CatLane/E+ via Getty Images

Co-produced with Treading Softly

I love a good goalpost.

When I’m driving a long distance, I love to count down the miles until I get there, so the interstate is my friend. The regular signage saying how close I am, or how far I’ve traveled provides me with regular updates on my progress.

I know how far I’ve gone, all while knowing exactly where I am, and how far I have left to travel.

It’s a nice sense of having a clear perspective on my past, present, and future. Something which all too often we lack in life, don’t we?

So when we have goals for retirement, it can be difficult to know where exactly to hang our hats. Is it a specific target portfolio value? A specific amount we’ve socked away over the decades?

Many use a goalpost of having a portfolio value of $1 million.

This goalpost is uniform and easy, “Be a millionaire and retire rich!” However, the path to get there can be extremely varied. Some just buy lottery tickets and hope for the best. Others try to find the next Amazon, Netflix, or Google. Others try their hand at the fast-paced moshpit of penny stocks. Or they might brave the frontier of cryptocurrencies, where its lack of regulations and abundance of scams makes it feel like the wild west of investing.

The historical sidekick to retiring with $1 million is to withdraw 4%, adjusted for inflation, annually. This was called the “SAFEMAX” method. So with $1 million in portfolio value, you’d withdraw $40,000 annually each year until you’ve burned through your assets or you pass away. It has worked well for many but leaves those same individuals fearing a market downturn or mis-timed withdrawal leaving them penniless before breathless.

So what if you could get $40,000 or more annually without selling a single share? That’d be the dream, right? I’d say that even better would be if it required a fraction of the amount saved. How about only $400,000 or 40%? Too good to be true? Not in today’s market.

I have long said that bull markets are great, but bear markets are when wealth is truly made. The foundation for riches and wealth is laid in bad times, which then explodes in value when good times roll back around.

Let’s look at two investment opportunities that will provide you with wealth today and riches tomorrow.

Let’s dive in.

Pick #1: ECC – Yield 15.1%

Whenever prices are low and dividend yields are high, many investors are biased to assume that the company’s ability to pay the dividend is at risk. The reality is that falling share prices do not cause dividend cuts. Nobody in any boardroom has ever said: “Our share price is down 30%, so we should cut our dividend.” Dividends are paid out of cash flow, not share price.

Share prices do fall when investors fear the dividend is at risk. Yet share prices fall for a lot of other reasons that are completely unrelated to the dividend.

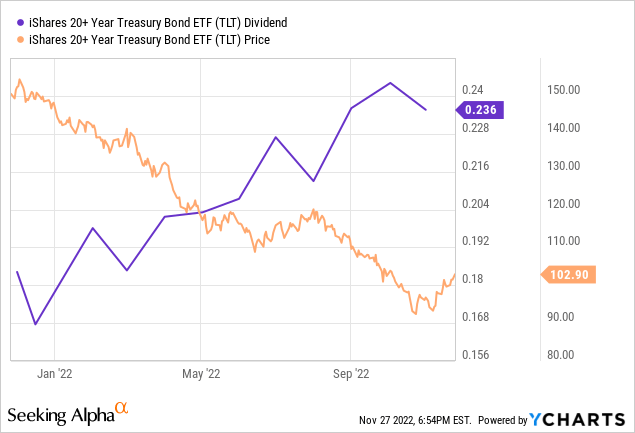

Don’t believe me? Consider iShares 20+ Year Treasury Bond ETF (TLT), which carries long-term Treasury bonds. The price has fallen off a cliff, while the dividend has gone up significantly:

Is the dividend at risk of being cut? Of course not. Treasury yields are higher, and as holdings mature and it reinvests the principal, it is reinvesting at higher yields. The dividend will continue on a generally upward trajectory.

Why does this happen? Because the value of a bond is based on its yield. Treasuries that were sold at par yielding 1-2% are less valuable on the secondary market in a world where the 10-year Treasury is now yielding nearly 4%. Why would you buy a Treasury bond with a 2% coupon when you can buy one with a 4% coupon? You wouldn’t unless the price declined below par. Those who own lower coupon bonds have to sell them at lower prices because higher coupon bonds with the same risk are alternatives.

