8vFanI

Looking for a high yield income vehicle that’ll benefit from rising interest rates?

Business development companies, known as BDCs, offer retail investors high yield exposure to private companies, and some of them, like Hercules Capital, Inc. (NYSE:HTGC) focus on companies which are already backed by venture capital firms. These other firms don’t want to lose their investments, and will continue to support these companies. This has been crucial during the pandemic.

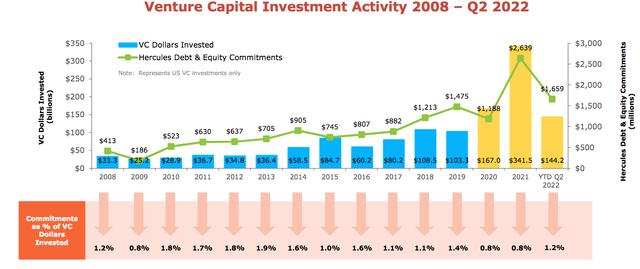

HTGC invests a much smaller % of capital in these companies, compared to their VC backers, ranging from 0.8% – 1.9%:

Profile:

HTGC focuses primarily on pre-IPO and M&A, innovative high-growth venture capital-backed companies at their expansion (venture growth) and established stages in a broadly diversified variety of technology, life sciences and sustainable and renewable technology industries.

It has a $2.58B debt portfolio, and also holds warrants for 103 companies, which add more upside potential to its investment portfolio.

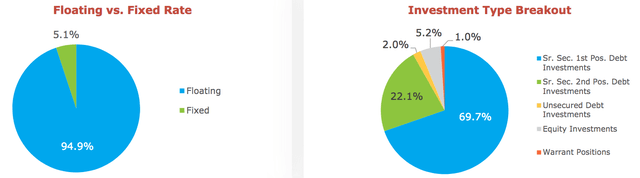

The debt portfolio is ~95% floating rates, with rate floors – ~70% in Senior Secured 1st position and 22% in Senior Secured 2nd position investments. It also holds 5% in Equity investments, 2% in unsecured investments, and 1% in Warrants:

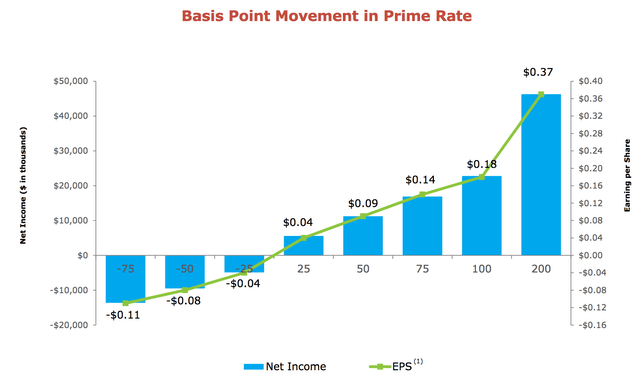

Management now estimates that a 100 basis point increase in the prime rate would add $.18/share to HTGC’s EPS, while a 200 basis point increase would add $.37/share, both up $.02 from Q1 2022. The current prime rate is 5.50%, vs. 4.75% just a month ago.

Holdings:

A key factor in analyzing BDCs is the health of the underlying companies that they’ve invested in. The market’s misgivings about the ability of those companies to survive the pandemic led to deep price reductions in BDCs’ price/share in 2020.

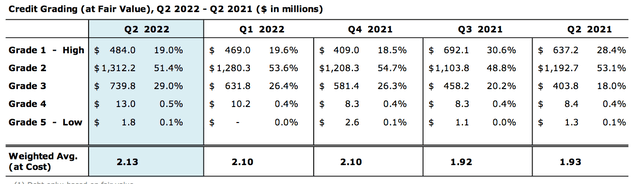

As of 6/30/22, HTGC’s holdings’ lowest two rating tiers, 4 & 5, comprised 0.6% of its portfolio, up slightly vs. Q4 ’21. The top two tiers, 1 & 2, were 70.4%, vs. 72.2% in Q4 ’21.

Loans on non-accrual increased by 1 in Q2 ’22, with a total of 2 debt investments, comprising 0.7% of the total portfolio on a cost basis.

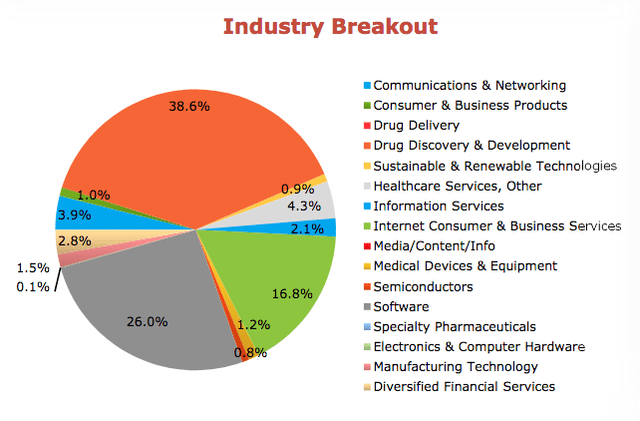

The top industries are Drug Delivery, Software, and Internet Consumer & Business Services, forming 81% of the portfolio’s industry exposure, much more concentrated than other BDCs we’ve covered:

