alvarez/E+ via Getty Images

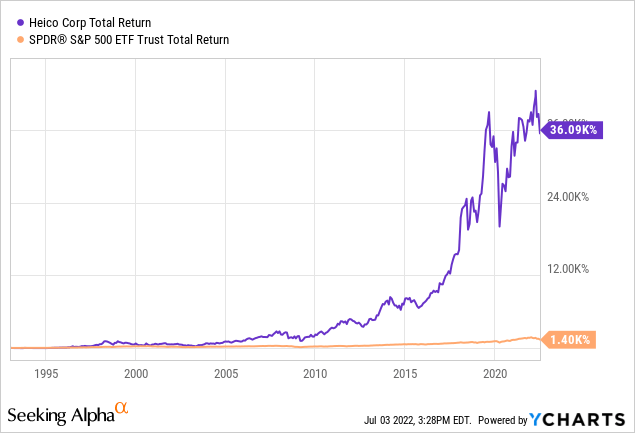

HEICO (NYSE:HEI) is a company that over the last 40 years has beaten all major American indices. Over the last 20 years, the company has compounded value at an annual return of 20% focusing on a niche market that has dominated since its inception.

Even though HEICO has produced outstanding returns for shareholders over the last years, I firmly believe that the company can continue to do so in the coming years due to the growth of the market in which it operates combined with the acquisitions it makes in the niche markets it operates in. Although HEICO sounds appealing, right now the valuation is quite high, and it may have some downside risk in a short-medium term horizon. Nevertheless, the company will continue to increase its free cash flow at higher rates than those of the market.

Business segments

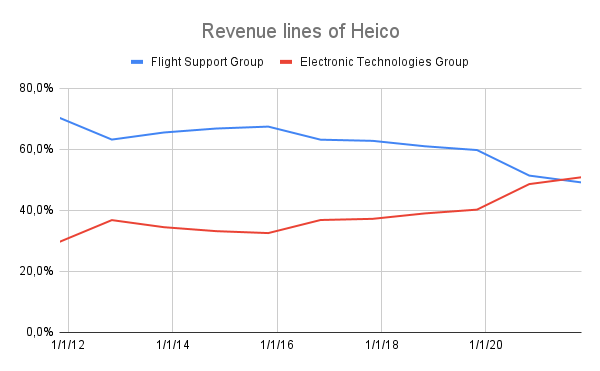

HEICO breaks down its revenue line into two categories: Flight Support Group and Electronic Technologies Group.

- Flight Support Group (FSG): This segment is focused on providing high-quality and cheaper components than Original Equipment Manufacturers (OEMs) for aircrafts such as: turbines, wing components or metallic structures, among others. This segment is more dependent on the number of planes made every year and the products it sells are less recurrent than the rest of the business. This segment currently represents 49.2% of HEICO’s sales. The main competitors of HEICO in this segment are: Airbus (OTCPK:EADSF), Boeing (BA), TransDigm (TDG) and other smaller companies that operate in mechanical niche markets. The weight of this segment has been reducing over the years due to its less recurrent revenue nature. HEICO has been focusing more on strengthening the Electronic Technologies Group.

- Electronic Technologies Group (ETG): This segment is more focused on providing mission-critical electronic subcomponents that are used in planes, such as: electro-optical devices, laser products, microwave power equipment, power electronics and other critical components that are needed in order to keep the aircraft working. This segment is more oriented to niche markets and it is more profitable and more resistant to economic slowdowns such as the one that we are experiencing in this 2022. This segment currently represents 50.8% of HEICO’s sales. This segment is more niche-market oriented and has competitors such as Avnet or Teledyne, but the highly fragmented nature of the market makes it possible for the business to grow in the coming years. As the company also takes care of the maintenance of aircraft and their critical components, the ETG segment also benefits positively from this fact.

