Margarita-Young/iStock Editorial via Getty Images

Benjamin Franklin famously stated in a 1789 letter to French physicist Jean Baptiste Le Roy:

…in this world nothing can be said to be certain, except death and taxes.

While he is not the only person to have stated this, his famous quip over 200 years later has proven to be true when it comes to taxes. And when it comes to taxes, H&R Block (NYSE:HRB) has emerged as the world’s leader in tax preparation services since its founding in 1955.

During the most recent year, HRB employed 60,000 tax pros, helped prepare over 21 million U.S. tax returns, served almost 9 million clients with various DIY products and served 2 million small businesses with their tax and other financial needs. Additionally, Wave, a recent acquisition, further extended the company’s footprint into small business services by providing business owners invoicing, payment and other services.

While the exact future of H&R Block may not be entirely certain, what we can be sure of is that taxes are here to stay, and H&R Block has positioned itself to continue to lead the way in helping individuals and businesses prepare their taxes in a way that is easy and affordable.

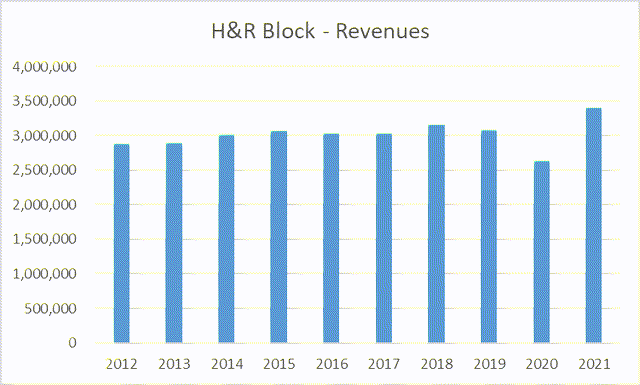

Looking back over the past ten years of HRB financials, several things stand out that are encouraging for the future. Slow and steady revenue growth has been the name of the game for HRB. It gets a little muddy for pure comparisons given the 2020 tax season debacle and the announcement of a new fiscal year which now ends in June, rather than April. In the year ended April 2021 (their most recent fiscal year reported), the company reported revenue of $3.4 billion, which was quite a bit higher than fiscal year 2020. However, because of the pandemic which began in 2020, the tax filing deadlines were delayed into fiscal 2021, so the comparisons are not great.

During the company’s Q4 2021 earnings call, in order to look ahead to fiscal year 2022, they provided estimated full year 2021 revenue of $3.25 billion. For fiscal year 2022, the company has provided revenue guidance of $3.4 billion (midpoint), which is an increase of 4.6% over the estimated 2021 comparable revenue. If the company can achieve this revenue, it would represent the best annual revenue growth since 2018 (excluding the 2021 pandemic impacted results).

Much of this higher revenue growth can be attributed to the company expanding beyond its traditional tax preparation services by moving into the area of small business services. In 2019, the company acquired Wave Financial, which is a financial services platform that helps small businesses manage their finances. It provides accounting, invoice and receipt-tracking software, and also offers payment processing, payroll and other bookkeeping services. These services are used by over 400,000 small businesses globally each month. Through the first nine months of this year, Wave revenues were just $59 million, but it is 32% higher than the first nine months of 2021.

The company has also launched Spruce, a mobile banking platform with 150,000 signups and over $60 million in customer deposits. Finally, the Block Experience is an initiative to help leverage technology and digital with their traditional face-to-face experience. All of these represent opportunities to reach more people and businesses in different ways to help generate more revenue through its core tax prep and financial services. Many of these endeavors are relatively young, but over the next several years, have the potential to help the company maintain that low to mid-single digit revenue growth rate that we are expecting for this year. In fact, management is confident of 3% to 6% annual revenue growth over the long-term. This level of growth would be a significant improvement upon the annual growth rate of 2.4% over the past five years.

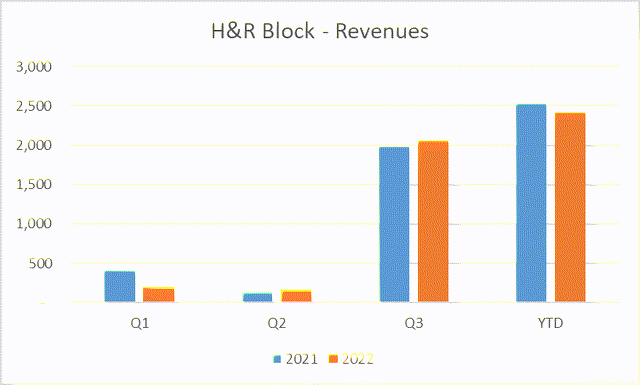

Looking at the current year’s results, it would appear that the company’s revenues are down in the comparable nine-month period ending March 31. However, diving into the company’s 10-Q, management points out that the tax deadline for filing individual 2019 tax returns was extended from April 15, 2020 to July 15, 2020, thereby shifting a portion of revenues from that tax season into the nine months ended March 31, 2020.

