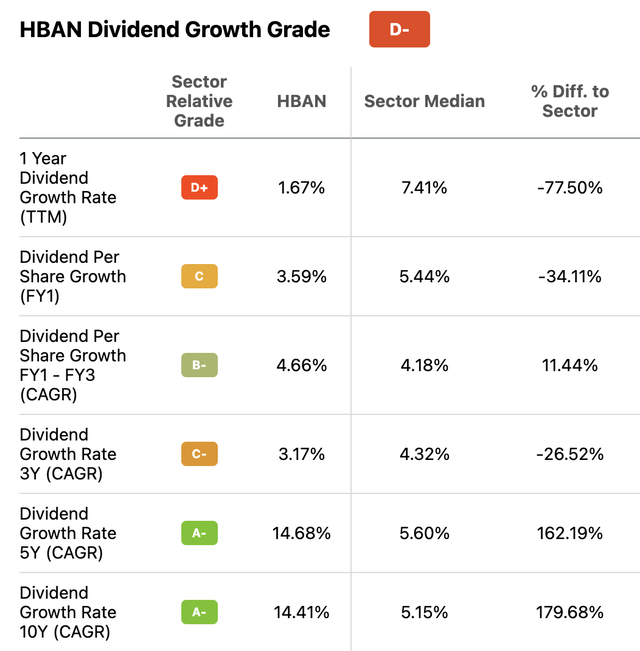

When we dig a bit deeper, we see that this ugly grade is mainly based on shorter-term dividend growth. Over the past 10 years, the annual average dividend grade was 14.4%, which is roughly 180% above the sector median of 5.2%. Bear in mind that we’re dealing with a stock that pays $0.155 per share per quarter. That’s $0.62 per year, or 4.9% of the current stock price. A 10% annual hike adds at least another 40-50 basis points to your yield on cost. That’s a huge deal.

Unfortunately, we haven’t seen double-digit growth in a while. Over the past few years, dividend growth has slowed significantly. Since the start of the pandemic, the company has hiked just once. On October 22, 2021, the company announced a 3.3% hike to the aforementioned $0.155 per share per quarter.

With that in mind, there’s plenty of good news for long-term investors. First of all, the basis for future dividend growth is great. The current 4.9% yield is one of the highest in modern history, ignoring the pandemic selloff that briefly pushed the yield above 8%.

Even Goldman Sachs came out making Huntington a “top sector pick” for high dividend growth and yield, as reported in early May.

While the economy and markets have changed since then, I like the company’s recommendation:

“We continue to recommend investors own stocks with high dividend yield and growth,” he added. “Dividend stocks currently trade at attractive valuations and have historically outperformed during periods of elevated inflation.”

With that said, the valuation is indeed attractive as the company continues to perform rather well.

Huntington Bancshares Is Attractively Valued

The thing about high-yield stocks with rather slow capital gains is that finding a good entry is so important. First of all, the higher the yield, the bigger the impact of dividend growth. When yields hover between 4% and 5%, the impact of dividend growth is high, as I briefly showed in this article. Moreover, getting additional capital gains potential really makes a difference in the long-term as well.

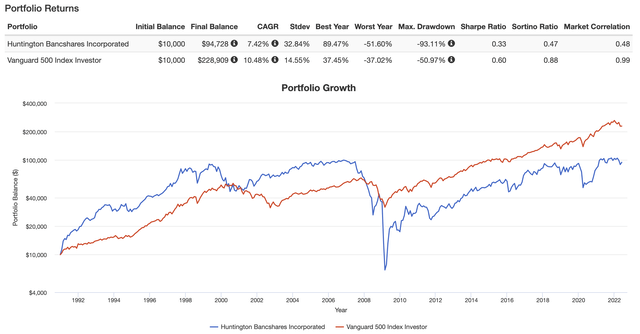

With that said, on a long-term basis, the relative performance of HBAN is abysmal. Going back to 1990, the stock has returned 7.4% per year. The S&P 500 has returned 10.5%. That’s not the worst performance. However, it includes dividends, and it comes with a 32.8% standard deviation. This lowers the Sharpe ratio (volatility-adjusted performance) to 0.33. That is an abysmal number.

