porcorex/iStock via Getty Images

High-yield investing has admittedly become rather easy in recent weeks, with even some blue-chip names such as Altria (MO) throwing off a near 9% yield. It’s easy to become jaded, however, as one may accept that this is the new norm, especially considering the current inflationary environment.

If history is of any indicator, however, it’s that high dividends may not last forever, and that now may be a good time to buy more of one’s favorite stocks while also diversifying into other income sources.

This brings me to Horizon Technology Finance (NASDAQ:HRZN), which now yields 10.4%, after having fallen from the $16 level just earlier this year to just $11.55 at present. In this article, I highlight what makes HRZN a potentially good income portfolio diversifier, so let’s get started.

Why HRZN?

Horizon Technology Finance is an externally-managed BDC that provides secured loans to venture capital and private equity backed growth companies in the technology, life science, and healthcare information and services industries.

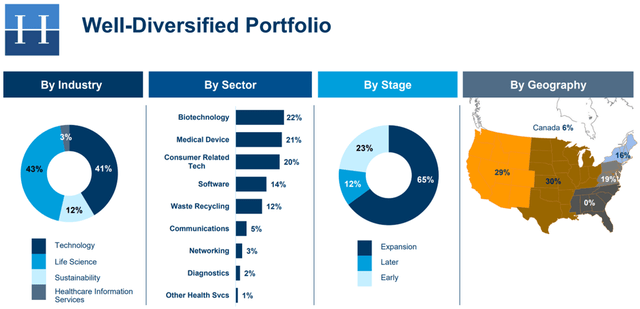

HRZN’s portfolio is well-balanced by industry, with 41% of portfolio fair value allocated to technology, 43% to life science, 12% to sustainability, and the remaining 3% to healthcare information systems. As shown below, most of HRZN’s portfolio is allocated to companies in the less risky expansion and later stages, signaling maturity and more line of sight.

HRZN Portfolio Mix (Investor Presentation)

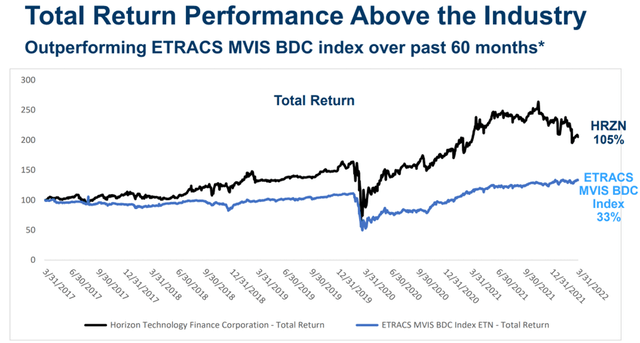

This strategy has served HRZN well, as demonstrated by its strong total returns over the past 5 years, with a 105% total return from 3/31/2017 to 3/31/2022, beating the 33% total return of the ETRACS BDC Index, as shown below.

HRZN Total Return (Investor Presentation)

Meanwhile, HRZN is seeing solid underlying fundamentals, with a high 14.9% average debt portfolio yield over the trailing 12 months, although this has cooled a bit to a still robust 12.4% during the first quarter. HRZN is also seeing impressive portfolio growth of 36% over the past year, to $515 million.

Moreover, HRZN maintains a low risk profile, considering that its borrowers have on average a low 20% loan to value ratio, comparing favorably to the 80% LTV average for mid-market loans.

This low-risk approach is reflected by the fact that HRZN has just one investment, MacuLogix, on non-accrual, with management expecting for it to resolve itself over the current and next quarter while injecting a small amount of liquidity to make it happen. Plus, management estimates that nearly 96% of the portfolio carries a safe 3-rating or better.

Notably, HRZN is currently under-earning its $0.30 quarterly dividend rate (paid monthly) with $0.26 NII per share during the first quarter, having to do with seasonably light prepayments. However, HRZN has plenty of cushioning to cover its dividend rate, with $0.47 per share of undistributed spillover income from prior portfolio liquidity events.

It also has a large addressable market and plenty of firepower to fund its pipeline, with a low 0.9x debt to equity ratio, sitting well below the 2.0x statutory limit. This was reflected by management during the recent conference call:

Our advisor continues to enhance the Horizon platform with additional hires and promoting members of its team into key management positions, ensuring we remain on course to generate future growth and continued profitability.

The benefits of the Horizon platform include: an expanded lending platform and the power of the Horizon brand to access a larger number of investment opportunities, a pipeline of investments that has never been larger, enhanced capacity to execute on a backlog of commitments and new opportunities and an experienced that is cycle-tested and fully prepared to manage through potential macro or economic headwinds.

Near-term risks to HRZN include the downturn in growth, namely tech, stocks since the start of the year, and this may have a negative impact on HRZN’s portfolio value. However, this may be temporary, and delayed liquidity events such as an IPO or buyout may result in heightened demand for HRZN’s loans, as portfolio companies may want to avoid dilutive equity sales to venture capital and private equity firms.

Lastly, the recent share price weakness has made HRZN more attractive. It currently carries a price to book value of 0.99x, sitting well below its range over the past 3 years, outside the early pandemic period. Sell side analysts have an average price target of $14.13, implying a potential one-year 33% total return including dividends.

HRZN Price to Book (Seeking Alpha)

Investor Takeaway

Horizon Technology Finance is a small but growing BDC that has seen impressive total returns over the past 5 years, prior to the recent downturn. It is benefiting from strong underlying fundamentals, with solid portfolio growth and yield. With the recent share price weakness, HRZN appears to be an attractive buy for high income investors seeking monthly dividends and capital appreciation potential.

Be the first to comment