It gives an indication, though, of the extreme seasonality of the business. But management even indicated in their MD&A that the year-over-year periods are not directly comparable.

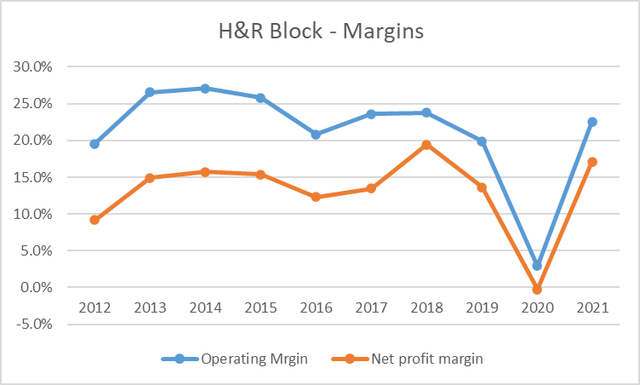

Turning to profitability, with the exception of the pandemic year in 2020, the company has generated very strong operating and net profit margins over the past decade. Operating margins have averaged 21.3% over the past ten years, with 2021 at 22.5%. Similarly, net margins have averaged 13.1% over that same period, with 2021 at 17.1%.

These are very healthy margins, which help to drive the company’s cash flow, capex and return of capital to shareholders. It should be noted that through the first nine months of 2022, the operating margin was 18%, which is above average over the past five years, but below the reported 2021 and the pro-forma 2021 of 22.5%. Again, the comparisons are difficult, and it will be interesting to see how the full-year shapes up when they report full year results in a couple of months.

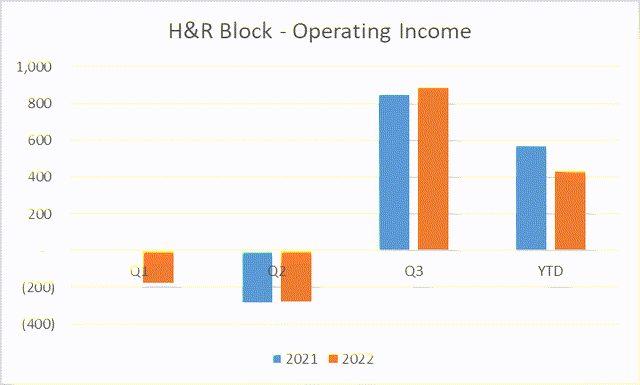

For completeness, we can look at the current year results, but again, the year-over-year periods are not directly comparable:

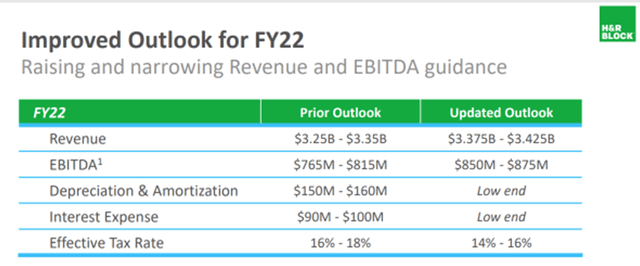

Due to the lower revenue in 2022, many of the year-over-year expenses are also impacted by the movement in filing deadlines. But the big news during the Q3 presentation was the improved guidance for the remainder of the 2022 year:

This improved outlook is what caused a jump in the stock price, which is discussed later in the article.

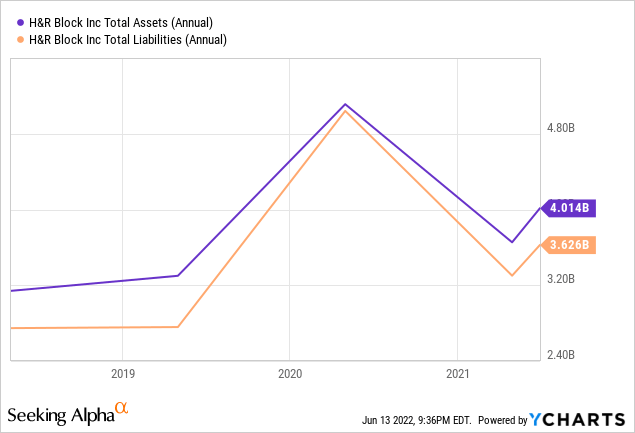

The company has a strong and healthy balance sheet. Total assets have increased 5.1% annually over the past five years, while liabilities have increased at just 3.2%.

