monsitj

Investment Thesis

HNI Corporation (NYSE:HNI) experienced strong demand for its products in the second quarter of FY22, resulting in elevated backlogs at the end of the quarter. However, demand started to moderate later in the quarter due to concerns related to the softening of the economy. Despite this, the company’s 2H FY22 is expected to grow in the low teen digits due to the elevated backlog levels, higher price realization, and growth initiatives taken by the company. The company’s growth initiatives include investing in plant and operations, acquisition of hearth products installing distributors, and advancing digital efforts. In the long term, the fundamentals of the commercial as well as housing industry remain strong with the economy reopening, favorable trends in demographics, the low housing inventory, and record high home equity levels. The company is simplifying its business by restructuring one of its eCommerce businesses and has announced the sale of Lamex, a furniture business in China and Hong Kong. This should benefit the profitability of the company in the long term.

HNI Q2 FY22 Earnings

HNI Corporation reported better-than-expected second quarter FY22 financial results. The net sales in the quarter increased 21.8% Y/Y to $621.8 mn (vs. the consensus estimate of $606.65 mn). The adjusted EPS in the quarter was up 30% Y/Y to $0.52 (vs. the consensus estimate of $0.34). Net sales increased due to the higher volume and price realization in the Workplace Furnishing and Residential Building Products segments. The adjusted operating margin was flat Y/Y at 5% due to the pressure on gross margin from price-cost dilution and lower net productivity. However, the adjusted EPS in the quarter improved Y/Y due to the solid organic volume growth and the slightly lower share count.

Revenue outlook

Both the Workplace Furnishings and Residential Building Products segments generated double-digit Y/Y revenue growth in the last quarter. The sales of the Workplace Furnishing segment grew 18.2% Y/Y due to the higher price realization and increased volume. In the Residential Building Products segment, pricing, volume, and lead time improvement drove the revenue growth by 21% organically. The RBP segment’s backlog levels remained elevated at the end of the quarter. Sales in the remodel and retrofit grew faster than the new construction.

In the Workplace Furnishings segment, orders in the second quarter increased 4% Y/Y against a tough comp of 41% in Q2 FY21. The company started experiencing softening order growth later in the quarter, especially from small-to-medium-sized customers. SMB customers react more quickly compared to large customers to any changes in the economy. These customers are pulling back in response to recessionary concerns and declining confidence metrics. The company’s strategic accounts business, which targets the largest customers, grew 60% Y/Y in the last quarter. The company has reduced its guidance for the Workplace Furnishings segment to the low teens for FY22, which is 700 bps to 900 bps lower than the previous guidance. Slightly more than half of the reduction is due to the slower volume growth in 2H FY22 and the rest is due to the sale of Lamex, a China and Hong Kong office furniture business which was sold for $75 mn in July.

In Residential Building Products, segment orders in the second quarter increased 14% Y/Y against a tough comp of 40% in Q2 FY21. New Construction order rates outperformed remodel retrofit activity orders. The order rates in the segment have moderated due to the negative trends in single-family housing, primarily driven by affordability. However, the revenue in 2H FY22 should be driven by the pricing actions, inorganic revenue, elevated backlog levels, and growth initiatives taken by the company within the segment. This should fuel the growth rate for the segment in the high teens for FY22 with a 7% contribution from acquisitions, 10% from higher price realization, and low single-digit volume growth from the elevated backlog levels.

HNI is maintaining its focus on long-term strategies by investing in organic and inorganic growth opportunities and divesting businesses that are affecting its profitability. The company invested a total of $5 mn in the second quarter to make its operations more productive and resilient. The company is also investing in its go-to-market capabilities, including advancing its digital efforts, enhancing its connection with end users, and developing new products. During the last quarter, the company acquired a hearth product installing distributor located in Raleigh, North Carolina. The acquisition will strengthen HNI’s presence in the region. This is the sixth hearth installing distributor acquired by the company in the past three years. The company now owns 27 installing distributors – this has enhanced its service capability and improved connections with its homebuyers, homeowners, and homebuilders. The company’s unique vertically integrated business model has an unmatched product and channel reach with the regional distribution infrastructure, offering unparalleled customer service. More than 25% of the RBP segment’s revenue comes from this vertically integrated Residential Building Products model.

Inorganic growth is expected to remain a part of the RBP segment’s long-term strategy. The company has a Debt-to-EBITDA ratio of 1.7x at the end of Q2 FY22 and plans to further lower debt levels in 2H FY22 from the proceeds it will receive from the sale of Lamex. This should give the flexibility to invest in strategic acquisitions and within its business. The long-term opportunities in the housing and repair and remodel industry remain strong due to the favorable demographic trends, lower housing inventory, and record high home equity levels. This should benefit the RBP segment revenue growth.

