metamorworks/iStock via Getty Images

Harmonic Inc. (NASDAQ:HLIT) proves that it still has potential for growth and expansion. The fundamentals show high revenue generation capacity and efficient asset management. These values are in line with the company’s 2022 guidance. Increased demand for more extensive data transfer should help it to reach this target.

Meanwhile, the stock price had a steep decline in January. But now, it continues to move sideways after a slight rebound. Given the company’s expansion plans and potential undervaluation, there are avenues for growth.

Harmonic’s Strong 2022

Harmonic, Inc. made a giant leap in 2021. Its massive expansion in the EMEA and APAC fields is a testament to its flourishing capacity. With more demand for reliable connections, Harmonic sees more promising growth prospects. Its expansion to rural areas and the deployment of more innovative solutions will be its growth drivers.

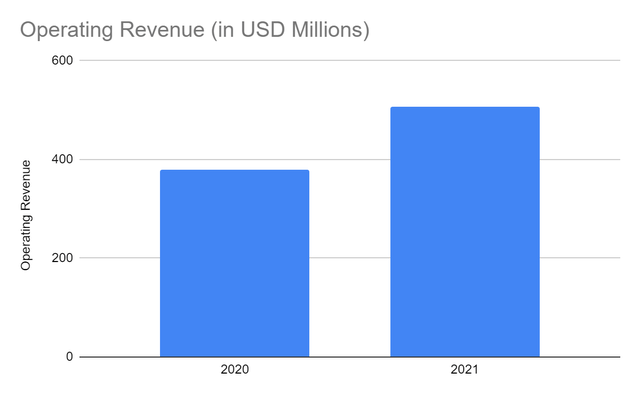

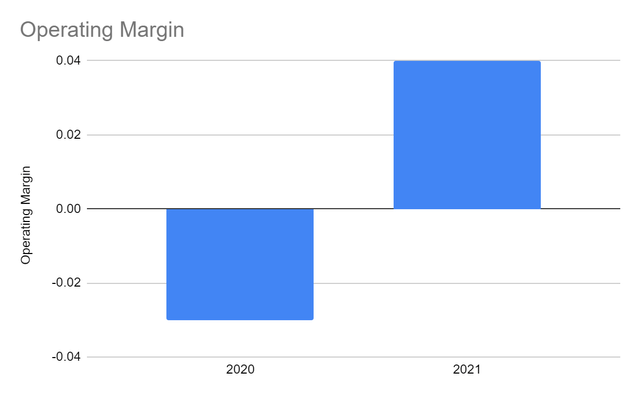

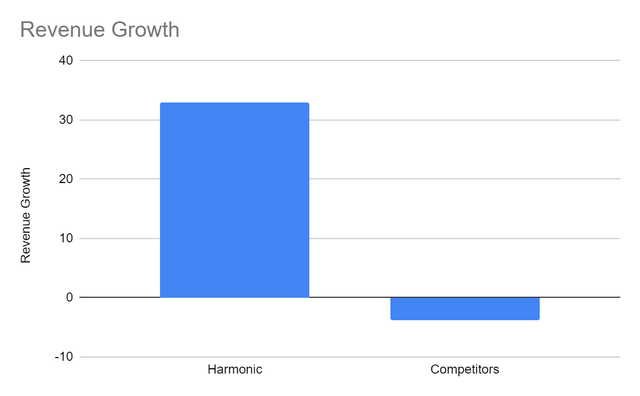

Moreover, it started to cater to a broader market last year. So, its fundamentals suggest that increasing its operating capacity will generate more revenues. In its financial release, the continued expansion of its operations appears fruitful. Its operating revenue amounted to $507 million, a 33% year-over-year growth. In 4Q 2021, its cable access revenue rose by 53%. Also, it became more profitable. The operating margin reached 0.04, the highest in the last five years. Net income amounted to $13.2 million, another highest value in recent years.

Operating Revenue (MarketWatch)

Operating Revenue (MarketWatch)

This year, Harmonic promises more fruitful results with continued innovation and expansion. It now has more means to sustain the enlargement of its operating capacity. It can produce more high-tier cable access, video delivery software, and streaming players. With more people at home, the market demand for more reliable data transfers will increase. In 2021, the global bandwidth demand rose by 29%, showing increased device connections and data transfers.

In turn, Harmonic is creating new strategies in its business segments to keep up with the fast-paced growth. For instance, it introduced its Leapfrog MAC Anywhere FMA solution for extended cable leadership. Today, it shows more flexibility and capability to deploy multi-gigabit broadband services. The equipment interoperability for its cable access platforms continues to demonstrate development. It may simplify network operations with their preferred hardware while powering 10G multi-gigabit.

