structuresxx/iStock via Getty Images

REIT Rankings: Hotels

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on October 4th.

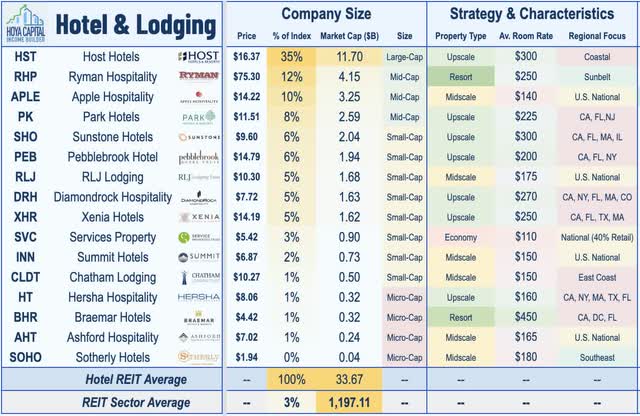

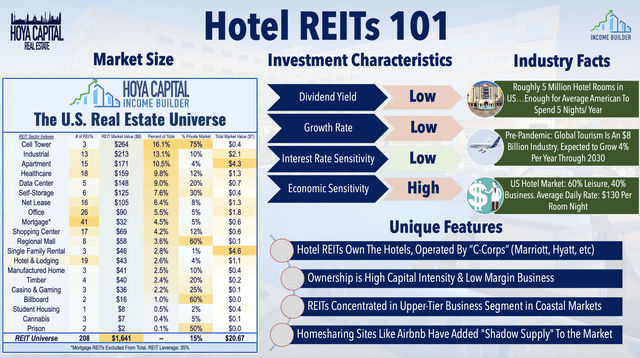

Hotel REITs have held up surprisingly well through the recent market volatility – and through two-quarters of GDP contraction – and remain one of the top-performing property sectors this year following a solid summer of operating performance. Despite depression-era levels of consumer confidence and elevated transportation costs, the U.S. hotel industry enjoyed a “summer to remember” with record-high revenues and profitability as several years of pent-up COVID-delayed travel demand helped to offset mounting economic headwinds and a slow and still uncertain recovery in business travel. Within the Hoya Capital Hotel REIT Index, we track the sixteen largest hotel REITs, which account for roughly $35 billion in market value.

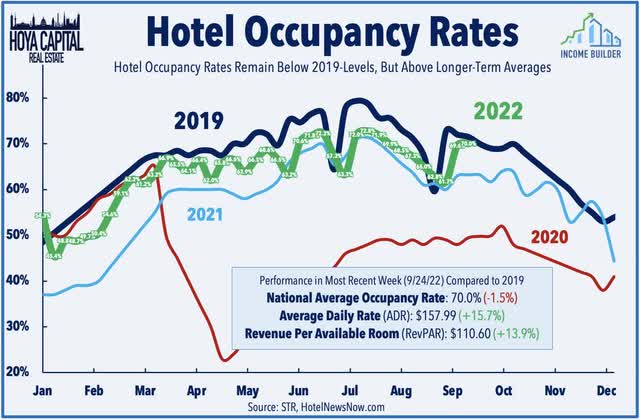

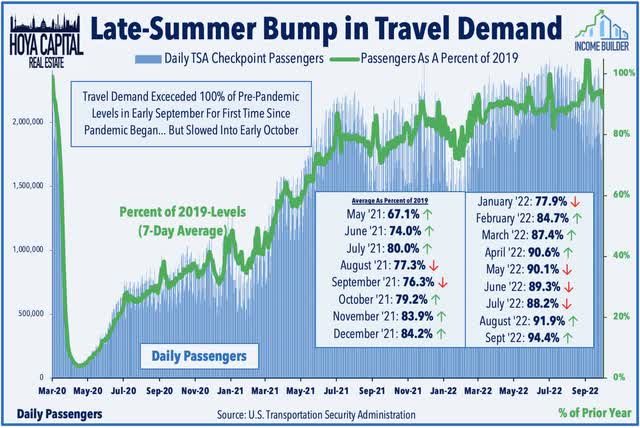

Dubbed the ‘Summer of Revenge Travel’, Americans traveled this summer at rates that approached or exceeded pre-pandemic levels as several years of COVID-delayed leisure demand was unleashed. Critically, hotel operators have enjoyed significant pricing power during this period, pushing average daily room rates to levels that were 10-30% above pre-pandemic rates throughout the summer, which more than offset the modest lag in overall occupancy rates relative to pre-pandemic levels resulting from business demand that remained more than 20% below 2019-levels and international tourism that was 40-60% below pre-pandemic levels throughout the summer.

