ClaudineVM/iStock Editorial via Getty Images

[Please note that this article is based on a trading alert that was published for Wheel of Fortune‘s (“WoF”) subscribers on March 25th]

Long Standing Affair

Höegh LNG Partners LP common units (NYSE:HMLP) as well as Höegh LNG Partners LP, 8.75% Series A Cumulative Redeemable Preferred Units (NYSE:HMLP.PA) goes back a long way.

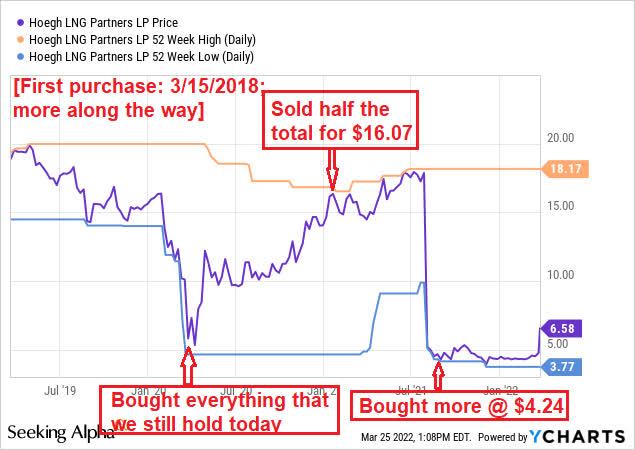

Our first purchase of the common unit was four years ago, and since then we’ve added on a number of occasions, especially two years ago when the price (and market) collapsed.

The position had grown substantially over the years (especially following the March 2020 purchases) to an excessive size, beyond our comfort level. This led us to sell half of it on Jan. 12, 2021 for $16.07.

At the time, many subscribers were quite upset with this sale, especially since the price rose another 13%, and distributions ($0.44/quarter) kept being paid.

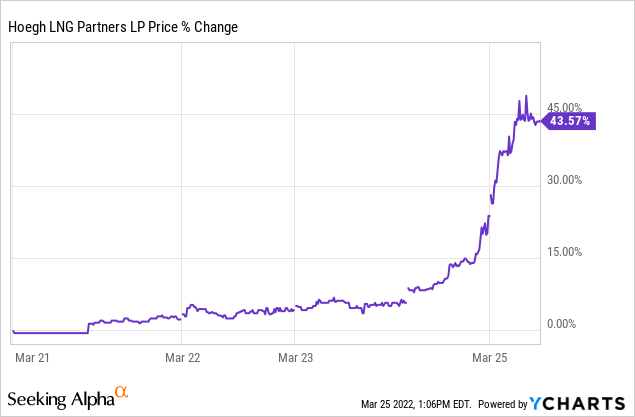

Y-Charts, Author

Nonetheless, following reports regarding a legal dispute with HMLP’s Lampung (this FSRU is still part of an ongoing arbitration) that led to a massive distribution cut (to only $0.01/quarter), the price tanked by 80% (!) to as low as $3.77.

Suddenly, selling half on January 2021 didn’t seem such a bad move…

After studying the legal “issues”, realizing that this is way less severe than the partnership (deliberately) has communicated to investors, as part of the MLPs’ (unofficial) “take-under playbook” (see more details about this hereinafter) – we decided to actually buy more.

On Aug. 26, 2021 we bought more of the stock straight (for $4.24) as well as sold PUTs ($5 strike, for $1.67). These PUTs were assigned to use a week ago for a net price of $3.33 (=5-1.67).

At this point in time, the entire position (the half that we still hold) is a result of purchases that were made over the past two years. Furthermore, each and every purchase (let alone the entire position) is in the green (total return basis) right now.

Trouble in Paradise

Reminders:

1) July 28, 2021:

- Höegh LNG Partners collapses to a 52-week low after slashing its quarterly distribution from $0.44/share to a token penny a share.

- Investors likely will not see a return of the distribution any time soon, as Höegh LNG says it plans to use any extra cash following its near-term refinancing of the FSRU Lampung credit facility toward debt reduction and strengthening the balance sheet.