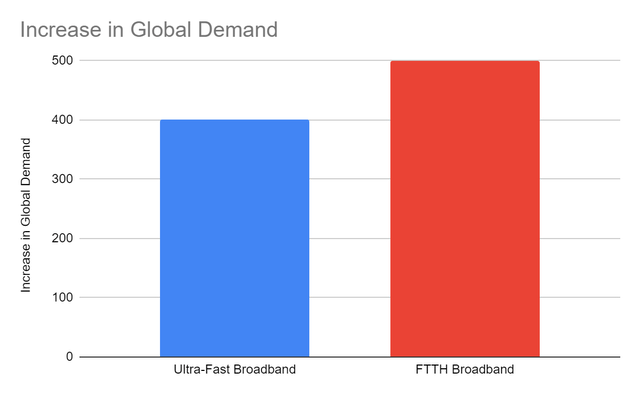

This breakthrough is timely as the demand for faster broadband grows. In fact, the company is working with GCI to deliver ultra-fast broadband services. This move will benefit both companies as the market demand for ultra-fast broadband rose by almost 400%. With CableOS, Harmonic stays at the forefront of innovations as its popularity continues. Also, it now produces high-tier streaming SaaS players and non-FCC-driven broadcast edge solutions.

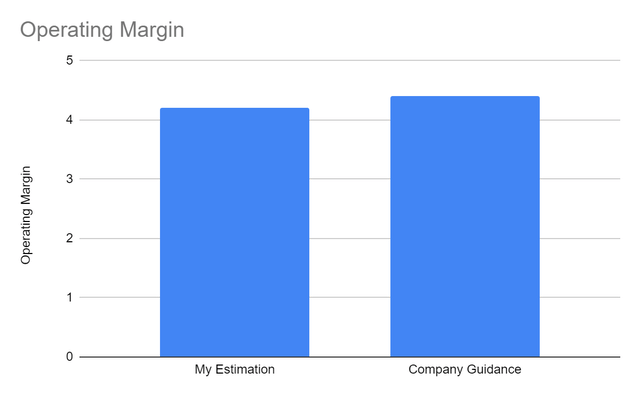

Fortunately, Harmonic has a large capacity to provide high bandwidth data transfer. It keeps up with evolving customer needs and demands. That is why the expansion and deployment of more and newer solutions is timely and relevant. Also, its market share expanded to 6% while many of its peers experienced contractions. It is no wonder that the company projects 12-18% revenue growth with a 4.4% operating margin in 2022.

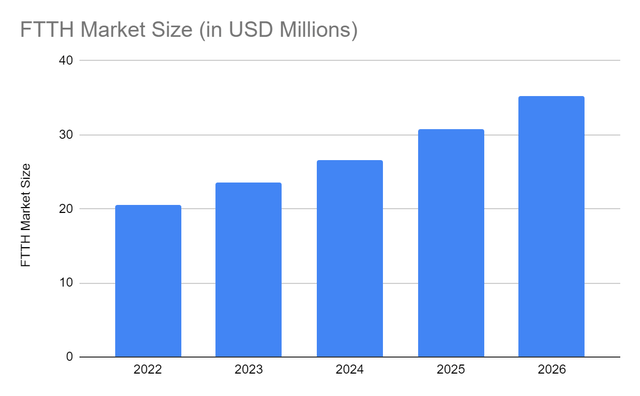

Another key move is expansion of fiber-to-the-home (FTTH) PON capabilities to rural areas. As more people work remotely, there is more demand there for reliable connections. Recently, there has been a 500% global demand increase for FTTH broadband. The market estimates FTTH to reach $54 billion with a CAGR of 14.6%. So, its new and continued innovation of 10G technology becomes more exciting. It matches the continued deployment of its DOCSIS 4.0 standard as its primary means. Higher bandwidth data transfers will be achieved. This will match Harmonic’s expansion and help stimulate revenue growth.

