Freedoo/iStock Editorial via Getty Images

I rate Hermès (OTC:OTCPK:HESAY)(OTC:OTCPK:HESAF) a sell at its current price of €1,074. As a long-term investor, I usually hesitate to sell any stock as long as the overall growth story of the company remains intact. The current valuation of Hermès, however, can’t be justified and is a result of temporary heightened margins. Assuming normalizing margins and a reversion to the mean regarding P/E and FCF multiples, I see Hermès true value around €830 (23% below the current level).

Introduction

Hermès is a company based in Paris, France, that produces and sells luxury goods from the following categories:

- Leather Goods and Saddlery: Bags, riding equipment and other (45.55% of FY2021 sales)

- Ready-to-wear and Accessories: Clothes, belts, costume jewelry, gloves, hats and shoes (24.71% of FY2021 sales)

- Silk and Textiles: Scarves, Shawls and Stoles

- Other Hermès sectors: Jewelry and home products

- Perfume and Beauty: Perfume, Make-Up

- Watches

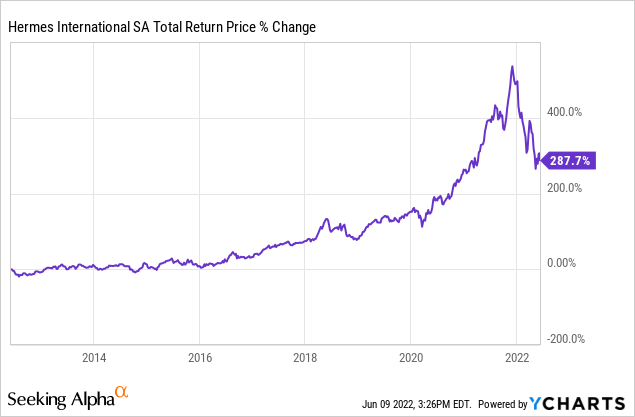

The total return for Hermès shareholders over the last ten years is shown in the chart below. Even despite the recent drop in price, shareholders achieved a total return of 287.7% or a CAGR of 14.5% over the last ten years.

Hermès main competitors in the luxury goods space are LVMH (OTC:OTCPK:LVMHF)(OTC:OTCPK:LVMUY), the luxury conglomerate around Louis Vuitton, and Kering SA (OTC:OTCPK:PPRUF)(OTC:OTCPK:PPRUY), the company owning brands like Gucci and Saint Laurent.

Main Thesis: Temporary heightened margins

My thesis is that Hermès’ margins are temporarily heightened due to after effects of the pandemic. In FY2020, Hermès’ revenue declined by 7% to €6,389 million (FY2019 revenue: €6,883 million). In FY2021, revenue skyrocketed by 40% to €8,982 million.