This trend in the Treasury markets impacts the prices of all debt instruments. The Treasury Bond is the gold standard against which all other debt is measured. After all, it is considered “risk-free”. So when an investor is considering taking a risk buying debt that might or might not be paid back, the price they are willing to pay will be significantly influenced by how much return they can receive, taking no risk. Investors will take a risk, but they want to earn more for taking a risk than they could earn, taking no risk at all.

At its core, Eagle Point Credit Company (ECC) is an investment in debt. Debt that is owed by companies with B/B+ credit ratings, which is a higher risk than a Treasury Bond secured by Uncle Sam with an AAA credit rating.

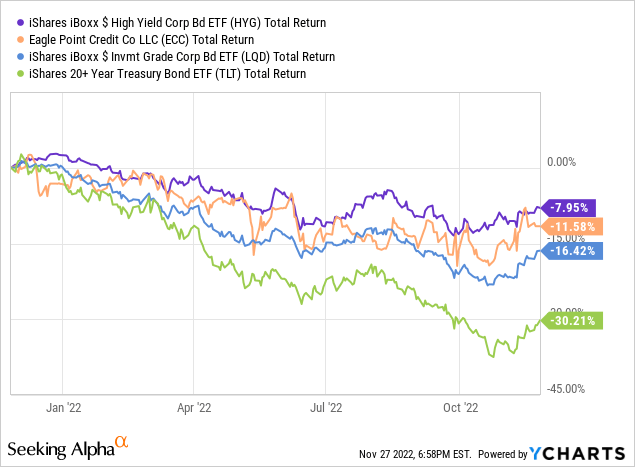

Over the past year, the prices of all debt have fallen, which has been the main cause of the decline in ECC’s price. Whether high-yield or investment grade, the prices of all debt have declined with Treasuries.

As ECC’s price has fallen, the dividend yield has risen well into the double-digits – an area that makes many investors run in fear of a dividend reduction. Yet what happened when ECC announced Q3 earnings? ECC announced a $0.50 special dividend. Additionally, in the earnings call, CEO Majewski stated:

As we have looked at this, the rationale for declaring the 50 is that we think taxable income we will have even more spillover income. So, let’s pay some out now. We can avoid the excise tax, because that will be paid quickly enough. To the extent our final tax returns look like we will have even more. We will pay that out. And we will have to take a reserve for it in the fourth quarter for that excise tax. And then we would expect to pay out one or more specials during 2023 related to 2022 taxable income to the extent our projections are correct.

In short, ECC is paying out another special, and ECC expects it will have to pay out even more later to meet its distribution obligations, but they are going to wait until they actually do their taxes to make sure reality matches their projections.

Why is ECC producing so much money that a 15% distribution yield plus two special dividends still isn’t enough to meet its tax obligations? Note the TLT chart above – even as prices are falling the dividend is rising. Prices are falling, but cash flow is rising.

On new investments, ECC is getting a 17% Effective Yield. That is the expected yield adjusted for assumed credit losses. In other words, they are drawing from past experience to predict how many borrowers will default over the life of the CLO, and they are still getting 17% yield.

CLO has been raking in cash hand over fist. Over the past year, recurring cash distributions have covered the dividend by 200%! The future outlook remains bright as CLOs are buying up loans at $0.80-$0.90 on the dollar. Yes, some of those borrowers will not pay. Some of those loans will be a big fat zero. But the funny thing about corporate debt, far more loans will be paid as agreed than will go into default. More companies survive than file bankruptcy. ECC is positioned to be a huge winner thanks to that reality, with a dividend that is going up.

Pick #2: SAR – Yield 10%

We weren’t terribly surprised to see a dividend hike from Saratoga Investment Corp. (SAR), but we were pleasantly surprised by the size. SAR hiked its dividend 25.9% to $0.68/quarter.