Different Revenue Lines of HEICO (Own Models)

Business Strategy

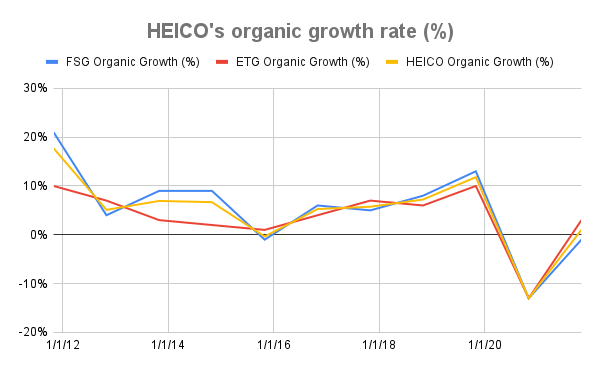

HEICO’s strategy is mainly based on two main drivers: organic growth and a disciplined and long-term oriented acquisition strategy. In the first place, organic growth has been pretty impressive over the last decade, averaging 5% for the last 10 years, with positive growths every year with the exception of 2020, when the business was negatively impacted by the Covid-19 pandemic, that halted aircraft production and international traveling. The following chart shows the organic growth of HEICO’s operating segments.

HEICO’s organic growth (sec.gov and Own Models)

Acquisitions have also been key in HEICO’s performance over the last years. In their own words (from the last Annual Report):

Since 1990, we have completed approximately 88 acquisitions complementing the niche segments of the aviation, defense, space, medical, telecommunications and electronics industries in which we operate.

In addition, HEICO’s acquisition strategy consists of approaching to niche markets in which they have traditionally operated, such as the ones previously mentioned. The company seeks to invest in free cash flow generative businesses with a strong capital discipline, abilities to grow and that are available at reasonable prices. I believe that this negative macroeconomic situation can increase the company’s ability to perform strategic acquisitions that will expand the cash flows they generate.

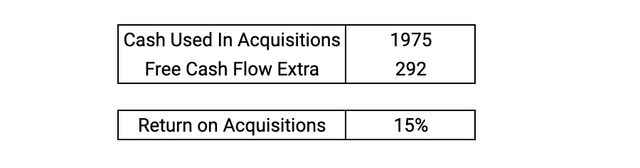

HEICO’s acquisition strategy has also been profitable over the last decade. HEICO has used almost $2 billion in acquisitions, and has been able to expand its Free Cash Flow on nearly $300 million. This yields a return on acquisitions of almost 15% which, combined with organic growth (around 5% on average), a 20% return, which matches the stock return over the last 10 years.

HEICO’s Return On Acquisitions (sec.gov and Own Models)

In conclusion, HEICO has two main sources of growth that can boost returns for shareholders in the coming years: one the one hand, they can keep increasing prices and producing more aircraft parts (organic source) and, on the other hand, they can also continue acquiring good businesses at reasonable valuations. This will maintain their returns on acquisitions high and, combined with the organic growth they have, I believe the company will be able to produce positive returns for unit-holders in the years to come.

Future Outlook & Market Structure

HEICO is present in a market that will grow in the coming years. The pandemic has halted the production of aircraft and in the next years (with the recovery of international flights) more orders will come. This can be a positive catalyst for the business in the next three or four years. Nevertheless, the rumors of recession have not left us, and this phenomenon could originate a serious economic pullback that would reduce the production of aircraft. It has been estimated that this market will be able to grow at rates of 4% per annum for the next decade, and this could impact on HEICO’s profits positively. The combination of growth in volume and growth in prices can produce organic growth rates that would oscillate between 4-6% in the coming years.

In addition, HEICO is present in a really fragmented market and has to compete against OEMs in price but at the same time can acquire smaller competitors to increase its revenue base.

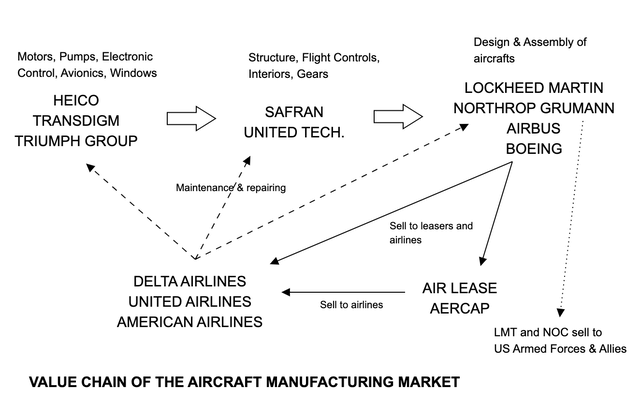

The following chart illustrates the process of value generation in the aircraft manufacturing industry and where HEICO is located.

