RiverNorthPhotography

Introduction

Huntington Bancshares (NASDAQ:HBAN) just reported its third-quarter earnings. The Columbus, Ohio, based regional bank is the only bank holding of my dividend growth portfolio. I bought the bank in 2020 after the pandemic sell-off as it was part of a project I was working on back then, which was focused on buying undervalued companies. I never sold the stock because I fell in love with its ability to deliver long-term shareholder value through steadily rising dividends and a juicy yield. I covered that in a recent article. In this article, I am going to break down the company’s just-released earnings in light of ongoing macro developments. I was pleasantly surprised as the company beat earnings estimates thanks to strong loan growth, high credit quality, and growth in non-interest income. While the company does acknowledge that its facing macro headwinds, management was quite upbeat, which helped the stock to rally more than 8% after the earnings call.

While the macro environment is indeed challenging, I believe that HBAN remains a great investment whenever the market offers us a new opportunity.

So, let’s look at the details!

A Recession?

The economy is not in a good spot. That’s mainstream news by now, as everyone has witnessed the volatile bear market we have entered this year.

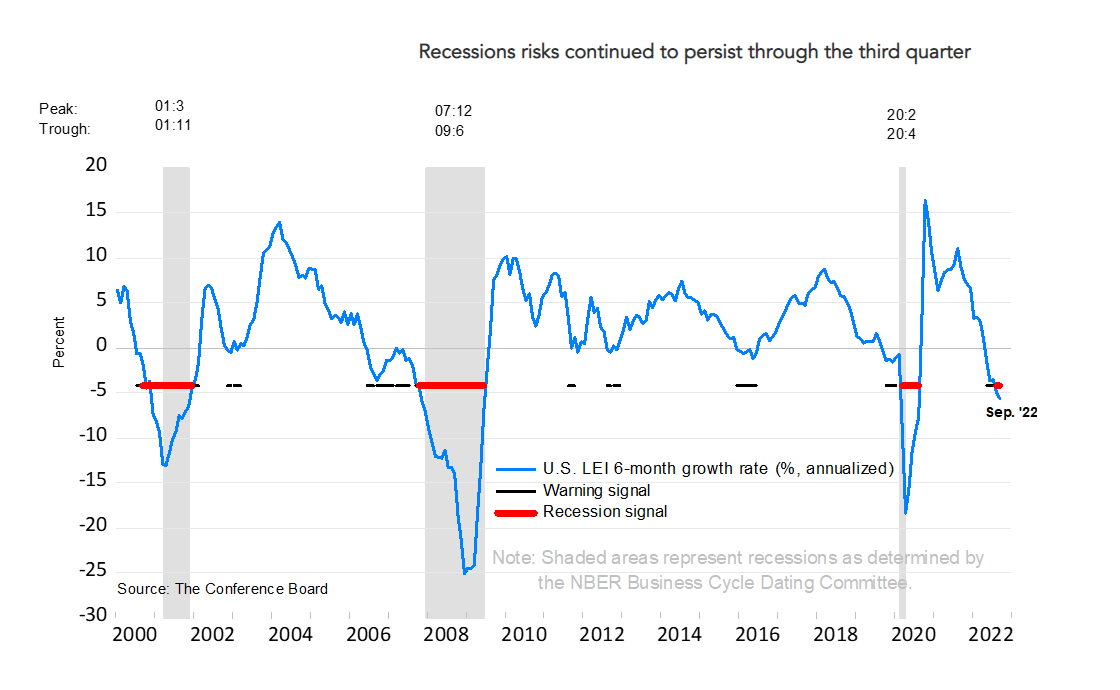

Even the Conference Board, which officially determines when we’re in a recession is now looking at an official recession according to its own model:

The Conference Board

Market participants are dealing with a toxic mix of slowing economic growth, persistently high inflation, and a hawkish Federal Reserve trying to moderate inflation.

That’s toxic because the Fed is tightening as we go into a recession.

This is putting tremendous pressure on the housing market. For example, mortgage rates are now closing in on 7.0%, which is a two-decade high. Meanwhile, US existing home sales have dropped to multi-year lows thanks to the biggest drop since 2007.