Dividends:

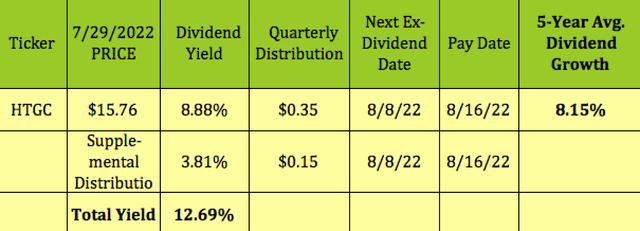

Management raised the quarterly distribution by 6%, from $.33 to $.35/share, which equals an 8.88% yield, at the 7/29/22 intraday price of $15.76.

HTGC is one of the few BDC’s with a positive 5-year dividend growth rate, at 8.15%, among the highest dividend growth rates in the industry.

HTGC also has a history of paying supplemental distributions, in addition to its base payouts. This is the 3rd straight quarter of $.15/share supplemental payouts. This adds another 3.81% to the yield, for a total of 12.69%.

The ex-dividend date is 8/8/22, with an 8/16/22 pay date.

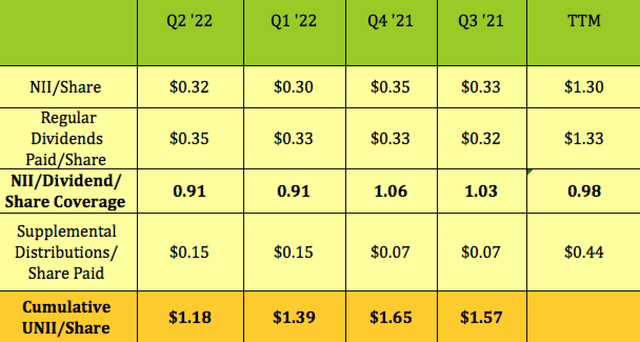

NII/Dividend per Share coverage was .91X in Q2 ’22, and has a trailing average of .98X, BUT, HTGC also has Undistributed NII/Share, UNII of $1.18, which affords ample coverage, and allows it to pay those %.15 supplemental distributions:

Earnings:

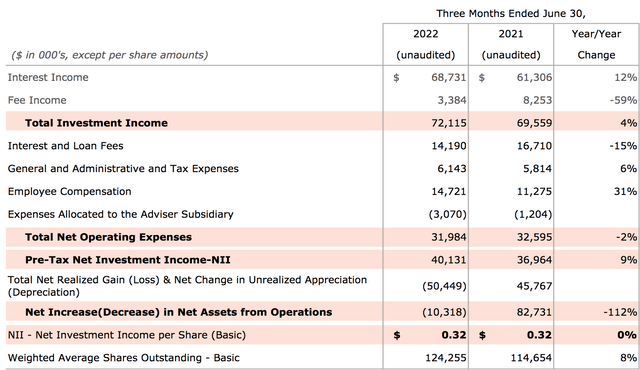

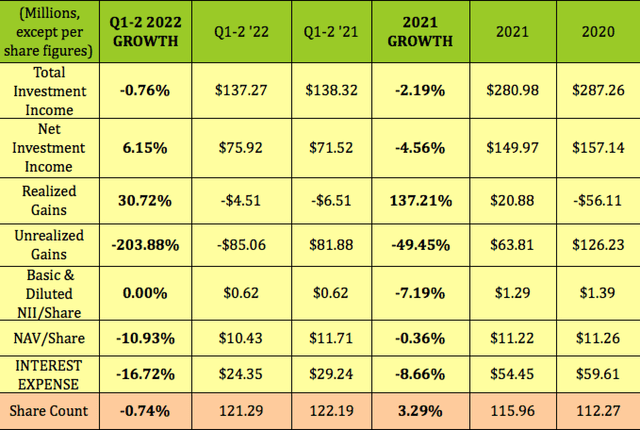

Q2 ’22 saw a 4% rise in total investment income, with pre-tax NII growing by 6%. NII/Share was flat, at $.32, due to an 8% jump in the share count. HTGC had sequential net debt investment portfolio growth of over $169M, which aided in management’s decision to raise the quarterly distribution.

Q1-2 ’22 total investment income was ~flat, while NII rose 6%, and NII/share was flat, at $.62. NAV/Share was down -10.9%, due partially to the supplemental dividends. While Interest expense improved, down 16.7%. The average Q1-2 share count was down slightly, but the 6/30/22 ending share count rose to 124.26M.

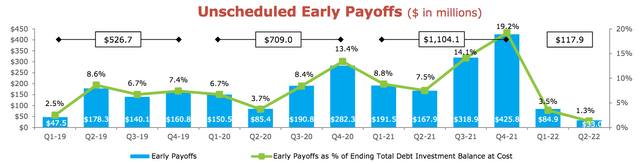

Early payoffs can boost NII, but they’re quite lumpy on a quarterly basis. For example, unscheduled payoffs were 19.2% of HTGC’s debt investment balance in Q4 ’21, but have plummeted to just 1.3% in Q2 ’22. The flip side of that event, though, is that it sets up the portfolio for higher interest earnings in the 2nd half of 2022.

New Business:

HTGC had record gross debt and equity commitments of over $1.04B in Q2 2022, its first $1B-plus quarter of new commitments. Fundings were also strong during the quarter, over $439M.

Leverage & Profitability:

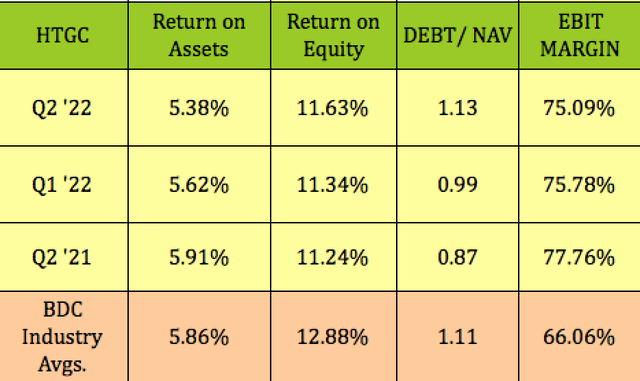

HTGC has very consistent ROA, ROE, and EBIT Margin figures, with ROA roughly in line with BDC industry averages, and ROE a bit lower than average, while its EBIT Margin is above average.

Debt:

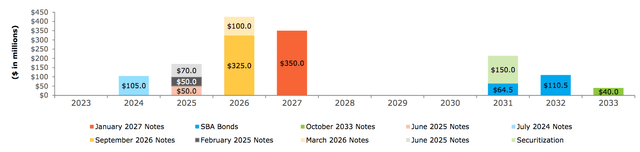

HTGC’s earliest debt maturity isn’t until 2024, when $105M in Notes comes due. Management uses a diverse array of sources to fund its investments. ~50% in Equity, 37% in Institutional Notes, 6.5% in SBA loans, and ~5% in credit facilities.

Management increased the capacity of HTGC’s credit facilities to $770M, and also raised $200M in institutional debt. Its debt is rated Baa3 by Moody’s, and received an institutional grade rating from Fitch’s.

Performance:

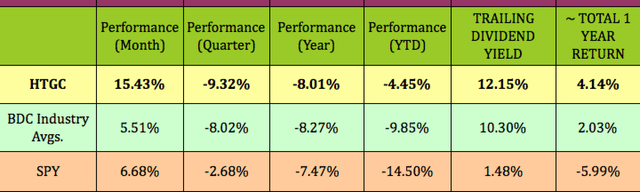

HTGC has outperformed the BDC industry and the market so far in 2022, and has enjoyed a 15.4% price gain over the past month, outdistancing its industry and the S&P by wide margins.

It has also outperformed the market and the BDC industry over the past year, on a total return basis, returning ~4%, vs. 2% for the BDC industry, and -6% for the market.

Valuations:

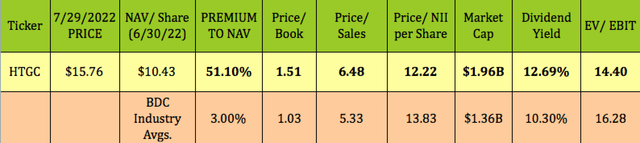

At $15.76, HTGC is selling at 51% premium to its $10.43 NAV/Share, vs. an industry average of 3%. This premium pricing puts it in a good position to raise capital via more share sales, so we’ll probably see additional secondary offerings over the next 2 quarters.

However, its earnings multiple, Price/NII per share, at 12.22X, is actually a bit cheaper than the 13.83X BDC industry average, as is its EV/EBIT, a testament to its earnings power.

HTGC has a long history of selling at a premium to NAV. Since 2017, its Price/NAV has ranged from 1.11X to 1.47X on a yearly basis.

Analysts’ Price Targets:

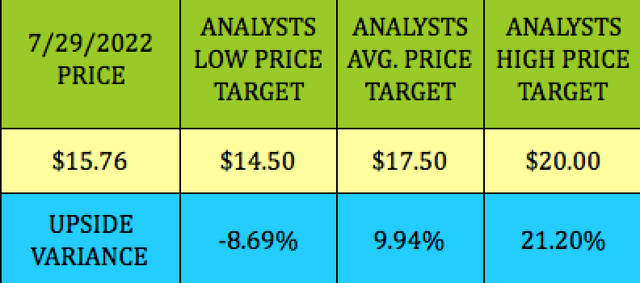

At $15.76, HTGC is ~10% below analysts’ $17.50 average price target, and 21% below the $20.00 highest price target.

Parting Thoughts:

We’re changing our rating for HTGC from a buy to a hold for now, but only because we’ll soon be heading into the weakest period of the year for market pricing. Add it to your watchlist, and wait for a market pullback in September-October, in order to take advantage of a cheaper entry point.

If you’re interested in other high yield vehicles, we cover them every weekend in our articles.

All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.

Be the first to comment