Justin Sullivan/Getty Images News

Headlines flooded the newswire as Warren Buffett’s Berkshire Hathaway (BRK.A) disclosed an 11.4% ownership stake in HP Inc. (NYSE:HPQ) which was acquired for $4.2 billion. HPQ had jumped 18.59% ($6.50) upon the disclosure, and shares appreciated from $34.97 to $41.47 before profit-taking began. Over the next 7 trading days, shares of HPQ declined by 9.65%, from $41.47 to $37.47. During the selloff from the Buffett bump, UBS came out and downgraded HPQ, citing consumer PC weakness and slower buybacks. This comes a month after Morgan Stanley (MS) downgraded both HPQ and Dell Technologies (DELL) last month due to forecasted PC sales. HPQ has witnessed a tremendous run outpacing the SPDR S&P 500 Trust (SPY) over the previous 5-years as it appreciated by 104.87% compared to 86.62% from SPY. The question now is whether to follow in BRK.A’s footsteps as a selloff occurs in the price, or is UBS and MS correct?

I believe now is a great time to start a position in HPQ and dollar cost average into it over time. The selling may not be over from the Buffett bump, but if the markets rallies during Q1 earnings, HPQ will probably rally with the market. The bottom line is that shares of HPQ look inexpensive due to the financial metrics, they are yielding 2.67%, and their earnings forecast is strong. HPQ is a well-run company that has been creating value for shareholders by appreciating stock price and returning capital through dividends and buybacks. Maybe MS and UBS are correct in the short term about declining PC sales, but several catalysts should nullify this argument. Windows 7 support ended on 1/14/20 as the push to Windows 10 occurred. Now that Windows 11 is out, Windows 10 support will end on 10/14/25, meaning that corporations and personal consumers will need to upgrade their OS platform over the next several years. Technology is now engrained throughout society, and I believe HPQ will continue to thrive.

HPQ shares look inexpensive as their financials indicate HPQ is a buy

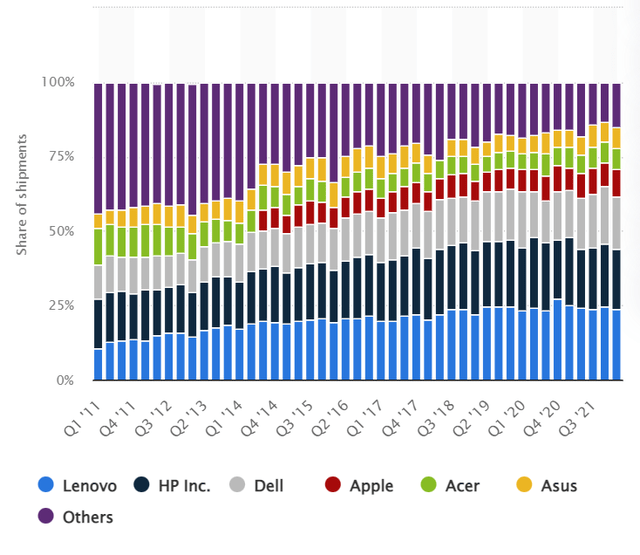

In the trailing twelve months (TTM) HPQ has generated $56.07 in revenue per share and $5.64 in EPS. HPQ’s current share price is $37.47, which places its P/S ratio at 0.67 and its P/E at 6.64. These metrics represent a company that isn’t growing, and that’s the exact opposite of what is occurring. HPQ doesn’t report on a calendar year as their fiscal year starts on 10/1 and ends on 9/30. At the end of HPQ’s 2016 fiscal year, they generated $48.24 billion in total revenue. The arguments were that computer equipment companies such as HPQ got a COVID bump in 2020 as everyone upgraded their equipment to facilitate a new work environment. From the end of 2016 thru 2020 (4 fiscal years), HPQ’s annual revenue increased by $8.4 billion (17.42%). When you expand thru 2021 for the 5-year annual revenue growth figures, HPQ grew its annual revenue by $15.25 billion (31.61%) as they finished 2021 with $63.49 billion in revenue. This is hardly a company that isn’t growing, as its TTM revenue is $64.87 billion. Since Q1 of 2011, HPQ has maintained its position as the 2nd largest vendor of personal computers behind Lenovo.

In addition to HPQ having a low P/S and P/E, HPQ is doing a great job of turning a profit. Everyone knows the story, the computer industry faced tremendous supply chain issues, and chip manufacturers were severely impacted throughout the pandemic. This didn’t stop HPQ from growing its net income, its free cash flow (FCF) or being able to return capital to its shareholders. 2021 was HPQ’s most profitable year in a decade as they produced $6.5 billion in net income. Over the past 5 fiscal years, HPQ grew its net income by $3.84 billion (143.92%), and in the TTM, HPQ has generated $6.52 billion of net income. This is a company that continues to churn out profits despite disruptive external factors.

