panida wijitpanya/iStock via Getty Images

Investment thesis

Horizon Technology Finance (NASDAQ:HRZN) has an attractive dividend yield combined with monthly stability and security of payments. It invests in sectors and in companies that are in the growth stage in growth sectors. The management could slowly but steadily grow the net interest income in the past 5 years. I believe HRZN is a bit neglected BDC but a good company with stable fundamentals. However, investors should be aware that HRZN is trading above its NAV per share by more than 20% which makes it a bit more speculative buy.

Business Model

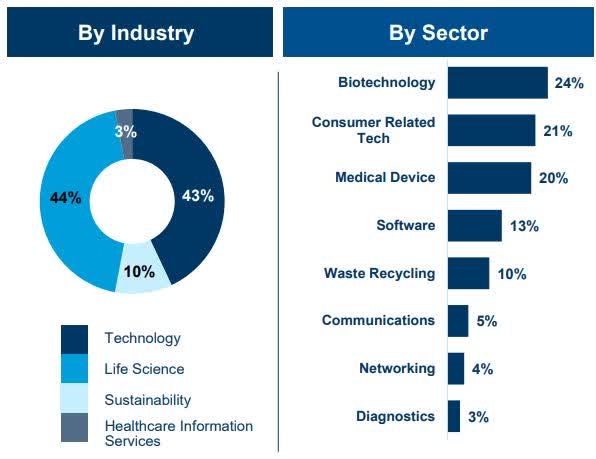

Horizon Technology is a business development company specializing in lending and investing in development-stage investments. HRZN is not a typical BDC because it focuses on growth-oriented loans for companies seeking venture capital investments. HRZN provides structured debt products to life science and technology companies. Since 2004, Horizon has directly originated and invested more than $2.3 billion in venture loans to more than 285 growing companies. Its portfolio is geographically diversified but by industry, the main focus is on technology and life science companies. These two sectors are growing significantly with projections that the tech sector will grow by 6.7% in 2022 alone. The life sciences sector broke records in Q4 2021 in private equity and venture capital investments. Over 800 companies received a total of almost $23 billion worth of investments. This sector is not only fueled by new investment but the external factors are in their favor such as the aging population of the U.S.

Quarterly Presentation

Financials & Earnings

Q4 results and Q1 results expectations

HRZN’s portfolio at year-end stood at $458.1 million, an increase of 30% from the end of 2020. NII per share was almost the same in Q4 as in the third quarter. HRZN generated $0.39 per share net investment income and had a NAV per share of $11.56. Net asset value per share declined by 0.3% compared to third-quarter results but could grow by 4.9% year-on-year. The company experienced a record year of almost $175 million in pre-payments due to the low-interest-rate environment. This pre-payment pressure will very likely ease in 2022 and further ease in 2023 with the rise of interest rates. HRZN could also grow its warrant and equity positions in portfolio companies by the end of 2021 when they had positions in 76 companies compared to 68 companies at the end of 2020.

I expect strong results from HRZN for the first quarter of 2022. The company will announce its Q1 2022 earnings on April 25, 2022. We can already see that prepayments are on the decline because the company reported prepayments of $12 million for the first quarter, compared to $55 million of principal prepayments during the fourth quarter of 2021. As of March 31, 2022 HRZN closed new loan commitments totaling $100.4 million to 11 companies which will further fuel NAV.

