Rena-Marie/iStock Editorial via Getty Images

Overview:

For the past decade Hasbro (NASDAQ:HAS) has been the industry leader in terms of sales and earnings growth as compared to the relatively stodgy and high-executive suite turnover at Mattel (MAT). Both companies had strong brands, with Hasbro supporting product lines that include Play-Doh, My Little Pony, Nerf, Baby Alive, Wizards of the Coast, a full array of classic board games such as Monopoly, Transformers, Scrabble, and partner brands for Disney’s Star Wars, Frozen, Marvel, and Princess lines., More recently, the company acquired the eOne entertainment company in which it picked up the popular Peppa Pig brand.

Hasbro had a stable, experienced management while chief competitor Mattel was in management turmoil — running through 4 CEOs in 5 years – even though its major brand franchises including Barbie, Hot Wheels, Fisher-Price, and Thomas the Tank remained dependable names for consumers.

Now, however, the relative investment attractiveness of the two companies have, in my opinion swapped places. Mattel finally appears to be in a better position than Hasbro. (*See SA “Mattel Might Finally Be Swell,” August 6, 2021)

Vital Details:

Both companies face similar earnings growth challenges. These include the price of raw materials, mostly based on petroleum-based plastics, supply chain issues with unloaded boats clogging West Coast ports, sharp price increases for labor, virus lockdowns in many countries, and political uncertainties in Asia, with particular concern about threats by China against Taiwan that might intensify after the early February Olympics.

Hasbro had however been relatively aggressive in attempting to more broadly diversify into the entertainment and sports businesses. And just prior to the pandemic, in December 2019,.paid up substantially ($3.8 billion) to acquire Canada’s Entertainment One. Hasbro subsequently sold Entertainment One’s Music Arm for $385 million. It was a good move but scarcely diminished the massive debt level incurred.

The acquisition, provided a few good brands *including the aforementioned Peppa), but in my opinion largely led the company into areas where its management ability and expertise was (and is still) not nearly as great as in toys and games. Diversifications of this type, business history often shows, will typically lead to a loss of focus.

Then there were two other important events of the last few months of 2021. Most saddening was the passing of long-time CEO, Brian Goldner at the age of 58. He was obviously still young and talented enough to lead the company for at least another decade.

But then there was also a self-inflicted problem that was revealed in a broadcast by Fox’s Hannity on Fox News July 19 available at Hasbro whistleblower claims CRT being pushed through toy packaging; training says 6 month olds can be racist

Here a whistleblower who believes in the peaceful principles expounded by Martin Luther King, Jr. exposed that the company was getting into woke racial politics and trying to influence through its toys children as young as 6-months or one or two years. I dare say that this would likely be alienating/offensive to at least half the U.S toy-buying population; it is also an invitation to boycotts and demonstrations and is clearly a prescription for losing customers and revenues.

This means that unlike Mattel (which also partly blundered into politics but in a comparatively minor way, now has the relatively stable and steady management, while Hasbro faces the inflation, product shortages, and other industry-wide issues with greater management uncertainty.

Numbers:

Earnings for Q3 2021 were, as with most companies, up from the severe lockdown Q3 of the year before. And diluted EPS for the quarter rose 14% to $1.83.

Third Quarter 2021 Brand Performance:

