Gabe Ginsberg

In July 2022, we published an article about Hormel Foods Corporation (NYSE:HRL) on Seeking Alpha, titled: “Hormel could be a safe haven in turbulent markets.” At that time, we rated the stock as a “buy.” Our main arguments for the rating were:

- Safe and sustainable quarterly dividends.

- The valuation of the firm appeared attractive according to the Gordon Growth Model.

-

Hormel has a strong track record of outperforming the broader market during times of low consumer confidence.

We also highlighted the potential risks associated with the uncertain macroeconomic environment, primarily with the elevated commodity prices and freight costs.

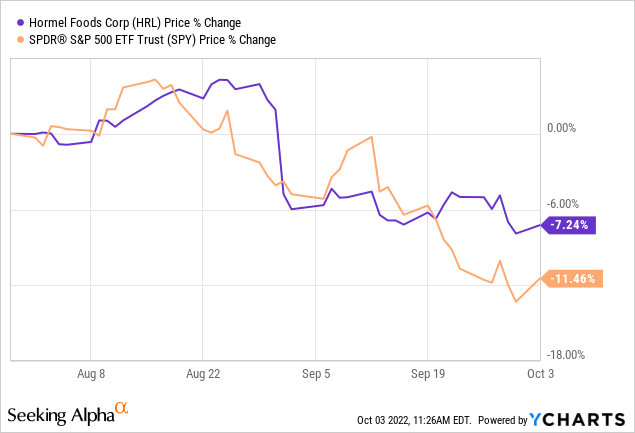

Since our last writing, HRL’s share price has declined by 7%, which is slightly better than the 11% decline of the broader market.

Today, we revisit HRL and give an updated view on the firm, based on the latest news and earnings.

Performance during times of low consumer confidence

To understand, whether the firm is really able to perform well during the current period of low consumer confidence, we have to see how the demand for their products has developed in recent months and how they were able to manage their costs. Let us take a look at the latest earnings report, released in September.

The key financial highlights of the second quarter were:

- Record net sales of $3.0 billion, up 6%; organic net sales up 3%

- Operating income of $291 million, up 40%; up 17% compared to adjusted operating income of $248 million last year

- Operating margin of 9.6%, compared to 7.2% last year and compared to adjusted operating margin of 8.7% last year

- Pretax earnings of $290 million, up 42%; up 18% compared to adjusted pretax earnings of $245 million last year • Effective tax rate of 24.5%, compared to 13.3% last year

- Diluted earnings per share of $0.40, up 25%; up 3% compared to adjusted diluted earnings per share of $0.39 last year

- Cash flow from operations of $186 million, up 143%.

As we expected earlier, the demand for Hormel’s products remains strong. The record net sales prove that despite the rising prices, consumers are keen to purchase the firm’s products. With the introduced price increases, the firm was also able to offset the inflationary pressures across many categories.

We believe that the firm’s iconic brands played an important role in keeping the demand high. Brand recognition and customer loyalty play an even more important role, when consumer sentiment is poor. However, we have to mention that HRL has also spent about 20% more in advertising spending to reach these results. Advertising spend was $37 million, compared to $31 million in the year-ago quarter.

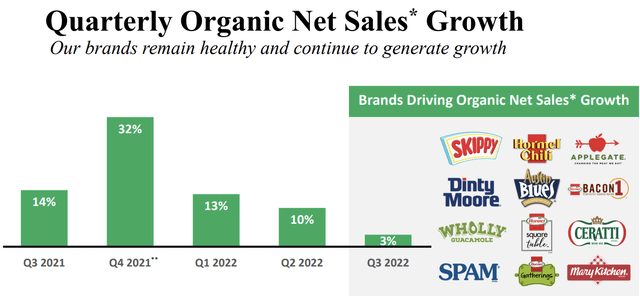

Please note, that while sales growth has continued, it significantly slowed compared to the quarters before.

Also important to point out that these results are not driven by a single segment alone. Many segments have outperformed expectations and substantially contributed to reach the record sales figures and offset the commodity price-related headwinds.

So, let us take a closer look at the individual segments now.

Segment results

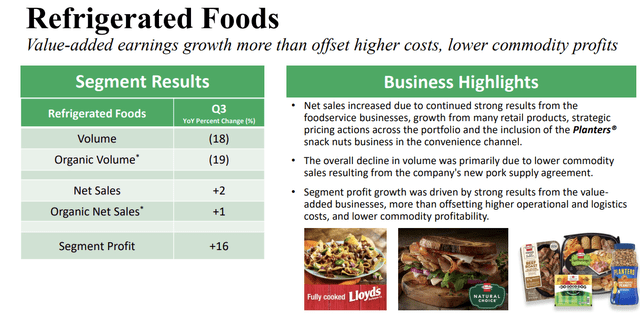

Refrigerated foods

While the volume for the refrigerated foods segment has declined, it was not driven by the lack of demand, but primarily by the lower commodity sales, resulting from the firm’s new pork supply agreement.

