naveen0301/iStock Unreleased via Getty Images

With the Reserve Bank of India (RBI) finally lifting restrictions on the launch of HDFC Bank’s (NYSE:HDB) digital initiatives (~15 months after imposing these restrictions in Dec 2020), the bank’s long-term growth story looks to have regained momentum. While the inflationary and geopolitical headwinds could weigh on the economic recovery near term, HDFC Bank’s track record of sustaining loan and net interest income growth through the cycles, while also maintaining best-in-class asset quality, should allow for a re-rating. While the stock has underperformed in recent months, the lifting of the RBI restrictions (first on credit cards and now on the digital side) and the bank’s strong market positioning makes the current valuation at ~2.6x 2024 P/BV (vs. high-teens ROE), particularly lucrative at this point in the cycle.

|

F2024E |

|

|

PE |

16.5 |

|

Price to Book |

2.6 |

|

Price to Core PPOP |

11.5 |

|

Dividend Yield |

1.4% |

Source: Market Data, Author

RBI Restrictions Lifted; Digital 2.0 Initiatives to Begin

In a recent release, HDFC Bank disclosed the RBI’s decision to lift the ban on its Digital 2.0 program. For context, the RBI had previously restricted HDFC Bank from onboarding new credit card customers (lifted in August last year) and implementing its Digital 2.0 plans due to repeated system outages. The announcement was a long time coming – in its 2021 Annual Report, CEO Sashi Jagdishan acknowledged the bank’s shortcomings on the technology front and outlined large-scale investments to scale-up its IT infrastructure, including accelerating its cloud shift and migrating core data centers to state-of-the-art facilities to handle any potential load for the next three to five years.

If its post-ban credit card activity is anything to go by, the lifting of the digital ban should kickstart a new wave of growth – new credit card issuance by the bank saw a spike in the subsequent months, hitting 1.3m new credit cards issued in Jan 2022. This has driven the bank’s credit card market share to 22.8%, although there remains some way to go before it regains its ~25% share peak in 2020. That said, the impact of its digital initiatives should be more gradual – the new business-generating activities under Digital 2.0 will likely hit the P&L a few quarters down the line, but over the long term, accelerating customer acquisition in the digital channel and gaining wallet share should prove highly accretive. Key digital initiatives in the pipeline over the next 12-18 months include a payments hub, a customer experience hub, a neobank (within HDFC Bank), and an integrated ecosystem spanning the auto, healthcare, and rural banking segments.

Governance Improvements Led by Slowing Attrition and Better Aligned Incentives

The RBI ban has had favorable implications for the bank’s transparency as well – the bank’s annual report now discloses details of senior and junior management team members with incomes over the Rs10m mark. Relative to the 2017-2019 period, when the bank saw a significant reduction in ESOPs (i.e., HDFC Bank’s employee stock ownership plan) in absolute terms, 2021 disclosures also highlighted a shift toward more ESOPs being granted to the staff. Interestingly, ESOPs exercised during the year also came down, and thus, options outstanding now stand at ~168m (~3% of outstanding shares). In line with its ESOP-heavy compensation policy shift, attrition levels have also moderated in 2021 – a welcome development after the CEO’s retirement in 2020 and the resignation of the Deputy CEO in 2018. With a better-aligned incentive plan in place and no high-profile exit over the last year or two, I see no reason why the bank should have difficulty retaining top talent going forward.

Expect Earnings Growth Amid Retail Momentum and Improving Asset Quality

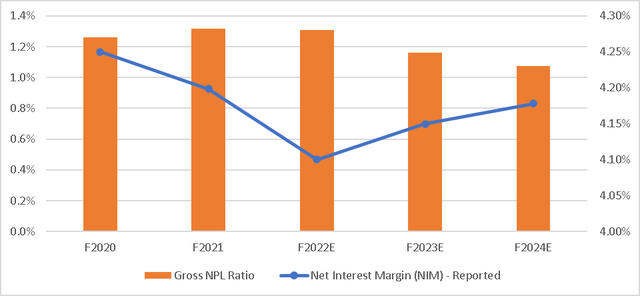

With the ongoing inflationary environment set to drive rates higher in the coming months, NIMs should benefit, with HDFC Bank’s relatively high share of floating rate loans likely to help the bank as well. That said, the key to the overall improvement rests with asset yields, in my view. In this regard, HDFC Bank has excelled – its asset quality has been industry-leading for years now, and even through the worst of the NPA (non-performing assets) corporate recognition period, the bank was able to maintain its best-in-class asset quality. The bank’s ability to effectively manage asset quality was also evident through the worst of the COVID impact, with its NPA ratios staying resilient throughout. As of Q3 FY22, HDFC Bank’s gross NPA ratio has further declined to 1.26% (down from 1.42% in the prior year), creating a solid platform for the bank to boost its NIM toward the upper end of the guided 4-4.4% range.

JP Research, HDFC Bank Disclosures, Author

As the post-COVID economic recovery in India continues, retail loan book growth will likely be a key earnings driver. Sequential growth rates over the last two quarters have been strong, and assuming this continues, I think retail loan growth could quite easily hit a high-teens % CAGR over the 2022/2024 period – slightly above the overall bank’s loan book growth trend. Adding to the retail loan growth potential is the launch of new products such as BNPL (Buy Now/Pay Later) and a fully revamped payments offering as well as improvements to its other consumer products. While the investment in technology and growth could lead to a near-term rise in cost ratios, this should be more than offset by automation benefits kicking in, with a sustained ~38% cost/income ratio representing a very feasible outcome, in my view.

A Quality Franchise on the Recovery Path

With the lifting of the RBI’s ban on HDFC Bank’s Digital 2.0 program, much of the negative sentiment should fade from here. To be clear, the new businesses planned under Digital 2.0 will likely not contribute visibly to growth and profitability anytime soon, but over the long term, the ramp-up of digital customer acquisition and wallet share bodes well for the sustained profitability of the bank. Plus, the bank’s franchise strength remains intact, and concerns around its tech capabilities and management churn have been addressed, with asset quality also resilient through the cycles. Given the best-in-class RoE, market leadership across multiple segments, and its established track record of managing growth with asset quality, I believe a wider premium to closest peer ICICI Bank (IBN) is justified. At ~2.6x 2024E P/Book, the stock offers investors good value, in my view.

Be the first to comment