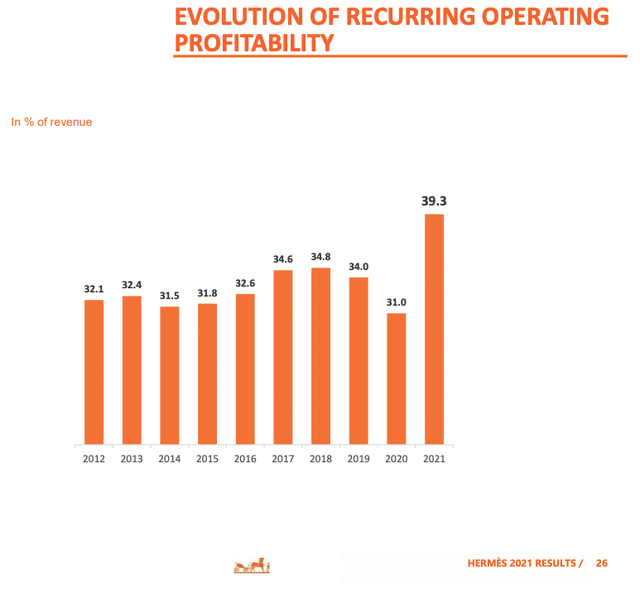

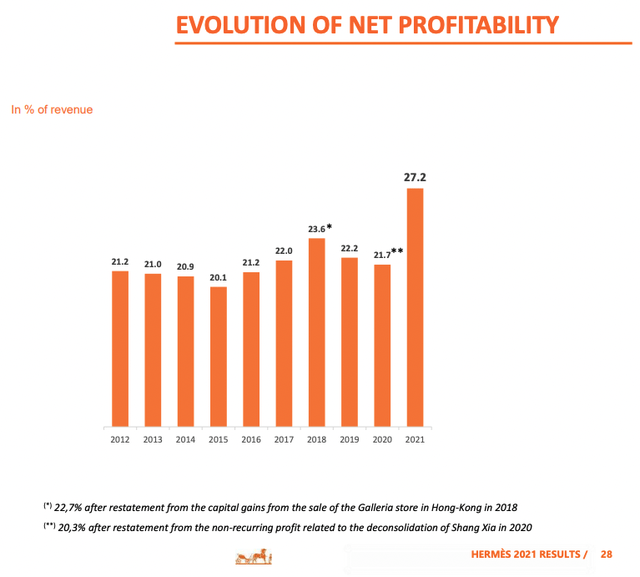

I think that the revenue Hermès lost in FY2020 due to the pandemic has shifted to FY2021 and early FY2022. Hermès’ highest value items like the Birkin and Kelly Bags often have long waitlists for interested costumers (if anyone is interested, you can read more on that here), so the demand side will likely never be a problem (and wasn’t a problem in FY2020). I think that Hermès rather faced challenges on the supply side in FY2020, causing the 7% drop in revenue mentioned above. With these supply constraints lifting through FY2021, more customers on the waitlists were able to buy the products they waited for, resulting in a revenue shift from FY2020 into FY2021 and early FY2022, which ultimately led to temporary margin expansion. Chart 1 and 2 show the operating and net margins since 2012.

Chart 1 (2021 full year results presentation – page 26) Chart 2 (2021 full year results presentation – page 28)

The operating margin has historically been in the range of 32-34% while the net margin has hovered around 21%. It is obvious that the current margins of 39% and 27% look like outliers (meanwhile the FY2020 margins have been pretty low, probably due to the supply side challenges I mentioned earlier). While looking for an explanation from the company for these high margins in FY2021, I only came across one statement in the comments to the consolidated financial statements in the annual report for FY2021:

The gross margin rate was 71%, up by 2.8 points compared to 2020. This improvement stems from a leverage effect on fixed production costs, a gradual improvement in productivity and an exceptional inventory disposal rate.

Source: Annual Report 2021 – page 38

This would explain 280bps of the operating margin expansion in FY2021. The operating margin expanded from 31% in FY2020 to 39.3% in FY2021. This leaves 650bps of operating margin expansion to be explained. My guess is that this part of the margin expansion was a result of the revenue shift from FY2020 into FY2021. Revenue from the goods that were produced in FY2020 was accounted for in FY2021, while the production costs were accounted for in FY2020.

I think that the margins will start a reversion to the mean in the midterm. Even if the operating margin stays at 35% (200-300bps over the last ten-year average), this would still be a significant headwind to the bottom-line since the margins would drop 430bps from 39.3% in FY2021 to 35% in the coming years.

Valuation implications of the thesis

I will go over the current valuation first. At the end of FY2021 there were 104,964,401 fully diluted shares outstanding. At the current price of €1,074 this results in a market capitalization of €112.73 billion. After deducting the net cash of €4,894 million, the enterprise value amounts to €107.84 billion. The FY2021 net income of €2,445 million and free cash flow of €2,873 million lead to a current P/E of 44 and an FCF-Yield of 2.66%.

Prior to the pandemic (FY2015-FY2019), Hermès traded at an average P/E of around 38 and an average FCF-Yield of 2.80%. It’s fair to say Hermès has never really been a cheap stock. Comparing the current valuation to the multiples from FY2015-FY2019, Hermès appears to be slightly overvalued at the moment.

The average net margin from FY2015-FY2019 was 21.8% and the average FCF-Margin was 23.5%. I will assume that 200bps of the margin expansion is not temporary, so I will calculate with a net margin of 23.8% and an FCF-Margin of 25.5%. The TTM revenue amounts to €9,663 million. Assuming the normalized margins mentioned above would result in TTM net income of €2,302 million and TTM FCF of €2,462 million.

With the historic P/E of around 38 and the historic FCF-Yield of 2.80%, this would lead to a per-share price target of €837 (P/E) and €829 (FCF-Yield) for potential downside of around 23% from the current price of €1,074.

Going forward

Why even invest in Hermès?

To determine how to proceed going forward, we need to ask ourselves if we want to invest in Hermès in the first place. The short answer is yes.

