IAM-photography/iStock via Getty Images

When Warren Buffett and Berkshire Hathaway Inc. (BRK.A, BRK.B) take a major position in a stock you just bought, you feel pretty good about it. About the same time I recommended Paramount Global (NASDAQ:PARA) to members of Margin of Safety Investing, Berkshire was building a position. By the end of Q2, Berkshire owned about 13% of Paramount.

With shares of Paramount having fallen with the pessimistic stock market this year, you can now buy Paramount cheaper than both me and Buffett. I strongly recommend you do so whether you are a growth or dividend investor, or like me, both a growth and dividend investor. Here’s why.

Quick Take On Paramount Global

In February 2022, I rank ordered dividend stocks for subscribers of Margin Of Safety Investing. Comcast (CMCSA) and Paramount Global were tied at number 8. Since then, due to Paramount falling in price from about $27 per share to about $18 per share, it is now higher on that list due to deep value.

Paramount’s assets include:

- Paramount Pictures Corp.

- CBS Entertainment.

- Including Sports and News divisions.

- BET Networks.

- MTV Entertainment Group.

- Showtime.

- Nickelodeon.

- Pluto.

- Various international holdings.

- more…

According to their most recent earnings, annualized subscriber growth is clocking in at about 19% year-over-year to over 43 million. Global direct-to-consumer revenue was up 56%, and overall revenue growth was up 120% YOY.

A number that jumps out at me is gross margins of over 34%. That’s likely to rise in my opinion, as subscriber numbers grow globally and expenses rise more slowly than revenues. That is the beauty of subscription revenue, of course. It is scalable.

Return on equity is around 15% as well, and return on investment is about 11%. Again, those are all likely to improve over time.

I view Paramount as a deep-value play with big growth and improving margins.

How We Opened Our Paramount Position

In February 2022, I rank ordered dividend stocks for subscribers of Margin Of Safety Investing. Comcast and Paramount Global were tied at number 8. Since then, due to Paramount falling in price from about $27 per share to about $18 per share, it is now higher on that list due to deep value.

Among our strategies is to sell cash-secured puts. Incidentally, selling cash-secured puts is a well-known strategy for Warren Buffett and Berkshire Hathaway. I am not certain they did that here.

Here is how I laid out our initial trades for entering Paramount Global shares:

“I strongly suggest taking a 1% starter position with the intention of building a full 3-4% position in coming months.

I am also selling the $25 May puts on PARA. It is currently selling for $1.25 which represents a 5% premium for 12 weeks holding time or a shade over 20% annualized (quick eyeballing, not counting the days).”