Increase in Global Demand (RTE)

FTTH Market Size (Future Market Insights)

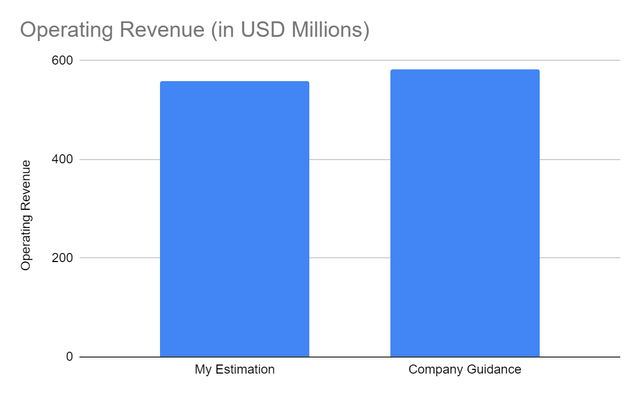

Operating Revenue (Harmonic, Inc. )

Operating Margin (Harmonic, Inc. )

How Harmonic May Sustain Its Expansion

Harmonic’s recent guidance is currently set at $570-596 million for revenues. It appears achievable since it produces quality video and cable solutions and appliances. But while the values appear optimistic, the company must do its best to materialize its goals. Now, Harmonic offers more innovations, given the successful FMA interoperability of MAC Anywhere. It is also starting to expand in rural areas with its FTTH broadband. With the continued deployment of its DOCSIS 3.1 and 4.0, higher bandwidth will be achieved. This will match Harmonic’s expansion and solutions and help stimulate revenue growth.

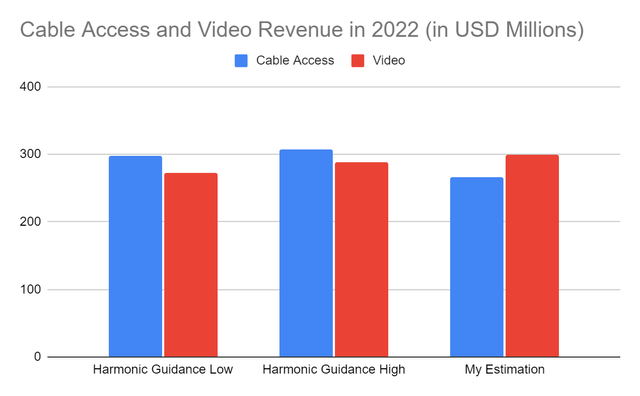

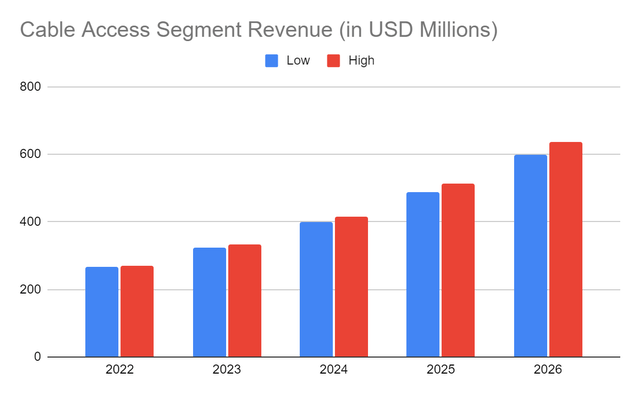

Many recent studies show optimism given the growing cabling access and video market. The global cabling access may reach $88.49 billion with a CAGR of 7.10%. Fortunately, Harmonic enjoyed market share expansion while many of its peers experienced contractions. With the current market share of 0.06% and its average amount, my expected growth is 23-24%. Its 2022 cable access revenue may reach $268-270 million. In the next few years, I expect it to reach $600-637 million.

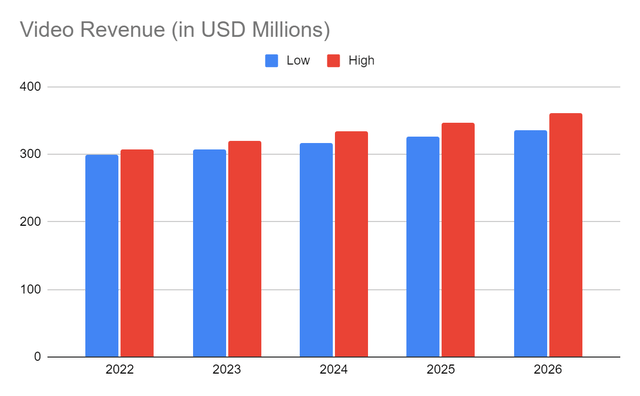

Likewise, the video and analytics market may amount to $14.9 billion with a 20.4% CAGR. Given its current market share of 0.06% and average value, it may reach $336-361 million in the next few years.