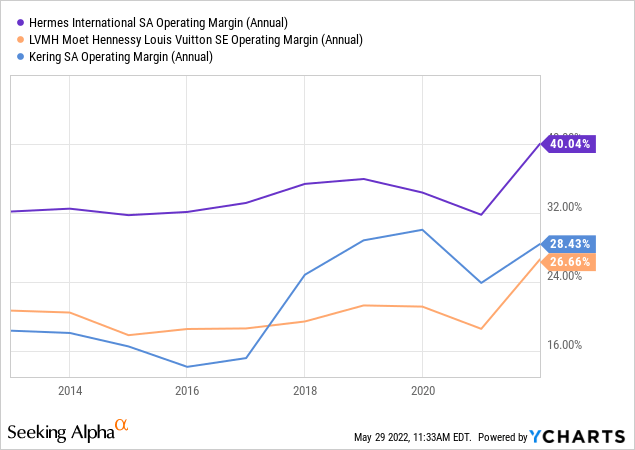

Hermès is the absolute leader in the luxury goods space. This becomes clear after taking a look at the operating margins compared to the closest peers. The chart below shows the operating margins of Hermès, LVMH and Kering over the past few years.

Hermès’ margins have consistently been way higher than the margins of its peers. The reason for this is the strength of the Hermès brand that allows the company to (a) demand higher prices and (b) save marketing costs, resulting in higher margins.

An example of Hermès’ ability to save on marketing costs since the products speak for themselves is that Hermès doesn’t have to rely on so-called “Brand Ambassadors” to promote the brand.

The peers Kering and LVMH regularly appoint these Ambassadors for their brands. Here are two examples:

- LVMH appointed the K-Pop boy group BTS as ambassadors for the Luis Vuitton Brand in early 2021

- Kering appointed Chinese singer and actor Xiao Zhan as the new global brand ambassador for the Gucci brand

In the case of Hermès, you won’t find any kind of ambassadors. I think the customers that Hermès targets simply don’t care if a celebrity promotes a bag, watch or scarf they want to buy. Hermès knows this and doesn’t even bother to get active in this space (saving millions of $ in the process since they don’t need to pay anyone to promote their products). This shows the strong moat of the Hermès brand.

The financial metrics are also excellent. For the FY2021, Hermès ROCE came in at 55.35%. The ROCE has been (except for FY2020) consistently around or above 50% since 2015. This is yet another sign of Hermès strong moat, showing that the capital requirement to generate high returns are low. According to S&P Global Capital IQ (Source: TIKR Terminal), at the end of FY2021 Hermès had €4,894 million net cash on the balance sheet. Meanwhile, the goodwill only amounted to €42 million. It is hard to find a balance sheet as healthy as this. Hermès financial position is excellent.

What to look out for

Hermès will publish first half results for the FY2022 on 07-29-2022. The most important part of this report will be the margin development. If there are signs of the margins already starting to compress compared to the record highs of FY2021, this could lead to a further drop in the stock price.

My guess is that we will only see margins start to compress in the results of the second half of FY2022, which should be released around February 2023. I will probably write an update article after these results are published.

Risks to the thesis

The main risk to this thesis is that the margin expansion in the recent past is not temporary, but rather sustainable into the future. This would be possible if my assumption regarding the revenue shift from FY2020 into FY2021 and early FY2022 is wrong and the record margins in FY2021 prove to be a result of price increases from the 2nd half of FY2020 onward that simply far outpaced cost inflation.

Another risk is that I underestimate the waitlists for the Birkin and Kelly bags I mentioned earlier. Hermès might simply raise prices while not caring if some people on the waitlist drop out. I already outlined that demand is not a concern for Hermès, so this is definitely possible. This would result in a compression of the waitlist and an increase in revenue that may be sustainable going forward.

Conclusion

Fundamentally, Hermès is the absolute leader in the luxury goods space and has excellent financial metrics. At a reasonable price, it is a company I would love to own. A premium valuation and price for the quality of the business are justified.

However, the current valuation can’t be justified. I think that this is a temporary overvaluation due to heightened margins that should start to revert to the mean in the midterm. For investors already holding Hermès, I would advise selling and looking out for better possibilities elsewhere, while keeping an eye on Hermès’ margin development. If margin compression takes place, leading to a further drop in price, there might be a buying opportunity in the future.

At the current price of €1,074 I rate Hermès a sell with a price target of around €830.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment