Scott Olson/Getty Images News

Elevator Pitch

I assign a Sell investment rating to DraftKings Inc.’s (NASDAQ:DKNG) shares. I see DKNG’s shares continue to fall as the company will take quite a while (i.e. a few years) to achieve positive free cash flow and earnings, and loss-making names aren’t favored by investors now.

Why Has DraftKings’ Price Been Dropping?

DKNG refers to itself as “the only U.S.-based vertically integrated sports betting operator” and “a multi-channel provider of sports betting and gaming technologies” in the company’s media releases.

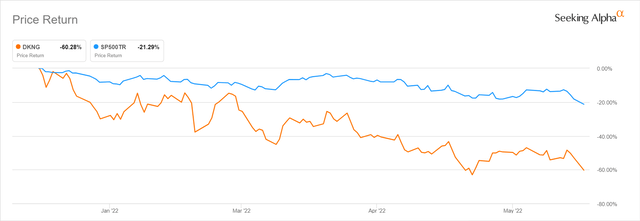

DraftKings’ 2022 Year-to-date Share Price Chart

DraftKings’ share price has dropped by -60.3% in the first six and a half months of this year, while the S&P 500 has fared relatively better with a -21.3% correction.

In my opinion, there are two key factors that have driven the sharp fall in DKNG’s shares in 2022 thus far.

The first key factor is a distinct change in investors’ preferences, with DKNG being out of favor.

A January 25, 2022, TechCrunch commentary highlighted that “profitability” was more correlated with “positive stock returns in the software sector” in 2021 as compared to “revenue growth” for the first time in five years. In 2022, it is clear from the stock price performances of DKNG and other similar rapidly growing yet unprofitable companies that the market clearly favors profitable stocks over their loss-making peers across sectors.

JPMorgan (JPM) Asset Management also published a recent article on May 25, 2022 which emphasized that “Value has outperformed Growth by a significant margin so far in 2022” and noted that “Value is set to enjoy long-term tailwinds” due to a reversal of past underperformance, inflation, and under-allocation by institutional investors. DraftKings is obviously in the growth stock category given its high top line expansion rates (2017-2021 revenue CAGR of +61%) and its lack of profitability (still loss-making at EBITDA level now).

The second key factor is concerns over DKNG’s ability to fund future growth.

A Seeking Alpha News article published on May 31, 2022 noted that “it is unclear if new market entries in California and other locations could push the company to raising funds through an equity offering.” According to the sell-side consensus financial forecasts obtained from S&P Capital IQ, DraftKings is expected to generate a negative free cash flow of -$929 million in fiscal 2022 as compared to its -$435 million negative free cash flow generated in FY 2021.

At the Goldman Sachs (GS) 2022 Travel and Leisure Conference on June 6, 2022, DraftKings assured investors that it has a “multiyear plan that does not entail us needing to raise more capital” and it has “stress tested that plan under a variety of scenarios.” As of March 31, 2022, DKNG has about $1,773 million of cash on the company’s books as per S&P Capital IQ, which should allow the company to sustain its business operations until the end of 2023 at the worst.

Nevertheless, DKNG did mention at the recent Goldman Sachs conference that “there could always be some black swan type situation like what happened where sports shut down in 2020” which might affect the company’s future capital and cash flow expectations. In the current market environment, it is unsurprising that investors are fearful and tend to price in the worst-case scenarios for most stocks.

In the next section, I do a review of DraftKings’ Q1 2022 financial performance.

DKNG Stock Key Metrics

DKNG announced the company’s financial results for the first quarter of 2022 on May 6, 2022, before trading hours.

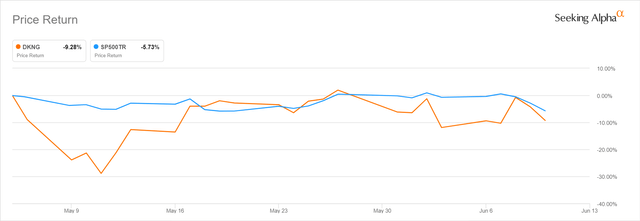

DraftKings’ Post-Q1 Results Announcement Stock Price Performance

As per the chart above, the market’s initial reaction to DKNG’s Q1 2022 results was unfavorable. While DraftKings’ stock price performance subsequently recovered a week later, it merely matched the performance of the S&P 500. Overall, in the month or so following its first-quarter results announcement, DKNG’s shares have still pulled back by -9.3% and underperformed the broader market.

DKNG’s revenue increased by +34% YoY from $312 million in Q1 2021 to $417 million in Q1 2022, and this was +1.4% ahead of Wall Street’s expectations. Looking forward, DraftKings revised the company’s guidance for full-year FY 2022 top line from $1,850-$2,000 million to $2,000-2,025 million, as part of its Q1 2022 results release.

But as I mentioned in the preceding section of the current article, the market is now more concerned about profitability rather than revenue growth. As such, it was discouraging to see DKNG’s non-GAAP adjusted gross profit margin contract from 50% in Q1 2021 and 53% in Q4 2021 to 32% in Q1 2022.

At the company’s Q1 2022 results call, DraftKings explained that its Q1 2022 gross profit margin “was heavily impacted by the launch of New York, which had negative gross margin in the quarter due to Q1 being its launch quarter.” This sort of confirmed investors’ fears that DKNG’s aggressive expansion into new markets will hurt its future profitability and free cash flow generation. As such, it is understandable that DKNG’s share price has remained weak despite above-expectations revenue for the first quarter of 2022.

Is DKNG Undervalued?

DKNG might seem undervalued if one refers to the Wall Street analysts’ price targets, but my analysis suggests otherwise.

The average sell-side target price for DraftKings is $28.13, which represents an upside of +155% versus its last done share price of $11.03 as of June 13, 2022. The most bearish analyst covering DKNG stock thinks that its shares are worth $13.00 which is equivalent to a +18% capital appreciation potential. Since the individual analysts would have used different valuation methodologies and assumptions in arriving at their respective price targets for DKNG, it is hard to judge the appropriateness of their valuations.

Based on my calculations, DraftKings’ last traded stock price of $11.03 translates into a rather rich 30 times forward P/E multiple applied to the company’s consensus fiscal 2026 earnings per share of $0.66 (as per S&P Capital IQ) discounted to the present using a 14% discount rate.

My own valuation analysis suggests that DKNG is overvalued, or at best fairly valued, based on the implied forward FY 2026 P/E multiple based on its current share price.

Has DraftKings Bottomed Out Or Will It Keep Dropping?

My view is that DraftKings’ stock price will keep dropping. This is because the factors that led to DKNG’s shares falling year-to-date in 2022 could still exert downward pressure on the stock in the near future.

Considering worse-than-expected inflation numbers for May 2022, the market should retain its preference for value stocks that are profitable. This suggests that it won’t be anytime soon that investors rotate back to growth stocks such as DraftKings.

DKNG’s road to profitability and positive free cash flow generation is still years away. Consensus financial estimates sourced from S&P Capital IQ point to DKNG turning free cash flow positive and profitable (bottom line) in FY 2025 and FY 2026, respectively. As noted earlier, the company’s gross margin contraction for Q1 2022 suggests that continued market expansion will be a drag on its profit margins and free cash flow generation, and this increases the risk of a capital raise in the future.

As such, I think that DKNG’s negative share price momentum will continue for the time being.

Is DKNG Stock A Buy, Sell, Or Hold?

DKNG stock is a Sell. The company’s shares haven’t bottomed out, as I think its current valuations aren’t appealing. Based on my analysis, the market currently values DraftKings at a rather hefty 30 times forward FY 2026 P/E multiple.

Be the first to comment