The reason for that performance is obviously the Great Financial Crisis, which did a number on financial stocks. It caused the bank to fall by 93%. That really impacts the long-term returns.

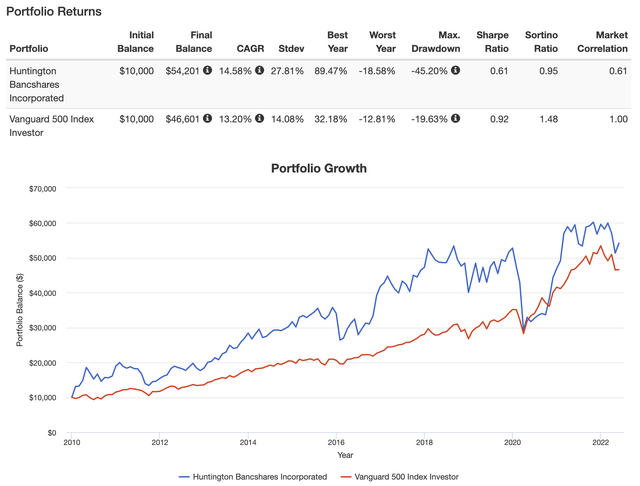

Going back to 2010, the Sharpe ratio is still worse, yet now, investors are outperforming the market – despite a number of steep drawdowns. The stock always bounces back quickly, causing the 2010-2020 total return CAGR to come in at 14.6% – beating the S&P by a bit more than 100 basis points.

If we exclude any future financial catastrophes that may push banking stocks down 90%, HBAN does deliver good returns, although investors absolutely need to be aware that this comes with significant volatility.

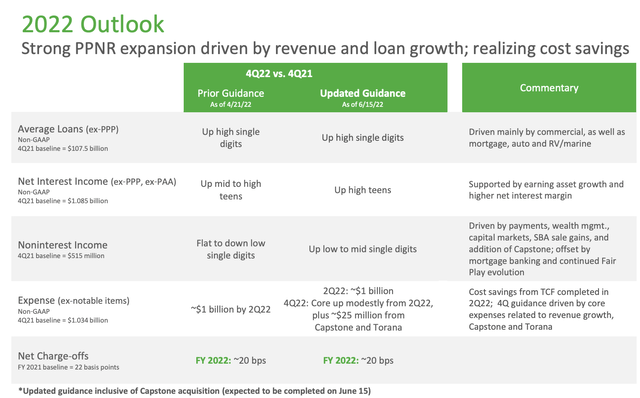

Now, with that said, the company is making good progress. In a recent presentation published on June 15, 2022, the company updated its investors. This included a strategic update.

- The company’s cost savings were fully realized in 2Q22 after the acquisition of TCF. Moreover, the company is seeing a “continued path to sequential pre-provision net revenue growth, supported by executing on priorities and achieving TCF cost savings as expected.”

- The company is poised to benefit from the yield curve and growing net interest income thanks to higher rates.

- HBAN is seeing modest growth in deposits with stronger growth in fee income, including payments, capital markets, and wealth management.

On June 15, the Capstone Partners deal closed. HBAN bought one of the nation’s most successful middle-market investment banks – it won the 2022 US Middle Market Investment Bank of the Year award. Capstone covers 12 dedicated industries. It has headquarters in Boston and Denver and 185 employees across 12 offices in the US.

What this mini-Goldman Sachs company does is active sell-side M&A, capital advisory, and financial advisory services. Between 2017 and 1Q22 (annualized), HBAN (ex Capstone) grew capital market fees by 15.8% per year. This year, the company could do $168 million in capital market fees. Capstone adds $96 million to this, which shows the size of the impact on HBAN.

Personally, I’m glad HBAN is going in that direction, as “traditional” banking services are simply not able to deliver high returns.

- Strong credit quality is another tailwind as allowances for loans and leases are at 1.87%, it’s the top quartile of regional banking.

As a result, the company has upgraded its 2022 guidance. Both net interest income and non-interest income are expected to grow faster, thanks to higher net interest margins and better results in wealth management.

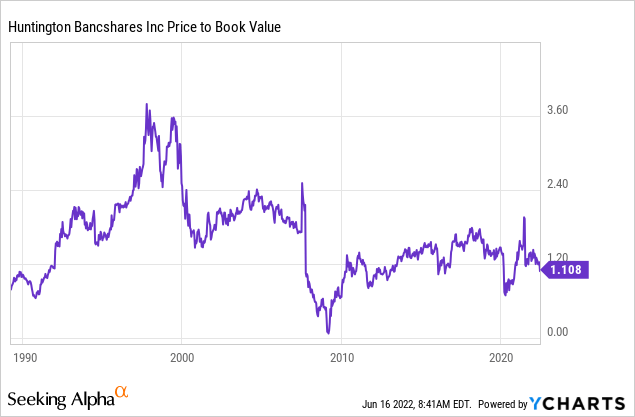

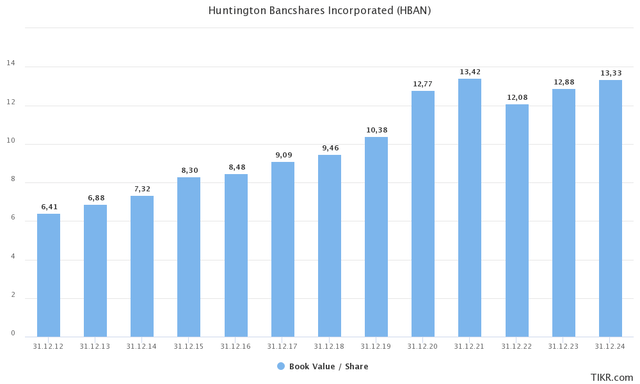

These numbers are a reason for analysts to give the company the following book value per share estimates:

- 2023: $12.88

- 2024: $13.33

The compounded annual growth rate of the book value per share between 2012 and 2024E is 5.8%, which is more than a decent number that supports satisfying dividend growth.

What this means is that HBAN is trading below the expected book value using the $12.60 stock price. HBAN is trading at 0.98x and 0.96x 2023 and 2024 expected book value, respectively.

The median valuation after the banking recovery of 2012 is roughly 1.25x the bank’s book value. This would imply between 28% and 33% upside over the next 1-2 years.

Right now, the stock is down roughly 32% from its 52-week-high, as investors have started to price in weaker economic growth.

With that said, in the past 2 months, the bank has received two underperform ratings with price targets of $15 and $11. I believe that we’re in a situation where analysts have started to downgrade expectations. The bank’s expectations are based on current GDP estimates, which are at 2.3% for 2022 after 5.7% growth in 2021.

Given the economic environment, I believe that GDP estimates will come down in the months ahead. However, I don’t expect that HBAN will continue its severe downtrend. The company has lost a third of its value over the past few months, which means investors are very close to pricing in a recession. This helps the risk/reward, even if some downside is still possible, of course.

Takeaway

I bought HBAN rather cheap in 2020 when I turned bullish on banks given my view on inflation. The bank has been a core holding of my dividend growth portfolio since then. While I’m not that fond of high-yield investments, I like to maintain a healthy mix of growth and high yield in my portfolio.

Huntington Bancshares gets the “high-yield” job done. The company is yielding roughly 5%, it has a history of strong dividend growth that got interrupted by the pandemic and the acquisitions of TCF and Capstone Partners. Both deals allow the company to operate more diversified and more efficiently, which should result in improving dividend growth in the years ahead. On top of a 5% yield, that will likely mean more than decent long-term total returns for investors – even if volatility remains elevated.

Right now, the stock is ignoring the company’s own guidance. While HBAN is expecting better results, the stock is down roughly a third from recent highs as investors and traders are starting to price in a recession.

While there’s nothing positive about a recession, the good news is that a lot has been priced in. Investors who are looking for a decent yield from a company that does come with long-term capital gains can use current prices to initiate a position. The same goes for HBAN investors looking to add some exposure to an existing position.

However, I do not advise new investors to buy a full position right away. High market uncertainty could come with a bit more downside. I would buy 25% now and add gradually over time. That way, lower prices can be used to average down. If the stock were to suddenly take off, investors have a foot in the door.

(Dis)agree? Let me know in the comments!

Be the first to comment