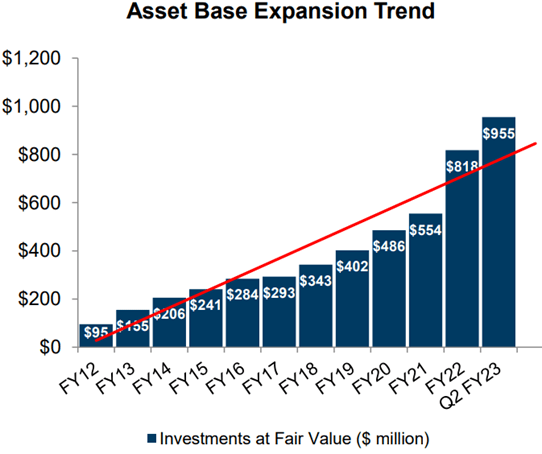

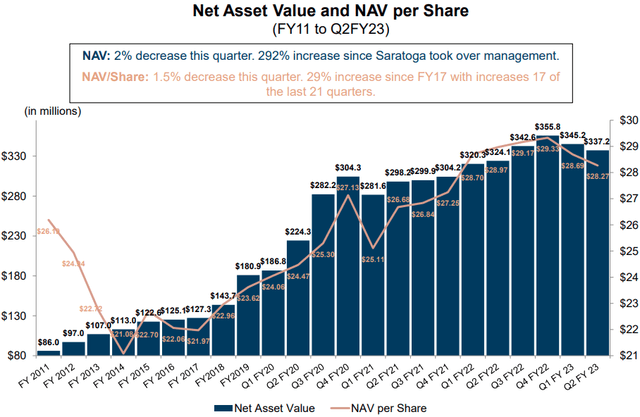

During COVID, SAR took a conservative route and cut its dividend from $0.56/quarter to $0.40/quarter. For the past two years, we’ve remained patient, watching the dividend creep back up as SAR expanded its asset base. (Source: Saratoga Investment Corp Q2 2023)

Saratoga Investment Corp Q2 2023

SAR has been growing assets in a way that has been beneficial for their per/share metrics. NAV per share has grown as well and is above pre-COVID levels.

Saratoga Investment Corp Q2 2023

Like most BDCs, SAR follows the business plan of borrowing fixed-rate debt and lending floating-rate loans. That strategy is a huge winner when interest rates are rising.

Despite this, SAR’s share price is still below pre-COVID levels. Their dividend cut and the slow pace it was restored could very likely be a reason why investors have shunned SAR.

We love dividends as much as the next investor and a lot more than most. Our entire portfolio revolves around dividends. Yet, sometimes, paying out massive dividends is not in the best interests of shareholders over the long term.

You might have heard of the “Stanford Marshmallow Experiment“, 4-year-old children were given a marshmallow and told that if they didn’t eat it, they would get a second one. Those who could resist the temptation experienced greater success ten years later than those who ate the first marshmallow early.

Investors who can exercise patience and self-restraint are also more likely to experience better success.

Sometimes, it is best for the company to retain capital and reinvest it for future returns. That is what SAR has been doing, and today, their dividend growth has rocketed up, and patient investors are now reaping the rewards.

Conclusion

With SAR and ECC, we can receive large double-digit yields today, and the expectation of further dividend growth in the future. ECC is tossing off large monthly distributions and special dividends to boot. SAR is regularly growing its dividend with a management team that is keen to protect the company’s value while also rewarding its shareholders.

A blended yield of over 12% means having $400,000 invested today, your portfolio will readily produce over $40,000 in annual income, plus leave you some extra to reinvest – something we deem extremely important in our Income Method taught to High Dividend Opportunities members. No income portfolio is fully fleshed out with only two income-producing investments, we recommend holding no less than 42 of them, so you’ve got 2 freebies today and only need 40 more to build out that portfolio.

Your retirement goalpost could easily be to retire with a millionaire’s income stream, to do so you’d only need to generate $40,000 annually. No such a hard goal to make if you have over $400,000 in your portfolio to use. Perhaps once you’ve had a taste of the good life via income investing, your next goal will be to generate a multi-millionaire’s income stream.

You’ll be there in no time if you keep reinvesting your dividends. That’s the beauty of our Income Method.

Be the first to comment