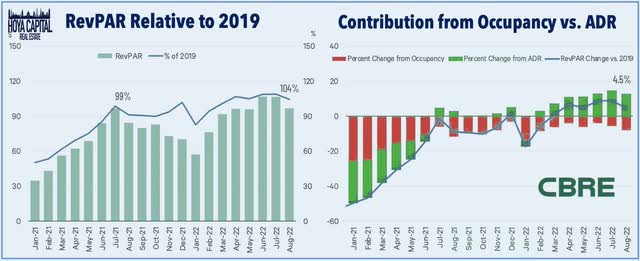

According to recent data from STR, U.S. hotel revenue per available room (“RevPAR”) set a series of all-time highs throughout the summer as the hotel industry exceeded pre-pandemic profitability levels in every month since April. In the most recent week of data, average hotel occupancy was still about 2% below 2019-levels, but Average Daily Rates (“ADR”) were remarkably more than 15% higher than 2019, resulting in an average Revenue Per Available Room (“RevPAR”) that was 14% above pre-pandemic levels.

Solid operating performance and improved balance sheet health have fueled the long-awaited return of dividend distributions as 10 of the 16 hotel REITs have either reinstated or raised their dividends this year. That said, we remain skeptical over the sustainability of the recovery in the upscale urban markets given the complexion of the RevPAR recovery – driven by pent-up domestic leisure travel and surging room rates rather than an underlying occupancy recovery. Recent TSA Checkpoint data has indicated that throughput briefly exceeded 100% of pre-pre-pandemic levels in late August before moderating back towards the 90% level that it’s hovered around since March.

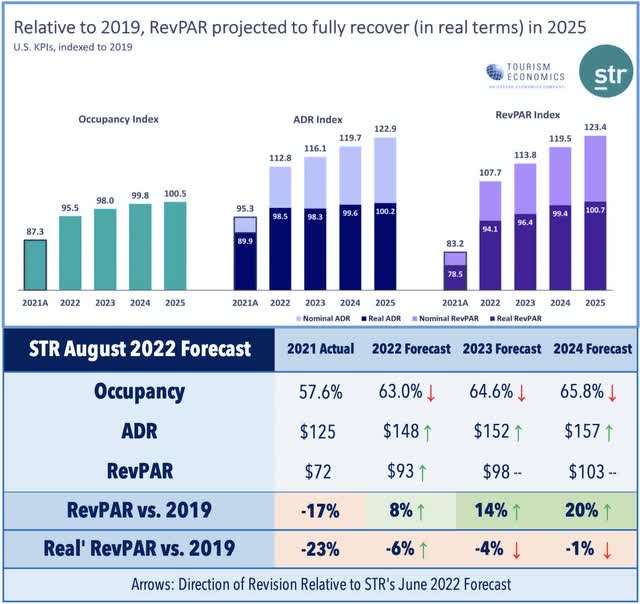

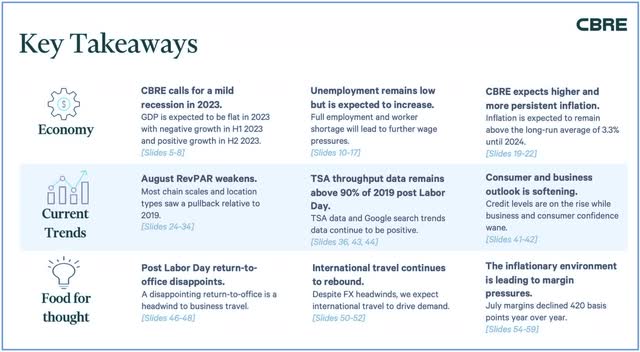

STR – the leading hotel industry research firm – provided a mixed updated outlook in their U.S. hotel forecast in early August, raising caution about the impact of slowing economic growth, ongoing labor shortages, and unevenness across markets. STR now believes that nominal RevPAR will surpass 2019 levels this year – ahead of the prior forecast of 2023 – but delayed its forecast for the recovery in real RevPAR to 2025. STR noted that “Leisure demand hit significant levels this summer… and business travel should be much more aligned with pre-pandemic patterns in the fall and winter… but there are reasons to be concerned about the economy, continued challenges around labor and business transient still lagging.”

