limpido

Energy became a hot topic this year, and I hope you’ve earned a bit over the hype. The key question for many investors is when to realize profits. As recent market history shows, the Buy & Hold strategy doesn’t work too well. The crops need to be harvested, otherwise the fruit will become rotten.

Although I expected the recession and the stock market to decline, I think the time of harvest for energy assets hasn’t come yet. Big changes at the oil market are unfolding now, and this can be big news for the market.

News #1: On December 5th, EU states will ban imports of Russian crude oil.

News #2: On the same day, an oil price cap plan led by the Group of Seven will come into force.

These acts will change a lot at the market, as Russia is one of the world’s largest oil producers. It will also bring a lot of turmoil to the industry as both changes are introduced for the first time. It may turn out to be a very interesting earning opportunity for attentive investors.

During the COVID-19 market bottom, I wanted to invest in oil, but I was too hesitant to trade with it. There isn’t a spot market for oil, since you can only buy it with the help of derivative instruments that can be quite risky. You may have the same apprehension about the derivatives market that I used to have. If that’s the case, I’d like to show you how retail investors can profit from the opportunity without taking as high risks.

Russia won’t get its hands dirty in oil cap

The war in Ukraine started over 8 months ago and has become utterly brutal over the last few months. Many of us saw terrible pictures from Bucha and Irpin and know how real evil looks. To stop Russian aggression, the US, European countries, and other G7 members decided to take out the main source of war funding— oil proceeds— from Russian hands. So, the US banned oil imports from Russia in spring and Europe will ban it starting in December. This can have a major effect on oil market supply-chains because Europe was the main consumer of Russian crude.

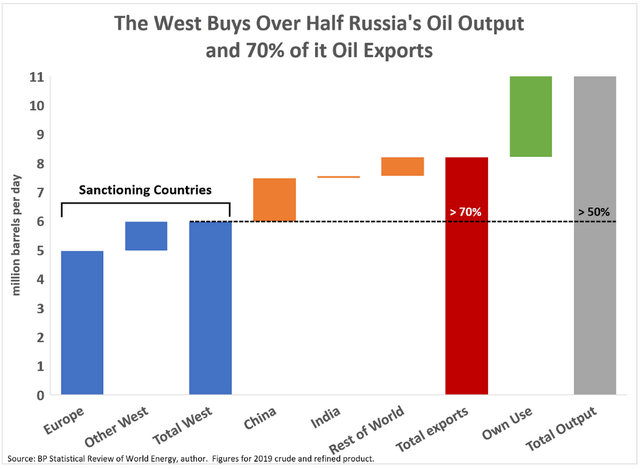

Source: Russian Oil’s Achilles Heel – by Craig Kennedy (substack.com)

Although the ban has yet to be introduced, European countries have bought much less oil from Russia over this year compared with the past. But it didn’t do much to curb Russia’s finances. To keep its proceeds afloat, Russia successfully expanded exports to China and India. Plus, rising geopolitical uncertainty only increased oil prices and helped Russia earn even more from its exports.

To further tackle the issue, G7 was thinking about an instrument that wouldn’t completely deprive the world of Russian oil, but still limit Russia’s profit from it. A simple global ban on the crude would be a bad solution because Russia comprises over 10% of the global market. If you prohibited its oil completely, the prices would skyrocket and drive inflation. The worst outcome the Fed could imagine.

A solution that killed two birds with one stone was found: a price cap. It will prohibit Russia from selling oil to any country in the world when the price is higher than the pre-settled one. It isn’t quite known exactly what it will be at the moment, but the cut-off price is expected to be $60 per barrel. If everything functions well, Russia will sell cheap oil abroad and won’t have any money to continue to wage war. At least, this is the plan. The question is, is Mr. Putin d’accord with it?

The reality is much more complicated. When I heard about the price cap for the first time, many questions came up in my mind. How will it be introduced? Who will monitor it? Will Russia abide by it? To try to answer some of these questions, my team and I spent a lot of time investigating the issue.

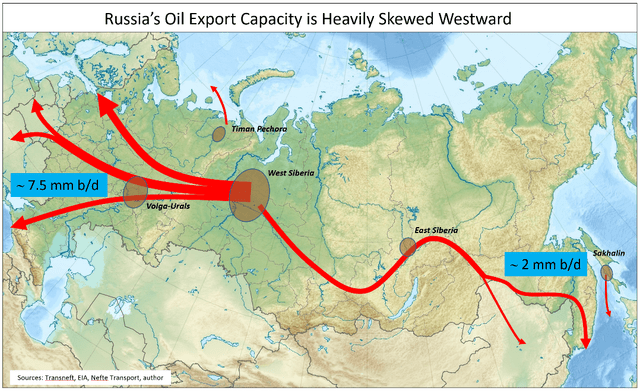

So far, Russia has mainly exported the oil via pipelines to Europe. The business expansion to Asia will require many transporting vessels that Russia simply doesn’t have right now. Because Russia needs to rent ships from international companies to deliver its cargo, the sanctions can be effectively imposed on logistic companies. G7 will prohibit any insurance, financing, and bunkering services to any vehicle that transports Russian oil above the cap price, which will make vessel providers think twice before dealing with sanctioned Russian oil. If cargo companies use a vessel even once for the transportation of “illegal” oil, they won’t be able to use its ships anywhere else. The mechanism would be similar to the Cuban sanctions in the 60s.

Source: Russian Oil’s Achilles Heel – by Craig Kennedy (substack.com)

The idea behind this plan is that absence of a required fleet will force Russia to abide by the sanctions. Otherwise, the oil will be shut-in the wells and the Russian oil industry will suffer a lot. But will Russia cooperate or prefer self-destruction? I’m pretty sure that it won’t. It would be humiliating for Putin to play by someone else’s rules. Russian officials also claimed several times that there is no intention to abide by the cap.

In a no-cooperation scenario, Russia won’t be able to use a foreign fleet. It will need to massively increase its own vessel fleet. Since it isn’t easy to expand the fleet quickly, the oil supply can be disrupted. As Sergey Vakulenko, a leading energy specialist from Carnegie Endowment, writes:

Russia will need about 200 tankers to keep up its exports. Russia’s biggest shipping company, had around fifty tankers. New Suezmax tankers cost $80 million, while their scrap value is $10–$15 million, so 150 tankers will cost at least $1.5–$2.5 billion. Even if Russia is able to buy all necessary tankers, the creation of a fleet will take some time. During transitionary period Russian production may be reduced and limited by the available shipping capacity.

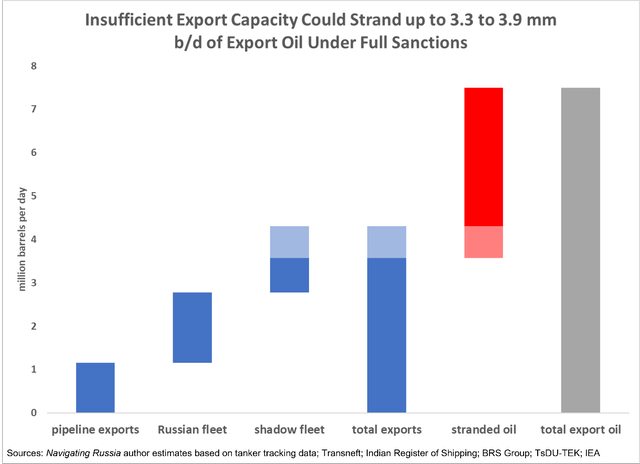

Even if Russia is ready to spend money on the expansion of its own fleet, it can’t happen overnight and will take time. Granted, Russia could also tap into the so-called shadow fleet, a marginal group of aging tankers with anonymous ownership and an appetite for transporting sanctioned crude. But even despite the shadow fleet capacity, during this transition, period oil can become scarce for global consumers. Craig Kennedy, a research fellow at the Harvard Davis center, estimates that the export will decrease by half:

Once sanctions are fully in place, Russia’s total crude and product exports (seaborne + land) could fall by as much as 3.3 to 3.9 million barrels a day from a baseline of 7.5 million barrels a day, absent any sales under the price cap mechanism or revisions in the planned G7-EU sanctions. This decline is likely to phase in gradually from October through the end of January, as foreign shippers start avoiding cargoes that might not reach their destination ports prior to the December 5th and February 5th cutoff dates.

I believe that such a scenario hasn’t been fully factored into current oil prices. Even though mainstream financial media does write about the changes, they don’t mention the issues associated with it. For example, in a recent Financial Times article, there wasn’t a single word about potential supply-chain issues associated with the price cap. The level of expertise discussing Russia is very low. Partially because its role in the world GDP is marginal, and partially because it’s an autocratic regime that is difficult to analyze. This gives the earning opportunity to us.

Oil, oil, oil. Show me the money

The simplest way to benefit from rising oil prices is via ETFs such as the Energy Select Sector SPDR ETF (NYSEARCA:NYSEARCA:XLE). It contains various energy names including the largest energy companies, such Exxon Mobil Corp (XOM) and Chevron Corporation (CVX). Other possible ETFs are Vanguard Energy ETF (VDE) or Vanguard Energy Fund Investor Shares (VGENX). The key question here is whether or not energy stocks behave similarly to oil prices and indices. Will energy funds decrease if oil rises but the recession probability grows?

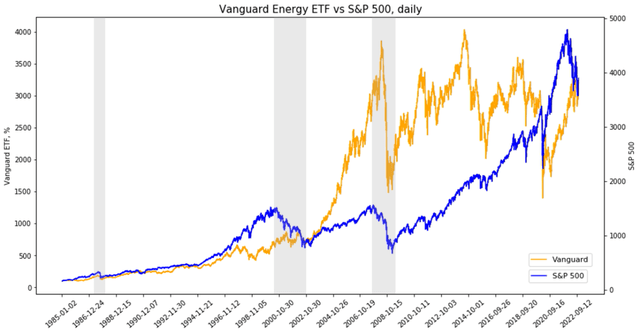

Note: I’ve noted that VDE is more popular than VGENX among investors. The latter also includes non-US energy companies and dates back to 1986 rather than 2005 like VDE. Otherwise, the performance of both funds was historically similar, but different in 2022. For long-term trends, we rely on VGENX due to data availability.

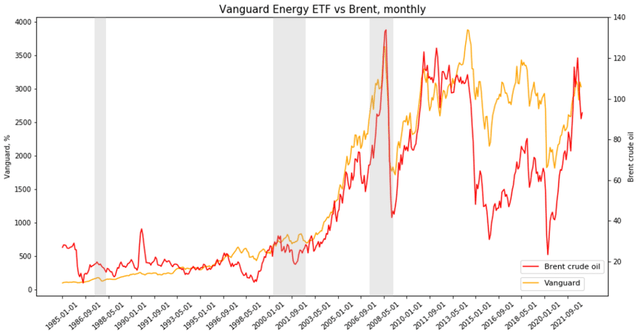

Over the long-term, energy stocks were much more volatile than the broad market (blue line), but its overall performance was very close to S&P 500. This means that the Buy & Hold strategy would bring the same return that S&P 500 did— just with a bigger headache for retail investors. You need to trade over the cycle if you want to invest in energy.

From the chart below, we can see how closely energy stocks followed oil stocks over the long run. In 2015, the sector collapsed following an increased oil supply due to new extraction methods in the US. Over 2020 energy stocks underperformed as the oil price remained subdued. Throughout 2022, the energy stocks recovered following increasing oil prices.

Contrary to popular opinion, energy stocks aren’t always growing in the late phase of the cycle. Its path is mainly driven by oil prices that usually go up when the economy is feeling good. But there are so many other supply factors affecting crude prices, such as new technologies, OPEC agreements, and geopolitical issues.

So far, it seems that the energy stocks are a good instrument to benefit from anticipated oil price increase. But does the pattern keep up just before a recession?

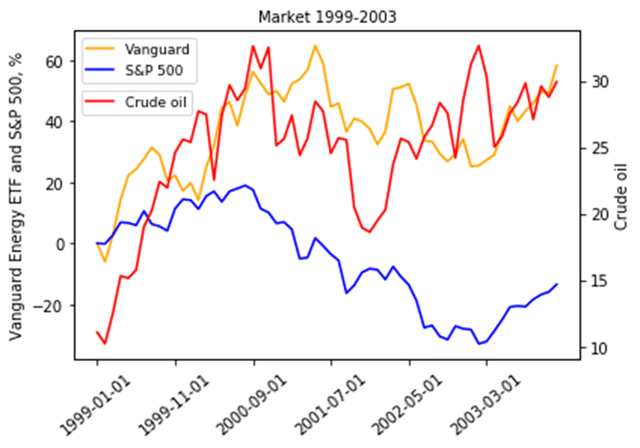

In the graph below, the energy stocks decline only several months after the start of the S&P 500 bear market. Looking at the crisis over 2001-2002, we see a very interesting picture. Oil peaked when the broad market peaked, but energy stocks only reached a high several months afterwards. It is also fascinating that the energy sector didn’t fully follow oil prices. When 9/11 occurred, Brent prices jumped because investors were concerned about a potential war against terrorism. But energy stocks didn’t follow oil prices, they continued declining following the S&P.

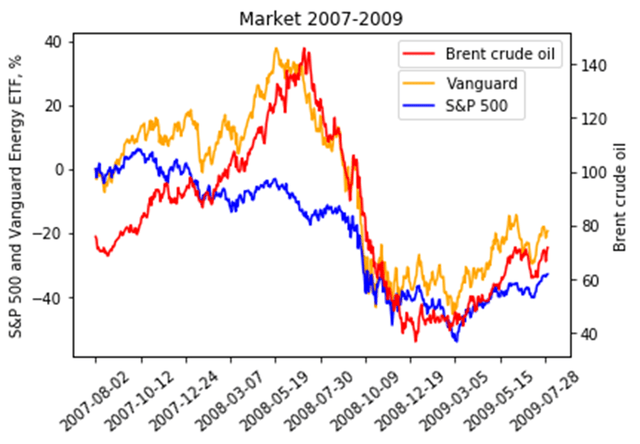

A similar development happened in 2008-09 when indices reached a peak in late 2007, but oil and energy stocks peaked later in the summer of 2008. In this case, unlike 2001-02, the energy sector followed the oil prices rather than the index.

As we’ve just seen, the energy sector has historically peaked after the indices. But its path hasn’t always been linked to oil prices in the months of an economic crisis. I believe that this time, it can also be the case. Higher crude prices will make the FED increase rates even more aggressively due to rising gasoline prices. This would have a tremendous effect on all stocks, including the energy ones.

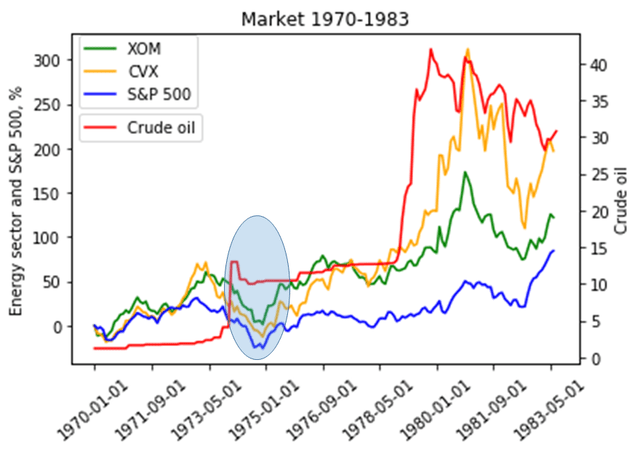

We can see a similar pattern in the 70s. Oil shock in 1974 led to higher inflation and lower stock prices. The largest energy stocks followed the index, although companies profited from more expensive crude.

To finalize our discussion about ETFs, we also look at the valuation of the largest oil companies: XOM and CVX. Their current EV/EBITDA multiples are higher than during the previous recessions but in line with the historic average multiples. Increasing oil prices will boost EBITDA and keep multiples flat even by increasing share prices. If you like these shares, you can profit from the investment idea via these stocks. But still we prefer buying oil directly to avoid equity risks given a looming recession.