Bloomberg

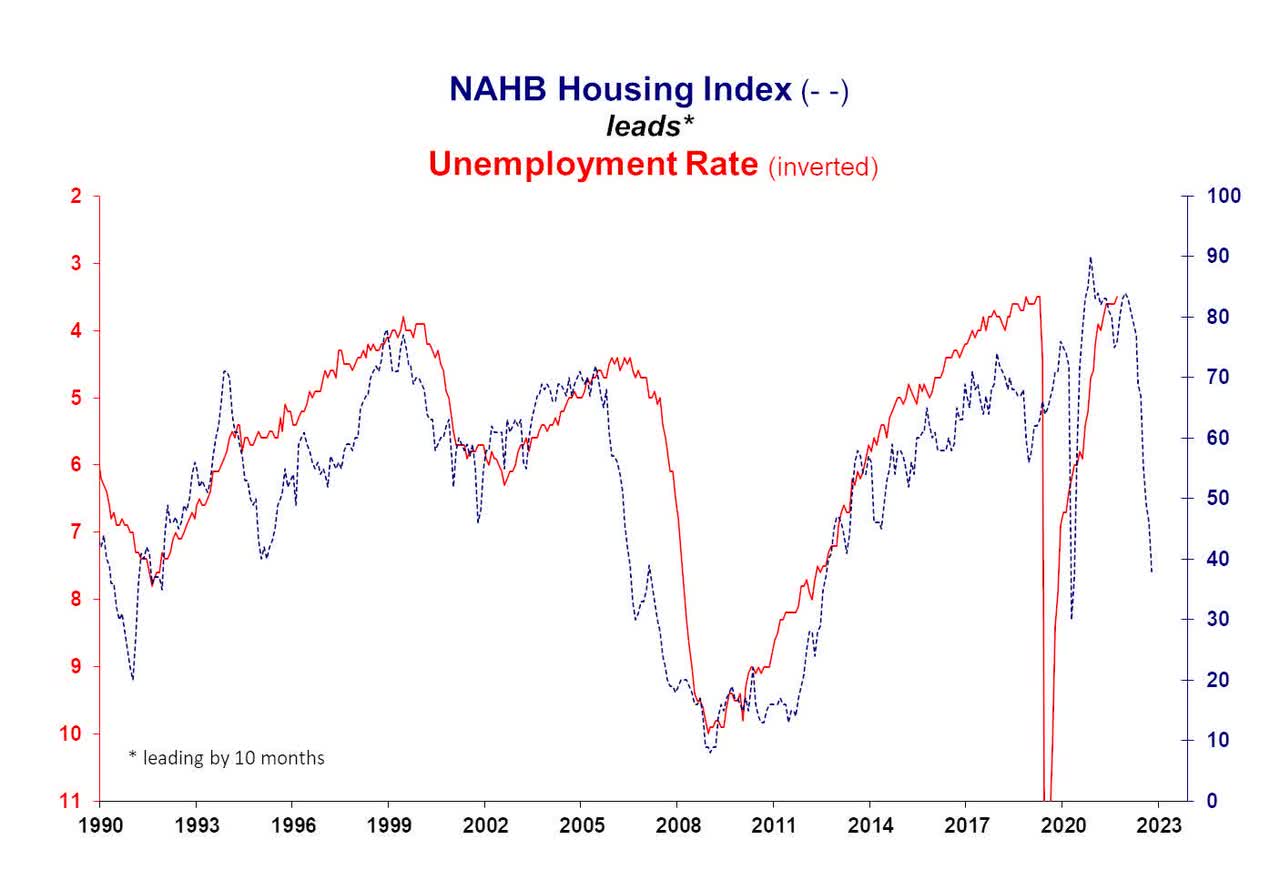

The same goes for homebuilding sentiment, which is – historically speaking – a great indicator of the nation’s unemployment rate as the graph below shows. That makes sense as housing/homebuilding is tied to a wide variety of other economic activities, including but not limited to financing, building materials, construction, furniture, and so much more.

Twitter (Via @spomboy)

Recent academic research looking at home prices and unemployment rates found that:

[…] changes in residential real estate prices do not have a causal effect on unemployment rates in the same quarter. However, it takes 9-12 months for an increase (decrease) in real estate prices to decrease (increase) unemployment rates. This effect is significant during both pre- and post-financial crisis periods and robust to control for the economic characteristics of MSAs.

