ExperienceInteriors/E+ via Getty Images

Hudson Pacific Properties, Inc. (NYSE:HPP) is a real estate investment trust (“REIT”) whose tenants include some of the largest technology companies, such as Alphabet (GOOG) (GOOGL), Amazon (AMZN), and Netflix (NFLX), to name a few. Their concentration of high-quality office buildings and studios in the West Coast of the U.S. remains a draw for the media and tech industries, despite recent concerns regarding the future of work.

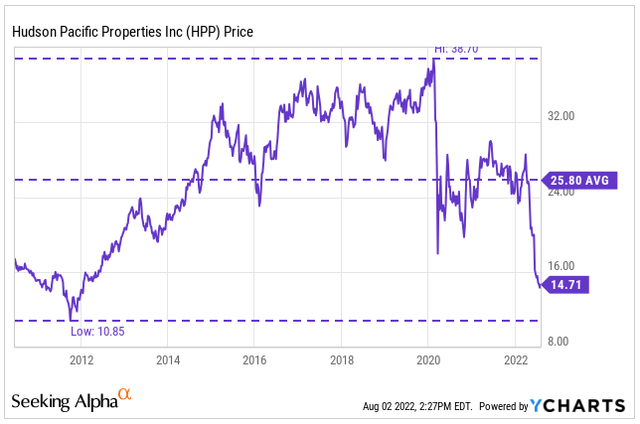

Shares in the stock are currently down over 40% YTD and are trading at multi-year lows. Over the past month, shares have been relatively rangebound, even following their most recent earnings release. With much already priced into the stock, HPP offers significant upside potential and presents an attractive risk/reward opportunity for investors with a moderate level of risk tolerance.

YCharts – HPP’s Share Price History

Steadily Growing FFO and NOI

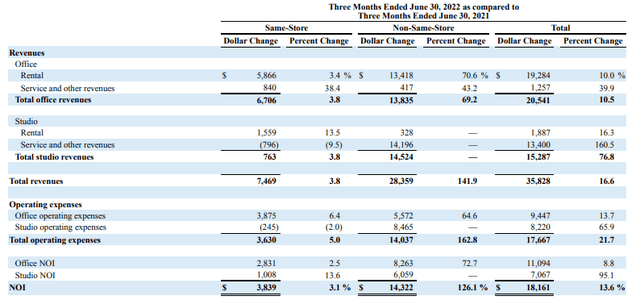

In the three months ended June 30, 2022, HPP reported total revenues of +$251.4M. This was up 16.6% from the same period last year and about +$4M better than expected.

Of the two reportable revenue segments, offices and studios, rental revenues on offices, which represent 85% of total revenues, were up about 10% for the period, while studio revenues were up 16.3%.

There was also a notable increase in service and other revenues in the studios of +$13.4M, which primarily relate to tenant recoveries and other ancillary revenues.

Through the first half of the year, total revenues are now up to +$495.9M, a 15.7% increase from last year, with rental revenues attributable to offices up 9.3% and studios up 13.2%.

Total operating expenses were also higher during the period, up 16.2% overall, driven by higher general and administrative (“G&A”) and studio expenses. Over the past six months, G&A is up 19.2%, driven primarily by lower non-cash compensation expense last year compared to the current year.

Though expenses were up, HPP still grew net operating income (“NOI”) by +$18.2M or 13.6% during the quarter. This increase was driven by non-same-store increases in both office and studio NOI, which were collectively up +$14.3M due primarily to a +$13.4M increase in rental revenues resulting from the delivery of their One Westside development to Google in November 2021. This was partially offset by a +$5.6M increase in operating expenses associated with the higher revenues.

Same-store NOI was up 3.1% in total with a 13.6% contribution from studio NOI. From a cash perspective, same-store cash NOI was up 7.3% due to the commencement of cash rent on various leases with Twitch Interactive, WeWork (WE), and Rivian (RIVN).

Q2FY22 Form 10-Q – Summary of NOI

Similarly, funds from operations (“FFO”) was also higher during the period at $0.51 per diluted share compared to $0.49/diluted share last year. YTD on an adjusted basis, AFFO is now up +$4.7M or 4.2%.

