Thinkhubstudio

Dear Investors,

The Headwaters Capital portfolio gained +7.2% in Q4 ’22 compared to a +9.2% gain for the Russell Mid Cap Index.

The same factors that were present in the market during the first 9 months of the year, persisted in Q4: large cap (S&P 500 +7.6%) outperforming small cap (Russell 2000 + 6.2%) and value (+10.3%) outperforming growth (+6.9%). However, the underperformance of the HCM portfolio relative to the index was entirely due to a single stock, which is described in detail below. Despite the Q4 performance, the HCM portfolio still outperformed the index by 3.7% over the back half of 2022 as the headwinds from the highly correlated growth sell-off experienced in the first half of the year subsided.

Headwaters Capital Returns:

|

FY ’22 |

Since Inception |

|||

|

Q4 ’22 |

(12/31/22) |

2021 |

(1/4/2021) |

|

|

Headwaters Capital (Gross) |

7.2% |

-22.7% |

17.9% |

-8.9% |

|

Headwaters Capital (net) |

7.0% |

-23.4% |

17.1% |

-10.3% |

|

Russell Mid Cap Index |

9.2% |

-17.3% |

22.6% |

1.4% |

|

*Performance for the Headwaters Capital portfolio has been calculated by Liccar Fund Services for the period presented above. **Individual SMA performance may differ from the results presented above. [1] |

2 Year Review (2021-2022)

It might be helpful to review the objective of this strategy before diving into a discussion of the past 2 years. Like all actively managed investment strategies, the goal is to outperform the market, net of taxes and fees. As shown above, that was not accomplished over the last 2 years. Nonetheless, I continue to believe that patiently owning competitively advantaged businesses with durable long-term growth opportunities is the best way to outperform the market through a cycle. Harnessing this compounding of earnings can be extremely powerful if you have the patience as an investor to allow the process to unfold. Irrespective of the basic math principles of compounding, a patient investment approach has inherent tax benefits from low turnover and the long-term focus provides opportunities to use the liquidity of the public market to our advantage. I provide all of this as background to reiterate that I am not seeking to capitalize on short-term themes or market preferences, but instead remain focused on finding businesses that fit this investment philosophy.

In many ways, I think about the performance of an investment strategy through a market cycle as having parallels to a British Open. As avid golfers are aware, the weather at an Open Championship can wreak havoc or provide ideal scoring conditions, often changing rapidly with little notice. In some years, the Open winner draws the perfect weather for his game over all 4 days, which can help propel the golfer to victory. However, in most years, consistent play throughout variable weather conditions is what leads to a golfer hoisting the Claret Jug. In terms of how this relates to investing in the public equity market, highly variable macroeconomic environments (and associated investment environments) can create strong tailwinds or headwinds to investment portfolios through a market cycle. As recent history has shown, economic environments can be extreme and can shift rapidly. Over the last three years alone, the market has had to navigate both a negative oil price and a $150 oil price, secular deflation and runaway inflation, supply shortages and supply gluts, etc.

Sticking with the British Open metaphor, these rapidly changing economic environments created significant volatility in the equity markets over the last two years. 2021 opened with clear skies and easy scoring conditions, driving strong returns for many of the high growth companies that led the market in 2020. However, the playing conditions quickly changed as central bank stimulated economic growth provided a tailwind to cyclical companies that were trading at cheap valuations. This historic fiscal spending also led to accelerating inflation and a rapid rise in interest rates. Growth stocks were punished as valuations were re-calibrated and more value-oriented stocks outperformed. Commodity linked equities were the best performers of the entire market as this boom of economic growth collided with years of under-investment and geopolitical supply shocks. This investment environment largely persisted through the first half of 2022 until concerns around a Fed induced recession began to take hold. Suddenly, many of the cyclical names that had performed well over the last year were in the cross hairs of an economic slowdown. The point of this exhaustive market summary is that predicting each of these macroeconomic environments and consistently positioning a portfolio to capitalize on these themes is difficult, not to mention highly inefficient from a tax perspective. Furthermore, investment strategies that adhere to specific investment styles will inevitably perform extremely well when the economic and market cycle is a tailwind, but will also see equal underperformance when that investment style is out of favor.

