HWCC Has Near-Term Downsides

In recent times, Houston Wire & Cable Company (NASDAQ:HWCC) faced supply chain disruptions issues and significant pricing pressure in some of its most notable product categories. The metal price deflation can erode its operating margin in the near term. I also think lower sales will keep its EBITDA margin under pressure in the medium term.

To improve operating margins, the company closed one of its largest facilities and implement IT-enabled process improvements. While the company has touted the low-smoke, zero-halogen cable products to become its next growth drivers, I think its plans would face a setback in the current recessionary condition.

HWCC has sufficient liquidity, but negative cash flow from operations can become a significant concern in the current scenario. Long-term investors can wait and watch for recovery, once the economy starts recuperating from the ongoing uncertainty.

What Are The Economic Indicators Saying?

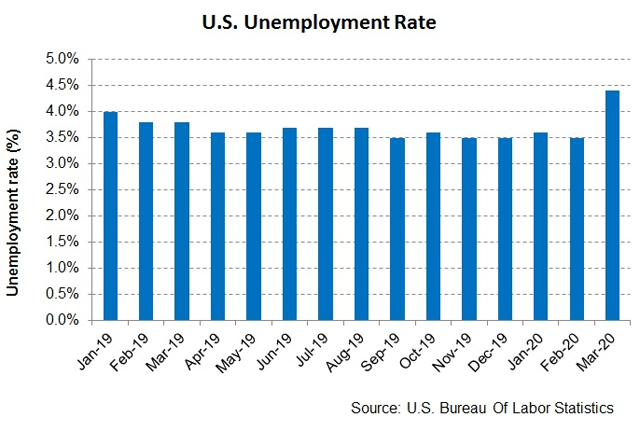

Unemployment rate jumps: Total unemployment, in March 2020, had a spectacular jump as the coronavirus strangled our life and economy. The U.S. Bureau of Labour Statistics data suggests that the U.S. unemployment rate rose to 4.4% from 3.5% in February, which is the highest month-over-month increase in the rate in the last few decades. The hospitality industry accounted for much of the employment loss. High unemployment typically translates into lower industrial product demand, leading to decreased revenues and margin for industrial product providers like HWCC.

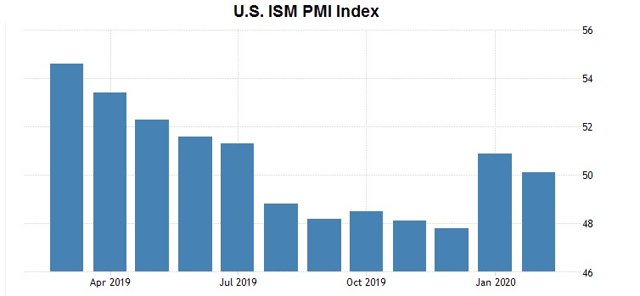

The ISM Manufacturing Prices Index declined in February 2020 compared to a month ago, due mainly to the new order contraction, slow production, and unemployment rate. So, as the indicators point out, its revenues can increase in Q1. However, as the manufacturing and trade have frozen following the government-imposed lockdown, the looming demand concerns can weigh in on its performance in Q2.

Recently, the U.S. government’s passed a $2 trillion stimulus package. It can boost private consumption in the short term, which would be beneficial for industrial suppliers like HWCC. But I have doubts about the long-term efficacy of the program.

Energy Activity Will Weaken

The crude oil price has crashed since the beginning of 2020, with ~60% year-to-date fall. Prompted by the steep fall in price, the U.S. rig count has dropped by 17% since the beginning of 2020. The international energy activity did fall but was relatively resilient so far. The U.S. E&P activity will decline as the upstream operators accelerated the capex cut to protect cash flows. Thus, the energy industry will be a severe drag on HWCC’S financial results. It is difficult to predict when the energy market environment will improve, but I do not see any positive movement at least in 1H 2020.

What’s The Strategy?

Due to the current headwinds, the company now focuses on the fabrication services, which typically fetch a higher margin. It is also restructuring its business following its policy to pursue high-margin services. In 2019, it reviewed Vertex (acquired in 2016) and its position in the value chain. Subsequently, it decided to exit the Attleboro facility, which was its largest distribution center. The company relocated inventory to the facilities in Chicago and New Jersey. While the movement did result in a $3 million charge in 2019, the management expects improved fill rates, and superior operating efficiencies will deliver an annualized net savings of ~$1 million per year.

The other area which saw some remarkable changes in Q4 2019 relates to information technology and the completion of two multiyear projects. The company undertook an infrastructure and system architecture upgrade, which will provide a scalable and cost-effective platform for an advanced enterprise strategy. Also, in 2019, it upgraded the ERP system of the electrical business unit. Plus, through the implementation of LEAN, it improved productivity, as well as operations and distribution. With these improvements, it plans to retire debt and bring down leverage (debt-to-EBITDA) from the above 5x now to a range of 2.5x to 3x.

Gross Margin Contraction: What’s Ahead?

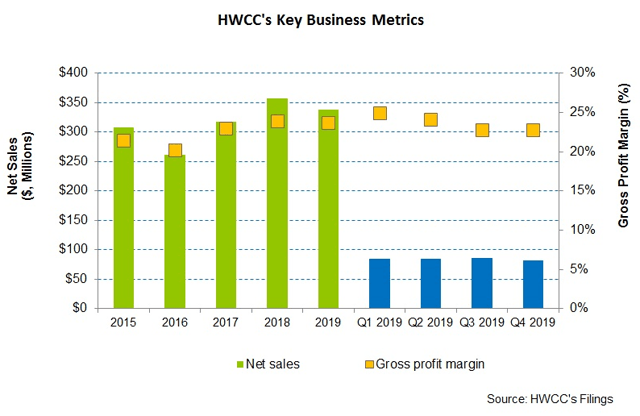

In Q4 2019, gross margin remained resilient, although it began to look weak as the quarter-end approached. Although the company’s sales were increasing during the first part of the quarter, it worsened throughout the period, due to the combination of the December holiday season and the intermittent supply chain disruptions from supply chain retooling. In the face of competition, steel, wire, rope, and fasteners faced significant pricing pressure. Interestingly, the base metal price deflation, too, hurt pricing. These factors culminated in a substantial slowdown in business activity.