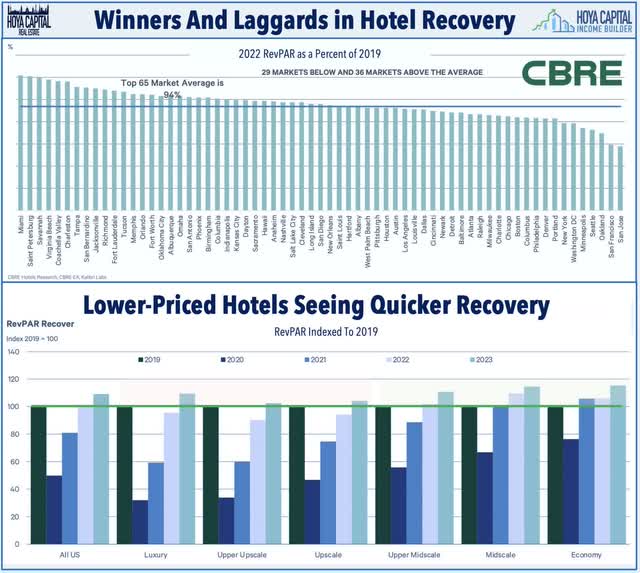

CBRE provided a similarly mixed outlook on the hotel sector in their latest report last month, expecting a full demand recovery next year, but reiterated that there are “winners and laggards” across hotel markets and segments. CBRE noted that “hotel-specific leading indicators show no signs of deterioration, but macroeconomic leading indicators suggest there could be challenges ahead.” Lower-priced hotels continue to significantly outperform on an inflation-adjusted basis, reaching 2019 RevPAR levels in 2021 and seeing a full occupancy recovery this year, but a surge in room rates in the luxury segment this summer offset the RevPAR differential.

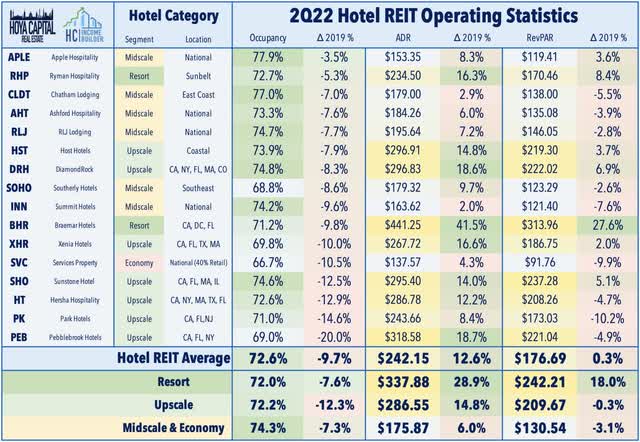

As discussed in our REIT Earnings Recap, these trends were on full display across hotel REIT earnings results as the mid-scale segment remains further along in the occupancy recovery than REITs focused on the upscale and luxury segments. Notably, Apple Hospitality (APLE) reported occupancy levels that were essentially even with pre-pandemic levels – and exceeded 2019 levels later in the summer according to recent updates – while upscale hotel REITs with a business-heavy mix – notably Park Hotels (PK), Pebblebrook (PEB), Hersha (HT), and Sunstone (SHO) reported occupancy rates that were still 10-20% below pre-pandemic levels in Q2. Of note, however, much of the upscale and resort segment was able to more than offset the occupancy lags through substantially higher average room rates, driving RevPAR to levels that consistently exceeded pre-pandemic performance throughout the summer.

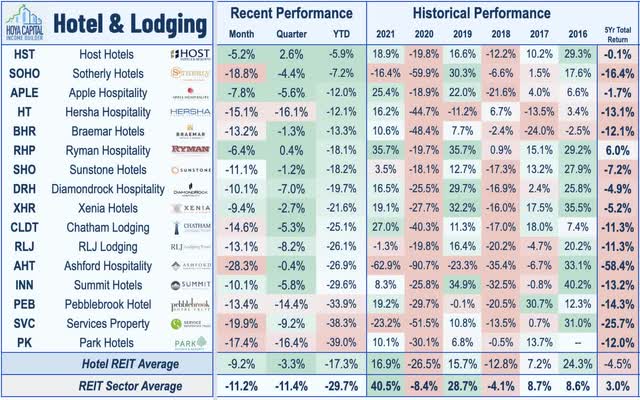

Hotel REIT Stock Price Performance

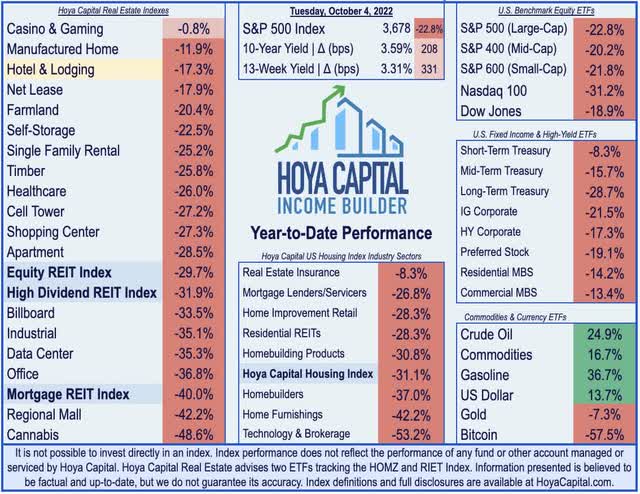

Hotel REITs were the top-performing REIT sector for much of 2022, buoyed by the growth-to-value rotation across the global equity market and optimism around the post-COVID recovery. Slowing economic growth and mounting skepticism over the sustainability of the travel recovery momentum has dragged on the sector since late Spring, but hotel REITs still remain one of the better-performing property sectors this year. The Hoya Capital Hotel REIT Index – a market-cap weighted performance index – is lower by roughly 17.3% so far in 2022, outperforming the -29.7% decline from the Vanguard Real Estate ETF (VNQ) and the -22.8% decline from the S&P 500 ETF (SPY).

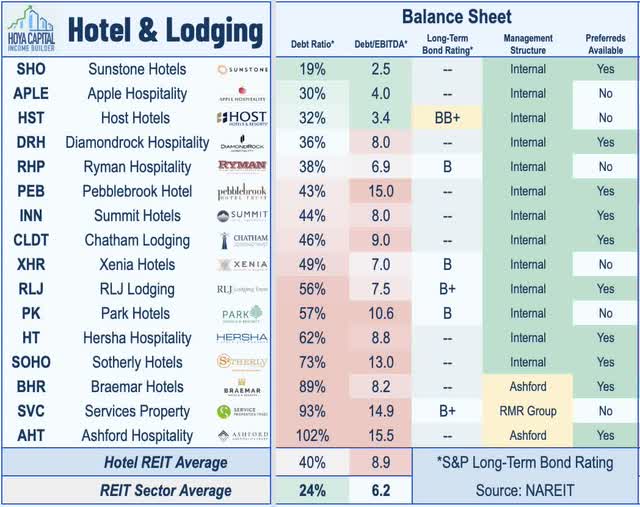

Of note, if hotel REITs are able to hold onto the outperformance this year, it will snap a four-year streak of underperformance relative to the broader Equity REIT Index. Within the sector, we’ve seen a continued “flight to quality” pattern and outperformance from hotel REITs with the strongest balance sheet including Apple Hospitality and Host Hotels (HST). We’ve also seen outperformance among REITs focused on the midscale and limited-service segment and those that have taken proactive steps to shore up their balance sheets through portfolio sales and debt refinancing.

Hotel REIT balance sheets have – as a whole – improved considerably over the past several quarters, but several REITs are still far from out-of-the-woods. The roller-coaster ride for Ashford Hospitality (AHT) – one of the worst-performing REITs of the past decade – has continued this year with the stock rebounding more than 50% from its lows in May, but still remains lower by more than 25% on the year amid a continued wave of dilutive share issuances. AHT, along with a handful of other small-cap hotel REITs including Service Properties (SVC) that operate with elevated levels of leverage, saw their balance sheet issues worsen during the pandemic and simply cannot afford any further setbacks in the recovery.