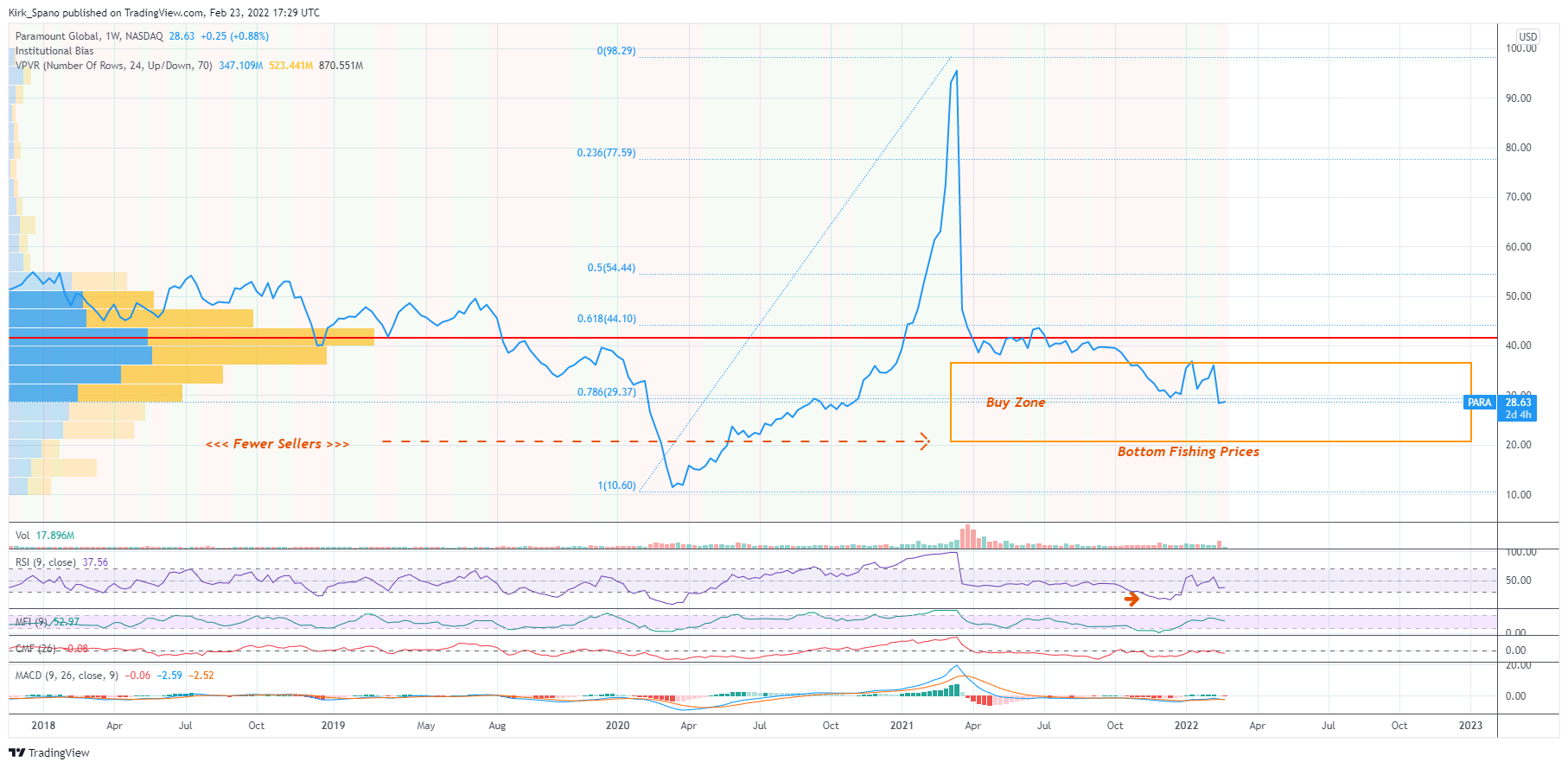

This was our initial buy zone chart from February:

PARA Buy Zone (Kirk Spano)

You’ll see I identified $20 per share as our “bottom fishing” price on weakness. Paramount Global shares are just slightly below that area now, which I identified with basic technical analysis and a couple of favorite quant factors.

I believe Paramount Global is in its bottoming process right now.

I have since acquired more shares at lower prices, and very recently sold a few more cash-secured puts with teen strike prices and expirations prior to year-end.

My net cost basis inclusive of option premiums is a shade over $20 per share and would fall to below $20 if the current batch of cash-secured puts were assigned to me.

Economic Rationality And Rising Earnings

When Netflix (NFLX) jumped out to a commanding lead in streaming, other content providers were left to try to catch up. A land grab ensued to see who could build their subscriber numbers the fastest. Spending skyrocketed on talent.

With a slowing of subscription growth industrywide and new winners emerging, the wild spending had to slow – and it has.

In the bullet points, I suggest that streaming services are entering a phase of economic rationality. From Amazon.com (AMZN) to Disney (DIS) and across the board, streaming prices are increasing.