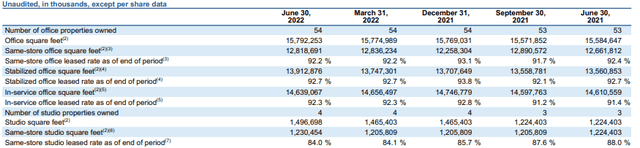

Strong Portfolio Metrics and Favorable Leasing Opportunities

At period end, HPP’s overall in-service portfolio remained strong. Total offices were 90.8% occupied and 92.3% leased at an annualized base rent per square foot (“ABR/psf”) of $53.27, while studios were 84% occupied and leased at an ABR of $44.70/psf. While the total in-service leased rate on the overall office portfolio was up 90 basis points (“bps”) from last year, same-store was down 20bps, though it remained the same sequentially.

Q2FY22 Investor Supplement – Portfolio Metrics

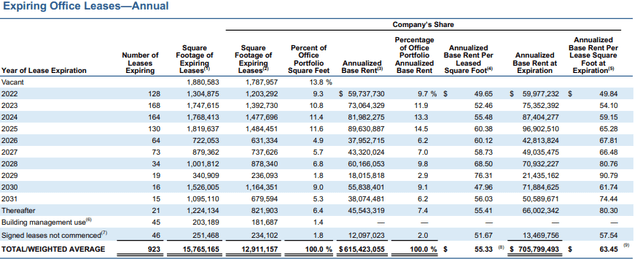

Over the next several years, HPP will need to be active in addressing expiring leases, as 50% of their office portfolio ABR is set to expire on or prior to the year 2025. One major expiration is their lease with Qualcomm (QCOM) at Skyport Plaza, which expired in July and was not renewed. This will produce a dip in both lease percentage and occupancy in later periods due to Qualcomm’s former position as a top 15 tenant.

Q2FY22 Investor Supplement – Lease Expiration Schedule

Another large expiration that will not be renewed is their lease with Block, Inc. (SQ) at 1455 Market, which will expire in Q3 2023. Currently, the company is engaging in marketing efforts to backfill the space and are in discussions with existing subtenants who occupy 25% of the space. As another former top 15 tenant, occupancy will likely take a hit next year if HPP is unable to backfill the space.

The expirations of these two large leases do present an opportunity, however, for leasing spreads. The lease at Skyport Plaza, for example, currently has an average ABR of $50.29/psf, suggesting renewal upside of about 6% at current market rates. While the ABR at 1455 is $53.73/psf, it is on the lower end of the other leases that are set to expire in the coming years.

Current Leasing Pipeline is Robust

The company’s ability to address their upcoming expirations is supported by their ongoing leasing activities, which remains robust. In the current quarter, they signed over 700k square feet of new and renewal office leases at a GAAP and cash spread of 16.2% and 5.5%, respectively. This was up 150bps and 10bps from last year.

Also included within the activities during the quarter were two significant renewals, one with Stanford University and the other with Nutanix (NTNX). The renewed lease with Stanford, which was set to expire in Q4 of this year, is now extended through the year 2027. Similarly, the Nutanix lease, with an original expiration year of 2024, is now current through 2030.

The overall leasing pipeline for the remainder of the year also remains healthy, with 2M square feet in active discussion and another 1M square feet of inquiries and tours on top of that. Excluding the QCOM lease, HPP has successfully addressed 55% of their remaining 2022 expirations within their in-service portfolio with another 10% in discussions.

On the disposition front, the company entered into contracts to sell two properties during the quarter, which when completed in Q3, is expected to yield +$50M in gross proceeds. Furthermore, HPP is also actively marketing two other properties, in addition to exploring alternative uses.

Upward Revisions to Full-Year NOI

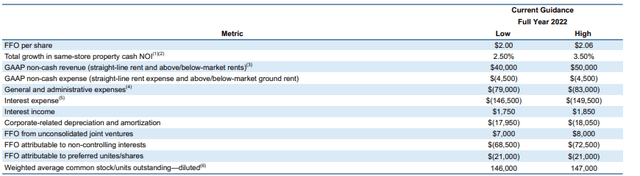

Looking ahead to the remainder of the year, HPP updated their guidance for FFO to a range of $2.00/share to $2.06/share. Unfortunately, this is a further reduction from the range provided in Q1, which was already narrowed at that time.