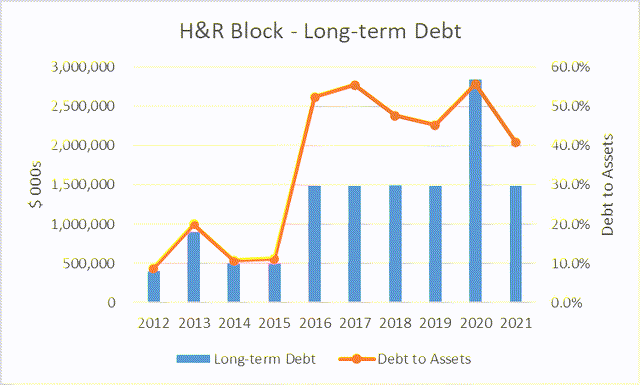

It is always a positive sign to see assets increasing faster than liabilities. One area of slight concern, and this not at all unusual among today’s corporations, is the higher debt levels than in the past. In 2016, the company increased its long-term debt substantially, from what was generally less than $1 billion to what is now almost $2 billion. Long-term debt prior to 2016 averaged 15% of total assets. Since 2016, long-term debt has averaged about 50% of total assets.

Despite this higher debt, interest expense is still very manageable, with a current weighted average interest rate of 4.2%. The interest coverage ratio in 2021 was 7.2x, compared to 9.1x in 2016, lower but still quite healthy. Currently, the company is managing its interest and debt, but it is always smart for investors to keep an eye on this going forward.

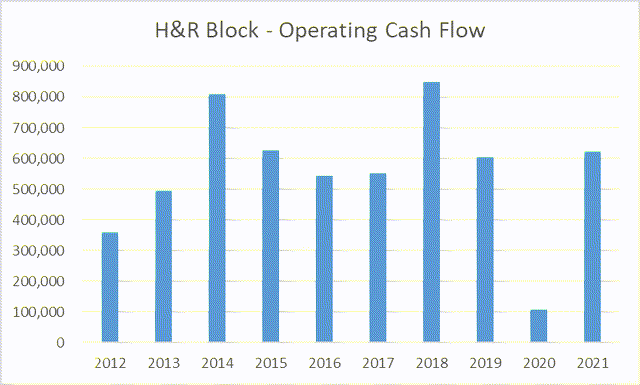

As mentioned earlier, the company produces a very healthy level of operating cash flow. Operating cash flow in 2021 was $625.9M, compared to $606.5 million in 2019. Over the past five years, operating cash flow has increased at 2.8% annually, which is actually higher than the five-year revenue growth rate.

One thing the company does with its cash flow is buy back shares. Since 2019, the company has repurchased about 23% of the then outstanding shares. Furthermore, since 2019, the company has paid out over $742 million in dividends, with an additional estimated $177 million paid in fiscal year 2022. I am looking forward to management’s comments on the future of buybacks and dividends in their next quarterly earnings announcement.

