andresr

Generally speaking, the medical space is viewed as a safe haven for investors during times of trouble. This is especially true when you talk about companies that own, manage, and operate hospitals, freestanding surgery centers, freestanding emergency care centers, urgent care facilities, and other related properties. This is because, though the economy may fluctuate from time to time, people still get sick and need treated. However, these are unusual times and, while COVID-19 cases are showing signs of rising again, fears exist in shareholders’ minds that a winding down of the pandemic may eventually hurt the very same medical facilities that benefited from the advent of the crisis. This has led the shares of some companies, such as HCA Healthcare (NYSE:HCA), to decline materially over the past couple of months. Though it is true that the business could experience some pain, shares are still priced on the cheap on both an absolute basis and relative to some similar firms. So despite the volatility the firm has been subjected to, I must in good conscience retain my ‘buy’ rating on the firm.

Times are difficult

Back on May 19th of this year, I wrote a favorable article regarding HCA Healthcare. In that article, I appointed to recent troubles the business had experienced. Namely, a weakening on its bottom line and a revision downwards in revenue caused shares of the business to follow the broader market lower. Having said that, I still said that shares of the firm were cheap and that the company still made for an excellent prospect for investors moving forward. As a result of my findings, I ultimately rated the enterprise a ‘buy’, reflecting my belief that it would outperform the market for the foreseeable future. So far, things have not gone exactly according to plan. While the S&P 500 is down by 3.2%, shares of HCA Healthcare have generated a loss for investors of 16.4%.

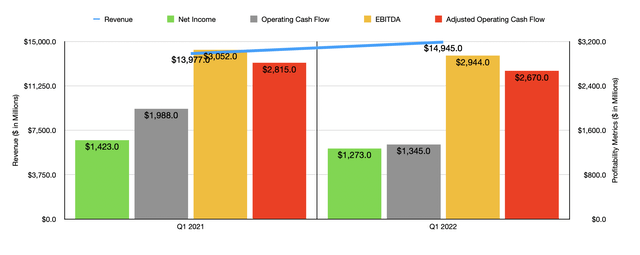

Interestingly, this sharp move lower has had nothing to do with new fundamental data coming out of the woodwork. After all, we still have the first quarter data for the company’s 2022 fiscal year being the most recent quarter for which data is available. As a reminder, figures reported by the company were rather mixed. Revenue came in higher, totaling $14.95 billion compared to the $13.98 billion reported just one year earlier. But on the bottom line, the company was negatively impacted by rising costs. For instance, salary expenses for the company increased year over year, climbing from 45.1% of revenue in the first quarter of 2021 to 46.4% the same time this year. Other operating costs rose from 17.4% to 18.5%. Only in the supplies category did the company see some meaningful reprieve, with costs falling from 15.9% of sales to 15.5%.

These changes brought the company’s net income down from $1.42 billion in the first quarter of 2021 to $1.27 billion in the first quarter of this year. Operating cash flow went from $1.99 billion to $1.35 billion. If we adjust for changes in working capital, it would have fallen from $2.82 billion to $2.67 billion. Meanwhile, EBITDA also worsened, falling from $3.05 billion to $2.94 billion. Due to these revelations, management ultimately revised guidance downward. But that didn’t change the fact that shares of the enterprise were trading on the cheap.

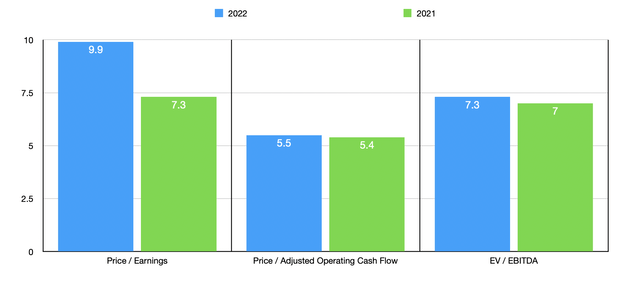

Using updated pricing, the firm is trading at a forward price to earnings multiple of just 9.9. This compares to the 7.3 multiple that we get if we use 2021 results. The price to adjusted operating cash flow multiple should rise from 5.4 last year to 5.5 this year. And the EV to EBITDA multiple should increase from 7 to 7.3. To put this in perspective, I decided to compare the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 6.6 to a high of 29. And using the EV to EBITDA approach, the range was from 6.1 to 16.4. In both cases, two of the five companies were cheaper than HCA Healthcare. Meanwhile, using the price to operating cash flow approach, the range was from 5.1 to 18.7. In this case, only one of the five companies was cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| HCA Healthcare | 9.9 | 5.5 | 7.3 |

| Universal Health Services (UHS) | 9.4 | 7.0 | 6.5 |

| Tenet Healthcare (THC) | 6.6 | 5.1 | 6.1 |

| Encompass Health (EHC) | 12.7 | 6.4 | 8.1 |

| Acadia Healthcare Company (ACHC) | 29.0 | 18.7 | 16.4 |

| The Ensign Group (ENSG) | 22.1 | 15.1 | 12.4 |

At present, analysts have mixed expectations heading into the second quarter earnings release. For instance, they currently think that revenue will come in at $14.73 billion. That would represent a 2% improvement over the $14.44 billion generated the same time one year earlier. On the other hand, earnings per share should come in at just $3.59. That works out to net income of roughly $1.06 billion. That would be down from the $1.45 billion generated in the second quarter of the company’s 2021 fiscal year.

What’s interesting about this, however, is that the market knew this information when I last wrote about the firm. They knew that management was guiding to lower expectations for the year and that the industry was experiencing some cost inflation. What wasn’t known, then, was what some other analysts think about the space. In early July, BMO Capital Markets lowered their price target for the company from $233 per share to $160 per share, citing pressures on both its top and bottom lines both this year and possibly next. At about the same time, an analyst at Deutsche Bank lowered their price target for the company from $306.00 to $200, while simultaneously saying that the bearish case on the company had been overdone. Citing ‘adverse operating conditions’, rival Universal Health lowered its guidance for the current fiscal year at the tail end of June, likely serving as the main catalyst for all of this pain. And just days before that, the US Supreme Court ruled in favor of the current method of calculating Medicare reimbursements for hospitals in a move that has largely been interpreted as a negative for the hospital space.

Takeaway

At this point in time, it seems very clear that the medical facility space is experiencing some pain. That pain could continue in the near term. It could even extend into next year. But for the value investor, this may not mean much. Even with revised expectations, shares of HCA Healthcare look quite cheap. And because of this, investors who are bullish about the company should see recent declines as an opportunity to load up on more shares, not as punishment for making a wrong call.

Be the first to comment