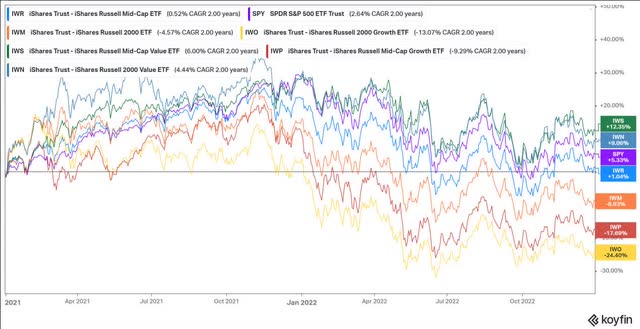

Back to the HCM strategy and the performance over the last 2 years. The HCM portfolio is built on the belief that consistent compounding of earnings will drive investment outperformance through a cycle. In order to compound earnings, companies must grow. As a result, the portfolio has a natural growth bias as an output of the investment philosophy. The HCM portfolio has no doubt seen significant headwinds over the last 2 years in the form of value outperforming growth and larger companies outperforming small companies. As the chart below details, small cap growth was the most out of favor investment style over the last 2 years (-24%).

Market Performance (1/1/2021-12/31/2022)

| *Note that energy performance (+151%, not a typo), was not included because it exceeded the scale of the Y-axis. |

Despite this difficult market backdrop, I am pleased with how the Headwaters portfolio has performed (-8.9%), meaningfully outperforming the small cap growth style most closely aligned to this portfolio. The quality focus combined with the ability of the portfolio companies to consistently grow earnings over the last two years provided valuation support during this sell-off. Closing out the British Open analogy, this portfolio avoided the significant drawdown experienced by the broader small cap growth universe and made the cut when the investment environment was a clear headwind for the strategy. By keeping the leaders close during this challenging environment, the portfolio is now well positioned to continue compounding investor capital and to capitalize whenever these headwinds inevitably turn to tailwinds.

With that summary of the first 2 years complete, I will continue to point readers back to the Q2 ’22 letter where I outlined my outlook for both the market and the portfolio. My outlook remains largely the same: there are numerous well-known headwinds that are at least partially priced in by the market. How the market performs in 2023 remains murky (2023 has started off stronger than most expected), but for investors with a multi-year investment time horizon, I believe the current environment presents some incredibly attractive investment opportunities. This is especially true for small cap stocks that are currently trading at depressed absolute and relative multiples and that typically outperform when central bank hiking cycles come to an end.

Q4 ’22 Portfolio Review:

Top Contributor: Fair Isaac Corporation (FICO) +45%. FICO outperformed in Q4 as the market finally received clarity on whether the FHFA would continue to require the use of FICO scores in the mortgage origination process. Contrary to what some investors expected, the FHFA announced that it would require a FICO score (as well as a Vantage score) to be used in all mortgage originations. The pending FHFA decision had been an overhang on the stock for the last 2 years, although I have noted previously that I believed it was overblown. In addition to the positive FHFA decision, FICO announced pricing increases for 2023 that exceeded market forecasts.

Top Detractor: Inotiv (NOTV) -57%. All of the quarterly underperformance of the portfolio was caused by the decline in NOTV’s stock price (-230bps performance drag). NOTV was the victim of alleged fraudulent activities by one of its key suppliers during the quarter. A DOJ investigation into illegal smuggling by this supplier caused a critical supply interruption, tied up significant working capital while the matter is being investigated and, most importantly, created significant uncertainty into the outlook for NOTV’s research models business. As a reminder, the core thesis for the NOTV investment was that the vertical integration of the research models business would support healthy revenue growth in its discovery and safety assessment business, thus creating a competitively advantaged CRO. Selling a stock down 57% is difficult, however the range of outcomes for the business is highly uncertain today given the DOJ investigation and elevated leverage caused by this supply disruption.

I would like to emphasize that I believe the company was truly a victim (the company is not under DOJ investigation, only the supplier) in this matter as they believe they were provided fraudulent documents related to these imports. Furthermore, management accepted a large equity grant as compensation in early 2022 and actively bought stock throughout the year, implying that they were likely unaware of any fraud and believed that the outlook for the business was positive. Nonetheless, I’m disappointed that management did not perform better due diligence on this acquisition.

Trading Activity

Sells: Cable One (CABO): As discussed in the Q3 letter, Cable One is facing heightened competition in its rural broadband markets. Increased competition combined with a mature market leaves little room for significant growth going forward. As a result of the more challenged growth outlook, I made the decision to sell the stock and allocate capital to higher return opportunities.