Valuation

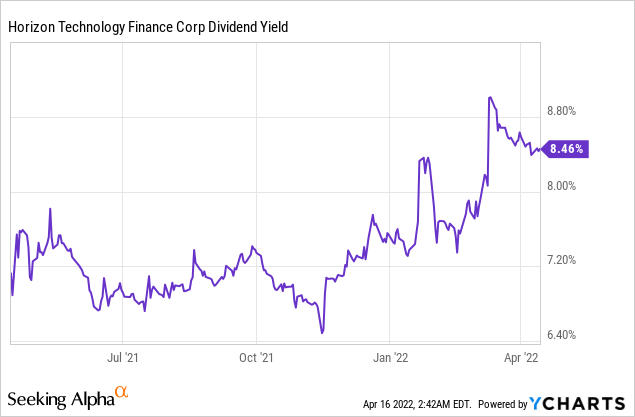

HRZN is trading at a premium to its NAV with NAV per share at 1.23 at the moment. However, it is still lower than in the previous months when you could buy HRZN with a hefty premium. The company has a debt-to-equity ratio well below the industry regulations (1.05x vs. 2.00x) and also lower than the maximum debt-to-equity targeted by the management (1.2x). Its P/E ratio (10.61) is almost identical to the sector median of 10.92. In terms of its dividend yield, it stands at an attractive level. You could only buy HRZN with an above 8% dividend approximately 16.5% of the time in the last 12 months. In addition, you could have bought HRZN with a better yield than the current one only in March 2022. The dividend yield suggests an undervalued company, the NAV per share suggests an overvalued company, and the P/E ratio suggests a fairly valued company. Because the price is so distanced from its NAV it will very likely come back (reverse to its mean) so that is why I believe HRZN is fairly valued at the moment.

Seeking Alpha

Company-specific Risks

HRZN is facing risks such as prepayment risk, interest rate rises, portfolio concentration in specific industries, and size disadvantages. HRZN’s portfolio is focused on a limited number of industries, mainly tech and life sciences. As a result, a downturn in any particular industry in which they are invested could also significantly impact the aggregate returns the company realizes. The target industries are susceptible to changes in government policy and economic assistance, (especially life science and healthcare) which could adversely affect the returns we see in HRZN’s portfolio.

In addition, the portfolio companies HRZN invests in typically require substantial additional financing to satisfy their continuing working capital and other capital requirements and service the interest and principal payments on HRZN’s investments. The majority of these companies are in the growth stage and building up critical mass to attract more funds and eventually go public. The risks are certainly lower than in the start-up phase but still many of these companies are making a loss month over month.

The interest rate rise will have an impact on HRZN’s NII. All of their debt investment are floating-rate loans which are great but there is a significant part of their financing that is also floating-rate. This means that the company will not be able to fully capitalize on rising interest rates and in addition, suitable investment opportunities will be harder to find in a rising interest rate environment.

My take on HRNZ’s dividend

Current dividend

HRZN has been paying consecutive dividends for 10 years a bit under the 13-year sector median. However, we can safely call HRZN’s dividend reliable because in the last 5 years they paid $0.1 per share every month. This also means that the management did not raise the dividend for a long time. HRZN is yielding at 8.46% at the moment.

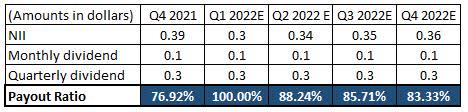

Future sustainability

The management is keen on maintaining the current dividends. They also emphasized in their press release that June 2022 will mark their 5 and a half year “anniversary” of paying reliable and stable monthly dividends. Based on the payout ratio the dividend is safe and sustainable for 2022 and beyond. The declining prepayments will help support HRZN’s investment income which will support the dividend. However, income-seeking investors should be aware that no dividend increases are on the horizon for 2022 or 2023 according to analysts’ estimates.

The table is created by the author. All figures are from the company’s financial statements and SA Earnings Estimates.

Final thoughts

HRZN has an attractive yield with monthly payments for income-seeking investors. The company’s fundamentals are stable, the prepayment risks are diminishing due to the rising interest rates and the companies they invest in are high-growth companies in high-growth sectors. There are some smaller risks to HRZN such as its floating rate credit financing or growth-stage companies that need additional funding. The biggest risk factor I see at the moment is that HRZN trades 1.23x its NAV per share. Despite this, a bit more risk-taker income investors might find HRZN a good addition to their portfolio at the current price.

Be the first to comment