monsitj/iStock via Getty Images

Investment thesis

I’ve returned to investing in the stock market and my only position at the moment is in a Bulgarian nitrogen fertilizer producer. The reason behind this is that natural gas usually accounts for around 80% of the costs in nitrogen fertilizer manufacturing and my country’s state-owned gas company is selling it at €71 per megawatt-hour before taxes for access, transmission, excise, and VAT.

The aim of the government is to keep gas prices artificially low in order to limit food price inflation. In my view, this creates a compelling investment opportunity considering European natural gas prices stand at €110 per megawatt-hour as of the time of writing.

So, that got me thinking that I should look at other public companies that are set to benefit from government regulation and this is where Hudson Technologies (NASDAQ:HDSN) comes into the picture. The company is set to have several golden years thanks to green laws in the USA that will require significant improvements in climate-damaging hydrofluorocarbons (HFCs) emissions in the heating, ventilation, air conditioning, and refrigeration (HVACR) industry. Let’s review.

Overview of business and financials

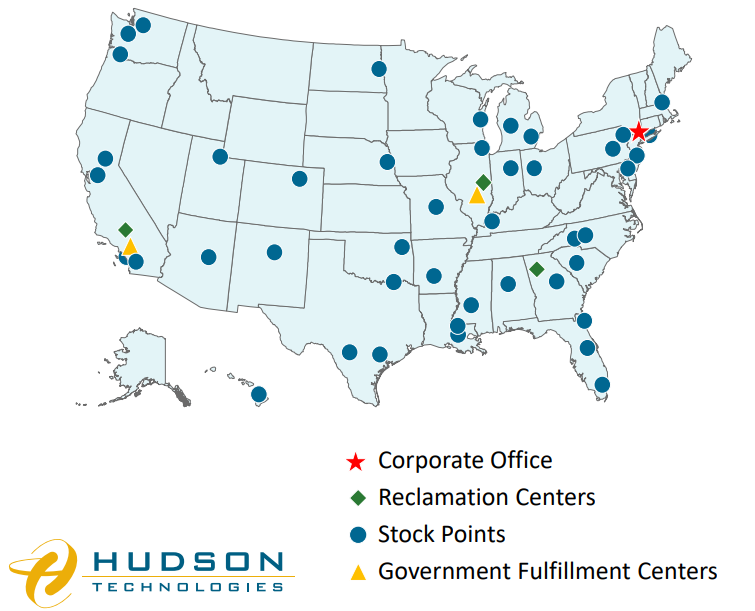

Hudson Technologies was founded in 1991 and is a provider of sustainable refrigerant products and services to the HVACR industry. The company has over 40 facilities and stocking points across the USA and it has more than 7,000 customers.