Margins

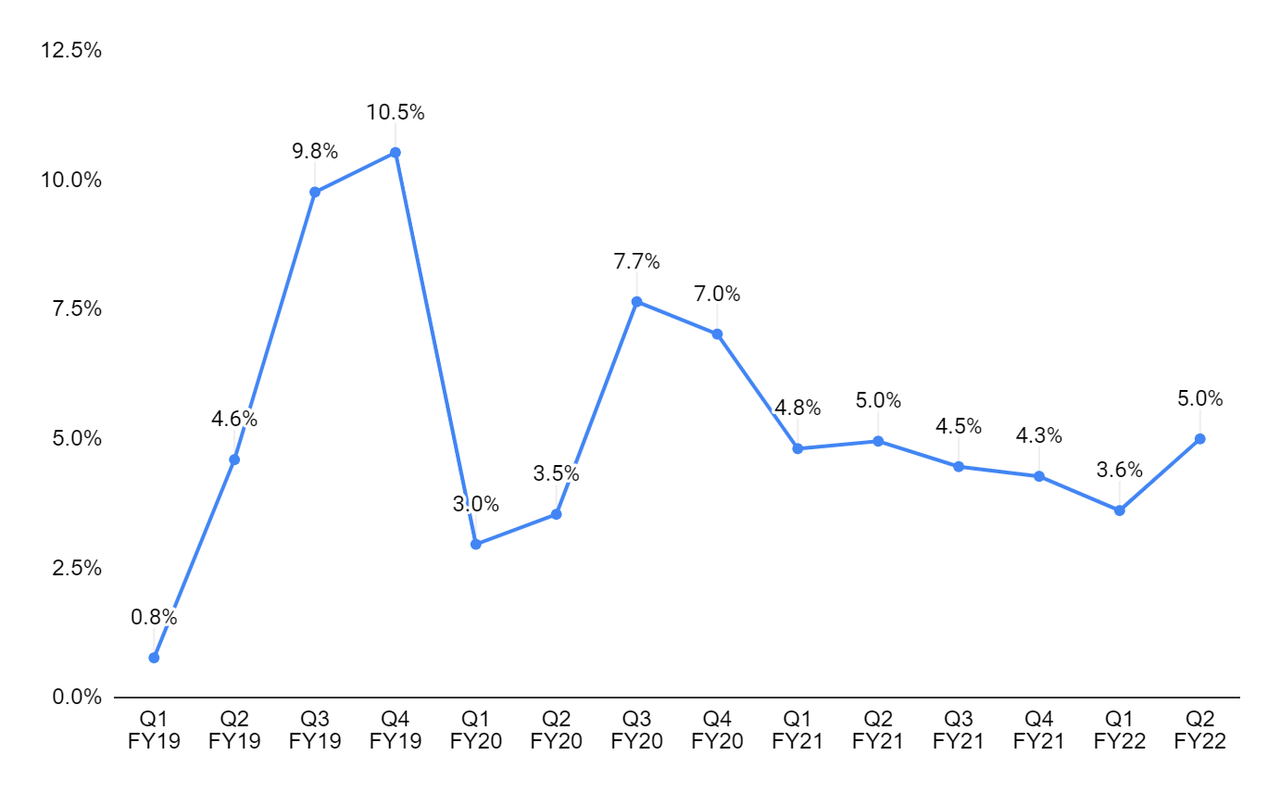

The gross margin in Q2 FY22 declined 130 bps Y/Y to 35.5% due to the price/cost dilution and lower net productivity, partially offset by higher volume. This led to a flattish Y/Y adjusted operating margin. However, both the gross margin and adjusted operating margin improved sequentially due to higher volume and recovering the inflationary pressure through price hikes. In the first quarter, price/cost was ~$2 mn favorable, and in the second quarter, it was ~$8 mn favorable. In the third and fourth quarters, it is expected to be $25 mn and $30 mn due to more price realization and less incremental inflation compared to 2H FY22. The price/cost is expected to be in the range of $60 mn to $70 mn for FY22, recovering the losses experienced by the company in the previous year. I believe the company’s adjusted operating margin should improve in 2H FY22 due to higher price realization.

HNI’s adjusted operating margin (Company’s data, GS Analytics Research)

The sale of Lamex, the elimination of small brands, and the restructuring of one of the e-commerce businesses are some of the steps taken by the company to simplify its business. This should benefit the Workplace Furnishings segment’s profitability. The exit from the low-profit product categories in the e-commerce business is expected to start benefiting the company from FY23.

Valuation & Conclusion

The stock is trading at 14.44x FY22 consensus EPS estimate of $2.33 and 12.89x FY23 consensus EPS estimate of $2.61, which is at a discount to its five-year average forward P/E of 16.95x. The second half of FY22 is expected to see some impact from the slowdown in the industry. However, revenue growth is expected to be in double-digits for FY22, due to the strong 1H FY22, elevated backlog levels at the end of the second quarter, higher price realization, and growth initiatives taken by the company. The company is making acquisitions and investing in plants and operations to grow its business and eliminate lower-profit businesses to improve the profitability of the company. The strong revenue and margin growth prospects, along with cheaper valuations, make HNI a good buy.

Be the first to comment