You can’t just buy Brent oil. There is no spot market for it. You can invest in it only via energy stocks or derivative instruments. If you are a classical equity investor, then you can try energy ETFs. But you should keep in mind that the energy stocks don’t always follow oil prices. Therefore, we prefer derivative trading. Because risks are higher with derivatives, we need to be very attentive to risk management.

Oil derivatives

If you love risk more than we do, then it makes sense to buy futures. If you want to have your risks under control, then a call option would be a suitable instrument.

Brent Futures

Assuming that the market is impacted over the winter, we are considering futures that expire in March of 2023. Since futures are a leverage instrument, you only need to buy them for a fraction of the amount you would like to invest in oil. If you want to invest around $1,000 in oil, for example, you could buy 11 Brent crude oil futures for 89.4 each. Because the leverage is 10:1, it would correspond to investing $983.4 while spending only 98.34. It would also mean that if oil prices go up by 10%, your futures position would increase to $1081 from $983. So you will earn $98, which would correspond to 10% for $983. As only $98 is invested in the futures, you could do whatever you want with the rest of the money ($1000-$98=$902). But this would involve really high risks, so ultimately, you need to be really careful. If the price of the futures significantly decreases, you need to invest additional money in it.

Brent Call Option

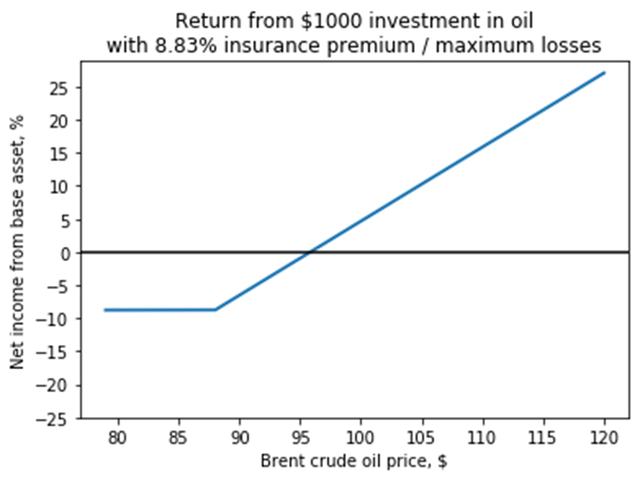

Because we want to have full control over the risks involved, we are investing in Brent with the call option. It allows us to earn good money while keeping risks under control if the investment idea doesn’t work. I’m buying the call option for Brent futures expiring in March of 2023. If you want to invest $1,000, you are going to need to buy 112 call options for $88.31. If the oil price goes down, my maximum loss won’t exceed $88.3, or 8.83% from $1,000 and won’t correspond to the call option premium. Like in the futures case, I prefer not doing anything with the rest of the money ($1,000-$88.3=$911.7) because I don’t want to increase the risks.

Call Option

Strike price: $88

Expiration date: 26.01.2023

Premium: 8.83%

Leverage: 1:10

Risks

There are certain risks involved if the investment idea doesn’t work. Craig Kennedy summarized the idea very well:

Many market observers expect declines in Russian exports, but not generally of the magnitude given here. They tend to see Russia’s supply chain as being more resilient than my analysis would indicate. Some believe shipowners wishing to continue in the Russia trade will find alternative sources of P&I insurance. Others think Russia’s surreptitious purchases of used tankers could bridge the gap. Still others point to various subterfuge shipping schemes—already being tested—that might be used in smuggling operations.

Another risk is if the recession starts unfolding quicker than expected, which could drag on the oil demand. It would subdue oil prices and the market won’t notice the lack of Russian oil.

Conclusion

The potential oil price hike presents a very interesting opportunity for us. We could earn a lot if the investment idea works out. There are two ways to profit from it: via stocks or ETFs such as XLE and VDE, and via derivative instruments. Stocks present too many risks for me with the looming recession. For call options, the risks are precisely quantified. If the investment idea goes south, I will only lose 8% with the options— not a penny more. I think it is a nice price for the potential gain.

Be the first to comment