Several hotel REITs have created significant shareholder value by selling assets into the private markets at premium valuations and using the proceeds to shore up their balance sheets. Hersha Hospitality (HT) has been among the better performers this year after selling nearly a dozen properties across several transactions including a recent deal to sell Hotel Milo Santa Barbara and Pan Pacific Seattle for $125MM – $455k per key – and a deal earlier this year to sell seven properties for gross proceeds of $505M or $360K/key. The company intends to use the proceeds to pay down debt and noted that the deals are ” confirmation of the public-to-private market valuation gap.” Elsewhere, Sotherly Hotels (SOHO) has been one of the outperformers this year following the sale of a hotel in Raleigh and the refinance of a hotel in Tampa which paid off a high-cost secured note and “facilitates a clearer path toward paying off our preferred dividend obligations.”

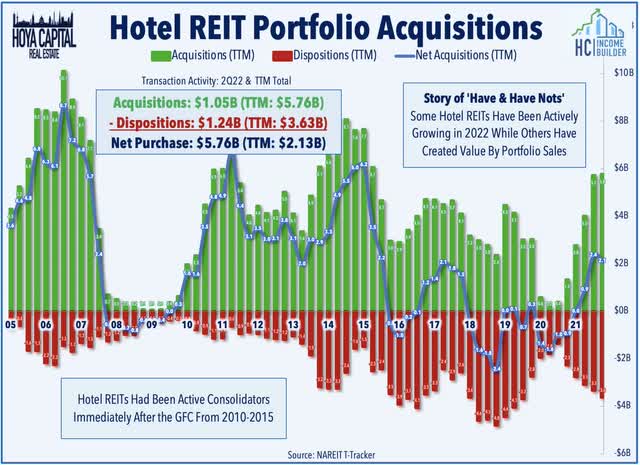

While REITs have been quite active with portfolio-level transactions, the larger-scale M&A deals have been few-and-far-between of late following a surge of activity in 2021. Last year, CorePoint Lodging surged more than 125% after it agreed to be acquired by a group led by Cerberus Capital. Condor Hospitality meanwhile, also soared more than 100% last year after selling its entire portfolio to Blackstone (BX) in a $305M deal that closed in January. These deals were the only major REIT-involved M&A since mid-2019 when Park Hotels (PK) acquired Chesapeake Lodging in a $3B deal.

Deeper Dive: Hotel REIT Economics

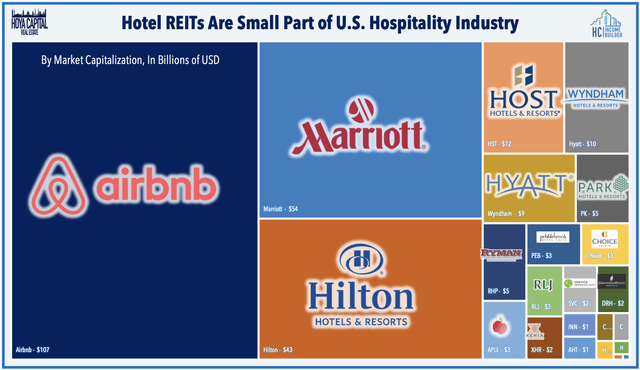

Hotel ownership is a tough, capital-intensive business even in the best of times. Generally, the companies that are ubiquitous with the hotel business Marriott (MAR), Hilton (HLT), Hyatt (H), Choice Hotels (CHH), and Extended Stay (STAY) – don’t actually own hotels but instead simply manage the hotel for the property owners. These hotel operators are typically structured as C-corporations and tend to operate with an “asset-light” operating model with higher margins and lower leverage. While REITs are effectively partnering with these hotel operators, the relationship with another emerging player – Airbnb (ABNB) – isn’t quite as friendly.

In recent years, hotel operators have been negatively impacted by a growing “shadow supply” of transient rooms offered through short-term home rental firms such as Airbnb. While we’re skeptical of Airbnb’s valuation – 2x the market capitalization of the entire hotel REIT sector combined – we are believers in the growing utilization of short-term home rentals. While short-term rentals represent less than 10% of available room nights on an average night, supply growth tends to swell considerably in response to high demand. Studies from STR and the BLS have found that short-term home rentals affect urban hotels most acutely, representing a source of “liquid supply” that compromises pricing power on critical compression nights.