Inotiv (NOTV): Sold due to issues outlined above.

Buys: ICF International (ICFI). See below.

ICF International (ICFI): Investing in the “-Ologists” for Government IT Modernization and Complex Program Implementation

Thesis

- Government advisory and service provider leveraged to secular growth areas of the civilian budget, civilian budget less cyclical than defense budget.

- Civilian agency focus combined with decades of institutional knowledge serves as a competitive advantage relative to commercial consulting firms and defense focused government services firms.

- Highly visible and recurring revenue given long-term nature of government contracts and high win-rate on re-compete bids.

- M&A tailwind to organic growth: portfolio of services that are well suited for complementary acquisitions, strong cash flow to fund M&A.

- Improved mix of durable, higher growth segments combined with stabilization of low growth businesses is under-appreciated by the market.

Company Overview

ICF International, headquartered in Washington, DC, is a government consulting and services firm focused primarily on civilian agencies within federal, state and local governments (75% of revenue). ICF was founded in 1969 and originally provided front-end advisory services to government agencies. Given the nature of advisory work, these engagements tended to be lumpy and contract values were a fraction of the value of the implementation work that followed. Around the turn of the century, the company realized that it could leverage this advisory expertise into providing the back-end project implementation work, which came with larger value contracts and longer-term engagements. The company began building out its contract bidding and implementation services teams at this time and implementation work now comprises most of its government related revenue. As an example of the process flow, the original ICF might be engaged by a government agency to advise on how to modernize a technology stack, which the agency would then use as a blueprint for the implementation work. ICF can now provide the upfront advisory work and capitalize on its domain expertise to win the back-end implementation services. While ICF has capabilities that span hundreds of different domains, examples of major government programs where ICF has participated include Energy Star, Smokefree.gov and Head Start.

ICF primarily focuses on civilian agencies, which are less exposed to budget cycles than defense agencies. Key areas of focus within the civilian agencies include digital transformation/IT modernization, federal health, disaster management and climate. All of these domains have secular growth tailwinds and generally strong bipartisan support (climate being an exception), which provides exposure to higher growth areas of the budget. Climate policies have more risk around election cycles, however the recently enacted Infrastructure Investment and Jobs Act (IIJA) and in the Inflation Reduction Act (IRA) provide some insulation around this cycle over the next few years. Additionally, broader citizen awareness and support for positive climate initiatives partially mitigates some of the budget risk longer term.

ICF competes with commercial consulting firms (Deloitte, Accenture, EY, etc) as well as smaller segments of government consulting firms, which are almost exclusively focused on the defense sector. ICF differentiates itself through its civilian agency focus, subject matter expertise via its deep talent pool and longstanding relationships with government agencies. As management has commented, ICF becomes institutional memory for these agencies given multi-decade engagements that often outlast many of the government employees in these departments. HHS is ICF’s largest client at 22% of revenue, however no single contract accounts for more than 4% of revenue.

ICF provides a broad array of consulting services in many different parts of the government, which adds some complexity to the story given the broad budget exposure. The key thread weaving all of these areas together is personnel expertise (the “-ologists”) with long-standing relationships in each of their respective government agencies. As one of the senior executives at ICF joked during their most recent investor day, the company employs almost every “-ologist” in existence. This speaks to the unique capabilities and talent within ICF and, when combined with the tenure at ICF, serves as a clear differentiator versus competitors. A summary of the key areas of domain expertise within ICF are outlined below.

- Digital Transformation and IT Modernization

- Focused on Low Code/No Code development and migration from on-prem to cloud.

- Contracts with almost all civilian agencies (HHS, FDA, CDC, USDA, DOT, FDIC, SEC, FCC, NASA, etc)

- While this business was a small part of ICF in 2019, new CEO John Wasson identified this as a long-term, critical growth area within the federal government. The majority of this business has been built through a series of acquisitions beginning in early 2020.

- Given the outdated nature of government IT systems, this segment represents a multi-year opportunity with growth rates exceeding +10%. Note that governments have been slower to adopt the technology upgrades seen in the private sector, so it is early innings of this upgrade cycle.

- Federal Health

- Data management and analysis, research, training, and health communications programs.

- Over 2,000 health professionals including toxicologists, psychologists, microbiologists, epidemiologists.