- The anticipated refinancing of the credit facility was not closed because of the refusal of charterer of the Lampung to countersign certain customary credit facility documents, and former HMLP sponsor Höegh LNG Holdings will not extend the current $85M credit facility due January 2023.

2) Dec. 6, 2021:

- HMLP Board received an unsolicited non-binding proposal, dated December 3, 2021, from Höegh LNG pursuant to which Höegh LNG would acquire through a wholly owned subsidiary all publicly held common units of the Partnership in exchange for $4.25 in cash per common unit.

- Höegh LNG has proposed that a transaction would be effectuated through a merger between the Partnership and a subsidiary of Höegh LNG (the “Offer”).

- The HMLP Board has authorized the Conflicts Committee of the HMLP Board, comprised only of non-Höegh LNG affiliated directors, to review and evaluate the Offer.

- The Conflicts Committee has retained advisors and discussions regarding the Offer are ongoing.

- The proposed transaction is subject to a number of contingencies, including the approval by the Conflicts Committee, the HMLP Board and the Höegh LNG board of directors of any definitive agreement and, if a definitive agreement is reached, the approval by the holders of a majority of outstanding common units in the Partnership.

- The transaction would also be subject to customary closing conditions. There can be no assurance that definitive documentation will be executed or that any transaction will materialize.

Dark Offer, Bright Prospects

What is the MLP/GP “Take-Under Playbook”?

- Cut the distribution; and/or

- Push dropdowns (=Transfer of assets from the GP to the MLP)

- Collapse the unit price

- Deleverage the MLP to the sole benefit of the GP

- Buy the beaten-up MLP very cheaply

It’s now clear (to us) that the “issues” the partnership reported on were part of an attempt by the new GP to push HMLP price as low as possible, in order to allow the GP to buy the partnership as cheap as possible.