On a positive note, however, management did revise NOI growth upwards to a range of 2.50% to 3.50%, which is up from 2% to 3% reported in the first quarter.

Driving current guidance was the impact of higher interest expense, offset by gains anticipated by the sale of two properties, which is expected to close during Q3. In addition, guidance also includes the full impact of QCOM’s expiration without renewal or backfill.

Q2FY22 Investor Supplement – 2022 Full-Year Guidance

Stable Balance Sheet

At period end, HPP had total assets of +$9.1B and +$5.1B in total liabilities, comprised of a combination of unsecured and secured debt with both fixed-rate and floating-rate structures. At present, approximately 70% of total debt is unsecured and 65% of total debt bears interest at a fixed rate.

In a rising rate environment, a greater weighting towards fixed-rate debt is preferable. While the current 65% weighting is satisfactory, it is considerably lower than the 86% weighting last year and 75% in Q1 of this year.

Additionally, the current weighted average interest rate on total debt is also slightly higher sequentially at 3.5% versus 3.3% in Q1. It is still lower, however, than the 3.6% reported in Q2 of last year.

At 53.7%, total debt now represents the majority of the company’s market capitalization, due primarily to the significant decline in the company’s share price. In contrast, total debt was 41% of the company’s market cap at the end of the first quarter.

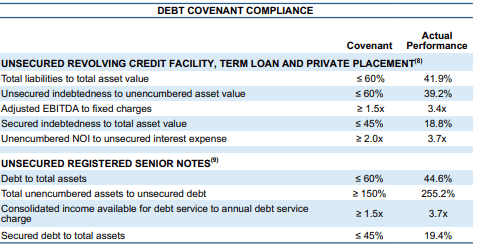

As a multiple of adjusted EBITDAre, however, net debt stood at 7.4x at period end, which is slightly higher than last year but a step down from Q1. In addition, HPP appears to be comfortably in compliance with all debt-related covenants. This should provide some assurance to weary investors.

Q2FY22 Investor Supplement – Summary of Compliance with Required Debt Covenants

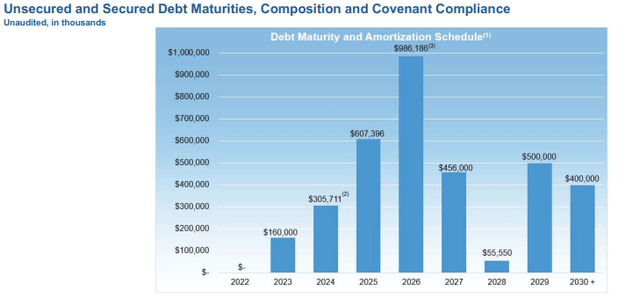

Ample Liquidity With No Significant Near-Term Debt Maturities

Total liquidity at quarter end stood at +$781.5M, consisting of cash and equivalents and availability on their credit facility. In addition, HPP has access to +$230M under two construction-related loans. As such, current liquidity is more than sufficient to cover current obligations, including reoccurring interest payments.

With no significant near-term maturities, there are limited concerns regarding repayment risk. The significant maturities in 2025/2026 will need to be addressed, but the company does have the necessary access to capital to address those obligations when the time arises.

Q2FY22 Investor Supplement – Debt Maturity Schedule

Significant Share-Price Upside Potential

Down over 40% YTD, HPP offers an attractive risk/reward opportunity for long-term investors. In addition, the shares in the stock offer a dividend yield in excess of 6.50% at current pricing. Regarding upside, a return to 10x forward FFO is certainly possible. This would indicate share price upside potential of over 30%.

The company does have major lease expirations to address in the coming years. But activity within their current pipeline suggests there is ample demand for the high-quality space in their portfolio.

Their elevated debt load is another concern, especially in a rising rate environment. They don’t, however, have any significant near-term maturities. And they also have ample liquidity and readily available access to the debt and equity markets. This will benefit them when the obligations are ultimately due.

With much of the news already priced into the stock, investors appear due for outsized returns in future periods as HPP eventually returns to a more respectable trading multiple.

Be the first to comment