- Levered to critical areas within health such as public health and social services, IT and scientific support, health care services.

- Climate, Environment and Infrastructure

- This segment provides consulting services related to policy and planning, risk assessments, permitting, monitoring, etc.

- Tailwind from Infrastructure Investment and Jobs Act over the next 5 years as funds begin flowing in 2023. Inflation Reduction Act provides additional funding for climate related work.

- Disaster Management

- 65% of this business is related to state and local disaster recovery programs. ICF oversees disbursement of funds related to these contracts. Current major programs include Puerto Rico following Hurricane Irma and State of Texas following Hurricane Harvey. Potential for Hurricane Ian and Fiona related work in 2023+. These revenues have some lumpiness around the initial event, but have a long tail of project work (e.g. Puerto Rico work is expected to last for another 8 years).

- 35% of this business is related to disaster mitigation efforts, which are seeing increased attention as governments look to improve infrastructure resiliency ahead of storm activity.

On the commercial side of the business (25% of revs), ICF provides similar advisory and consulting services to utility customers (70% of commercial revenue). Given the regulated nature of this industry and the long-term nature of these contracts, I view this as an extension of their government practice. Consulting work here primarily relates to energy efficiency initiatives and grid modernization, both of which have sustainable growth opportunities. Management believes this is another high growth segment, likely growing at least high single digit for many years.

The other 30% of this segment is a hodge podge of other commercial marketing services and loyalty programs for a variety of industries, but primarily hospitality and travel (they bizarrely run the loyalty program for Skittles). This part of the business is left over from the acquisition of Olson commercial marketing in 2014. ICF acquired this business at a time when government spending was depressed, which provided diversification of revs into the faster growing commercial sector. Strategically, it allowed ICF to bolster its marketing expertise, which was increasingly valued in contract bids as the government sought to improve citizen engagement via marketing outreach. The remaining commercial marketing services are profitable, but don’t have a strategic purpose in the business, which could represent an opportunity for portfolio rationalization in the future (note they sold a small business from this segment in Q3, so I believe this could be a near term opportunity).

Acquisitions

ICF is a business that lends itself well to acquisitions given that acquired companies can provide complementary domain expertise and/or provide deeper penetration into certain government agencies. The result of this consistent M&A program is that ICF steadily builds a more comprehensive portfolio of consulting expertise and gradually expands into more agencies. The network effects that come with broader domain expertise and increased government reach support both broader contract scope and increasing win rates on bids.

ICF has completed 22 acquisitions since 2002 demonstrating an ability to successfully execute both programmatic M&A as well as larger, more transformational type deals. Over the last 3 years, ICF has focused its M&A activities on building a leading IT modernization practice as management identified this as a long-term high growth area for the government. The IT modernization focus began with the acquisition of ITG in January 2020 and was followed by 2 additional acquisitions, Creative Systems (2022) and Semantic Bits (2022), to build out its expertise and scale in the IT space.

Management

CEO John Wasson started his career at ICF 35 years ago and was promoted to CEO in October 2019. Mr. Wasson has overseen the portfolio repositioning, specifically the push into IT modernization beginning with the acquisition of ITG in 2020. His experience with the company gives me confidence that he will continue to operate the business in much the same way it has been run for the last 20 years.

Financial Model

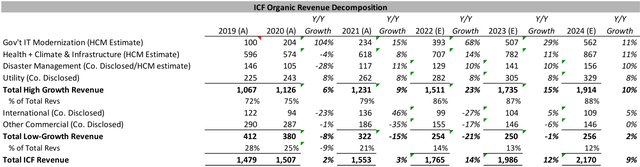

ICF’s presentation of its financials doesn’t do investors any favors. While they talk about their 5 key growth areas by vertical (IT modernization, health, etc), they disclose financial information at the government agency level. The easiest way to look at ICF is by segmenting their high growth businesses and their low growth businesses, which we can back into using management comments and investor presentations.

ICF’s high growth businesses now account for ~85% of revenue and collectively are expected to grow at least 10%. The low growth businesses are likely to grow low single digit at best as international revenues stabilize following the roll-off of a significant contract and the commercial businesses tread water following the recent portfolio rationalization. At a consolidated level, ICF should be able to sustain high single digit organic revenue growth as a result of the portfolio repositioning into higher growth areas of the budget.

