zoranm/E+ via Getty Images

Introduction

HP Inc. (NYSE:HPQ) is a leader in the personal computing and printing space. Personal computing (internally called personal systems) generates a majority of HP Inc’s revenue, but printing is where the majority of profits come from.

Investors have sold off the stock on concerns that printing is a dying business and that the business overall faces short-term headwinds. This has left the stock trading at multiples not seen since the March 2020 crash. However, with intelligent capital allocation from management, I believe shareholders could see solid gains over the next few years albeit with perhaps some more rocky near term risks.

Near-Term Trends

HPQ has faced some headwinds in China due to strict COVID-19 lockdowns as well as some impact from the Russia-Ukraine war resulting in a slowdown in spending in Europe. The company is also winding down Russian operations.

Furthermore, the company faces pressure as they lap work-from-home related sales.

Despite all this, the company managed to grow revenue 3.9% in Q2 FY22. All the growth came from personal computing, which grew 9% YoY (11% on a constant currency basis). Printing declined 7% YoY (6% on a constant currency basis). Diluted GAAP EPS fell 4%, but non-GAAP EPS increased 16%.

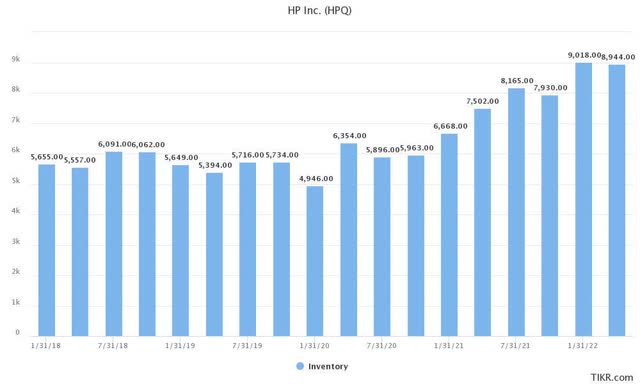

The back half of the year though could see these pressures hit the numbers harder. HPQ’s inventory has climbed to more than double what it has been in previous years, and if demand continues to slow, they may have to resort to some discounting to move inventory and free up cash. Management seemed to suggest some softening of demand on the consumer side of the business, offset by some strength in new growth avenues like gaming and peripherals. Particularly, management called out China as potentially having a negative impact on FQ3 results.

Valuation

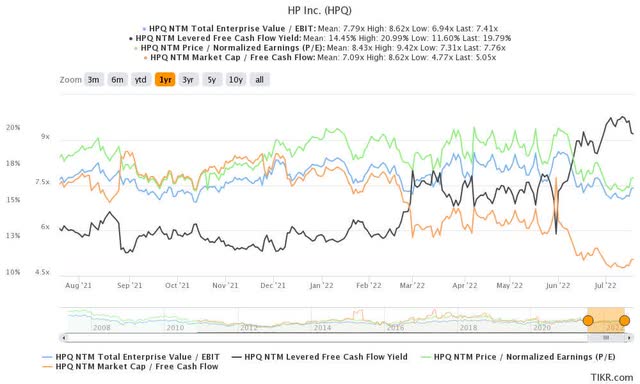

HPQ trades at a low multiple regardless of which multiple you pick. The company currently offers nearly a 20% levered FCF yield and trades at an NTM EV/EBIT of under 8.

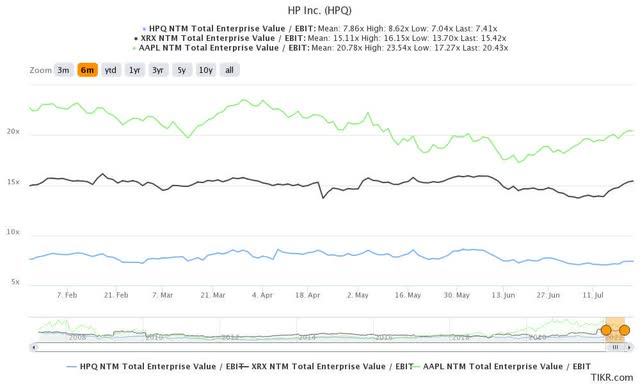

Relative to competitors like Apple (AAPL) in the personal computing space, or Xerox (XRX) in the printing space, HPQ’s multiple is much lower.

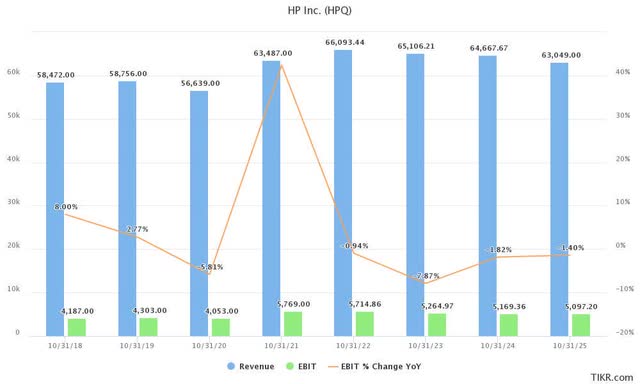

Analysts currently expect revenue for HPQ to peak in fiscal 2022 with EBIT having peaked in 2021. These are expected to decline going forward, and thus the stock has a cheap multiple on current numbers. Nonetheless, such a decline would not be all that dramatic.

HP Inc Revenue and EBIT (TIKR)

So how do shareholders make money here if earnings are declining over the next few years? It essentially comes down to capital allocation. At the current 19% levered FCF yield, if HPQ simply continues to return free cash flow to shareholders via buybacks and dividends, especially if the stock remains low in a tough back half of the year, investors could very well see double-digit returns going forward. Alternatively, management could also deploy this cash in the form of accretive acquisitions, which would help to increase earnings. Management has been doing exactly this, buying back $1 billion worth of stock in FQ2 alone and paying a $0.25 per share dividend ($262 million). HPQ also acquired Plantronics (POLY) recently.

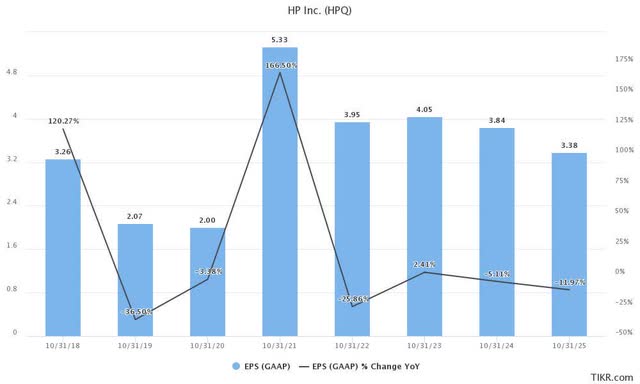

Despite HPQ buying back $1 billion worth of stock in Q2 alone, analysts have modeled an EPS decline for HPQ that is greater than the expected EBIT decline. I don’t see taxes increasing, and although the company has been increasing debt somewhat leading to an increase in interest expense, ultimately it seems share buybacks should be able to offset most, if not all, of the earnings decrease, meaning EPS should stay level or perhaps even increase.

Final Thoughts

HPQ faces some headwinds, but with intelligent capital allocation, I believe it is possible they can maintain or perhaps even increase EPS and FCF per share.

If EPS and FCF per share can indeed increase, then the multiple is unlikely to go lower from here and shareholders should see returns approaching the double digits. Nonetheless, I’d still warrant some caution as demand could continue to slow and HPQ’s high inventory may become an issue down the line.

Be the first to comment