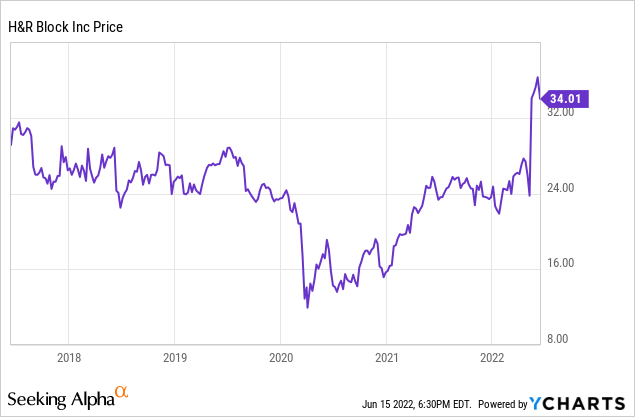

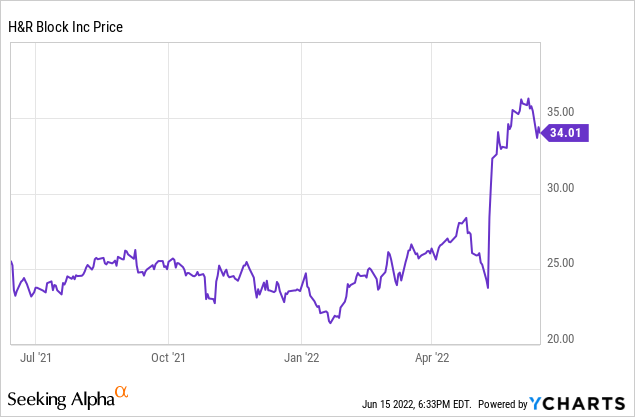

How has this translated into stock price performance? It depends on your time frame. If you look at a five-year chart, HRB was about $30 per share five years ago. Today, it is about $34, which is not a great return, even with the dividends. However, since the bottom of the 2020 pandemic driven selloff, the stock has gained about 192%. The stock really jumped after the 3rd quarter earnings report, when the company increased its full-year 2022 outlook.

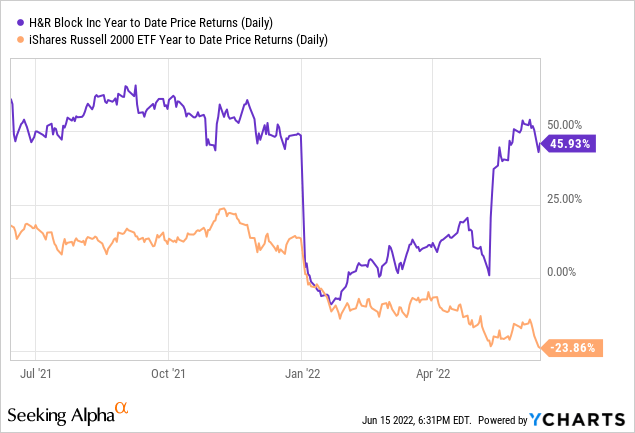

YTD, HRB is up 45.9%, compared to the Russell 2000 index which is down 23.9%. Clearly, the stock has held up very well during what are otherwise very difficult market conditions.

Even after this surge in stock price, HRB has a P/E of just 10 times earnings, which is well below the P/E of the major market indexes.

Finally, it might not be too far of a leap to think that Benjamin Franklin would add dividends to death and taxes as life’s certainties, at least with respect to H&R Block. The company has paid a dividend since 1972, and there is no indication that is about to change anytime soon. Currently, the annualized dividend is $1.08 per share, which is 3.8% higher than the previous 12-month dividend. At a recent price of $34.02 per share, the current yield is 3.17%. While lower than it was just last year, the stock still provides a healthy yield when compared to the S&P 500 which is yielding 1.64%.

Management has not provided much specific guidance on the direction of the dividend, other than to say basically that it has paid a dividend for many years and supports a healthy dividend going forward. The current share buyback plan expires this year, and it will be interesting to see if they approve a new buyback plan, particularly since so many shares have been retired over the past few years.

At a recent price of $34.01, I think the stock is fairly valued. The stock traded in a narrow range for most of the last year, between $22.50 and $27.50. It wasn’t until the Q3 earnings announcement when the stock popped from $23.77 on May 10 to $34.05 on May 17, a gain of 43% over a week.

The improved guidance was appreciated by investors. EPS is expected to be $3.44 this year and $3.68 next year, which is 7.0% growth. The P/E on next year’s estimated earnings is 9.2x; the P/E to growth ratio is 1.3x. These are very favorable for a steady growth kind of company that pays a healthy dividend and until now has been an aggressive buyer of its outstanding shares. The current yield is 3.17%, which was great a few months ago, but given the recent surge in Treasury yields, it doesn’t look so hot anymore. But I think the dividend is safe and I would expect it to continue on a steady growth trajectory. The company will be reporting its full-year 2022 results in about 2 months. I am looking forward to management’s comments on the dividend, the buyback program (if any) and thoughts on maintaining future revenue growth. Until that point, I am holding on to the gains on this stock and collecting a decent dividend in the meantime.

H&R Block has been a leader and innovator in tax preparation and business financial services since its founding in 1955. With America’s tax scheme becoming more complicated each year, the company is well-positioned to continue to help millions of taxpayers with tax planning, preparation and filing. The company’s expansion into adjacent business markets should only help to further strengthen the company’s market position and financial strength. As long as Benjamin Franklin’s 233-year-old comment rings true, H&R Block will be there to help.

Be the first to comment