Dzmitry Dzemidovich

Introduction

In July 2022, I wrote a bullish article on SA about international executive search company Heidrick & Struggles (NASDAQ:HSII) in which I said that the company looked significantly undervalued from a fundamentals point of view as it could finish 2022 with a net income of more than $80 million.

Heidrick & Struggles has just released its Q3 2022 financial results, and this was another strong quarter. On a constant currency basis, net revenue was $265.8 million, which makes it the highest third quarter revenue in the company’s history. However, adjusted net income declined by 9 % year on year and the guidance for Q4 looks soft as the market is slowing down. Heidrick & Struggles expects to finish the last quarter of 2022 with revenues of $215 million to $235 million. Overall, I’m no longer bullish on the stock as the macroeconomic environment is deteriorating rapidly. Let’s review.

Overview of the Q3 2022 financial results

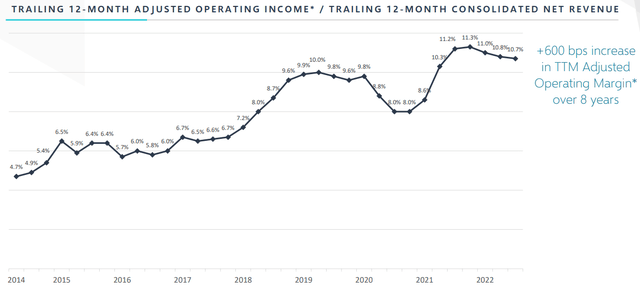

In case you haven’t read my previous article about Heidrick & Struggles, here’s a brief description of the business. The company is involved in the provision of top-level senior executive search services primarily on a retained basis and it currently serves more than 70% of the Fortune 1000 firms. Heidrick & Struggles also provides consulting and on-demand talent services. This is an asset-light business with almost no capital expenses. Revenues have doubled compared to 2014 and economies of scale have helped the company boost its adjusted operating income margin above 10%. However, there was a dip below this level during the COVID-19 pandemic.

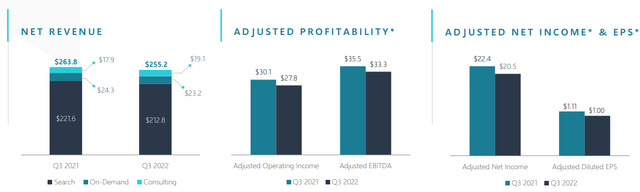

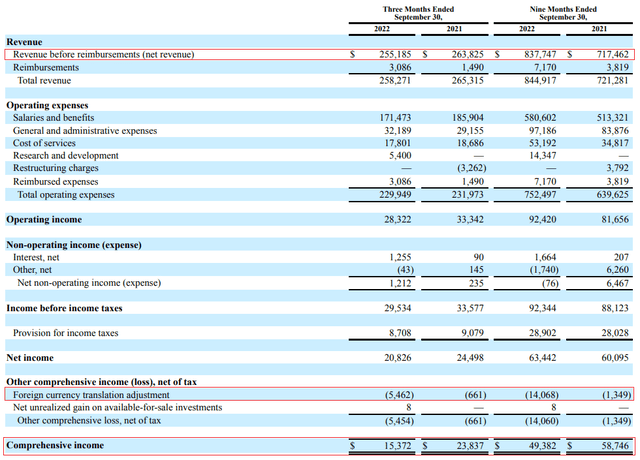

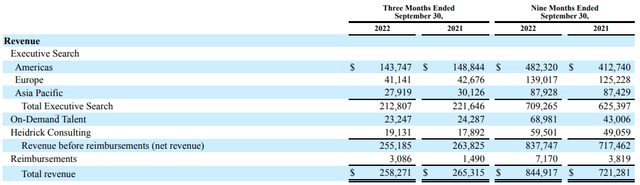

Turning our attention to the Q3 2022 financial results, I think they were strong as net revenue declined by 3% but inched up by 1% on a constant currency basis. However, adjusted net income dipped by almost 9% to $20.5 million while comprehensive income decreased by over 35% to $15.4 million, primarily due to unfavorable foreign exchange rates.

Heidrick & Struggles Heidrick & Struggles

The year-to-date operating income stood at $92 million, which is close to the $98 million achieved for the full year in 2021. Unfortunately for investors, Heidrick & Struggles revealed in its Q3 2022 earnings call that it’s starting to see a market slowdown and the Q4 revenue guidance looks underwhelming. The company expects to book revenues of between $215 million to $235 million for this quarter. For comparison, net revenue in Q4 2021 came in at $285.5 million.

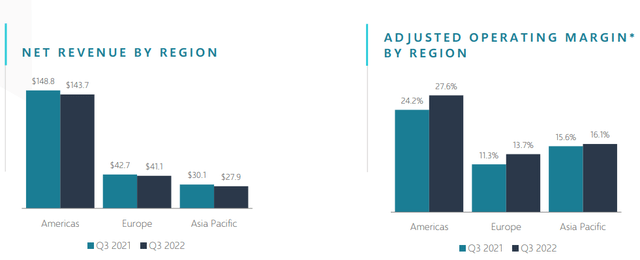

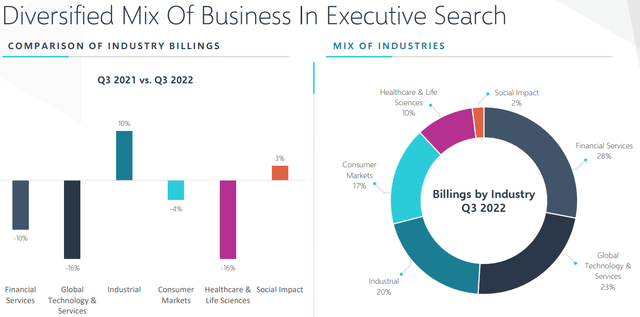

It seems that cracks are starting to appear in the company’s executive search business. In Q3 2022, net revenues declined in every region and there was a significant decrease in billings in the technology and healthcare segments. The adjusted operating margin in the executive search business is holding steady for now but this could change in Q4.

Heidrick & Struggles Heidrick & Struggles

The on-demand talent business of Heidrick & Struggles has historically been better at weathering economic downturns, but this is unlikely to make much of a difference as quarterly net revenue is only about $23 million.

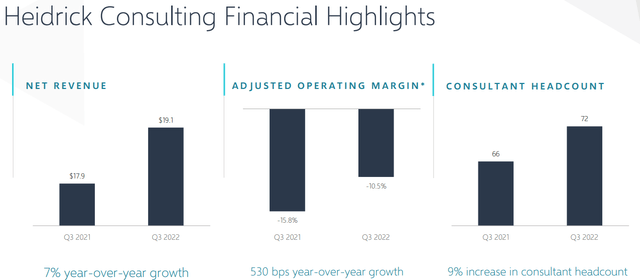

As you can see from the table above, the revenue coming from the consulting business is even lower. Sure, it’s growing rapidly, and Heidrick & Struggles mentioned in its Q3 earnings call that it continues to operate in a higher demand environment due to a tight labor market and a growing prioritization on succession planning. However, the issue is that this business isn’t profitable at the moment. Overall, executive search is the company’s bread and butter.

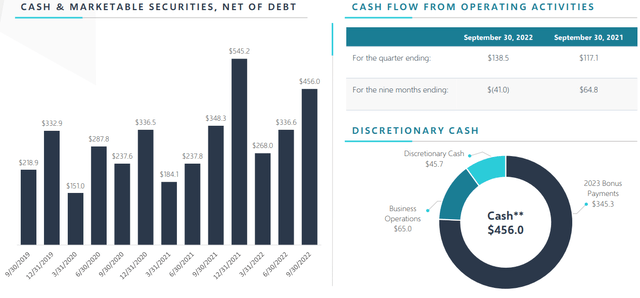

Turning our attention to the balance sheet, Heidrick & Struggles closed September 2022 with $456 million in cash and marketable securities. This is the company’s highest cash balance at the end of the third quarter in its history. There are no debts but keep in mind that a large portion of the cash position has been earmarked for employee bonuses. Traditionally, the cash position builds through the year and Heidrick & Struggles pays out the employee bonuses during the first quarter.

Excluding the $345.3 million accrued bonus payments, Heidrick & Struggles has an enterprise value (EV) of $458 million as of the time of writing. The TTM adjusted EBITDA is $142.5 million which means that the company is trading at just 3.2x EV/EBITDA at the moment. Sure, this seems low, but the business is vulnerable during a recession, and it seems we are in the early stages of a strong one at the moment. According to a KPMG survey of 1,325 CEOs between July 12 and August 24, about 91% of U.S. CEOs think that we are heading toward a recession in the next 12 months (slide 4 here). Just 34% of them believe that it will be mild and short. Looking at what happened during the Great Recession, Heidrick & Struggles posted losses in 2009 and 2011 and it took a whole decade for revenues to recover 2008 levels. Overall, I’m concerned that the stock could be turning into a value trap in this macroeconomic environment.

Investor takeaway

Heidrick & Struggles booked strong revenues in Q3 2022, but the company’s executive search business is starting to feel the pinch of challenging market conditions as billings in the technology and healthcare segments decreased significantly. The guidance for the last quarter of the year looks underwhelming and it seems that a lot of US CEOs are expecting a long and severe recession in the near future.

Considering the financial performance of Heidrick & Struggles has historically been sensitive to the change of business cycles, I think it could be best for risk-averse investors to avoid this stock. Heidrick & Struggles looks cheap, but I’m concerned that it could be becoming a value trap.

Be the first to comment