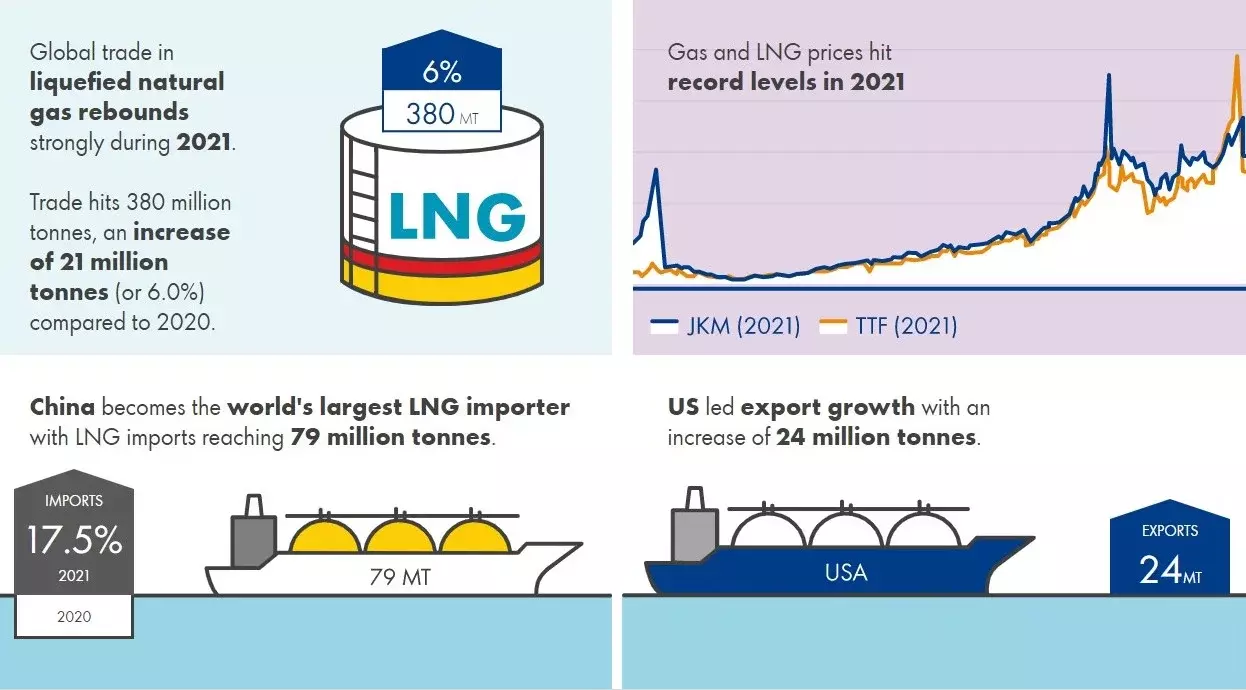

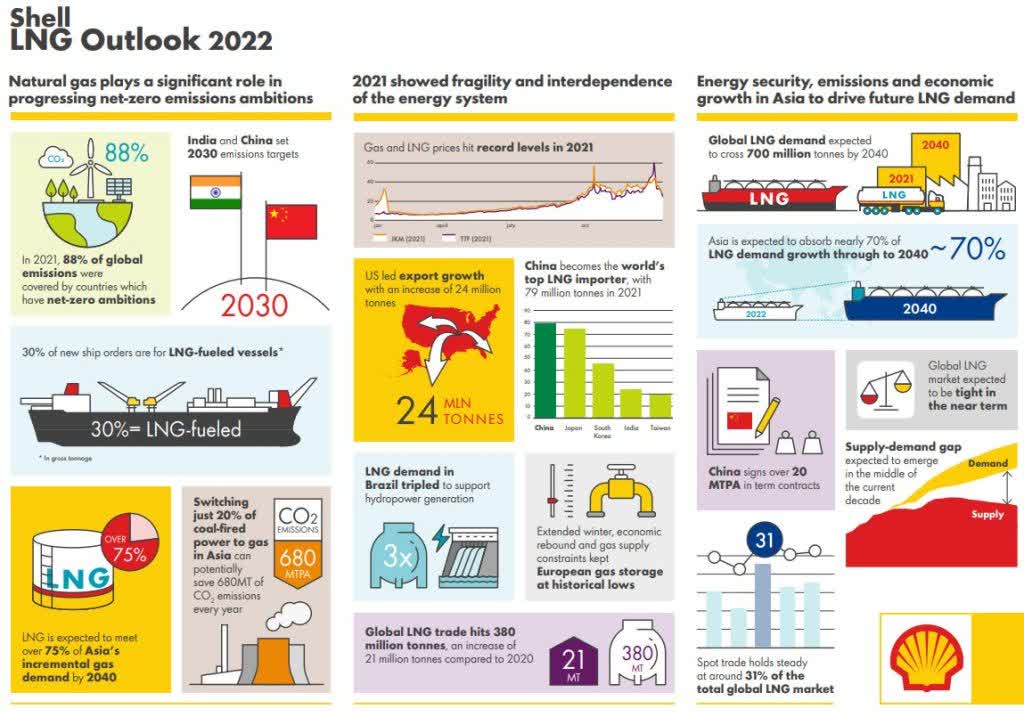

$4.25 has always been a disgrace, especially nowadays when the prospects of the LNG market are so much brighter (mostly, but not solely, “thanks” to the Russia-Ukraine war).

- “US natural gas futures were trading above $5.4 per million British thermal units on Friday, the highest since November 6th on expectations of stronger demand after the US struck a gas deal with the European Union, to help Europe wean off Russian energy dependence. The deal secures an additional volume of at least 15 billion cubic meters of LNG to Europe this year, with the long-term goal of ensuring 50 bcm per year until 2030. Exports topped a record 14 billion cubic feet for the third time in a week with the US already producing LNG near full capacity. Meanwhile domestically, late winter weather is giving a final boost to heating demand, with satellite data indicating colder temperatures until at least April 1st. On a weekly basis, the contract is expected to show a more than 10% jump, the steepest since the week ending March 4th.” – Trading Economics

- “LNG prices have been buoyed over the past year by rebounding global LNG demand-led by Asia-Pacific countries, especially China-in combination with significant constraints in production, particularly in the Atlantic basin.” – Petroleum Economist

- “We expect high levels of U.S. LNG exports to continue in 2022, averaging 11.3 Bcf/d for the year, a 16% increase from 2021.” – EIA

Shell Shell

We expect/ed the GP to come up with a better offer in order to address three main problems the original offer has:

1) Zero chance that non-affiliated parties would approve the original proposed price which is nothing short of a shameful rip-off.

