J Studios/DigitalVision via Getty Images

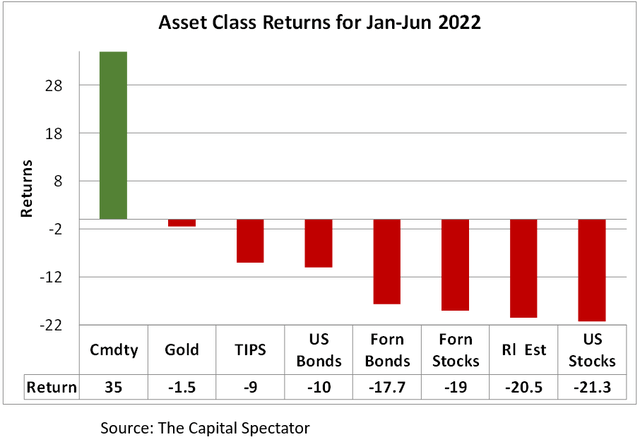

All asset classes except commodities lost money in the first half of 2022. US stocks lost the most, plummeting more than 21%.

Capital Spectator

So how have your 401(k) investments fared? The answer to this question usually depends on your risk and diversification, but not so this year unless you manage risk with cash.

Traditionally risk has been controlled with bonds, which have not protected this time, with US bonds losing 10% and foreign bonds losing 17.7%. Going forward, bonds will continue to lose money as the Fed takes the brake off of its ZIRP (Zero Interest Rate Policy).

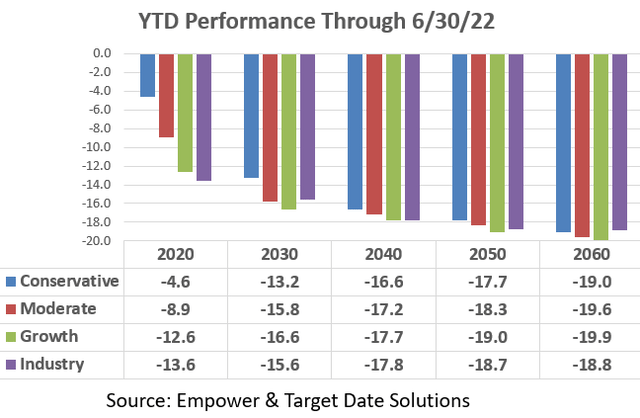

Your loss

Target date fund (TDF) performance provides a good barometer for what you should expect, as shown in the following graph. Your losses can range between 4.6% and 19.9%, a 15% spread, depending on your investment horizon and how you control (manage) risk.

Empower & Target Date solutions

Here’s a breakdown of the results. The important message is that bonds are not protecting.

- Industry is the S&P target date fund index composite of all TDFs. Most TDFs manage risk with bonds. At the target date (2020 fund in the graph) they are 50% in equities and 35% in bonds, so 85% in risky assets, losing 13.6%, protecting by a meager 5% against the 18.8% loss for 2060 funds.

- The Conservative, Moderate and Growth funds are TDFs used by the National Retirement Savings Plan (NRSP) of the Office & other Professional Employees International Union (OPEIU), one of the largest AFL-CIO unions. They manage risk with Stable Value. The Conservative fund is 70% in Stable Value at the 2020 target date. The Conservative 2020 fund has lost 4.6%, protecting by a substantial 14% against the 19% loss in the 2060 fund.

The Growth fund is 30% in Stable Value, compared to 35% in bonds for the Industry. All 3 OPEIU risk levels have protected more than the Industry in their 2020 funds.

Conclusion

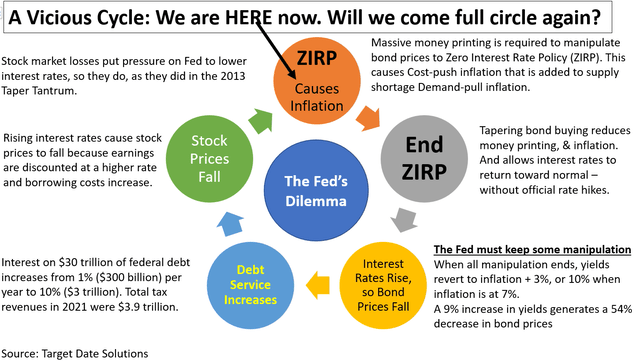

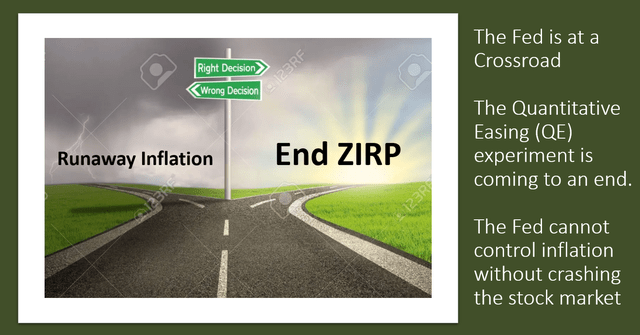

The end of ZIRP is just beginning because the Fed cannot continue ZIRP and fight inflation. ZIRP requires money printing that causes inflation.

The Fed is trapped in the cycle shown below. Many say the Fed will give up the fight against inflation because it harms stock prices. This is what happened in the “Taper Tantrum” of 2013.

Which do you think the Fed will choose – fight inflation or refuel the stock market bubble? In his “Beast on Wall Street” book Dr Robert Haugen explains that the stock market crash of 1929 was the cause of the Great Depression, rather than a leading indicator. In other words, concerns about a recession should center on the US stock market.

Target Date Solutions

Target Date Solutions

Be the first to comment