|

Brand Portfolio |

Net Revenues ($ Millions) |

|||||||

|

Q3 2021 |

Q3 2020 |

% Change |

||||||

|

Franchise Brands |

$ |

882.0 |

$ |

807.5 |

9% |

|||

|

Partner Brands |

$ |

366.7 |

$ |

409.2 |

-10% |

|||

|

Hasbro Gaming1 |

$ |

281.9 |

$ |

239.2 |

18% |

|||

|

Emerging Brands |

$ |

177.5 |

$ |

155.0 |

15% |

|||

|

TV/Film/Entertainment |

$ |

261.9 |

$ |

165.7 |

58% |

|||

Third Quarter 2021 Financial Results

|

$ Millions, except earnings per share |

Q3 2021 |

Q3 2020 |

% Change |

|||||||

|

Net Revenues1 |

$ |

1,970.0 |

$ |

1,776.6 |

11% |

|||||

|

Operating Profit |

$ |

367.9 |

$ |

336.6 |

9% |

|||||

|

Adjusted Operating Profit2 |

$ |

389.6 |

$ |

367.2 |

6% |

|||||

|

Net Earnings |

$ |

253.2 |

$ |

220.9 |

15% |

|||||

|

Net Earnings per Diluted Share |

$ |

1.83 |

$ |

1.61 |

14% |

|||||

|

Adjusted Net Earnings2 |

$ |

271.2 |

$ |

258.9 |

5% |

|||||

|

Adjusted Net Earnings per Diluted Share2 |

$ |

1.96 |

$ |

1.88 |

4% |

|||||

|

EBITDA2 |

$ |

443.0 |

$ |

422.3 |

5% |

|||||

|

Adjusted EBITDA2 |

$ |

462.1 |

$ |

442.1 |

5% |

|||||

The average EPS estimates for all of 2021 hover around $4.80 and for 2022 at $5.30. But given all of the aforementioned issues – raw material and labor cost increases (e.g. oil/plastics) shortages, shipping and delivery problems, etc. – it seems likely that average EPS estimates for both years will need to be reduced, perhaps by a large percentage.

Debt levels, inflated by the costly eOne acquisition, have recently been reduced by about $400 million, mostly by using proceeds from the eOne music division sale. Yet the long-term debt as of Q3 2021 remains elevated at nearly $4 billion, with total current liabilities adding another $2.26 billion on top of that. Also, about $1.4 billion in low-coupon notes come due by the end of 2024, a period in which interest rates may be much higher than currently.

In all, this is not a healthy position to be in during an ongoing inflationary pandemic in which the debt-to-revenue ratio (one of my favorite balance sheet indicators) is more than 1.2 (roughly $7 billion/$6 billion) and at a level that is in a financial danger zone. (For more on such ratios, see my Travel Industry Economics, 4th ed. 2021, Springer, and Entertainment Industry Economics, 10th ed. 2020, Cambridge University Press.)

Another consideration is that the elevated inflation rates with which consumers are struggling to cover higher food, gas, and housing prices will diminish discretionary spending budgets (real disposable incomes) for spending on things like toys and games.

Summary:

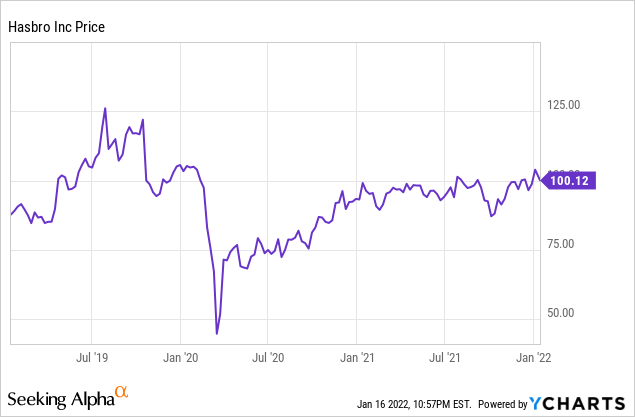

As it stands, Hasbro will likely over time muddle through these difficulties. But with 2022 estimated EPS that might at best be stuck at or only slightly above the estimated 2021 level of $4.80 and the likelihood of a go-nowhere stock, it is difficult to rate the shares of Hasbro at anything better than neutral (with a bearish tinge). Portfolios with short time horizons ought to thus consider HAS a source of funds better deployed elsewhere.

A final thought is that pair-traders might think of shorting HAS and going long MAT (roughly one unit to 5).

Be the first to comment