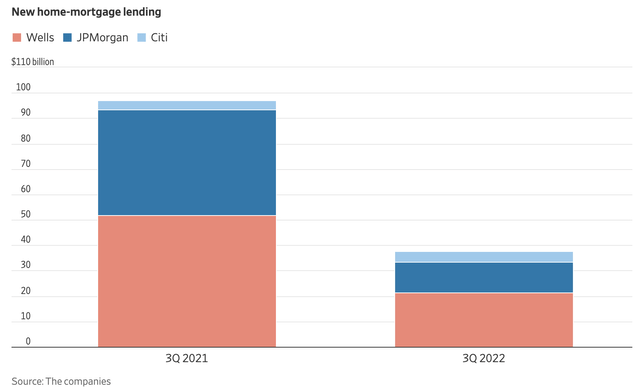

Going into HBAN’s earnings, we got some numbers from other banks. Numbers from the nation’s largest banks show a steep decline in mortgage lending as demand is down and banks are more careful. Hence, further tightening financial conditions.

Wall Street Journal

Mortgage lending is down 60% at Wells Fargo (WFC), down 70% at JP Morgan (JPM), and up 24% at Citigroup’s (C) much smaller mortgage division.

Moreover, as reported by the Wall Street Journal:

– Banks set aside more money to cover future loan losses. Last year, they were drawing down their rainy-day funds

– Consumers leaned more on their credit cards to deal with rising prices and a slide in their savings. Card spending was up by double-digit percentages at JPMorgan, Wells, and Citi.

– Bank executives say they are not seeing cracks in the financial system just yet, but they’re worried. “We’re just getting closer to what you and I might consider bad events,” JPMorgan CEO Jamie Dimon said.

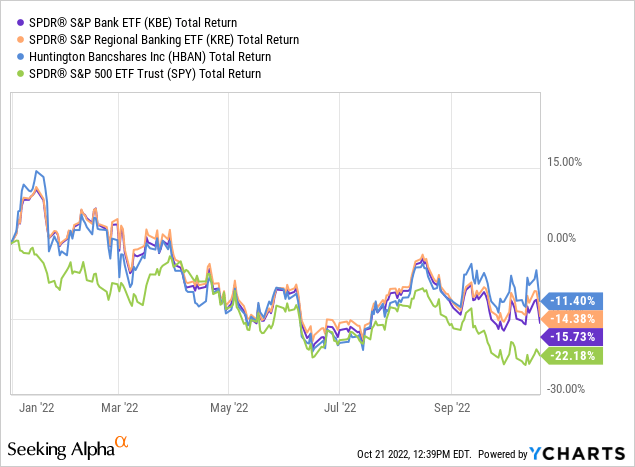

Year-to-date, banks are down 15.7%, which is a bit better than the 22% drawdown of the S&P 500. Regional banks are performing slightly better with HBAN shares outperforming all of them. Not by a lot, but it’s still a difference of at least 300 basis points in 10 months. I’ll take that any day.

With that said, let’s take a closer look at HBAN’s results.

HBAN Did Surprisingly Well

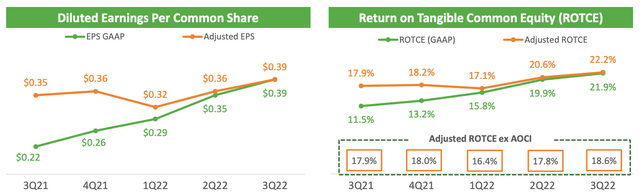

Huntington Bancshares reported a 3Q22 GAAP EPS result of $0.39, beating estimates by a penny. Revenues rose by 11.8% to $1.9 billion, which is roughly what the market was looking for.

Huntington Bancshares

The company has been positioned to benefit from higher interest rates with its asset sensitivity, while growth in its fee income business is also growing.

This also includes the company’s synergy opportunities coming from the TCF acquisition and the acquisition of investment bank Capstone Partners. The company is now in a better spot to use economies of scale while deepening its expertise via enhanced treasury management and capital market capabilities.

HBAN sees that it has the manpower (fully staffed) in key areas like Minnesota and Colorado, where the bank is becoming a top-3 small business lender. The bank is also the fifth-largest bank-owned equipment finance lender. Up from #7 previously.