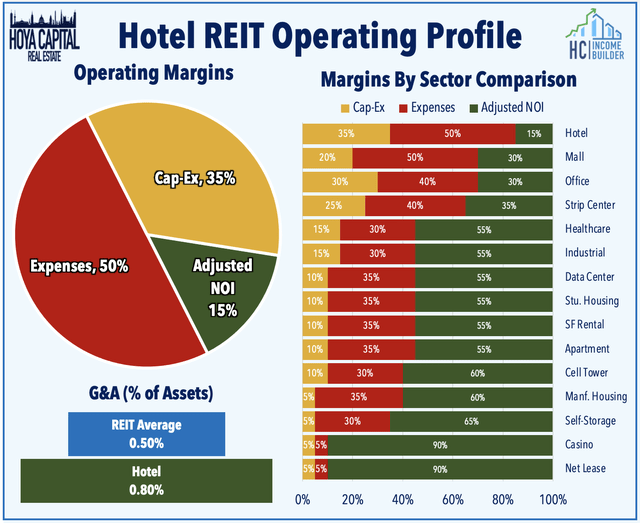

In contrast to these hotel operators, hotel REITs operate under a relatively asset-heavy model and operate at considerably lower margins. We estimate that during “normal” times, hotel REITs operate at adjusted NOI margins of just 10-20%, the lowest in the REIT sector. Because of this operating profile, they assume a high degree of operating leverage and are highly sensitive to marginal changes in supply and demand conditions. Hotel REITs tend to be less nimble and have slower growth rates than C-corp hotel operators, but have historically paid a sizable dividend yield to investors.

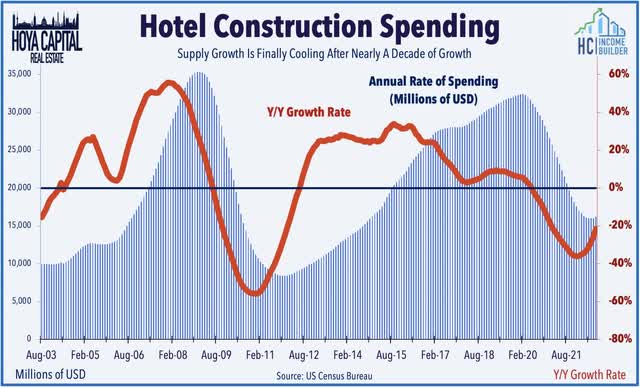

Perhaps the only silver lining of the pandemic, the hotel development pipeline is finally showing signs of cooling after a half-decade of above-trend growth, and if the past recession is any indication, developers will be slow to resume activity even after the dust settles. Over the past several years, supply growth was most acute in the middle- and upper-quality segments, the segments most commonly owned by hotel REITs. On the other hand, supply growth has been nearly non-existent in the limited-service and economy segments, which have been two of the outperforming categories over the past several years.