Aircraft Manufacturing Market Overview (Own Models)

The company operates in a niche market where TransDigm and HEICO control both the vast majority of it. Even though there is competition, HEICO is one of the biggest players and can acquire its competitors and integrate them into their horizontal structure. HEICO generates its revenues from selling components to bigger structure manufacturers such as Safran (OTCPK:SAFRF), United Technologies (now integrated into Raytheon Technologies (RTX)) or General Electric (GE). At the same time it gets recurrent revenues from maintaining aircraft that belong to airlines such as Delta (DAL) or United Airlines (UAL) or that are leased to them through leasers such as Air Lease (AL) or AerCap Holdings (AER).

Management

HEICO’s success would not be possible if it weren’t for its outstanding management team.

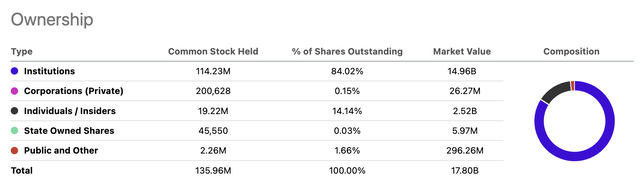

HEICO’s ownership (Seeking Alpha)

The previous image shows that 14% of the shares outstanding belong to insiders (Mendelson Family and Herbert Wertheim). The Mendelson Family is in charge of leading the business, with Victor and Eric Mendelson serving as co-Presidents of the company (since 2009) and their father Laurans Mendelson as CEO of the company since 1990. In addition, the Mendelson family has another 7% stake in HEICO through an investment firm, making them the largest shareholders with 14% of the shares outstanding. The fact that they own so many shares shows that there is a clear alignment between the interests of the founders and the interests of the shareholders. I firmly believe that if the founding family stays at the company, the strategy of growth combined with acquisitions will continue to happen, which will generate a great deal of value for shareholders in the long term. The management team is good, honest and has shown the ability to create a very good business in a competitive environment.

Financials

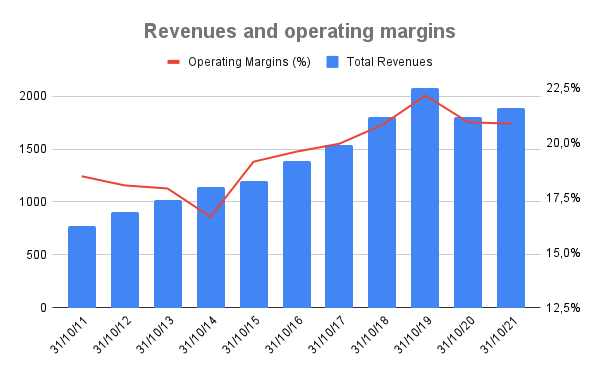

HEICO is known for having had a fantastic performance over the last years. Even though past returns cannot guarantee future returns, it is also said that history doesn’t repeat itself, though it rhymes. HEICO’s revenues have increased at a rate of 9.4% (this number has been negatively impacted by the pandemic), and their operating profits have increased at a rate of 10.7% per annum in the same period. This clearly shows that HEICO has been able to expand its margins, a sign of competitive strength that not many companies can show. The following chart shows how revenues have grown, as well as the expansion of their operating margins.

HEICO’s revenues and operating margins (sec.gov and Own Models)

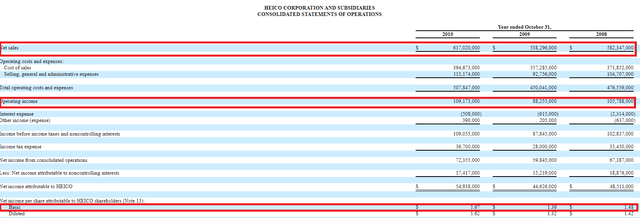

The company’s revenues are a strong combination of organic and inorganic growth, and margins remain high. That can be interpreted as a sign of financial strength in difficult times. Nevertheless, HEICO can suffer in periods of economic crisis. Even though the pandemic was a big issue for HEICO, the crisis was originated due to the impossibility of producing goods and services for the economy, and thus revenue fell. In my opinion, the Great Financial Crisis (GFC) is an interesting moment to evaluate HEICO’s resilience to economic crisis. The following data shows that the impact on revenue, operating income and net income was negative, but in 2010 the company was generating more revenue and net income than those it made before the GFC.

HEICO is a resilient business that can withstand stressful economic conditions (sec.gov)

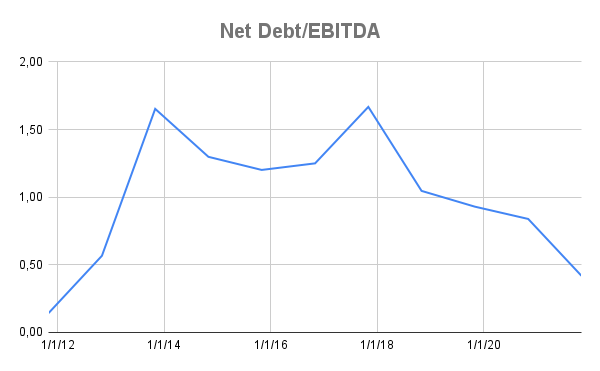

In addition, HEICO’s capital discipline is remarkable. Over the last decade, the management team has been committed to maintaining low levels of debt that won’t impact negatively on the operating activities of the business.

Net Debt to EBITDA (Own Models)

Valuation

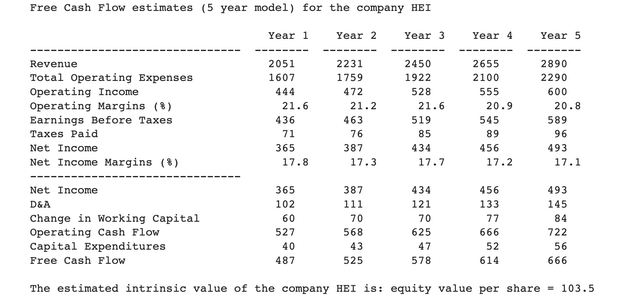

Even though HEICO is an outstanding business with impressive quality metrics and a strong track record of value generation, the stock looks expensive today not only compared to its peers but also to the estimated growth the company is going to have in the coming years. I will perform an automatic DCF analysis in which I will introduce a sole input (estimated revenue growth) and using historical data and future projections, I will calculate the future cash flows of the company as well as its terminal value. I will also take into consideration the current cash and debt position and the number of shares to determine the equity value of HEICO per share.

HEICO’s value using a DCF analysis (Own Models)

Using a terminal growth rate of 3%, due to HEICO’s proven ability to grow at a faster rate than the market plus the early stage of development of the company, a DCF analysis yields a fair value of around $104 per share. The stock price needs to drop 20% in order to consider the company an attractive buy for the long term.

Risks

It is quite obvious that HEICO, alongside the rest of the equity market, is not a risk-free asset, due to its volatile nature. I consider that the following points must be watched if the company is to have a good long-term performance.

- Recession: right now, the odds of a worldwide recession taking place are quite high. This would reduce the demand of international travels and, even though planes require maintenance, HEICO’s sales would go down as they did during the Great Financial Crisis.

- Bad acquisition strategy: there is a clear risk of underperformance if HEICO begins to acquire bad businesses or overpay for the companies they acquire. Nevertheless, I consider this risk to be minimal due to the good strategy they have been making over the last years and their extensive knowledge of the market in which they operate.

- Valuation: I think that right now this is the biggest threat for investors in HEICO. The market is expecting the company to grow at faster rates than the consensus and I believe that a recession might not yet be priced in. That is the reason why the company is trading with a premium compared to its estimated fair value. I believe that HEICO should drop another 20% to be considered a good risk/return opportunity.

Conclusions

HEICO is an extraordinary business that can continue to outperform the market in the very long term. Even though the business is of great quality and has proven to be extraordinary, the company’s current valuation is really high and can lead to underperformance in the short-medium term. I believe that anybody who has HEICO should not sell it, but right now is not the moment to start acquiring the stock. I will happily add HEICO to my personal portfolio if the company reaches the $100 price level or below it.

Be the first to comment