PixelCatchers/E+ via Getty Images

Although the hotel industry may not be viewed at this moment as particularly appealing because of continued economic concerns and in light of the pain that many of the businesses in this space suffered during the COVID-19 pandemic, the fact of the matter is that we are seeing a remarkable recovery in the fundamental condition of these enterprises. One firm that has demonstrated significant improvement lately is Hersha Hospitality Trust (NYSE:NYSE:HT). Unfortunately, the market has not been particularly kind to the enterprise lately. Despite strong performance, high levels of debt and the existence of a large amount of preferred stock that has, when combined with broader economic concerns and the continued restructuring of the enterprise, led to a tremendous amount of pessimism regarding the company’s prospects. While I would definitely agree that the company is not a best-of-breed prospect at this time, I do think that shares are cheap enough today to warrant some nice upside potential. Because of this, I have decided to rate the business a ‘buy’ at this time, reflecting my belief that it should outperform the broader market moving forward.

A disparity

The last time I wrote an article about Hersha Hospitality Trust was in June of this year. In that article, I talked about some of the big changes accompany was going through, including a rather sizable sale involving non-core assets. That sale has since been completed for the most part, with six of the seven assets agreed upon having been offloaded. Assuming a continued return to normalcy, the company is also looking rather cheap. All combined, this led me to rate the business a ‘buy’, but the market has so far disagreed with this assessment. While the S&P 500 is down by 1.6%, shares of Hersha Hospitality Trust have generated a loss for investors of 8.8%.

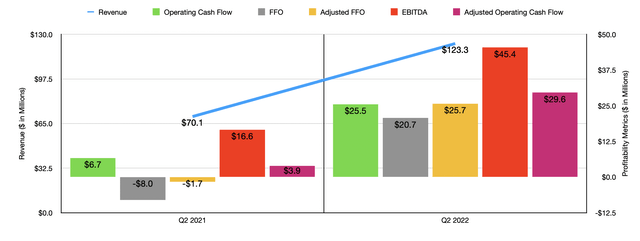

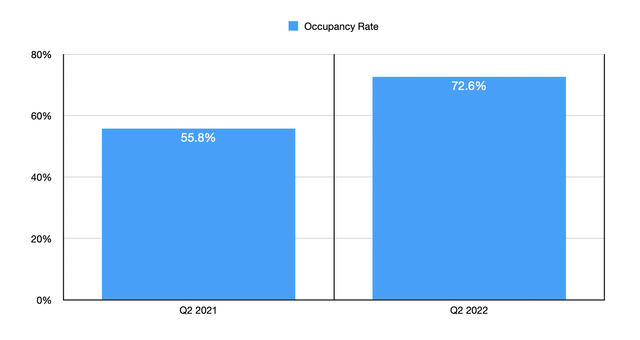

Although painful, I believe that this decline is likely temporary. But to truly understand what kind of prospects the company has, we should dig in a bit deeper. Since I last wrote about the company, we have only seen one additional quarter worth of data come out. But that data is so far quite robust. Consider the picture from a revenue perspective. During the second quarter of the year, sales came in at $123.3 million. That dwarfs the $70.1 million in revenue generated the same quarter one year earlier. This increase in revenue was driven by a couple of key factors. First and foremost, the company saw its occupancy rate improve rather markedly, rising from 55.8% in the second quarter of 2021 to 72.6% the same time this year. The second key factor seems to relate to the ADR of the business. This is the average daily rate that the company can charge for a room at one of its locations. In the latest quarter, this number for its comparable properties came out to $286.78. This compares to the $208.81 reported for one year earlier. The disparity between these two quarters is even greater when looking at the RevPAR, or what the company actually collects from its rooms. That number rose from $116.48 in the second quarter of last year to $208.26 the same quarter this year. The big driver behind this, obviously, is the rise in occupancy.

As a result of higher revenue, the company is seeing an explosion when it comes to profitability. Operating cash flow went from $6.7 million in the second quarter of 2021 to $25.5 million the same time this year. If we adjust this for changes in working capital, the metric would rise from $3.9 million to $29.6 million. FFO, or funds from operations, went from negative $8 million to positive $20.7 million. Meanwhile, if we adjust for changes in working capital, the metric would have risen from negative $1.7 million to $25.7 million. And the EBITDA for the firm also increased, climbing from $16.6 million to $45.4 million.