Hudson Technologies

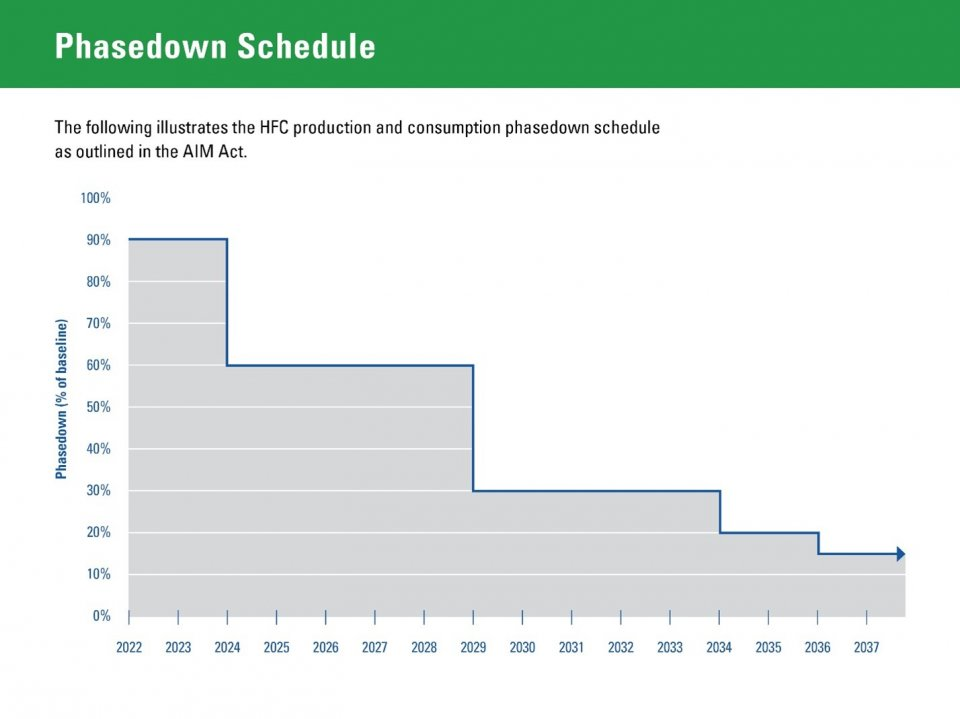

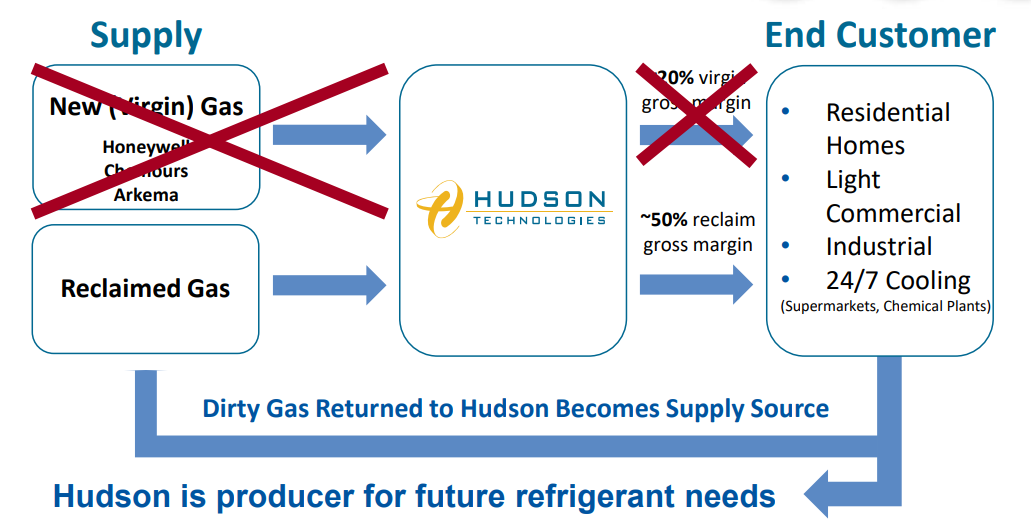

Hudson Technologies has proprietary reclamation technology that recovers all refrigerants, and it has a market share of around 35% in the USA. In my view, this is crucial as the U.S. Congress passed the American Innovation and Manufacturing (AIM) Act in December 2020 which gave the Environmental Protection Agency (EPA) the authority to phase down climate-damaging hydrofluorocarbons (HFCs) to 15% of their baseline levels by 2036. This could be the most significant congressional action on climate change in years. In September 2021, the EPA established the HFC production and consumption baselines from which reductions must be made.

Environmental Protection Agency

There are over 100 million HFC units installed in the USA at the moment and their owners will be required to transition to next-gen equipment. And the EPA plans to promote reclamation in all phases of the implementation of the AIM Act, which means that the reclamation business of Hudson Technologies will have a key role to ensure that the country has the necessary HFC supply during the phasedown. Virgin R-22 production in the USA stopped at the end of 2019 meaning that the whole supply now comes from reclaimers. Reclaimed HFCs stood at around 6 million pounds in 2020 and are set to increase to 40 million pounds by 2024.

