Olivier Le Moal/iStock via Getty Images

By Barbara Velado

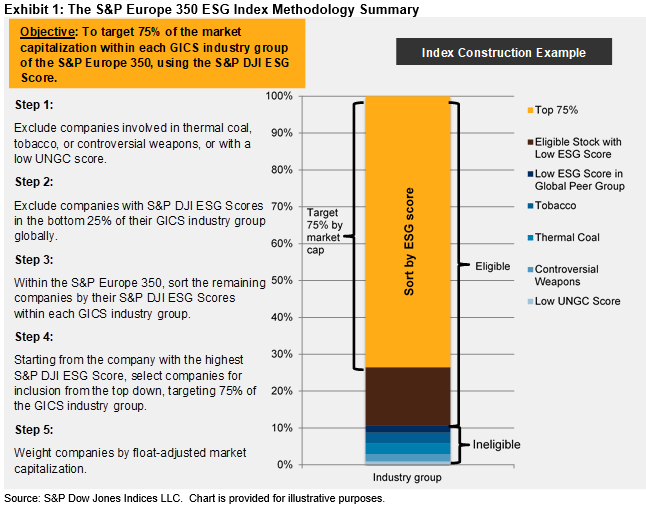

Launched in 2019, the S&P Europe 350® ESG Index is designed to represent a broad-based, sustainable European benchmark. The index looks to provide an efficient tool for those aiming to focus on the European market, while aligning investments with ESG principles. Here, we dive into how the index achieves this – and why index design matters.

How Is the Index Designed?

The S&P Europe 350 ESG Index brings ESG considerations to the headline S&P Europe 350, which seeks to track the large-cap developed European market, spanning 16 countries.

First, the index applies baseline exclusions by removing companies involved in business activities such as tobacco, controversial weapons and thermal coal.

The index further removes companies in the bottom 25% by S&P DJI ESG Score within each industry group. Companies are then selected by their S&P DJI ESG Score, with the index targeting 75% of each GICS® industry group by market cap.

S&P Europe 350 ESG Index Methodology Summary (Author)

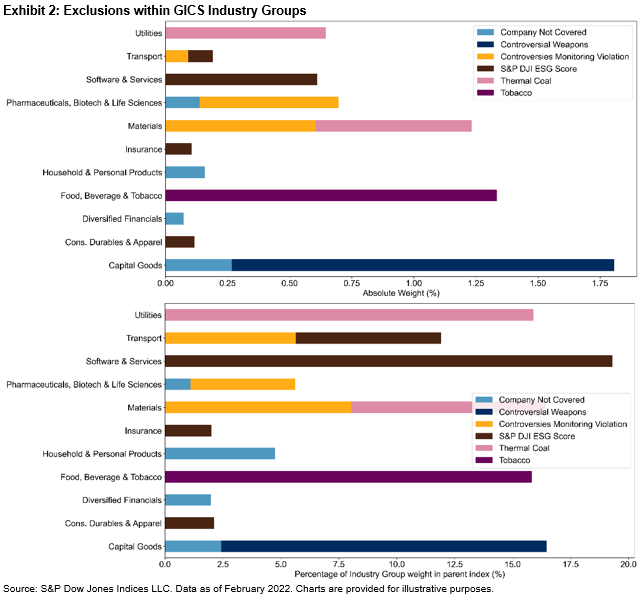

The Impact of Exclusions

When considering exclusions by industry group, Capital Goods and Food, Beverage & Tobacco are the most affected on absolute index weight terms. This is due to their high exposure to controversial weapons and tobacco (see Exhibit 2).

When analyzing excluded weight as a percentage of its total industry group weight, Software & Services is the most affected, due to low S&P DJI ESG Scores.1

Exclusions within GICS industry groups (Author)

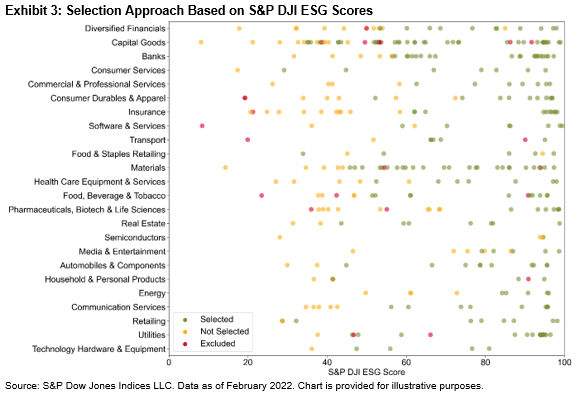

The Importance of S&P DJI ESG Scores

S&P DJI ESG Scores play a crucial role in the selection process for the S&P Europe 350 ESG Index. When considering each GICS industry group, companies with low S&P DJI ESG Scores may be eligible, but not selected.

As scores improve, we see companies make it into the index (see Exhibit 3). This highlights the importance of integrating S&P DJI ESG Scores into the methodology, as it ensures the index not only removes companies involved in detrimental business activities, but selects the best sustainability performers.

Selection approach based on S&P DJI ESG scores (Author)

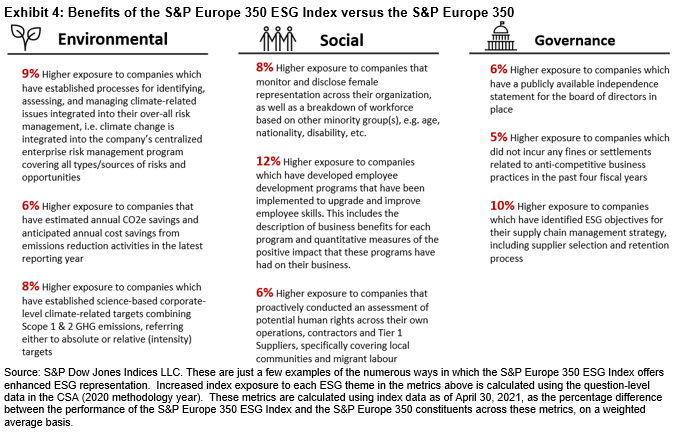

What Does the S&P Europe 350 ESG Index Achieve?

Through this simple, rules-based approach, the S&P Europe 350 ESG Index accomplishes two parallel objectives:

- Raises the sustainability bar relative to its underlying index (see Exhibit 4); and

- Maintains an industry-group neutral composition relative to the underlying index.

Benefits of S&P Europe 350 ESG vs. S&P Europe 350 (Author)

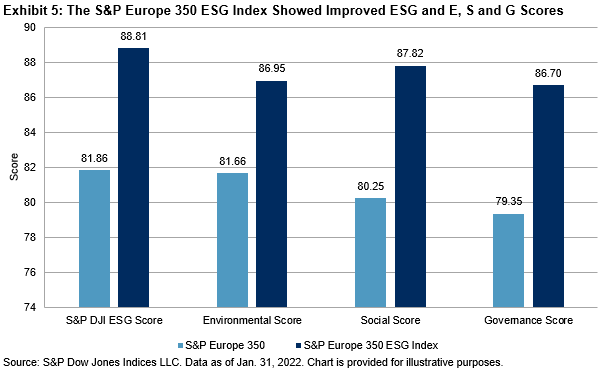

The index shows enhanced sustainability characteristics, as well as dimensional environmental, social and governance improvements relative to the underlying index (see Exhibit 5).

S&P Europe 350 ESG vs. S&P Europe 350 (Author)

By incorporating ESG criteria into a large-cap, broad-based European market, the S&P Europe 350 ESG Index establishes itself as the alternative, sustainable benchmark to the S&P Europe 350. It presents an efficient tool for market participants who increasingly place sustainability and ESG considerations at the core of their strategies.

1 Companies that have an S&P DJI ESG Score in the bottom 25% of scores within their GICS industry group in the S&P Global LargeMidCap and S&P Global 1200 are excluded.

Disclosure: Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI please visit www.spdji.com. For full terms of use and disclosures please visit www.spdji.com/terms-of-use.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment