Pgiam/iStock via Getty Images

Overview

The Howard Hughes Corporation (NYSE:HHC) is a real estate company that develops ‘master-planned communities’ (MPCs). It has a unique business model by which it can create value for its shareholders from the same project over a very long period of time.

Pershing Square Capital Management, an American hedge fund management company founded and run by activist investor Bill Ackman, owns almost 27 percent of HHC. Such a high stake can be both rewarding as well as risky.

HHC’s Unique Business Model With MPCs

The Howard Hughes Corporation was founded in 2010 as a spin-off from General Growth Properties, and is headquartered in Dallas, Texas. The company operates in four segments: MPCs, Operating Assets, Seaport District and Strategic Developments. The MPCs segment develops, sells and leases land and homes, to residential home builders and developers, including land parcels designated for retail, office, hospitality, and residential projects.

HHC owns and operates 5 MPCs – Ward Village in Honolulu, Columbia in Maryland, The Woodlands Hills Summerlin in Las Vegas, The Woodlands in Texas, and Bridgeland in Texas. The company buys a huge area of land and develops commercial assets in a part of it. This creates demand for residential properties, and HHC sells their land to developers, who bring in residents to the master-planned communities. This again increases the value of the commercial assets, which generates even more residential demand.

Howard Hughes Corporation also has acquired MPCs in order to achieve inorganic growth. It acquired a large-scale MPC in Phoenix’s West Valley, from Jerry Colangelo’s JDM Partners (JDM) and El Dorado Holdings (El Dorado) in October 2021. HHC paid $600 million for almost 37,000 acres of land. In this MPC, HHC has the opportunity to build over 100,000 homes for an estimated 300,000 residents and to provide 55 million square feet of commercial development in the area.

Historical Performance

The price performance has been extremely poor over the short and medium term, and mostly negative. The only time the company generated positive price growth is over the long term, but that too is marginal. Over the past 10 years, the price grew by 2.9 percent CAGR. Such real estate companies, banking on long term value creation, generally pay a high yield in order to create value for the shareholders in the short and medium term. Unfortunately, Howard Hughes Corporation doesn’t pay any dividend.

It may seem that the company’s financial performance has been very poor, as the assets it possesses are yet to generate significant value. However, this is not the case. Howard Hughes Corporation recorded consistent growth in most of its financial metrics. It has achieved significant YoY revenue and income growth. The estimated funds from operations (FFO) per share in 2022, 2023, and 2024 stands at $6.11, $5.05 and $10.84 respectively. During the past two quarters, HHC has generated a per share FFO of $3.67 and $1.37.

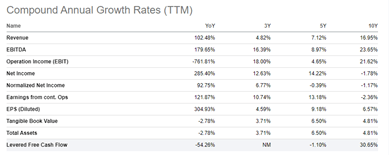

HHC Growth (Seeking Alpha)

Thus, while the price performance has been poor, the fundamentals of HHC are relatively stronger. The conclusion I can draw from this is that price performance does not reflect fundamentals, so there may be long term potential in the stock.

Huge Stakes By Bill Ackman

Howard Hughes Corporation has a market value of $4.18 billion, and is mostly owned by financial institutions. Pershing Square Capital Management, an American hedge fund management company founded and run by activist investor Bill Ackman, owns almost 27 percent of HHC. The stake was first established in 2010 as a result of its spin-off from General Growth Properties, Inc. (GGP). Later, they added 10 million shares in Q1 2020 at a price of $50 per share through a private placement. Pershing Square increased its stake by 26 percent in 2021, and now has 13.62 million shares of HHC.

Whenever a single investor (other than the promoter) holds such a high stake in any company, there lies the risk of disproportionate control. And in the case of hedge funds, the risk multiplies because of their inherent risk. Hedge funds have a reputation of investing in high-risk, high-return projects or companies, and thus risk-averse or risk-neutral investors generally stay away from such projects or companies. In case the hedge fund suffers a huge loss, or develops negative vibes regarding any of its investments, it may sell its entire stake at one go, which will be detrimental for a company like HHC.

Bill Ackman did the same with Netflix Inc. (NFLX). Nearly three months after revealing a $1.1 billion stake in Netflix and Ackman praising Netflix’s “best-in-class management team”, he sold out his entire 3.1 million share position following the news that Netflix lost subscribers for the first time in a decade. Pershing Square’s accumulated stakes in NFLX during January 20 to January 26, when the stock traded in a range of $360 and $400. And almost 4.5 months after that, NFLX is trading at $182.

Ackman himself has admitted that his most successful investments have always been controversial, and that his first rule of activist investing is to “make a bold call that nobody believes in”. Ackman has made extremely successful investment decisions such as Lowe’s Companies Inc. (LOW), Chipotle Mexican Grill Inc. (CMG), Restaurant Brands International Inc. (QSR), Hilton Worldwide Holdings Inc. (HLT), Agilent Technologies Inc. (A), etc. However, Bill Ackman did commit blunders in the past. The most famous one was his disastrous $1 billion short bet on Herbalife, made in December 2012.

A short bet makes money when the stock price falls, and Ackman predicted the price will fall down to zero. He made a three-hour presentation on Herbalife at an investment conference and called the nutritional supplements company a pyramid scheme. The stock was trading at about $45 when Ackman first disclosed his $1 billion short. Shares are now trading around $92. Ackman finally exited the bearish bet against Herbalife in March 2018.

So the takeaway from Mr. Ackman’s high stake situation is that it makes the HHC investment risky because no one can predict when he may sell out, and no one can predict whether, if he does, he will be right.

Conclusion

By owning every aspect of the value chain of MPCs, HHC can create value for its shareholders over a very long period of time. By owning a huge land base, and commercial assets, these MMCs may take years to generate value, but can deliver growth for a very longer period of time.

However, despite all the promise this company shows, the price performance has been extremely poor, and mostly negative. The probable reasons for poor price growth may be the absence of dividend, uncertainty over value creation over short and medium term, and the high stakes owned by Bill Ackman.

Be the first to comment