Hudson Technologies

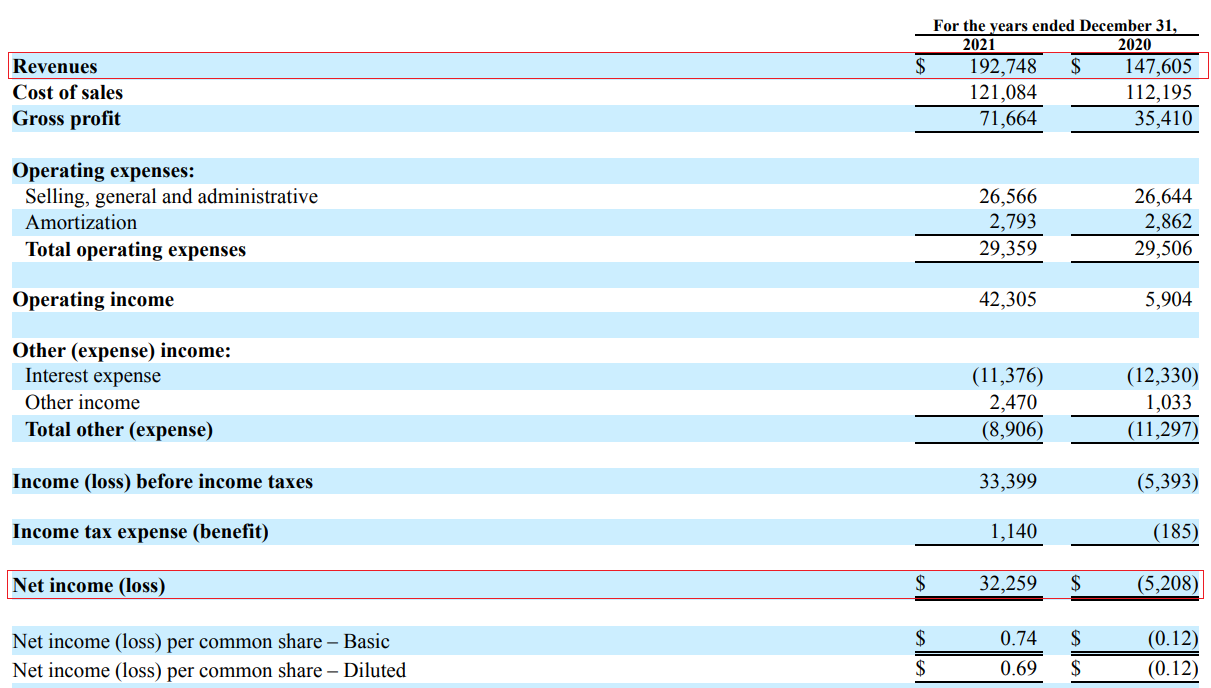

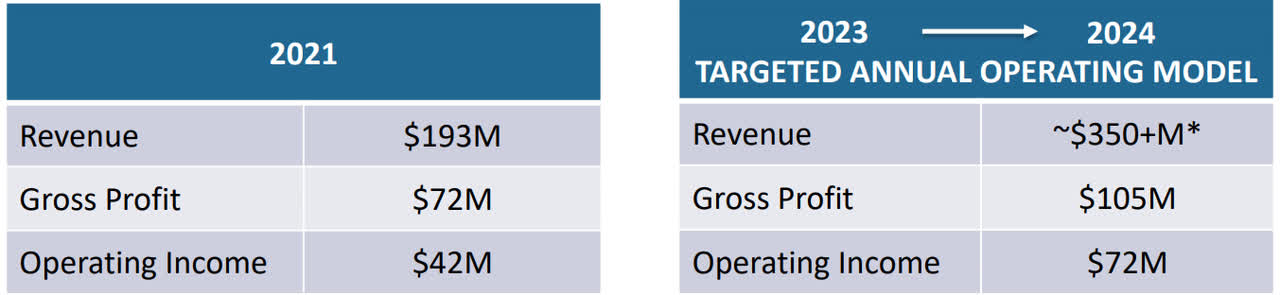

The shift in the market is already starting to positively affect the financial results of Hudson Technologies. The company closed 2021 with record revenues of $192.7 million as refrigerant prices are rising. The margins have improved significantly, and Hudson Technologies is now profitable.