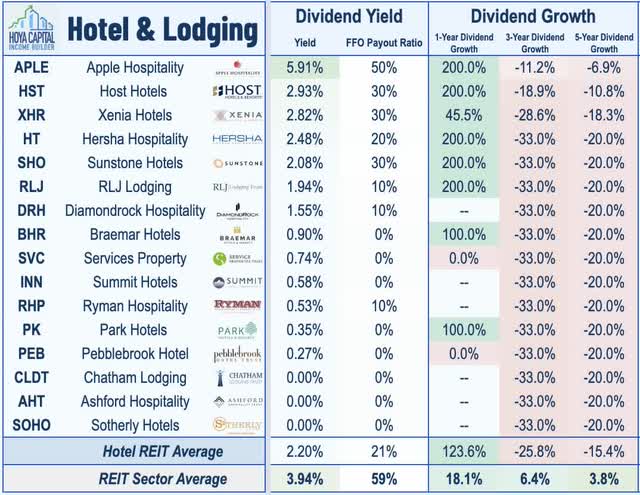

Hotel REIT Dividend Yields

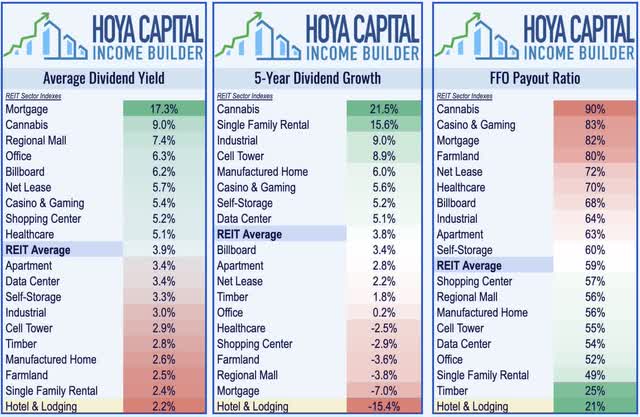

It’s tough to pay dividends if hotels are sitting half-empty. Generally speaking, 40-50% occupancy is needed to “keep the lights on” for hotel REITs. Once one of the highest-yielding REIT sectors, all 18 hotel REITs slashed their dividends in 2020 – accounting for a sizable percentage of the total REIT dividend cuts during the pandemic – and despite the first wave of dividend resumptions this year, hotel REITs remain in the basement of the dividend yield tables. Hotel REITs pay an average dividend yield of just 2.2%, far below the 3.9% yield on the market-cap-weighted average and significantly below the 9% yield on the tier-weighted Hoya Capital High Dividend Yield Index.

While hotel REITs have generally been among the last REITs to restore and/or raise their dividends, as anticipated earlier this year, Apple Hospitality was indeed the first hotel REIT to materially restore its dividend, reinstating its monthly cash distribution of $0.05/share, representing a healthy dividend yield of 5.91%. A wave of hotel REIT dividend resumptions has followed in the subsequent quarter and we’ve now seen 10 of the 16 hotel REITs either reinstate or raised their common dividends this year. Aside from APLE which is substantially ahead of the field, Host Hotels, Xenia Hotels (XHR), and Hersha Hospitality now pay respectable dividend yields above that of the broader S&P 500. Three REITs have not yet resumed their common distributions: Chatham Lodging (CLDT), Ashford Hospitality, and Sotherly Hotels.

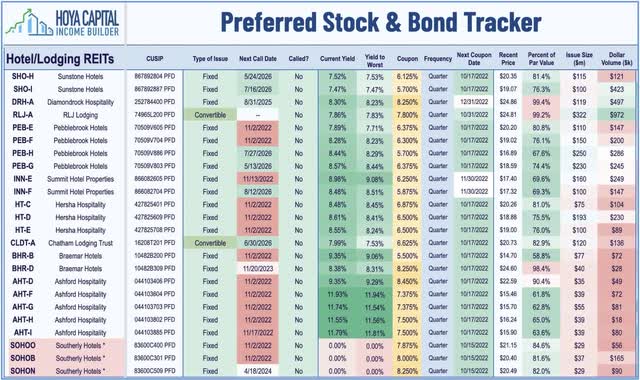

We see more compelling value in a handful of preferreds securities from hotel REITs – and we’ve noted in recent weeks that REIT preferreds have been hit unusually hard amid the recent volatility – a sell-off that has been driven more by large redemptions in index-tracking passive funds rather than underlying fundamental. We like the risk-reward across many of the 24 hotel REIT preferred issues for investors comfortable with the lower liquidity and relatively higher complexity of preferred securities compared to commons. While balance sheets aren’t in ideal shape for much of the sector, it would take a significant downturn to trigger suspensions. All 24 of the hotel REIT preferred issues are cumulative, which includes the provision that dividends owed must be paid out to preferred shareholders first before any common stock dividends can be paid.

Takeaway: Value in Limited-Service & Preferreds

Hotel REITs have held up surprisingly well throughout the recent market turmoil and remain one of the top-performing property sectors this year following a solid summer of operating performance. Several years of pent-up leisure demand from COVID delays helped to offset a slow business travel recovery and STR and CBRE recently reported that profitability levels were above 2019 levels throughout the summer. That said, we remain skeptical over the sustainability of the recovery in the upscale urban markets given the complexion of the RevPAR recovery – driven by pent-up domestic leisure travel and surging room rates rather than an underlying occupancy recovery, and while not as glamorous as full-service hotels, the limited-service segment is the superior source of long-term value at current valuations.

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Be the first to comment