Here is a comment from CEO Bakish from a recent presentation to Goldman Sachs (GS) investment bankers and brokers:

“But make no mistake, in all your models, you should assume price goes up over time because streaming is a great product. Paramount+ is certainly a great product, news sports a mountain of entertainment. And things like getting Top Gun by the end of the year, like people will like that. Over time, people will pay more than $4.99 or $9.99 for that. I guarantee it. And so we’ll do it at the right time but price increases are, for sure, part of the math in streaming.”

In addition, as the content kings consolidate their own services, they are saving money as revenues rise. Recently, Paramount revealed they are planning to streamline their Showtime service by folding it into their Paramount+ service on most platforms. This reduces the expense of maintaining multiple platforms.

Consolidation within the industry is also playing a major role. Amazon’s acquisition of private MGM and the Warner Brothers with Discovery merger both created situations where the emerging firms could extract synergies.

There have already been concerns raised by the Screen Actors Guild and Senator Warren that actors’ jobs might be at risk and that pay scales are being held in check or forced down.

This can only be good for the studios and streaming companies, as they look at production through a profitability lens. It’s not dissimilar to how oil and gas companies had to refocus their businesses on profitability after a wild era of spending to acquire land.

Global Growth Catalysts

Paramount has a slew of attractive growth catalysts that can both increase revenues and margins. That is the sweet spot for any company. Add revenue with limited increase in spend.

Among the most attractive is its global growth. Per Paramount:

“Paramount+ announced earlier this month that it plans to commission 150 international originals by 2025. Paramount’s production footprint includes a dozen studios in more than 20 countries, which feed the company’s content ecosystem across its streaming platforms, as well as its linear and broadcast TV networks. This global content strategy led it to become one of the top producers of Spanish language content in the world.”

To me, this is exposure to growing emerging markets’ incomes without all of the emerging markets’ stock risk.

On top of that is the fast-growing series in the U.S. I expect Paramount to be among the “must have” streaming services if it remains independent.

Potential To Be Taken Over

And that leads to a major consideration for Paramount. Paramount is a clear takeover target. Here’s what I said in February:

“…There has been rumors of a deal with NBCUniversal, but the odds of that passing regulatory muster seem low unless CBS spins off sports and news.

More likely, a company like Alphabet (GOOG, GOOGL) makes a run at them. If Google bought studio content and added it to their YouTube content, it would be similar to the Warner Bros studio content and Discovery’s reality content. Alphabet’s cloud presence and cash pile makes them a natural to buy content and add it to their distribution capabilities.

Another deal that makes sense in my mind is an acquisition by Netflix. Consider that Netflix is rumored to be seeking introducing an ad based service. Paramount could show them the way. In addition, Netflix would acquire an amazing content library, news division, sports rights and a movie studio.

Those are just a few scenarios for Paramount.”

The market cap not only presents a deep value stock investing opportunity. To me, it is a signal that the company could be taken by a company with the right strategic plan and checkbook.

Remember, Paramount Global is the merger of Viacom and CBS – companies that had split up years earlier. Mergers and acquisitions are in their corporate DNA.

The current market cap for Paramount Global is only $13 billion. That’s something that Berkshire, a tech company or Netflix could all absorb. Indeed, Paramount’s market cap is not much higher than Roku’s (ROKU), and they have been rumored to be an acquisition target.

I don’t know why Paramount wouldn’t be far more attractive than Roku. Paramount has far more assets in addition to the ad-supported revenues and expertise in advertising.

While I think it is a coin-flip that Paramount Global gets bought, I don’t think it is imminent. I think they will stick with showing growth and improving margins to drive their market cap higher. With a diamond-hands major holder in Berkshire, I think they will be successful in driving share prices up.

Dividend Income While You Wait

Currently, Paramount yields about 5%. That’s a great income, top 10% among S&P 500 companies, to receive while you wait for a rebound in share prices.

Buy Paramount Global

I rate Paramount a strong buy right now. I have recently made it a full 3-4% position in appropriate client accounts, and it will be roughly a 5-6% position if the cash-secured puts described above are assigned to me.

Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!

Be the first to comment