Sander Meertins/iStock Editorial via Getty Images

It is not the first time that we’ve looked at HeidelbergCement (HLBZF, OTCPK: HDELY). The last time, we initiated coverage with a buy rating and a valuation with an upside case scenario of 40%, unfortunately, the time was not right and HeidelbergCement stock price dropped due to the Russia/Ukrainian conflict. Today, we would like to present why we are still confident in the Company and what has happened in the meantime. Similar to what we have done with Total, we would like to briefly recap what makes up our long term thesis:

- After the pandemic and thanks to the EU recovery plan, we are believers in Keynesian spending by Governments in regions where HeidelbergCement operates.

- In particular, we highlight Italy as a key market for the Real Estate bonus subsidies and more specifically thanks to the Italcementi subsidiary.

- Thanks to the latest news and despite the high energy prices, we believe that the company will manage the cost pressure and they will pass through inflation costs.

HeidelbergCement Exposure in Russia

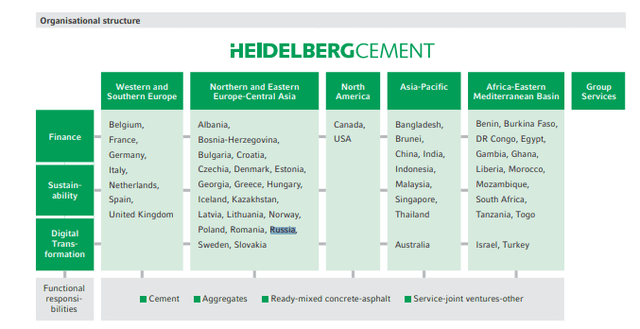

In our latest article, Russia had not yet moved against Ukraine. Since then, energy prices have jumped dramatically and international sanctions against Russia further deteriorated the whole inflationary environment. In 2021, looking at the HeidelbergCement Annual Report, Russia has been named 34 times. Looking at the HeidelbergCement reporting system, Russia is present in the Northern and Eastern Europe-Central Asia segment.

HeidelbergCement Reporting segments

Source: HeidelbergCement 2021 Annual Report

What’s important?

- The company is freezing all new investments in Russia. HeidelbergCement is present with three cement plants all for domestic operations.

- At the P&L level in 2021, the company revenue accounted in Russia was around 1%.

- Related to Ukraine, HeidelbergCement is not operating since 2019.

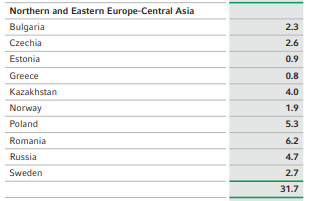

Total cement production capacity is 163.3 million tonnes / 4.7 million tonnes are located in Russia which is equal to 2.8% of the company’s production. It’s even lower if we consider aggregates reserves and resources & Joint Ventures.

HeidelbergCement Russia exposure

Source: HeidelbergCement 2021 Annual Report

Checking its annual report we highlight this key conclusion: “Based on the assumption of continued high energy cost inflation, the Managing Board expects a slight rise in result from current operations before consolidation and exchange rate effects. ROIC is expected to be around 9%“.

Conclusion

Even if “a reliable forecast of its operating business activities is currently not possible due to the very dynamic situation surrounding the Ukraine-Russia conflict. However, negative impacts on EBIT can be expected indirectly as a result of the very high volatility on the energy markets caused by the crisis’ management is forecasting a ROIC at 9%.

A perfect storm is happening in Europe, many small & medium cement plants are closing and announcing force majeure. In the meantime, HeidelbergCement has proposed an increase in its DPS policy of 9% for a total contribution of €2.40 per share and a dividend yield of 4.5% at the time of writing. The company is well managed and has a global footprint, adjusting our internal EBITDA estimate we came up with a price target of 70 euros per share, implying a 31% upside.

Previous coverage in the sector:

- LafargeHolcim (HCMLF, OTCPK:HCMLY): Multiple Arbitrage Thanks To Firestone Acquisition

- HeidelbergCement: The Best Is Yet To Come

Be the first to comment