imaginima/E+ via Getty Images

Investment Thesis: While Hilton Worldwide Holdings may see some volatility or a decline in the short-term due to investor apprehension regarding the travel recovery and COVID lockdowns in China, this could signal a buying opportunity as the overall growth environment for the company remains favourable.

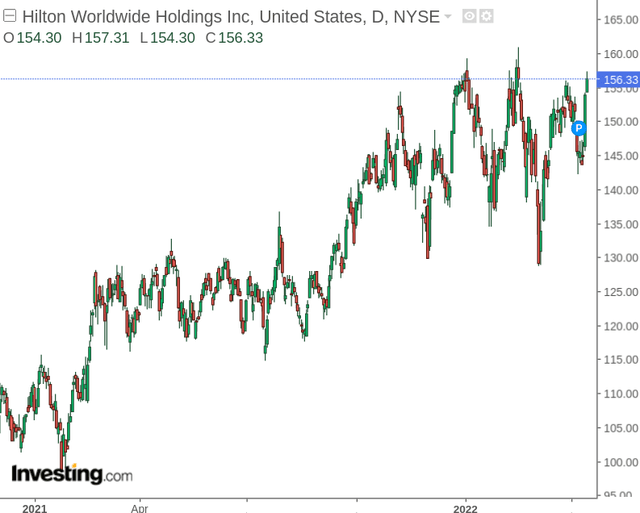

Hilton Worldwide Holdings (NYSE:HLT) saw a significant recovery in price after 2020 – when the business as a whole was most affected by the COVID-19 pandemic. Over the past year, we have seen the stock trade in somewhat of a zig-zag manner as the market tries to decide whether the stock could still have upside from here.

Back in February, I made the argument that while the recovery in occupancy rates has started to flatten out – the stock could still see longer-term upside given continued growth in earnings and a reduction in long-term debt.

The purpose of this article is to asses the potential trajectory for the stock from here – particularly in light of the recent macroeconomic situation with respect to higher energy prices and the ongoing geopolitical situation between Russia and Ukraine.

Recent Performance

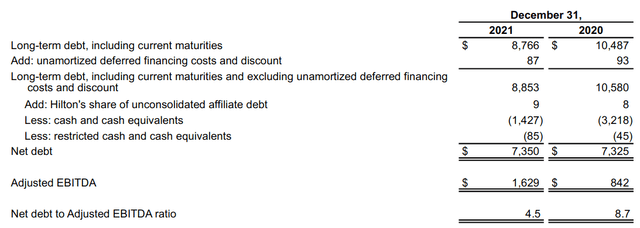

When looking at the company’s balance sheet for the most recent quarter, what is encouraging is that Hilton has managed to significantly reduce its net debt to adjusted EBITDA ratio – meaning that the company is lowering its debt load while concurrently boosting earnings.

Hilton 2021 Fourth Quarter and Full Year Results

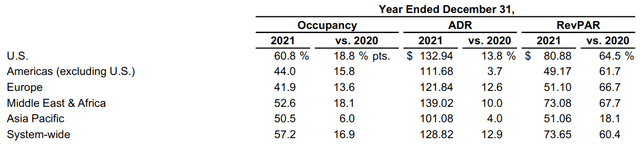

Additionally, not only did revenue see a strong rebound in 2021 (up by over 30% on a year-ended basis from the previous year), RevPAR (average revenue per available room) also saw double-digit growth across all geographies:

Hilton 2021 Fourth Quarter and Full Year Results

While earnings returned into positive territory in 2021 (diluted earnings for the year ended 2021 were $1.46 as compared to a loss of -$2.58 in 2020), the stock has not seen much upside trajectory as it is likely that a significant portion of the recovery happened just after 2020 due to vaccine optimism.

In this regard, it is worth considering where the stock could go from here given the current macroeconomic environment.

Looking Forward

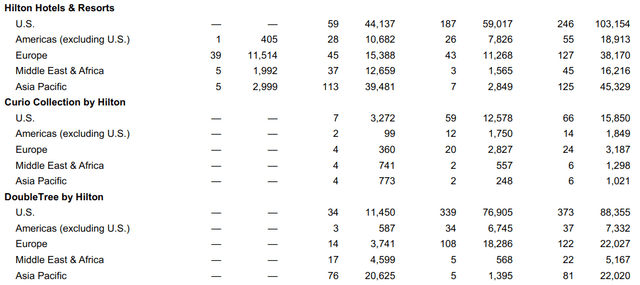

When looking at the room breakdown for Hilton Hotels & Resorts and DoubleTree by Hilton (two major chains for Hilton Worldwide Holdings as a whole), we can see that the Asia Pacific region accounts for a sizeable portion of the total number of rooms (as shown on the right-hand column), with Hilton Hotels & Resorts accounting for just under 25% of all rooms and DoubleTree by Hilton accounting for 15% of all rooms.

Hilton 2021 Fourth Quarter and Full Year Results

In this regard, Asia – and particularly China – serves as an important market for the company’s overall growth strategy.

Notwithstanding that lockdowns in China at present are significantly affecting booking demand – Hilton as well as Marriott (MAR) and InterContinental Hotels Group (IHG) are significantly speeding up their expansion into the Chinese market. Hilton agreed a deal with Chinese developer Country Garden to open over 1,000 Home2 suites in China, and even with COVID restrictions affecting booking demand – more than 700,000 of the 2.3 million hotel rooms under construction worldwide at the end of 2021 were based in China.

From this standpoint – it could be the case that the market has become somewhat apprehensive on the stock based on both fears that the sector as a whole might be overvalued coupled with the effects of current lockdowns in China on the sector.

This has been compounded by the recent spike in energy prices and the closure of Russian airspace to Western airlines – as these two factors will ultimately make flight bookings more expensive and serve to hinder the recovery that we have been seeing in the travel sector as a whole.

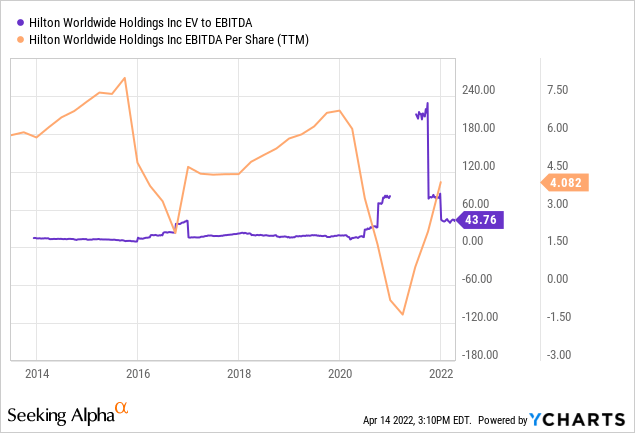

However, when looking at the EV/EBITDA ratio, we can see that while this ratio is still above pre-2020 levels – the ratio is approaching its historical range once again and earnings have been steadily recovering.

ycharts.com

While the stock still appears to be trading at a premium compared to pre-2020 levels, a further decline in price as a result of investor apprehension could signal a potential buying opportunity. Specifically, a reversion to the range of $130-135 as seen in early 2021 could be a good value point. Macroeconomic factors such as inflation are likely to steady out over the long-term, and China still maintains significant growth potential for Hilton Worldwide Holdings.

Conclusion

To conclude, Hilton Worldwide Holdings may see some volatility or a decline in the short-term due to investor apprehension regarding the travel recovery and COVID lockdowns in China. However, further apprehension could signal a buying opportunity as the overall growth environment for the company remains favourable.

Additional disclosure: This article is written on an “as is” basis and without warranty. The content represents my opinion only and in no way constitutes professional investment advice. It is the responsibility of the reader to conduct their due diligence and seek investment advice from a licensed professional before making any investment decisions. The author disclaims all liability for any actions taken based on the information contained in this article.

Be the first to comment