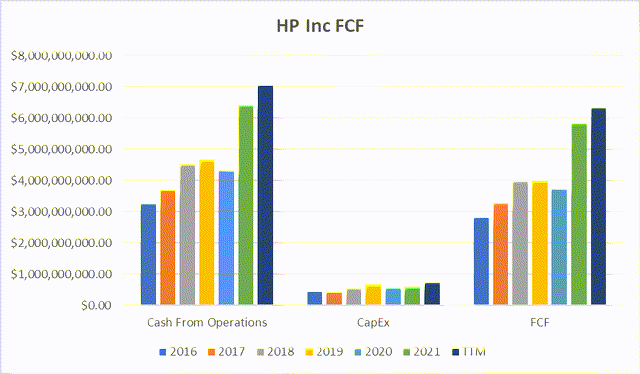

Expanding revenue, operational expertise, and profits leads to additional FCF. FCF could be the most underrated and most important financial metric to look at as this is how companies can repay debt, pay dividends, buy back shares, make acquisitions, or reinvest in the business. During inflation, you want to be in companies that not only generate positive FCF, but are growing their FCF. I always want to see a company that can grow its cash from operations while its capital expenditures stay relatively sideways. Over the past 5 full fiscal years, HPQ has grown its cash generated from operations by $3.16 billion (97.08%) as it increased from $3.25 billion to $6.41 billion. This was achieved with their CapEx increasing by only $149 million or 3.44%. This indicates a strong business operationally, as HPQ was able to produce almost double the cash it generated from its operations while increasing its CapEx by less than 5%. Ask any business owner, and they will tell you that this is incredible. This led to HPQ closing out its 2021 fiscal year with $5.83 billion in FCF, which increased $3.01 billion (106.71%) over the previous 5-years. In the TTM, HPQ is trending upward as their cash from operations exceeded $7 billion while CapEx grew to $711 million, allowing them to generate $6.32 billion in FCF.

When I think about investing in a company, I don’t want to overpay; that’s why I look at every investment as the present value of future cash flow. When you buy an equity stake in a company, your shares represent a portion of the business’s revenue and earnings, and you’re paying for the company’s future cash flow. HPQ’s market cap is $39.47 billion, placing its price to FCF ratio at 6.25x. This is incredibly low, even from a valuation methodology. To put this in perspective, here is how the following companies trade on a price to FCF methodology:

- Apple (AAPL) 26.48x ($2.7T market cap / $101.85B FCF)

- Microsoft (MSFT) 34.56x ($2.1T market cap / $60.69B FCF)

- Alphabet (GOOGL) 25.04x ($1.68T market cap / $67.01B FCF)

- Meta Platforms (FB) 14.59x ($570.54B market cap / $14.59B FCF)

- PayPal Holdings (PYPL) 21.94x ($119.19B market cap / $5.43B FCF)

- The Coca-Cola Company (KO) 25.04x ($281.89B market cap / $11.26B FCF

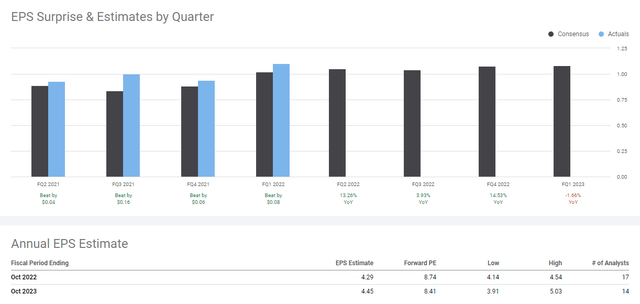

All these metrics look great, but they need to translate to expanding EPS for it to really matter. In 2021 the consensus estimate for HPQ’s EPS was $3.27, and they beat estimates each quarter. In 2022, HPQ has delivered 1 beat, and overall the consensus number has increased from $3.27 to $4.29 an increase of 31.19%. The 2023 consensus estimate for EPS is currently $4.45 as analysts are expecting HPQ to increase its EPS for the foreseeable future.

HPQ continues to return capital to its shareholders

HPQ has been a champion of shareholders, returning immense levels of their profits to them through dividends and buybacks. HPQ’s dividend can be traced back over 3 decades. What’s not to like about its dividend? HPQ pays $1 per share, which is a forward yield of 2.67%. HPQ has consecutively increased its dividend for 11 years at a 5-year growth rate of 11.57%. HP has a dividend payout ratio of 20.94%, which leaves a tremendous amount of room for future increases.

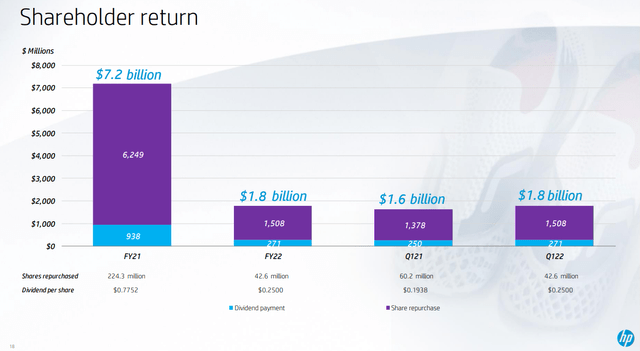

Since HPQ’s spinoff of Hewlett Packard Enterprises (HPE) in 2014, HPQ has been hard at work buying back shares. HPQ finished the fiscal year 2014 with 1.83 billion shares outstanding. At the close of 2021, HPQ had 1.08 billion shares outstanding on its balance sheet. Over a 7-year period, HPQ has reduced its outstanding shares by 40.97% as it eliminated 751.4 million shares. HPQ has also bought back 22.8 million shares in Q1 of 2022, as their total outstanding shares is currently 1.06 billion. In 2021, HPQ returned $7.2 billion of capital back to shareholders as they repurchased $6.3 billion worth of shares and paid $938 million in dividends. In Q1 of 2022, HPQ increased its return of capital by $200 million as it allocated more capital to repurchases and dividends.

Conclusion

I think HPQ is a solid buy under $40. The selloff from the Buffett pop may not be over, but now is a great time to get long on the position. The financial metrics I look at currently undervalue HPQ, and its price to FCF is absurdly low. This is a company that continues to generate increased levels of revenue, profits, and FCF, then goes ahead and returns large amounts of its profits to the shareholders. HPQ has a growing dividend, and each share they repurchase on the open market increases their revenue and earnings per share. I believe HP will continue to grow operationally, and when that is combined with buybacks, they will manufacture larger earnings beats, leading to price appreciation.

Be the first to comment