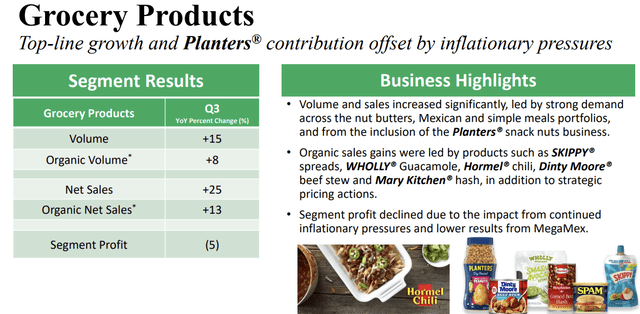

Grocery products

In contrast to the refrigerated goods, the volume of grocery products sold increased substantially. On the other hand, the segment profit has declined, due to continued inflationary pressures.

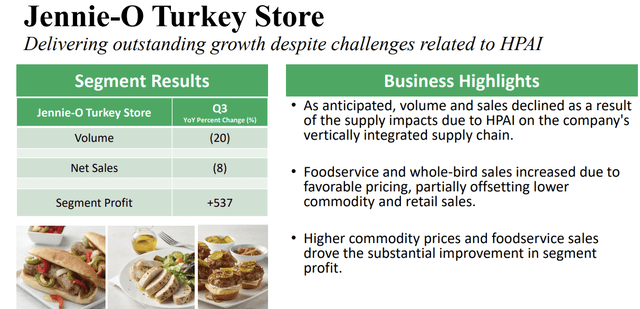

Jennie-O Turkey

The sales volume of the Jennie-O Turkey store segment has declined due to supply chain constraints, and again not due to the lack of demand for the products.

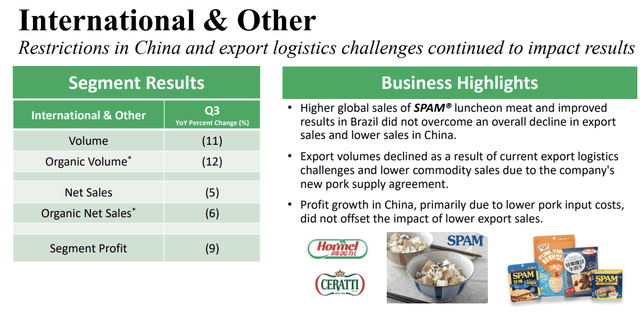

International and other

The international and other segment has been the worst performer in Q2. Both volume and profit declined, due to an overall decline in exports.

The management has summarized the results as follows:

The Jennie-O Turkey Store segment significantly outperformed our profit expectations for the quarter as the team managed limited turkey supply effectively and maximized operational performance. Refrigerated Foods delivered double-digit, value-added earnings growth on retail and foodservice items, more than offsetting lower commodity profitability. Similar to last quarter, impressive performance from these businesses helped mitigate higher input and supply chain costs across all segments.

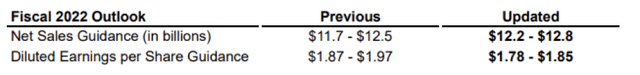

Outlook

Due to the strong sales performance year to date, the firm has also provided an upbeat outlook for the full year, in terms of sales. On the other hand, due to the cost inflation related to operations, logistics and raw material inputs, the earnings range has been revised downwards.

Management has also noted that they believe that the cost pressures are likely to be temporary.

As a result, we are revising our full year earnings guidance range. We view the majority of the escalated cost pressures we are currently observing as transient and likely to subside over the coming quarters.

Since the quarterly report, both aluminum and oil prices have come down further from their peak, reached in Q1, which could result in a positive impact on the firm’s margins in the quarters ahead.

Aluminium price (Tradingeconomics.com) WTI price (Tradingeconomics.com)

All in all, while the earnings outlook is worse than first expected, the sales figures prove that the demand for HRL’s products remains healthy. In the current market environment, we believe it is important to invest in businesses that have brand recognition, pricing power, and a relatively inelastic demand for their products. Based on the second quarter figures, HRL ticks these boxes. For these reasons, we reiterate our “buy” rating.

Dividend

End of September, HRL has declared a $0.26 per share quarterly dividend, in line with the previous. This translates to a 2.2% yield on an annual basis.

We have stated in our last article that HRL could be an attractive option for dividend and dividend growth investors, due to its strong track record of dividend payments. We also maintain this view.

Key takeaways

The demand for HRL’s products remain high, despite the declining volume of export.

HRL has successfully implemented price increases across their product portfolio, which helped to offset the cost pressures, caused by the elevated raw material and freight costs.

The steadily declining raw material prices could have a positive impact on the firm’s margins in the upcoming quarters.

The stock remains attractive from a dividend investing standpoint.

We maintain our “buy” rating on the stock.

Be the first to comment