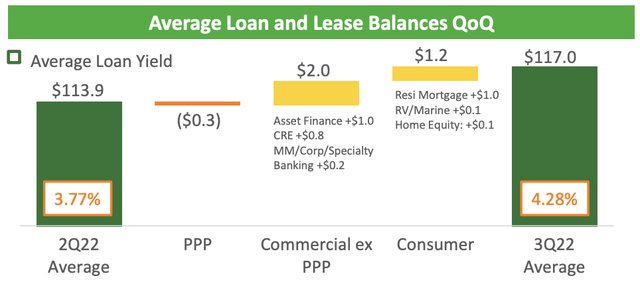

This helped the bank to grow average loans by $3 billion, or 2.6% quarter-on-quarter. Excluding pandemic-related PPP loans, growth is $3.3 billion – or 2.9%.

Total average deposits grew by $1.0 billion, or 0.7% versus the prior-year quarter. Deposits were up 2.6% year-on-year.

What’s interesting is that the company saw strong loan growth in all areas – except for PPP loans, which was expected.

Commercial loans were up $2.0 billion, with strong growth in commercial real estate, asset finance, and related. In the consumer segment, we see that residential mortgage loans were up – not down as I expected.

Huntington Bancshares

According to the bank:

In Consumer, growth was led by residential mortgage, which increased by $1 billion, driven by slowing prepays and higher mix of on-balance sheet loan production. We also saw steady growth in our vehicle finance business.

Total deposits rose by 0.7% quarter-on-quarter and 2.6% year-on-year, thanks to strong growth in the commercial segment. Consumers withdrew accounts, which fell by 1.9% versus 2Q22. The company did not comment on that. It can have something to do with high inflation. However, this decline is not that significant.

With that said, the company won big when it comes to net interest income.

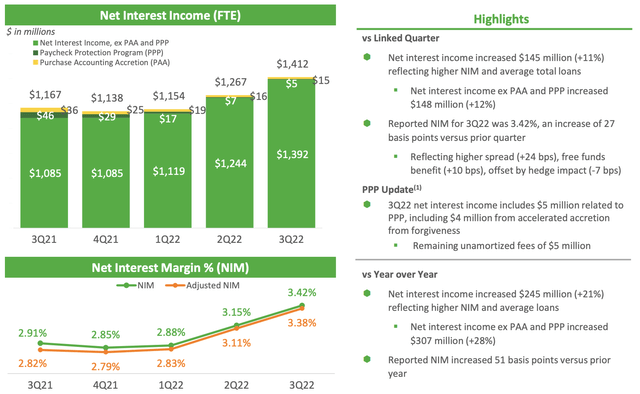

The bank reported another quarter of sequential expansion of both net interest income and NIM. Core net interest income, excluding PPP and purchase accounting accretion, increased by $148 million, or 12% to $1.392 billion. Net interest margin increased primarily driven by higher earning asset yields as a result of our asset sensitivity position.

Huntington Bancshares

Not only does HBAN benefit from rising rates, but it is also protected against the negative effects of rising rates. According to the company:

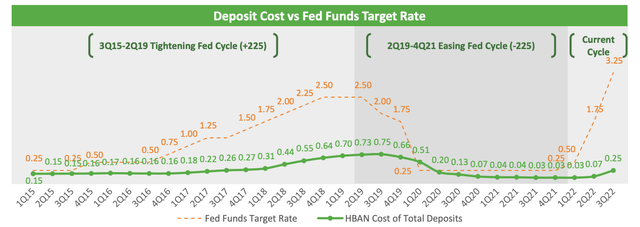

For the third quarter, we have started to see our average cost of deposits tick-up as expected. We are remaining dynamic in this environment. We continue to manage the portfolio at a very granular and segmented level to ensure pricing discipline and with a focus on growing the primary bank relationships that bring lower-cost deposits.

Huntington Bancshares

As a matter of fact, HBAN is protected against the volatile rate backdrop. The company is managing possible downside rate risks over the long term while positioning itself to benefit from higher expected rates in the short term.

In 3Q22, the company increased its downside protection by executing a net $6.6 billion of received fixed swaps (exchanging variable versus fixed rates) and $2 billion of callers. HBAN is expected to continue to deploy downside hedging strategies in the months ahead.

Non-interest income was down from $535 million in 3Q21 to $498 million in 3Q22, as a result of lower mortgage banking feed. That was caused by a reduction in saleable spreads and lower net MSR risk management.

Non-interest expenses were up $35 million.