As the energy price dipped low, HWCC’s management refrained from citing any forecast. However, it did provide a directional commentary, although investors should be cautious about the fact that a lot deteriorated since the Q4 earnings call. The company saw customer demand and business activity improving in early Q1, giving it some confidence over a better show compared to Q4 2019. Its priorities include executing expense management, improving customer service, and reducing debt. But then, with the economic activities coming to a standstill following COVID-19, it is more than likely that it will underachieve its target in the short term. I think the savings from the facility restructuring will offset some of the losses coming from revenue fall.

Analyzing Recent Performance And Parameters

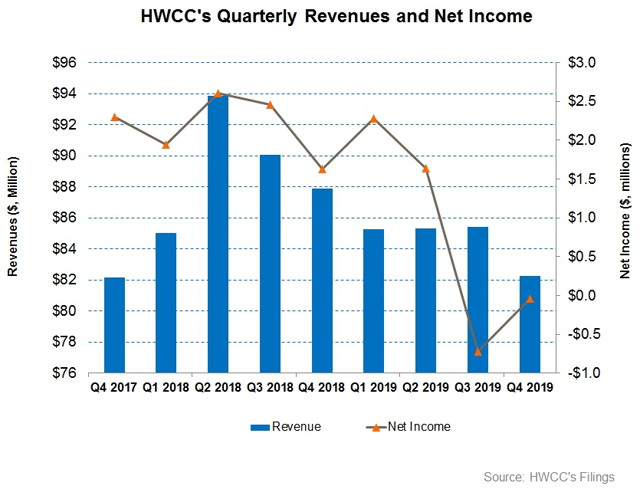

From Q3 2019 to Q4 2019, HWCC’s revenues declined by 3.6%, while its gross profit margin remained steady during the same period. Quarter-over-quarter, slower industrial activity, international supply chain disruption caused by tariffs and trade negotiations, and the impact of metals on the prices caused the revenue to fall in Q4. I discussed the tariff war and the effect of metal price deflation on the company’s financials in my previous article. I also explained in the article how, in 2019, the energy market value chain, starting from upstream and running down to midstream and downstream, weakened, and why it affected the MRO sales. These factors will continue to change the company’s performance in 2020.

FCF, Capex, And Debt

In FY2019, HWCC’s cash flow from operations (or CFO) was negative compared to a positive CFO a year ago. On top of lower revenues in the past year, the company’s CFO deteriorated primarily on account of higher inventories and high volume, fast-moving items to optimize terms with the vendor. In Q1 2020, the company sold a portion of the inventory purchase at year-end, which should lower the need for working capital. FCF (or free cash flow) was negative FY2019 due to the negative CFO.

As of December 31, 2019, HWCC had a debt-to-equity ratio (0.81x) in line with its peers. However, in the current energy market downturn, the ratio can prove to be too high. During Q4, it increased the asset-based credit facility by $15 million. The company’s balance sheet strength has not changed much since I wrote this article here.

What Does The Relative Valuation Imply?

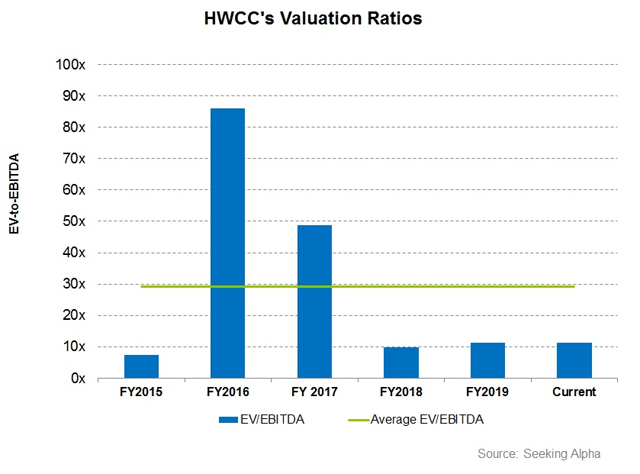

Houston Wire & Cable Company is currently trading at an EV-to-adjusted EBITDA multiple of 11.3x. So, it is currently trading at a significant discount to its average between FY2015 and now (29.1x). I have used analysts’ estimates provided by Seeking Alpha in this analysis.

What’s The Take On HWCC?

In the U.S., most of the leading economic and industrial indicators are tipped to hit record lows in the coming months as the effects of coronavirus reach its full potential. Even in Q4, the company faced supply chain disruptions issues, while the steel, wire, rope, and fasteners faced significant pricing pressure. The metal price deflation can impact the input cost, which can erode its operating margin in the near term.

To mitigate the effects, the company closed one of its largest facilities, which will save costs and improve operating margin. Also, the company is implementing several IT-enabled steps to upgrade its infrastructure. Despite the efforts, I think lower sales will keep its EBITDA under pressure in the medium term. The company has identified the low-smoke, zero-halogen cable industry to catalyze the top-line growth. But I do not see it producing any immediate result in the current recessionary condition. HWCC has sufficient liquidity, but negative cash flow from operations can become a significant concern in the current scenario. Investors should exercise caution.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment