Source: ItnewsAfrica

Investment Thesis

The South African Harmony Gold Mining (HMY) is a prolific gold miner that operates mainly in South Africa.

Source: HMY Website

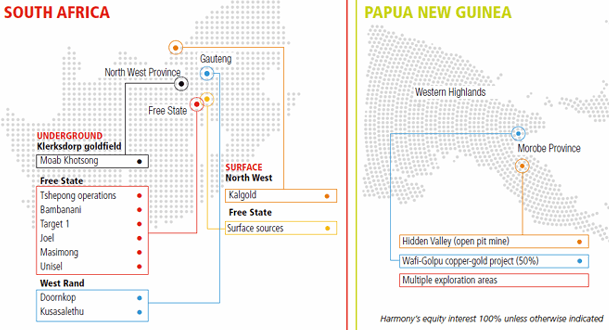

The company has a total of nine underground mining operations, one open-pit mine and several surface operations in South Africa. Harmony also is active in Papua New Guinea, where it owns the Hidden Valley mine – an open-pit gold and silver mine – and owns 50% interest in the Morobe Mining Joint Venture, which includes the Wafi-Golpu project and extensive exploration areas.

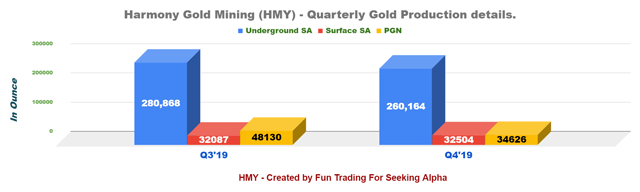

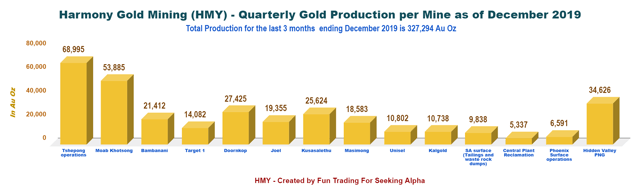

The gold production for the fourth quarter of 2019 was a total of 327,293 Au Oz, including three segments:

- South Africa underground mining: 260,164 Au Oz or 79.5%

- South Africa surface mining: 32,504 Au Oz or 9.9%

- Papua New Guinea: 34,626 Au Oz or 10.6%

The investment thesis is simple here and has not changed much from my preceding article. I consider the company as a long-term candidate for investors who want to own an active miner involved primarily in South Africa gold play.

It is quite similar to Sibanye (SBGL) that I also cover on Seeking Alpha. However, Sibanye is more affected by the PGM price. Sibanye produces platinum and palladium at a substantial level since the company acquired Stillwater a couple of years back.

The immediate problem that could eventually be negative for the miner is the potential production disruption from the coronavirus outbreak, which could affect production severely in Q3. It is not an immediate risk, but it is essential to think about it.

Finally, while I believe Harmony Gold is a robust long-term contender, I think Barrick Gold (GOLD) seems a slightly better choice after increasing its presence significantly in Africa with the merger with Randgold Resources in September 2018.

Harmony Gold is not different from several dozens of other gold miners that I am regularly following and fluctuate widely with the price of gold.

The gold price volatility is an essential factor when it comes to deciding the right strategy that can maximize your gain while minimizing the risk. A gold miner is prone to technical hiccups and can hardly be considered as a perfect proxy for gold. Often miners behave more like equity due to production issues.

With the recent outbreak, the situation is even more complicated and is producing extreme volatility never seen before. Thus, the best path to profit is trading short term about 30% of your long-term position using short cycles. However, it is not an impossible task and demands only a handful of trades throughout the year while making a huge difference both in your potential return and expected profit.

Harmony Gold Mining – six months ending December 2019 – The Raw Numbers

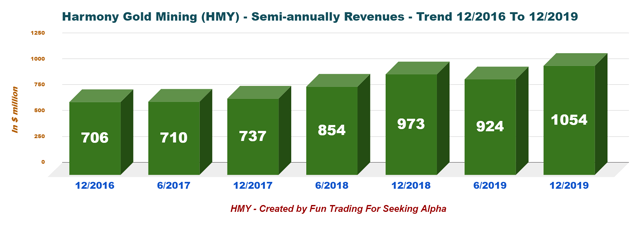

| Harmony Gold Mining | 6/2017 | 12/2017 | 6/2018 | 12/2018 | 6/2019 | 12/2019 |

| Total Revenues in $ Million | 710 | 737 | 854 | 973 | 924 | 1054 |

| Net Income in $ Million | -94 | 65 | -386 | 5 | -189 | 91.00 |

| EBITDA $ Million | -157 | 104 | -417 | 23 | -176 | 125.00 |

| EPS diluted in $/share | -0.21 | 0.15 | -0.87 | 0.01 | -0.36 | 0.16 |

| Operating Cash flow in $ Million | 143 | 137 | 166 | 187 | 143 | 186 |

| Capital Expenditure in $ Million | 183 | 191 | 165 | 169 | 186 | 155 |

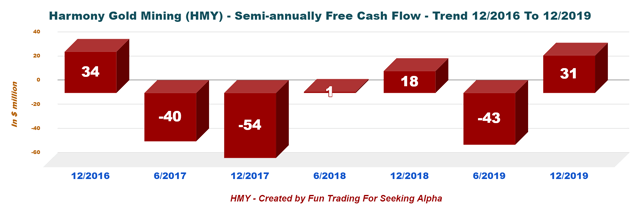

| Free Cash Flow in $ Million | -40 | -54 | 1 | 18 | -43 | 31 |

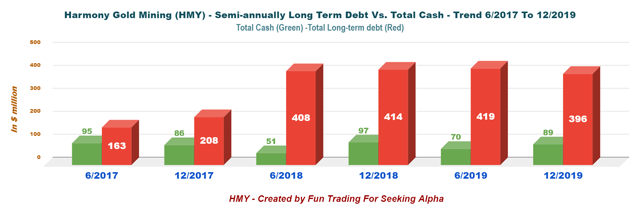

| Total Cash $ Million | 95 | 86 | 51 | 97 | 70 | 89 |

| Total Long term Debt in $ Million | 163 | 208 | 408 | 414 | 419 | 396 |

| Dividend in $/share | 4.55 | 0 | 1.72 | 0 | 0 | 0.00 |

| Shares outstanding (diluted) in Million | 456 | 454 | 500 | 537 | 533 | 549 |

Data Source: Company documents

H2 2019 revenues and other financial indicators

The company indicated in its semi-annual operational update, ending on December 31, 2019, the semi-annual results were positive with “good momentum” at most of its mines and a favorable exchange rate for the rand to the US dollar. However, production for H2 2020 was lower than H1 2020.

The company said the underground recovered grade was down by 5.4% to 5.26g/t at the South African underground operations. Harmony Gold indicated total revenues of $544.316 million in Q3’19, up significantly from $463.634 million in Q2’19. It is an increase of 21.6% due mainly to a massive gold price increase going from $1,315 per ounce in Q2’19 to $1,449 per ounce in Q3’19.

The rand versus the US dollar was steady at 14.69 this quarter.

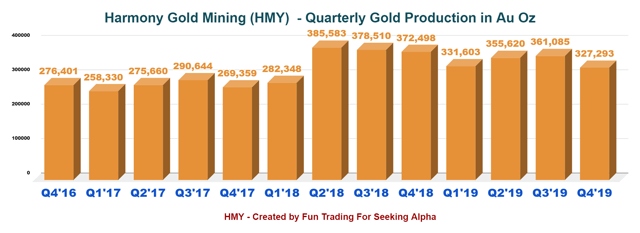

2 – Quarterly production analysis – Historical data

Note: Quarterly production (including Moab Khotsong)

Gold production was 327,293 Au ounces in the 4Q’19, down 9.4% quarter over quarter. The average gold price received during 4Q’19 was $1,447.

AISC for 4Q’19 was $1,283 per ounce versus $1,250 per ounce in 3Q’19.

Two mines have contributed significantly in the last results:

- Moab Khotsong in South Africa

- Tshepong Operation in South Africa

3 – Free cash flow

Free cash flow is the cash from operating activities minus CapEx. It is an excellent financial indicator of strength. The company has a loss of $12 million for 2019, with a profit of $31 million during H2 2019. We can see that the company is slowly getting its act together and is improving with gold, now around $1,500 per ounce. The only issue now is to make sure the company can continue mining without interruption.

4 – Wafi-Golpu project – a significant asset but having an uncertain future

Newcrest and Harmony both own 50% of the Wafi-Golpu project, while the PNG government has the right to purchase an equity interest.

It is an essential project for Harmony Gold.

In December 2018, the company and Newcrest Mining entered into an MOU with the Independent State of Papua New Guinea for the Wafi-Golpu project. From the PR:

The Papua-New Guinea Minister for Mining has advised that the State of Papua-New Guinea has withdrawn support for the Memorandum of Understanding with the Wafi-Golpu Joint Venture (WGJV) signed on 11 December 2018, citing the delay caused by the legal proceedings initiated by the Morobe Provincial Government rendering the timetable in the MoU as unachievable. The State intends to resolve the legal proceedings and to work with the WGJV to expedite the project permitting discussions.

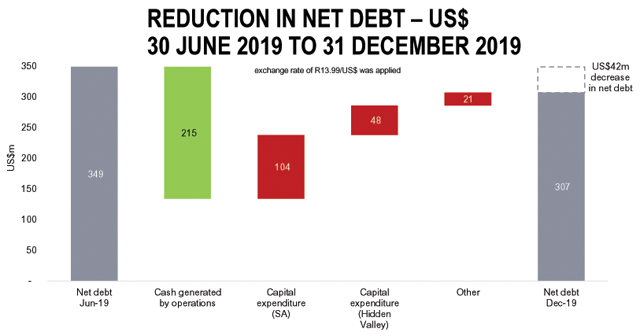

5 – Net debt as of June 2019

Net debt has been constant yearly. The net debt is now $307 million.

Details for the last six months below:

Source: February Presentation in US$.

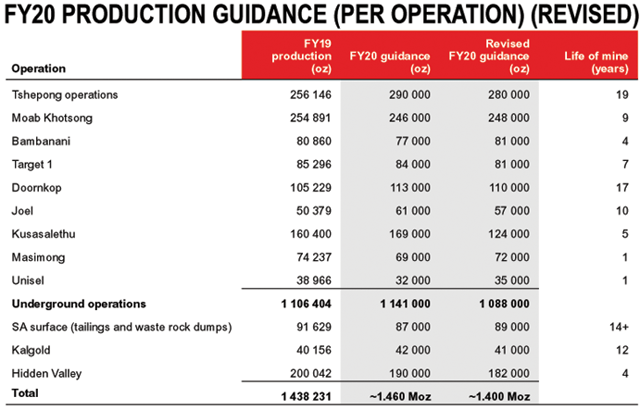

6 – Guidance 2020

From February 2020 Presentation

Conclusion and Technical analysis

Harmony Gold Mining had a decent H2 2020 results, helped by a good price of gold and a favorable change for the rand versus the US dollar. Capital expenditure went down from $169 million in H2 2018 to $155 million in H2 2019.

It seems that the market has discounted the not-so-good news about the lower underground grade or further delays for the Wafi-Golpu project in Papua New Guinea. However, the stock dropped significantly with the recent coronavirus outbreak, which did not spare the gold miner sector.

We have to be careful about how the market will react the next several weeks with the coronavirus spreading and potential of production disruptions. Today, Newmont (NYSE:NEM) indicated that the company put four mines on care & maintenance. It is a situation that we have to monitor seriously.

Technical Analysis

HMY experienced a support breakout at around $3.40 recently and dropped as low as around $1.80. The new target is now $3.55, where it is crucial to take some profit off the table. The new target on the downside should be about $1.45, in my opinion. However, the technical analysis is not accurate in such high volatility environment.

HMY experienced a support breakout at around $3.40 recently and dropped as low as around $1.80. The new target is now $3.55, where it is crucial to take some profit off the table. The new target on the downside should be about $1.45, in my opinion. However, the technical analysis is not accurate in such high volatility environment.

Author’s note: If you find value in this article and would like to encourage such continued efforts, please click the “Like” button below as a vote of support. Thanks!

Join my “Gold and Oil Corner” today, and discuss ideas and strategies freely in my private chat room. Click here to subscribe now.

You will have access to 57+ stocks at your fingertips with my exclusive Fun Trading’s stock tracker. Do not be alone and enjoy an honest exchange with a veteran trader with more than thirty years of experience.

“It’s not only moving that creates new starting points. Sometimes all it takes is a subtle shift in perspective,” Kristin Armstrong.

Fun Trading has been writing since 2014, and you will have total access to his 1,865 articles and counting.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment