YakobchukOlena/iStock via Getty Images

This article was originally posted in the CEF/ETF Income Lab on 11/7

Main Thesis & Background

The purpose of this article is to discuss my investment outlook for the final stages of 2022, with a focus on how readers can take some actionable steps to prepare for 2023. Yes, it is that time of year again when we focus on a fresh calendar. To me, this is good news – 2022 is a year to mostly forget (investment-wise). In this vein, it makes sense to try to make sense of how the market is going to react in the new year. Will we see more of the same, or will new trends emerge that we can look to capitalize on now before the masses catch on?

In this article, I will focus on a few areas I think are ripe for a rebound and also some areas that, I think, will remain under pressure. My hope is this gives readers some insight to make portfolio adjustments to capitalize on tax-loss harvesting, conduct a close examination on their winners, and debate what will be themes to invest in come January.

Fixed Income May Finally Get A Bump

The first area of focus for me is the fixed-income market. This has been a terrible year for bonds and credit across the board – some of which was predictable, some wasn’t. What I mean is that fixed income had a lot of risks going in to 2022. With the Fed telegraphing rate hikes, inflation remaining sticky, and bond funds with excessive amounts of duration risk (on average), a drop in underlying prices was all but guaranteed.

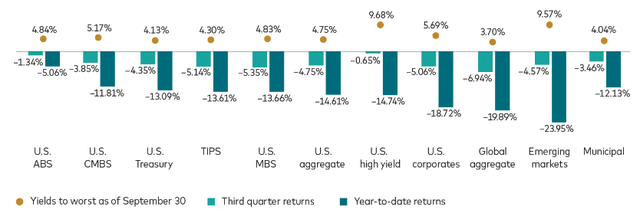

This is why I turned cautious on the fixed-income market as a whole, only to turn slightly bullish once the sell-off materialized. In mid-2022, I thought the push lower was a bit overdone and, while bonds did get a temporary reprieve, losses have continued to pile-up. This means that things went from bad to worse in the bond market, with double-digit losses across the board:

Fixed Income Sector Returns and Yields (Vanguard)

This is not a pretty sight, but begs the question – where is the opportunity?

Simply put, I think the market is ripe for a bit of a rebound next year. Risks remain on the horizon, but have started to get priced in to a level that I see enough upside to warrant positions. What I mean is, inflation is still very real and the Fed has remained committed to raising rates further. At the time of writing, the expectation is the Fed’s policy rate may end within a range between 4.75% and 5.25% in the second half of next year. This means that readers wouldn’t be wise to go “all in” at these levels because more downside is certainly possible.

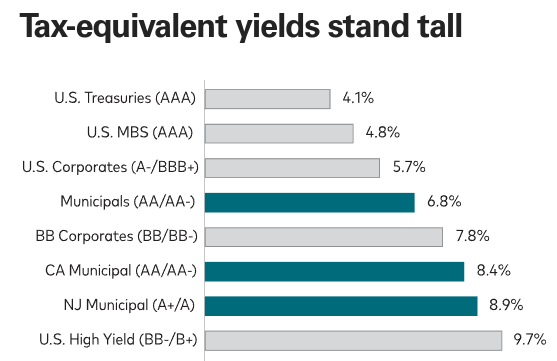

But the benchmark rate is already in the mid-3% range, and bond prices have begun to price in further hikes and recessionary risks. This tells me that if we get any piece of good news – whether it is an inflation decline, a Fed pause or pivot, or strong GDP growth – then the bond market could begin a nice cycle higher. In my opinion, the end of this bear market is near. This means investors can get some reasonable value and much higher yields than we have seen over the past decade. The U.S. high yield market is offering a yield near 10%, and the muni market has a 4% yield, which means tax-adjusted yields are in the 5-6% range (or higher depending on your state of residence):

Current Yields (Tax-Adjusted) (Moody’s)

I will be upfront in saying this investment idea has not been a good one this year. I was too early with buying-in, but I think over the long term, this will prove to be a lucrative entry point. Income streams are high enough I am willing to take some risk and plan on adding to my positions throughout 2023 if more weakness persists.

**My muni positions include the Nuveen AMT-Free Quality Municipal Income Fund (NEA) and BlackRock Taxable Municipal Bond Trust (BBN). I also own the BlackRock Floating Rate Income Trust (BGT) and PIMCO Dynamic Income Opportunities Fund (PDO).

Inflation and Higher Borrowing Costs Will Remain A Thorn For Consumers

My next topic focuses on some areas I think readers should be wary of. In particular, this is growth themes that are running on borrowed debt and little earnings. This also includes Consumer Discretionary and Retail names as a whole. To be fair, there are pockets of value in both of these corners. But my concern is that with global economic conditions tightening, investors want quality and value. They are punishing companies that fall short on earnings, especially those that are unprofitable (just look at DraftKings (DKNG) action last Friday, down 27%!).

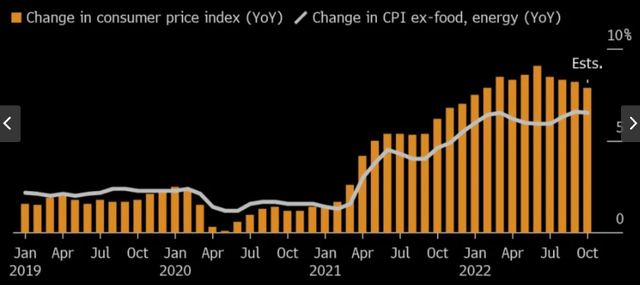

The challenge for 2023 is that the inflationary environment may be a little better, but not good. What I mean is that there are signs inflation may be peaking. Year-over-year inflation has come down from its peak and is expected to see a slight decline in October compared to September. However, it still remains at elevated levels, well above what we saw prior to 2021:

Inflation YOY Change (By Month) (Bloomberg)

The point I am making here is that inflation is not going to go away overnight. Even if the Fed keeps hiking rates and we enter a recession, prices are going to remain elevated. Think about it this way: if inflation drops down to 4-5% we would see that as a major win. But a 4-5% rise in prices on an annualized basis is still much higher than American consumers and businesses are accustomed on a historical basis. This tells me inflation will continue to pressure the market with a particular emphasis on areas exposed to consumer spending. As consumers cope with prices being higher for longer, discretionary retail names are going to continue to feel a pinch.

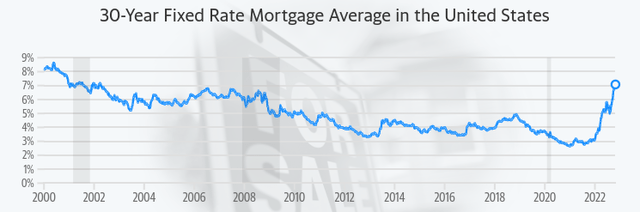

This is a double-whammy for American households because as prices are rising, the cost of credit is also going up. The Fed’s efforts have not done much to bring down inflation, but they have sent borrowing costs soaring. Look at the mortgage market as an example. The average 30-year mortgage rate recently eclipsed 7%. Americans hadn’t seen these levels in over a decade:

30-Year Mortgage Rate (Freddie Mac)

The broad takeaway is that American households/consumers are facing a difficult climate. This is going to limit the “want” spending category and pressure the outlook for discretionary names and/or companies that have large mark-ups on their goods. With Americans seeing higher prices and also higher interest rates on their credit cards and mortgages, I think next year is not going to offer much relief to Consumer-oriented investment plays. While 2023 may bring about change in other sectors, this isn’t one of them.

**I own the SPDR S&P Retail ETF (XRT) but will wait for another big drop in price before considering adding to my position. I continue to be long Lowe’s (LOW), Dollar General (DG), McDonald’s (MCD), and Walmart (WMT) because those are more defensive consumer names that could actually benefit from a more price conscious shopper.

Energy Gains Should Slow

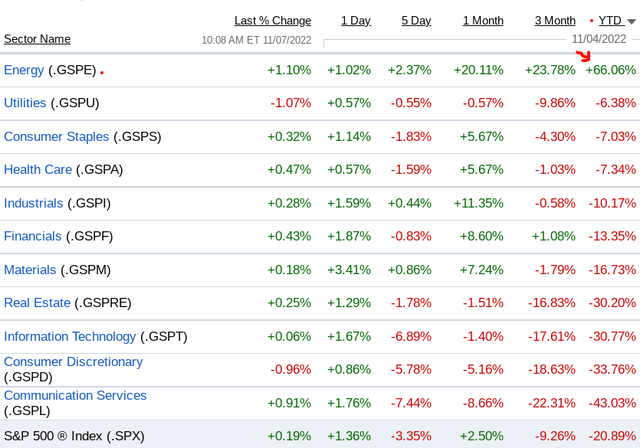

I will now shift to the Energy sector. This has been a saving grace for the market (and my own portfolio!) this year. While every other sector is in the red, Energy has posted a phenomenal YTD return:

YTD Performance (By Sector) (Fidelity)

I want to make it clear here, I am not overly bearish on this sector. Betting on Energy has been a winning play, and many of the reasons why this is so remain in place today. The primary of which is low supply, driven by policy decisions in the U.S., OPEC+ production cuts, and supply chain issues on a global scale. In this light, exposure to Energy continues to make sense, and it could very well continue to be a hot sector in 2023.

But I have concerns. With such a large gain this year, it is natural to want to lock-in some of this profit. That is precisely what I am doing now because I see some major headwinds that could push oil prices lower and bring down Energy shares to a more attractive buy-in point.

So, what are these risks?

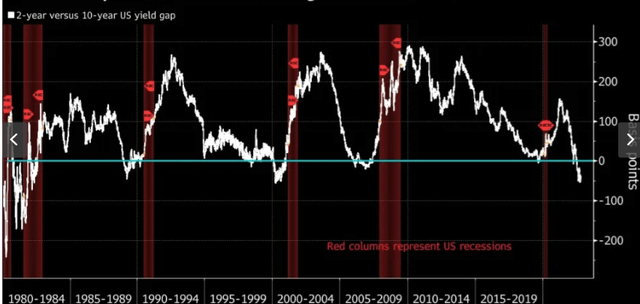

The first of which is a recession, in the U.S. and globally. With government stimulus spending remaining high across the world, higher interest rates have pushed out recession forecasts to the second half of next year. It was originally expected the globe would see a recession either by now or in the first half of next year. But dodging it so far has not put us out of the woods. The bond market is still pricing in an economic slowdown, as measured by the yield curve for 2-10 year Treasuries:

Yield Curve Inversion (Yahoo Finance)

A yield curve inversion is certainly not a guarantee of a recession, but it is one of the best indicators out there. If that happens, dependence on crude could drop as business activity declines. This will pressure Energy shares – although I would expect that pressure to be temporary as central banks will swiftly reverse to more accommodative policies.

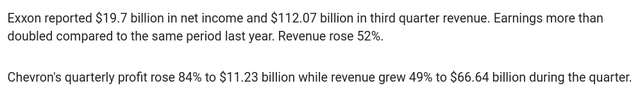

Another concern I have is political. With mid-term elections occurring tomorrow, I almost see a lose-lose proposition for Energy shares. The Biden administration has taken a stronger, more negative, tone against Energy companies in recent months as he tries to deflect blame for rising prices across the country. In this light, the performance of top Energy producers like Exxon Mobil (XOM) and Chevron (CVX) have made them prime political targets. They have almost performed too well, because it means politicians are going to take aim at record profits if given the chance:

XOM and CVX Profit (Q3) (Seeking Alpha)

This has led to calls of “windfall taxes” by President Biden, as reported by Bloomberg. These are predictable measures, with almost no chance of passing if Republicans capture control of either the House or the Senate after Tuesday’s elections. This is what I expect to happen, but I could be wrong. Windfall taxes have already become more commonplace in Europe, and if Democrats retain control of Congress, I would expect the chorus of such measures to markedly increase. This would harm the investment climate, and siphon off profit that belongs to shareholders. This is a key risk that will hopefully be removed in a few days’ time, but it is a risk nonetheless.

The other side of the coin is that Republicans pick up control of one of the chambers of Congress. But even then, we may not see the best environment for oil producers. If President Biden succumbs to political pressure and agrees to permit more drilling and production, he will find welcome allies in Congress. But is that really good for shareholders? If supply increases at a time when global economic growth is waning, we could see a sharp drop in the oil futures market. This could hurt forward earnings estimates, and could give share prices a chance to cool-off from what has been a breathtaking year.

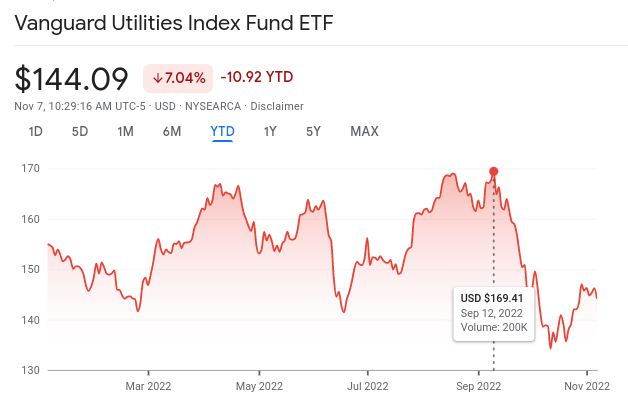

In short, I see such out-sized profits and share gains as a chance to take some chips off the table. If gains continue, great, I will keep making money – just less than otherwise. But markets have a tendency to correct, just look at how the Utilities sector corrected after having a relatively strong 2022 until mid-September:

Utilities YTD Performance (Google Finance)

I am suggesting investors approach this sector with more prudence in early 2023 than they have in most of 2022.