Beyond these numbers, understanding the actual valuation of the company is next to impossible. In addition to management not offering any guidance for the 2022 fiscal year, we also run into the problem that the rather sizable asset sale the company made makes comparing financial performance or projecting financial performance rather difficult. This picture is further complicated by the fact that, in early August, the company announced a refinancing of some of its debt. This involved taking on a $500 million credit facility consisting of a $400 million term loan and an undrawn $100 million revolving credit line. This deal also made it possible for the company to engage in an interest rate swap that locked in the interest expense on $300 million of the term loan at an annual interest rate of 3.95%.

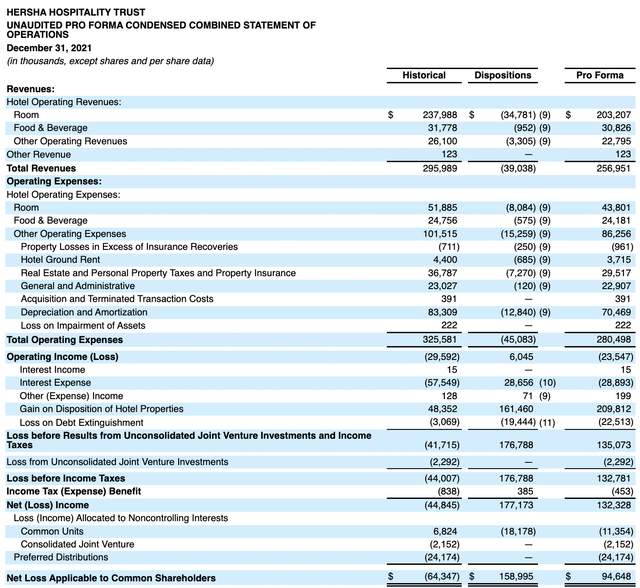

This is not to say that we don’t have anything to go on. For instance, after it completed the sale of six of the seven properties, the firm did show pro forma financial results for the 2021 fiscal year. But this data largely related to its income statement, not its cash flow. What we do know is that if we look at the revenue, minus cash expenses associated with those properties and factor in the interest savings generated from the sale, the company should experience pre-tax cash flow of $35.5 million per year in excess of what they otherwise would. But again, that is based on results from 2021 when financial performance was still significantly worse than it is today.

Even with these figures, we are left with difficulties in valuing the firm. The best approach to solving this problem, then, is to follow the same methodology as in my prior aforementioned article that’s linked in the second paragraph of this article. That approach calculates an implied EBITDA per room the company has after factoring in the asset sale. Staying true to that approach, we get a reading of $137.45 million, while stripping out preferred distributions and interest expense would give us adjusted operating cash flow of $96.50 million. This all implies a forward EV to EBITDA multiple for the firm of 10.8 and a price to adjusted operating cash flow multiple of 4.9. As part of my analysis, I did compare the company to five similar firms. On a price to operating cash flow basis, using data from 2019, these companies traded at multiples of between 1.6 and 10. And using the EV to EBITDA approach, the range was between 10.4 and 14.7. In the price to operating cash flow scenario, two of the five companies were cheaper than Hersha Hospitality Trust, while in the EV to EBITDA scenario as well, two were cheaper than it.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Hersha Hospitality Trust | 4.9 | 10.8 |

| Braemar Hotels & Resorts (BHR) | 4.4 | 11.1 |

| Chatham Lodging Trust (CLDT) | 10.0 | 14.7 |

| Ashford Hospitality Trust (AHT) | 1.6 | 10.7 |

| Service Properties Trust (SVC) | 6.5 | 11.0 |

| Summit Hotel Properties (INN) | 8.6 | 10.4 |

Takeaway

Based on all the data that we have today, the fundamental picture for Hersha Hospitality Trust is improving significantly. Having said that, there is a tremendous amount of uncertainty in the picture. The good news is that nothing really bad is happening. All the changes are aimed at improving the company’s operations moving forward. Pricing the company is definitely more an art than a science in this scenario. Based on my own assessment, shares are trading more or less in fair value territory compared to similar firms. Yes, investors could choose one of those other enterprises to invest into if they want to avoid this uncertainty. But on an absolute basis, shares do not look unreasonably priced at all. I wouldn’t exactly call this a strong prospect by any means, but I would still make the case that it probably offers some upside potential moving forward, leading me to keep it as a soft ‘buy’ at this time.

Be the first to comment