Ralph Orlowski

Henkel AG & Co. KGaA (OTCPK:HENKY) operates consumer and industrial businesses across three segments: Laundry & Home Care, Beauty Care, and Adhesive Technologies. Having outpaced consensus expectations in its latest quarter, Henkel has followed up with a raised full-year guide, signaling confidence in the underlying fundamentals. There likely remains a fair bit of conservatism in the guide, though, as an implied Q4 slowdown contrasts with the October performance (on par with the Q3 strength).

Even in the face of inflationary costs, Henkel’s pricing power has protected margins through the cycles. While bears will point to recent volume weakness in the consumer divisions, ongoing portfolio measures have exaggerated the headline YoY declines, leaving ample room for margin upside as Henkel wraps up the rationalization. With commodity prices also showing signs of moderation heading into FY23, the fwd valuation of ~16x P/E (below peers Reckitt Benckiser (OTCPK:RBGLY) and Unilever (UL)) screens as highly attractive.

| FY24 P/E | |

| Henkel | 15.6x |

| Reckitt Benckiser | 15.9x |

| Unilever | 17.9x |

Source: Market Data, Consensus Estimates from MarketScreener

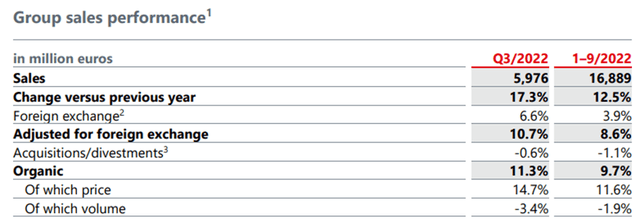

Henkel Flexes its Pricing Power

Henkel outpaced consensus numbers in Q3, led by organic sales growth of 11.3% and exceptionally strong pricing at +14.7%. Volumes were weaker, though by a much smaller % than pricing at -3.4%, with the consumer divisions seeing sizeable declines. The headline decline in volumes might seem concerning but needs to be viewed in context – Henkel is in the midst of a portfolio restructuring to drive higher margins, and the shedding of unprofitable volumes as part of this strategy contributed to the result. More importantly, Henkel’s market share is intact, and it isn’t losing competitiveness. Also positive is the ongoing integration of the ‘Laundry & Home Care’ and ‘Beauty Care’ units – the new organizational structure is now mostly in place, paving the way for the realization of more cost savings ahead.

Full Year Revenue Guidance Raised but Remains Conservative

Coming off a strong quarter, Henkel has raised the organic sales growth guidance to 7%-8% (up from 5.5-7.5% prior). Digging deeper, the delta is helped by a positive FX impact in the low-to-mid-single digits, while M&A is a detractor at a low-to-mid-single-digit negative. Given the context of ~10% organic sales growth YTD, though, Henkel’s revised full-year guidance implies a significant slowdown in Q4 sales of between -1% and +3%. Pricing in adhesives will understandably slow due to tougher YoY comps in Q4, but the consumer side remains strong, and volumes should bottom out as the portfolio restructuring enters its final stages. Net, the revenue update seems a tad conservative, in my view, likely as a buffer against what management sees as a volatile external environment. Yet, there have been no trends that point to such an outcome so far – October disclosures, for instance, show continued growth across all of Henkel’s core businesses.

Margin Guidance Revised Higher as Input Cost Inflation Eases

The full-year margin guidance has also been upgraded to 10-11% (up from 9-11% prior), while for EPS, management is now calling for a more moderate 15-25% decline (improving from down 15-35% previously), including EUR450-500m of restructuring charges. The latest earnings upgrade may be the first of many to come, in my view – even in an environment of weaker volumes, as industrial and consumer demand slow amid a challenging macro, Henkel still has ample margin opportunities at hand.

One key driver is cost. For FY22, the guidance for an average mid-20% increase has been reiterated for the full year, which equates to ~EUR2bn of inflation in absolute terms. Yet, the group has seen declines in key input costs such as edible oils and some petrochemical feedstocks across the US and Asia. This points to some conservatism in the margin guide as well, so I see ample room for another beat and raise in the upcoming Q4 results. Even in a bear case scenario where spot commodity prices move higher, Henkel’s pricing power should help to offset the inflationary challenges.

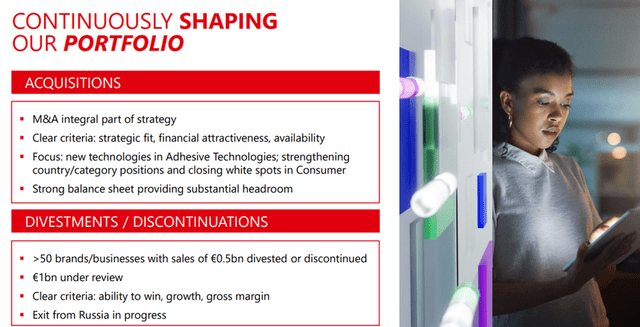

Leaning on M&A to Unlock Value

As laid out at this year’s Capital Markets Day presentation, Henkel’s capital allocation policies will prioritize M&A for now. Based on its track record, this seems like a sensible move – the consumer brands platform (recall Henkel’s decision to merge the ‘Laundry & Home Care’ and ‘Beauty Care’ into one ‘Consumer Brands’ unit) has already gone live in all regions outside of Europe, as execution runs ahead of plan. A successful merger would be a significant positive for the P&L – Henkel’s guidance calls for post-merger savings of ~EUR500m, with ~EUR250m to be unlocked in FY23 and the remainder by FY24.

In addition, Henkel is also focused on divestments as a source of value creation. Currently, dilutive businesses with net sales of up to EUR1bn are under review, and successful exits or wind-downs would boost the overall margin profile. Case in point – last year’s de-prioritization of the Turkish business allowed the company to redirect investment dollars to non-dilutive areas, driving a favorable mix shift. Next on the agenda is the exit from Russia at end FY22 or early FY23 – the Russian business hasn’t necessarily been dilutive but increases Henkel’s exposure to geopolitical risks. Expect the lack of contribution from Russia to be an earnings headwind from next year, though incremental savings from portfolio actions elsewhere could offset the drag.

Sustained Pricing Power Through the Cycles

Henkel’s pricing power shone through yet again in Q3, driving record-high quarterly nominal sales across all business units and regions. The only blemish has been the weakness in consumer volumes, though it is worth noting that the contribution of ongoing portfolio measures (vs. increasing elasticities) exacerbated the decline. At this point, we have likely seen the worst of the headwinds – the portfolio rationalization is due to conclude soon, while the moderation in commodity prices and the realization of EUR500m of merger savings support the case for a fitter, structurally higher-margin business. Net, I think investor concerns about Henkel’s progress are overblown; at a below peer fwd valuation of ~16x P/E and a ~3% yield, the stock offers good value.

Be the first to comment