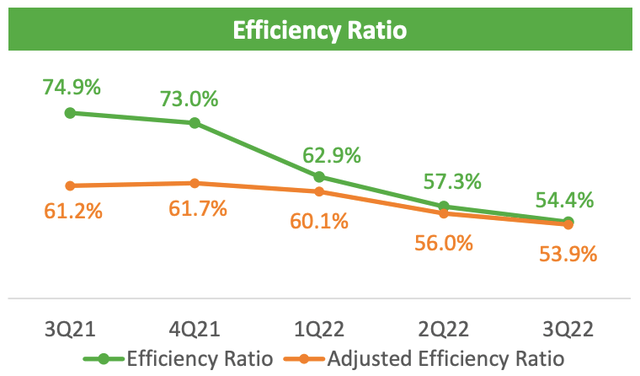

HBAN’s efficiency ratio, which is an outcome of its revenue drivers and expense management activities came in at 54.4% on a reported basis and adjusted for notable items was 53.9% for the quarter. On an adjusted basis, this reflects a decrease of 210 basis points quarter-over-quarter.

Huntington Bancshares

The company’s CET 1 ratio came in at 9.3%, which is in the company’s 9-10% range. This means that the company can focus on its number one priority, which is to fund organic growth. Its second priority is its dividend, which is roughly 60 basis points above the sector median, and currently at 4.5%.

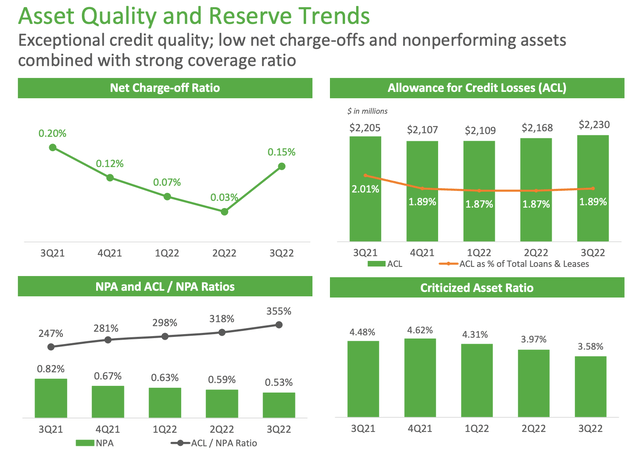

With that said, asset quality was very good. The net charge-off ratio rose from 0.03% sequentially. However, compared to the prior-year quarter, it’s down 5 basis points. The allowance for credit losses rose from $2.17 billion to $2.23 billion, which is an increase of 2.8%. However, it’s just 1.89% of total loans and leases, which is up just 2 basis points. It’s down more than 10 basis points compared to the prior-year quarter.

Huntington Bancshares

According to the company:

Allowance for credit losses was up two basis points to 1.89% of total loans, reflecting a conservative reserve posture given the heightened economic uncertainty, even as our internal portfolio metrics show stability.

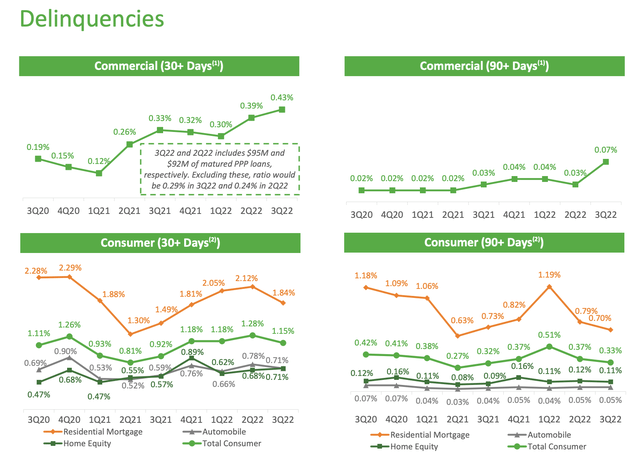

With that said, there is an uptrend in commercial delinquencies. On a 30+ day basis, the ratio is now at 0.43%. 90+ day delinquencies are also well-above their lows. Consumer numbers remain subdued.

Huntington Bancshares

According to the company, these numbers are off the lows, but below pre-pandemic levels.

That might be true, but we need to keep a close eye on these developments as I have little doubt that the quality of credit will deteriorate quite significantly in the months ahead.

What’s Next?

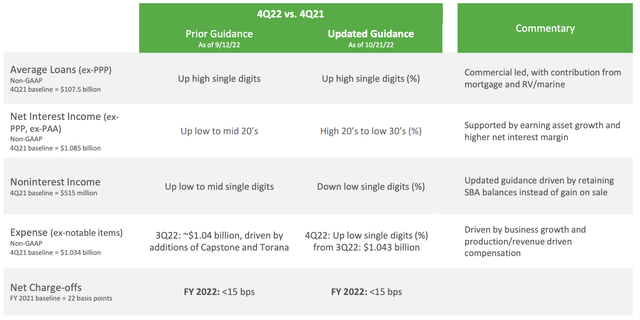

The outlook was another surprise. The company is sticking to its loan growth targets, it raised its net interest income outlook, and stuck to its credit quality expectations.

Huntington Bancshares

These estimates are based on current consensus economic expectations and the rate curve as of the end of September.

However, at the end of the earnings call, HBAN mentioned one very important thing: uncertainty.

According to the company:

[…] our business is performing exceptionally well right now with solid momentum in the underlying drivers and expanding profitability.

We also continue to see strength in our customer trends, where they appear to be managing through the environment well and with solid credit performance. Notwithstanding these clear positives, we are mindful of the heightened uncertainty and risks in the environment.

We are closely monitoring the impacts from persistently high inflation, rising interest rates, geopolitical instability and market volatility. The cone of uncertainty around the near-term economic environment has widened and the probability of a recession is increasing.

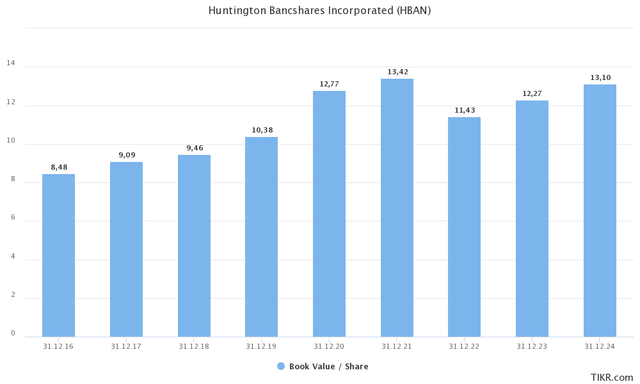

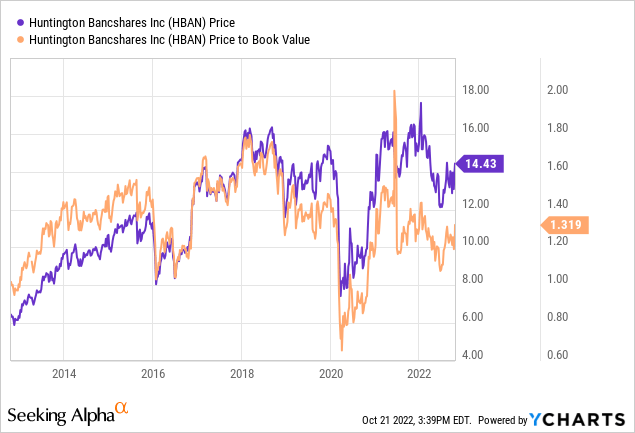

The valuation remains attractive. The bank is trading at 1.17x the 2023 expected book value.

TIKR.com

What this means is that if we’re not in for a devastating recession, the bank has a lot of room to grow its market cap/stock price.

Takeaway

Huntington Bancshares did a stellar job. If I wasn’t aware of the bigger macro picture, I would have guessed that everything is just peachy, based on the company’s numbers and comments.

Net interest income is very high, downside interest rate risks are hedged, and expenses are under control – even in times of high inflation.

Moreover, the company is seeing healthy credit quality and growth in mortgage loans. While I do not expect that to last, it shows the company’s resilience in this environment.

It also shouldn’t be underestimated how much the company is benefiting from synergies. The acquisition of Capstone Partners and the TCF merger is giving the company plenty of room to generate organic growth.

The valuation remains very attractive.

However, given market uncertainties, I do not recommend buying large positions. If you want HBAN exposure, start small and add on weakness as I believe we’re not out of the woods yet.

(Dis)agree? Let me know in the comments!

Be the first to comment