Hudson Technologies

Revenues for the last quarter of the year soared by 71% on the year to $37.8 million, which is unusual considering this should be the company’s weakest quarter as it falls outside its traditional nine-month selling season. Hudson Technologies said during its Q4 2021 earnings call that it expects refrigerant prices to remain high as the HFC phasedown gathers pace. The company is targeting revenues of over $270 million in 2022, with the figure rising to over $350 million in 2023 if HFC pricing follows a similar trajectory to Europe.

Hudson Technologies

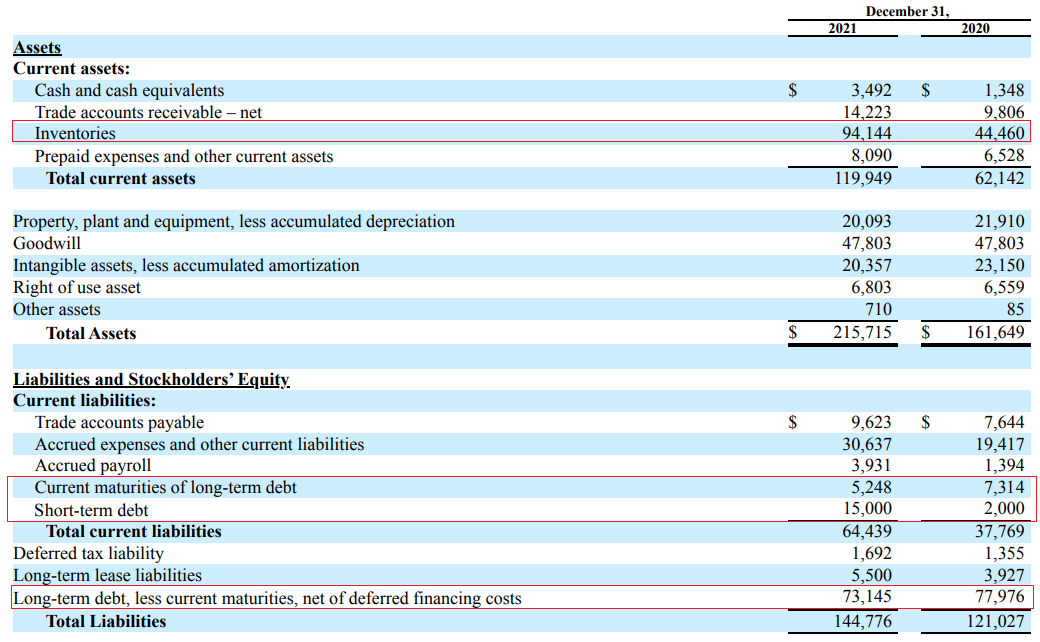

Turning our attention to the balance sheet, you can see that high refrigerant prices have resulted in a significant increase in inventories. This has impeded Hudson Technologies from paying down its debts, which are now higher than in 2020.

Hudson Technologies

Cash used in operating activities during 2021 was $1.2 million and the company closed the year with a net debt of $89.9 million. However, interest payments should be much lower in the coming years as Hudson Technologies inked a new $85 million term loan agreement in early March 2022. According to the company, the new debt structure will reduce the overall effective interest rate by around 3%.

Hudson Technologies is currently trading at 8.3x EV/EBITDA, which seems expensive. However, the ratio could come down to around 5x by 2023 if refrigerant prices remain strong. Considering that the AIM Act is likely to constrain supply for years to come, I think Hudson Technologies should be valued at more than 7x EBITDA for 2023, which translates into around $9.70 per share.

Looking at the risks for the bull case, I think the major one is a repeal of the AIM Act as a result of a change in the environmental policy of the USA. This could happen after the 2024 presidential elections. In any case, it seems that Hudson Technologies is likely to have at least two strong financial years before this risk potentially becomes a reality.

Investor takeaway

The refrigerant industry in the USA should have strong years ahead thanks to the AIM Act, and one of the big gainers is likely to be Hudson Technologies thanks to its leading position in the reclamation market. The company booked an operating income of $42 million in 2021 and this could grow to $72 million by 2023 if refrigerant prices remain high.

In my view, the company should be trading at around $9.70 per share. Perhaps the largest risk here is a repeal of the AIM Act as this would lead to a strong decrease in refrigerant prices. However, this is unlikely to happen anytime soon.

Be the first to comment