As described above, this revenue growth will be supplemented with complementary M&A, bringing total revenue growth into the low double digit range. Management has targeted 10-20bps of annual margin improvement from efficiency gains and scale, which supports ~10-15% EBITDA growth.

From a balance sheet perspective, ICF has appropriate financial leverage for the consistent nature of its business. The company should end the year at 2.5x of leverage and will de-lever by ~0.5x annually through free cash flow and EBITDA growth.

Summary Thesis

ICF likely sounds like a sleepy and complicated business, so why is the stock positioned well to outperform the market? The market has yet to appreciate the portfolio transformation that ICF has undergone under the new CEO. ICF now has 5 distinct areas of domain expertise that are leveraged to higher growth areas of the federal budget, areas that have broad bipartisan support and years of investment opportunity. Decades of government consulting experience and deep institutional knowledge within many of these agencies position the company well to capitalize on these growth opportunities. These 5 growth domains have additional near-term tailwinds from the recently passed IIJA and IRA, which should materialize in 2023 as allocated funds begin to flow. Furthermore, the low growth part of ICF’s portfolio is not only a smaller piece of ICF’s business entering 2023, but also on the cusp of reaching revenue stabilization after years of revenue declines.

The net result is that ICF now looks like a company that can steadily grow revenue in the high single digit range, which will be supplemented with M&A to bring total revenue growth above 10%. Slight margin expansion supports EBITDA growth of 10-15% depending on the pace of M&A. While the ~15% earnings growth is attractive by itself, there is additional upside from multiple expansion as the market comes to appreciate the higher growth profile of the current ICF business along with the durability of this growth.

As always, if you have any questions, please do not hesitate to contact me.

Christopher Godfrey

|

Important Disclosure This report is solely for informational purposes and shall not constitute an offer to sell or the solicitation to buy securities. The opinions expressed herein represent the current views of the author(s) at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented in this report has been developed internally and/or obtained from sources believed to be reliable; however, Headwaters Capital Management, LLC (the “firm”) does not guarantee the accuracy, adequacy or completeness of such information. Predictions, opinions, and other information contained in this report are subject to change continually and without notice of any kind and may no longer be true after the date indicated. Any forward-looking statements speak only as of the date they are made, and the firm assumes no duty to and does not undertake to update forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking statements. In particular, target returns are based on the firm’s historical data regarding asset class and strategy. There is no guarantee that targeted returns will be realized or achieved or that an investment strategy will be successful. Investors should keep in mind that the securities markets are volatile and unpredictable. There are no guarantees that the historical performance of an investment, portfolio, or asset class will have a direct correlation with its future performance. The composite performance (“portfolio” or “strategy”) is calculated using the return of a representative portfolio invested in accordance with Headwaters Capital’s fully discretionary accounts under management opened and funded prior to January 1, 2021. The performance data was calculated on a total return basis, including reinvestments of dividends and interest, accrued income, and realized and unrealized gains or losses. The returns also reflect a deduction of advisory fees, commissions charged on transactions, and fees for related services. For further information about the total portfolio’s performance, please contact Headwaters at www.headwaterscapmgmt.comor via phone at (404) 285 -0829 Investing in small- and mid-size companies can involve risks such as less publicly available information than larger companies, volatility, and less liquidity. Investing in a more limited number of issuers and sectors can be subject to greater market fluctuation. Portfolios that concentrate investments in a certain sector may be subject to greater risk than portfolios that invest more broadly, as companies in that sector may share common characteristics and may react similarly to market developments or other factors affecting their values. Headwaters Capital is a registered investment adviser doing business in Texas and Georgia. Registration does not imply a certain level of skill or training. For additional information about Headwaters Capital, including its services and fees, please review the firm’s disclosure statement as set forth in Form ADV and is available at no charge at IAPD – Investment Adviser Public Disclosure – Homepage. Past performance does not guarantee future results. |

Footnotes[1] The composite performance (“portfolio” or “strategy”) is calculated using the return of a representative portfolio invested in accordance with Headwaters Capital’s fully discretionary accounts under management opened and funded prior to January 1, 2021. The performance data was calculated on a total return basis, including reinvestments of dividends and interest, accrued income, and realized and unrealized gains or losses. The returns also reflect a deduction of advisory fees, commissions charged on transactions, and fees for related services. For further information about the total portfolio’s performance, please contact Headwaters at the email address listed. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment