Eoneren

Investment Thesis

In my view, Harte Hanks Inc. (NASDAQ:HHS) is a classic example of a turnaround – over the past decade the stock has fallen dozens of times in the face of deteriorating financial performance, but now things are turning for the better. The financial and operational results show a qualitative improvement quarter-on-quarter due to the improved fully integrated business model. That’s why I am drawing investors’ attention to this stock – with a relatively small market cap, HHS can grow many times over in the coming years, and by entering at the current price level, you will not have to pay too much for this growth opportunity.

Why do I think so?

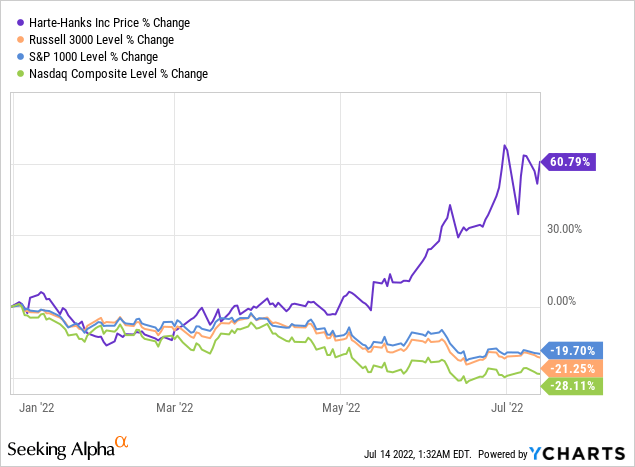

Harte Hanks Inc. is a marketing and customer experience company with a market cap of just $86 million that has delivered phenomenal returns since the beginning of 2022. Especially when we compare it to the major indices:

Such a strong performance against a declining market was possible thanks to phenomenal operating results.

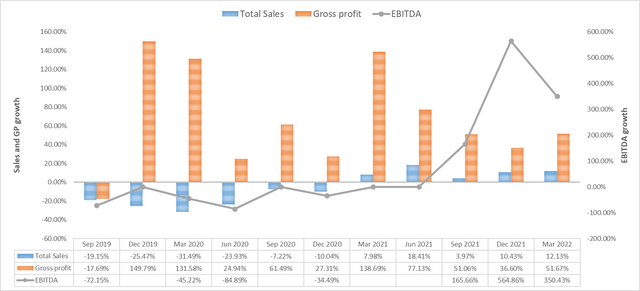

Author’s calculations, SA data

In recent quarters, HHS has managed to move from negative to positive growth, both in sales and in gross profit and EBITDA. Thanks to the optimization of fixed costs – D&A and SG&A have been decreasing quarterly by an average of 1.8% and 6.8%, respectively, since Q3 2019 – EBITDA has grown by a multiple of gross profit growth.

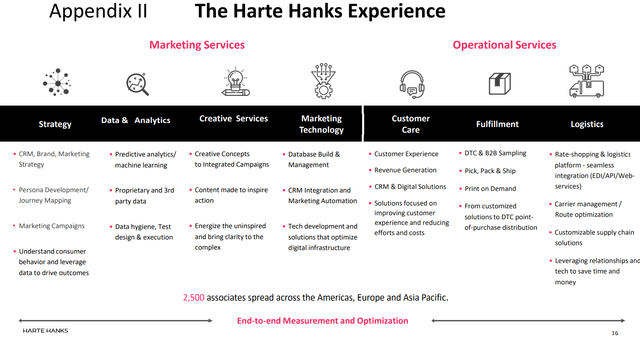

To better understand how the company manages to optimize costs so effectively against a backdrop of double-digit revenue growth (TTM revenue is up ~11% year-over-year), I recommend you take a look at the company’s business structure. Harte Hanks divides its operations into 3 segments [Source: HHS’s most recent 10-Q]:

- The Marketing Services segment delivers strategic planning, data strategy, performance analytics, creative development and execution, technology enablement, marketing automation, and database management;

- The Customer Care segment operates teleservice workstations in the United States, Asia, and Europe to provide advanced contact center solutions such as speech, voice and video chat, integrated voice response, analytics, social cloud monitoring, and web self-service;

- The Fulfillment & Logistics Services segment includes printing, lettershop, advanced mail optimization (including commingling services), logistics and transportation optimization, and monitoring and tracking to support traditional and specialty mailings.