2) Serious questions related to the partnership’s previous reports covering the Lampung FSRU. This article isn’t focusing on this dispute and so we won’t touch upon this with more details in this article. Nonetheless, eight months since it was said (by HMLP itself) that this dispute is putting the entire business at an imminent risk, it seems like (while this wasn’t “Much Ado About Nothing”) the partnership was too eager/speedy to warn of a “Wolf” (pack scale attack) when the situation was merely a (single) “Sheep” (read ship).

3) Reflecting the brighter LNG market prospects, as mentioned above.

Jury Reached a Verdict

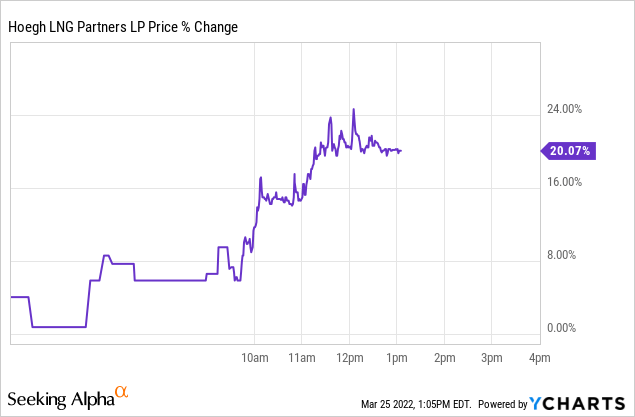

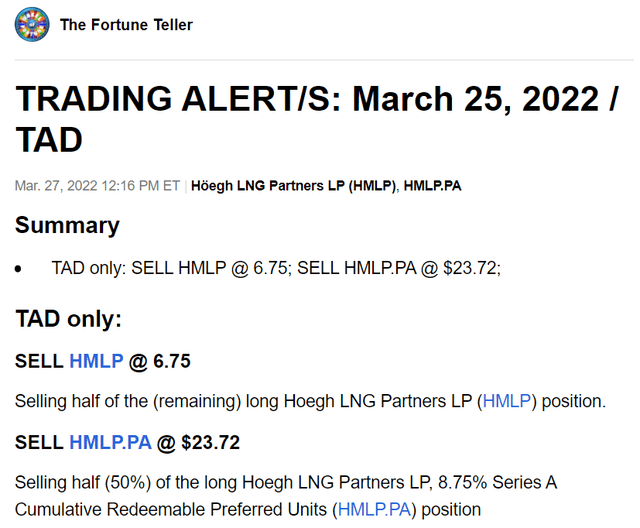

Either way, the market is already moving ahead (regardless of a better offer that may or may not come along) in light of the recent positive LNG market news/developments.

Source: @TheFortuneTell5

HMLP is jumping ~25% today (Friday, March 25, 2022).

Y-Charts

The unit price has gained about 50% this week!

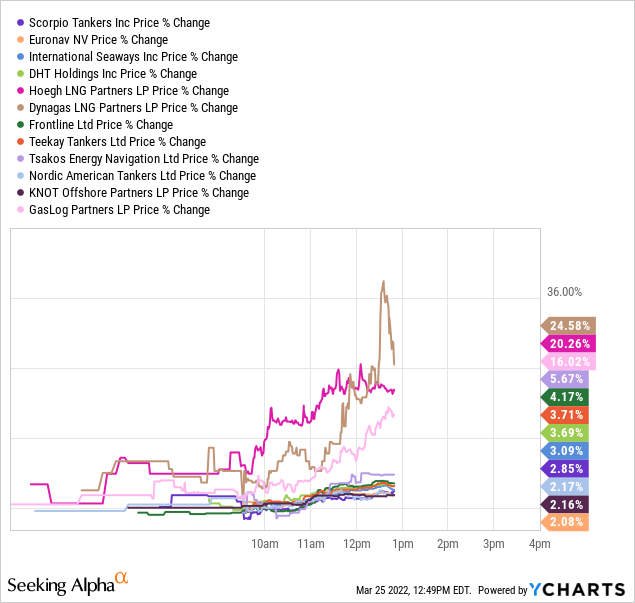

Y-Charts

It’s not only HMLP of course.

Anything with oil/gas storage capacity is jumping today; oil tankers and LNG carriers alike.

Y-Charts

Can HMLP keep climbing? Yes it can.

Nonetheless, since it’s clear that the GP interests are opposite to those of unitholders, and since the until price is already trading nearly 60% above the original offer price (of $4.25), we believe this is a good opportunity to take (additional) profits again. Therefore, we sell half of the current long HMLP position as well as half of the preferred unit.

Let’s not also forget that HMLP is operating (only) 5 FSRUs*, including the Lampung which is the vessel under legal dispute.

*Floating Storage and Regasification Unit. For better transportation efficiency, natural gas volume is being reduced to ~1/600 by cooling it to ~(-160°C) at the source of production, turning it into liquefied natural gas (“LNG”).

Just like Dynagas LNG Partners LP (DLNG), that we wrote about recently, when you run a small fleet, every issue with one of the vessels/leases puts the entire business at risk.

Although HMLP is operating within a niche, operating only 5 vessels makes the partnership way more vulnerable, and a higher risk usually calls for a quicker (than normal) profit-taking.

Preferred Share

Just like HMLP, HMLP-A suffered a tremendous loss following the distribution cut; while HMLP tanked 80%, HMLP-A lost about 40% of its value following the (distribution cut) announcement.

Nonetheless, the preferred hare has clawed almost the entire loss since that and it’s now flirting with the same total return that one would see prior to the (distribution cut) announcement.

Why are we selling half of HMLP-A then?

1) Just like the common unit, the preferred unit is subject to potential “monkey business” by the GP that may intentionally hurt holders. Nothing prevents the GP from suspending the distributions on HMLP-A, even if there’s no justified operational reason to do so, leaving holders with an asset that would be worth significantly less than par.

2) The price is now back to the level where it stalled over the past few months (since the distribution cut announcement), suggesting that we may be nearing the top (again).

3) Just like the HMLP, we’re sitting on very nice gains when it comes to HMLP-A. We believe that there’s very little chance for HMLP-A to trade back at par, therefore we see more risk than potential upside.

What’s the reason to sell half and keep the other half then? Truth is, the only reason to do that is the expectation/hope for an improved offer (by the GP) to buy HMLP, an offer that may include the redemption of HMLP-A.

Is this the likely scenario? No, it isn’t.

That’s exactly why we sell half of the position now.

By doing so, we’re already bringing ‘home’ the entire principal amount that we invested in HMLP-A over the years, which means we’re now playing with the ‘house money’.

Bottom Line

We may sell the remaining portions of HMLP and/or HMLP-A soon, depends on how things (mostly prices) evolve from here.

The rule of thumb remains the same (especially when it comes to the shipping arena): Going private equates a higher risk, and a higher risk calls for a smaller exposure.

Therefore, we’re in the process of reducing, and likely eliminating, our exposure to the HMLP group, just as we did (successfully) with Gaslog ltd. (GLOG) and Teekay LNG Partners (TGP) over the past year.

That was true for both common’s and preferred’s in the cases of GLOG (GLOG.PA) and TGP (TGP.PA, now SEAL.PA, and TGP.PB, now SEAL.PB) and that is (and will be) true in the case of HMLP too.

Be the first to comment