**I own the Vanguard Energy ETF (VDE) and will be reducing my exposure in the months ahead, in the hopes I can rebuild that position at a better price.

Quality Tech Names Look Reasonable

My last point for this review is to give quality Tech names a brighter glance in 2023. The large-cap names in this space has seen some sharp drops in 2022, but they still hold record amounts of cash and generally are battle-tested for the long term. In this vein, I believe investors should take a more tactical approach. I would suggest going light on more consumer-oriented NASDAQ names like Apple (AAPL) and Amazon (AMZN) which are at risk of inflationary pressures and supply-chain issues more than other Tech names. Therefore, I see NASDAQ’s drop this year as not necessarily a chance to buy in a broad-based fund, but to look for names that are beaten down when perhaps they should not have been.

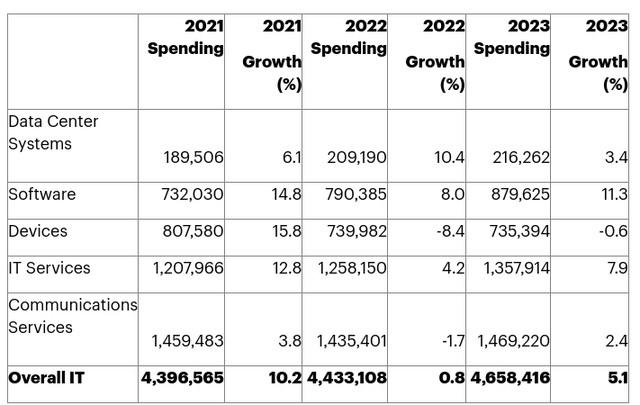

Personally, I want companies that are more business-focused than consumer-focused. Those that are players in the server, storage, networking, and cloud operations should perform reasonable well next year. In fact, consultancy firm Gartner expects to see continued growth in IT spending worldwide:

Global IT Spending (Forecast) (Gartner)

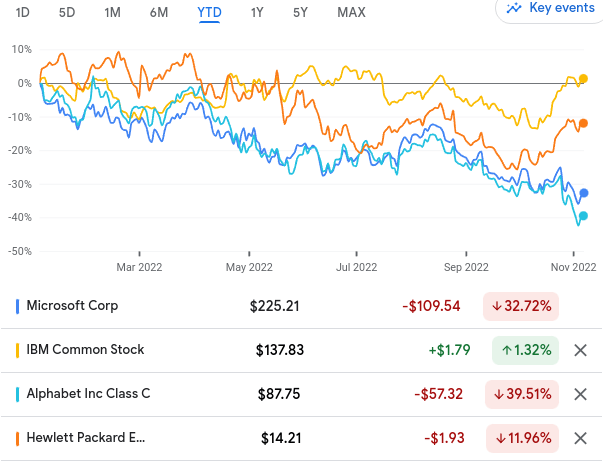

There are a few names I like here. I think focusing on Microsoft (MSFT), Google (GOOG), Hewlett Packard Enterprise (HPE), and International Business Machines (IBM) provides a more defensive positioning and also gives investors a chance to buy some big names that have seen big drops that I think are not completely warranted:

YTD Performance (MSFT, IBM, GOOG, HPE) (Google Finance)

The conclusion I draw here is that the NASDAQ’s 30%+ decline could give readers a screaming buy signal for that index. But I would take a more tactical approach. I am already long the Invesco QQQ ETF (QQQ) (which basically tracks the NASDAQ) and don’t feel going long there is the most productive play. I will get more creative with amplifying exposure to a few names I believe will perform well, rather than a large basket of companies.

**I own QQQ, but will be initiating individual positions in MSFT, GOOG, IBM, and HPE instead of building on my existing holding.

Bottom-line

I won’t shed a tear when 2022 ends. But I won’t get complacent in 2023 either. I see a brighter investment horizon if we can avoid a “hard landing” due to challenging global concerns. If we see central banks ease up a bit, geo-political risks fade with a resolution in the war in eastern Europe, limited flare-ups in Asia, and some much needed partisan gridlock in Washington, then markets may do just fine.

But this doesn’t mean to just plop money in the S&P 500 and forget it. A tactical approach is warranted. Specifically, I see value in some big Tech names that have disproportionately dropped, I believe lightening up on retail makes a lot of sense, and I plan on being more active with trading the Energy sector depending on what happens post-Tuesday’s elections. I also believe fixed-income will finally see a bit of a rally, allowing investors to recoup some of the losses they surely faced this year.

It is my hope this review gives readers a lot of food for thought, and helps everyone plan for a profitable new year – we have earned it!

Be the first to comment