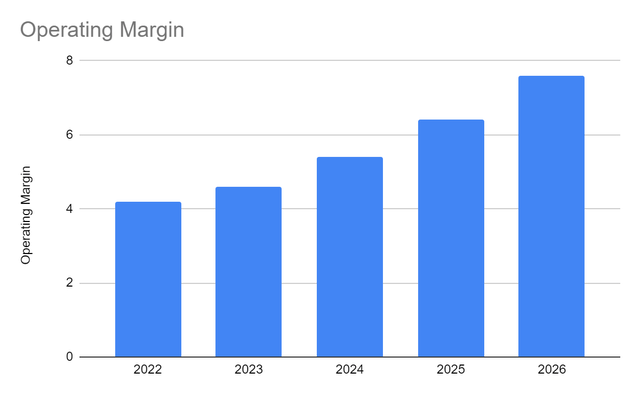

Moreover, Harmonic’s partnerships and increased market penetration will help revenues outpace costs and expenses. With its better asset management, I expect higher efficiency and profitability. Hence, the operating margin may rise from 4.2% to 7.6%.

Cable Access and Video Revenue (Harmonic, Inc.)

Cable Access Revenue (Author Estimation)

Video Revenue (Author Estimation)

Operating Margin (Author Estimation)

But, Harmonic does not depend on an ever-expanding market alone. Its efficient asset management is evident with increased operating margin and net income. The Return on Asset (ROA) is 4.2% or $4.2 income for every $100 asset. As Harmonic expands and generates more revenue, it keeps its costs and expenses lower to realize more profits. The increase in PPE and inventories alone may enable expansion. Alongside this is the company’s increase in cash, which now is almost as much as the total borrowings.

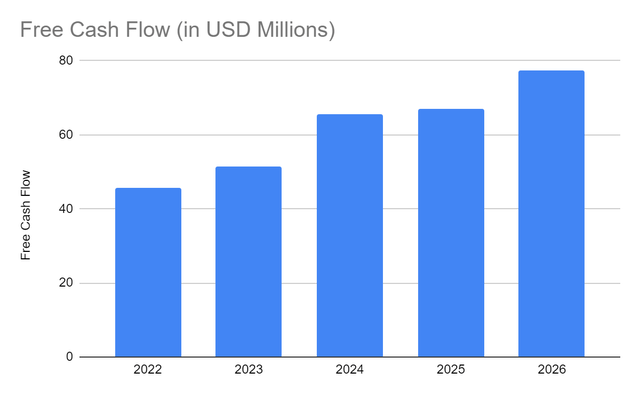

Lastly, its Free Cash Flow (FCF) quadrupled from $6.96 million to $28 million. Although CapEx decreased, the FCF will remain higher if we use the previous value. The Cash Flow-to-Borrowings ratio remained almost unchanged. So, there is consistent growth in all financial statements. This suggests that continued expansion will lead to higher profitability and sustainability.

Also, cash transactions are producing more inflows to expand further. Now, Harmonic will have more means to enlarge its production, leading to higher revenues and margins. With its continued and sustained expansion, I assume its CapEx will rise this year. I expect an 8-12% FCF-to-Sales Ratio for the next few years. Hence, Harmonic will have more cash to cover its financial obligations and expansion.

Free Cash Flow (Author Estimation)

Price Valuation

The stock price has been in a steep decline recently. From $12, the value plunged to around $8 or a 33% cut. But not long after, it started to move sideways and even increase a bit. At $9.46, it is 23% lower than its highs. But, the price remains elevated based on the 52-week pattern. The upside could have been due to higher income and investors’ confidence. Using the DCF Model, we can precisely estimate the price.

|

FCFF |

$36,000,000 |

|

Cash |

$133,000,000 |

|

Outstanding Borrowings |

$190,000,000 |

|

Perpetual Growth |

4-4.3% |

|

WACC |

7-7.3% |

|

Common Shares Outstanding |

103,000,000 |

|

Stock Price |

$9.46 |

|

Derived Value |

$10.54-12.88 |

Harmonic should sustain its recent growth and expansion if the fundamentals remain solid and intact. There should be a 12-26% upside in the stock price over the coming twelve months. If growth persists, the stock price may continue the recent rebound.

The Bottom Line

Harmonic, Inc. has a lot of growth potential now that its operating capacity matches the market demand. Its expansion may remain profitable with quality products and efficient asset management. Meanwhile, the stock price shows low to moderate volatility and a promise of an increase. The company may reach or even exceed its 1Q 2022 and full-year guidance and push the price upward. Hence, the recommendation is that Harmonic is a buy.

Be the first to comment