If you look at functionality, you can think of the company’s activities as two services – one marketing and one operational:

These activities are intertwined upon closer inspection – in my view, the Fulfillment & Logistics Services segment is particularly well positioned to effectively solve the supply chain problems of the company’s customers, thanks to HHS’s technological developments in data analytics. In other words, a kind of synergy effect is forming in an inconspicuous area that has experienced bottlenecks in recent years and is of great importance for the economic growth not only of individual regions but of the entire world.

The CEO devoted a lot of time during the most recent earnings call to examples of how the company’s fully integrated business model helps partners and customers achieve greater agility in their operations. A notable example is the success of the recent consolidation of the Kansas City facility, which had been restructured in recent years. Now the restructuring is complete – meaning that a significant portion of the costs that have been weighing on the company’s income statement will no longer be relevant.

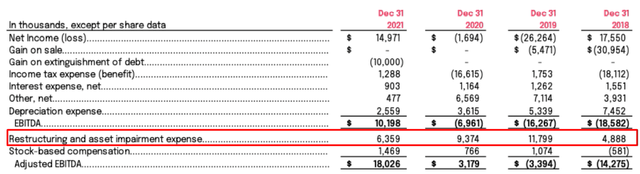

HHS’s IR materials, author’s notes

Yes, there is a low base effect due to past restructuring spending – earnings were temporarily understated and triple-digit EBITDA growth rates appear to be durable, although this effect is likely to fizzle out in a few quarters. But even without taking into account the effect of eliminating the restructuring, the company can grow organically – as shown by the margin expansions in the various business segments, which are presented without the impact of this type of expenditure.

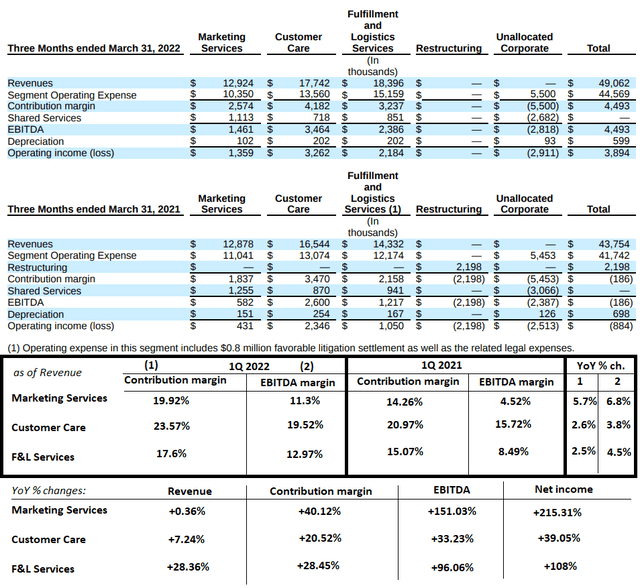

Author’s calculations, based on HHS’s 10-Q

The latest corporate news can only rejoice in management’s desire to get rid of preferred stock.

The Preferred Shares will be repurchased in exchange for ((i)) a cash payment equal to their liquidation value, or $9,926,000 and ((ii)) 100,000 shares of Harte Hanks common stock. The Preferred Shares to be repurchased are currently convertible into approximately 16% of the Company’s common stock on a fully diluted basis. Harte Hanks will fund the cash portion of the repurchase consideration with a combination of cash and cash equivalents on hand and borrowings under the Company’s credit facility. The repurchase is expected to close by the end of the third quarter of 2022.

Source: Harte Hanks’ press release

Over the last 4 quarters, distributions to preferred shareholders have gobbled up an average of 15.5% of quarterly net income – getting rid of this expense item now can significantly increase the company’s prospect value to common shareholders.

As the company expands, the growth of the company will slow down. Therefore, we must evaluate everything that can affect the quality of this growth (gross profit, EBITDA, etc.).

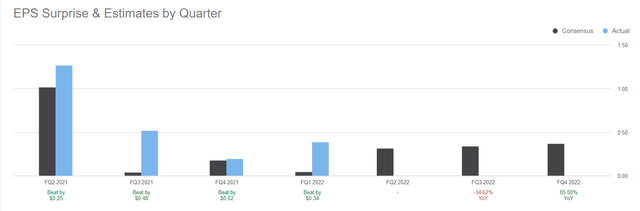

We already know that the company will liquidate preferred shares at the expense of its own cash (about $9.7 million at the end of March 2022) and a new credit facility – which will increase net income and earnings per share by about 15% from the end of 2022 to the end of 2023 and could support net income numbers going forward. What the cash to debt ratio will be in this transaction is not yet known, but the company’s current coverage ratio (TTM Times-Interest-Earned ratio = ~26) allows for a slight increase in debt without any problems. No new restructuring is planned (I have not found any such information. If you know more, feel free to share your insights in the comment section below). Therefore, even with a slight increase in the customer base or an expansion of relationships with the existing customer base, Harte Hanks will very likely be able to again exceed what I believe are underestimated analyst expectations:

Seeking Alpha, HHS, Earnings Summary data

Note: the EPS consensus forecast for Q3 2022 appears to include a planned buyout of preferred shares.

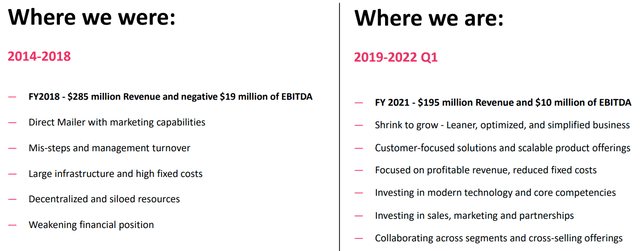

The current Harte Hanks looks nothing like what we saw a few years ago – one of the slides in the company’s June IR presentation says it best:

Key Risks and Takeaway

I must warn every reader of the possible risks of investing in Harte Hanks.

First, this is a company with a capitalization under $100 million, so the market risk is much greater than that of the major players.

Second, HHS has only recently returned to profitability – the positive results in recent quarters may not be enough to conclude with certainty about the success of the turnaround.

Third, forward multiples have already skyrocketed in the wake of the rally, and the stock may look quite overheated from a technical perspective, especially against the backdrop of a potential recession in the US.

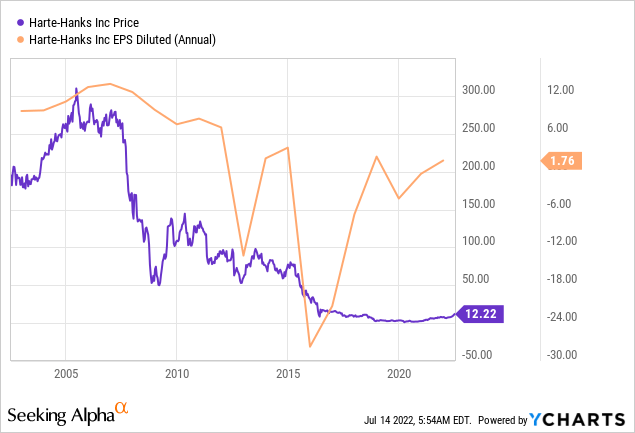

While I am aware of these risks, I still tend to believe that the bullishness we have seen in HHS stock since late 2020 is indicative of an improving fundamental profile. If management’s actions continue in a similar fashion, HHS’ share price could be well above its current $12.22 price in a few years. My conviction also arises from the results of the analysis of the valuation multiples – take a look at my reasoning in the chart below:

Author’s calculations and commentary, based on Seeking Alpha charting

As the turnaround progresses, HHS’ P/E ratio should nearly double once the company reaches the 2000-2012 scale. In terms of operating profit, HHS is already above 2015 levels, when the stock was worth more than $50 per share. In revenue and sales, the company is still far from that level, but everything is moving in that direction – FY2021 EPS shows a rapid recovery to the historical levels of the successful past:

Based on the foregoing, I recommend buying HHS stock at current price levels for the long term.

Happy investing and stay healthy!

Be the first to comment