Johnrob/iStock Unreleased via Getty Images

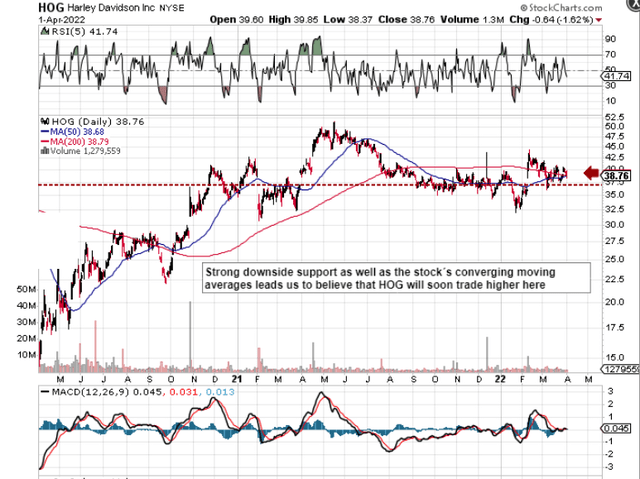

If we look at a technical chart of Harley-Davidson, Inc. (NYSE:HOG), we can see that shares are battling to trade above their 200-day moving average once more. In fact, any bit of sustained momentum here in HOG will result in the faster-moving 50-day average crossing above the pivotal 200-day average (golden cross). We last witnessed this type of signal back in September 2020 when shares delivered almost a 100% gain in the space of 8 months following the crossing of the moving averages. The strong support Harley-Davidson has just below the $37 level leads us to believe that the golden cross has a high probability of playing itself out here.

Technical chart of Harley-Davidson (StockCharts)

HOG Dividend Yield

Although HOG’s forward dividend yield comes in at a mere 1.63%, investors must remember that the yield only makes up a percentage of the company’s total return. However, by monitoring the key financial trends which make up the dividend, we can get a solid read on the strength of HOG’s fundamentals. This is why the dividend always must be evaluated in conjunction with the company as a whole.

For example, HOG’s forward dividend yield of 1.63% comes in well behind the average in this sector (2.21%) as well as the company’s five-year average. Suffice it to say, taking into account that Harley-Davidson’s prevailing yield is a solid proxy for overall investment risk, the bullish technicals discussed earlier are now beginning to look a lot more attractive.

Dividend Growth

From a long-term dividend growth standpoint, HOG’s 3-year as well as its 5-year average annual dividend growth rates actually come in at -25% & -15% respectively. This is due to the company deciding to cut the quarterly payout to a mere $0.02 per share back in April of 2020. However, since then, we have seen a strong ramp-up in the payout with the latest quarterly payment coming in just under $0.16 a share. Suffice it to say, to gauge management from a payout perspective, investors should note the eight-year period from 2012 to 2019 when the dividend increased by over 140%. Furthermore, the current forward dividend of $0.63 remains 58% off the 2019 annual payout of $1.50 per share. Suffice it to say, based on historic trends, the scope is there for strong dividend growth rates going forward.

Cash Flow

Harley-Davidson made $650 million of net profit last year of which it generated $976 million of operating cash flow. $120 million went towards capital expenditure which meant that $856 million of free cash flow was generated. Dividend payments in fiscal 2021 amounted to $92 million which means the pay-out ratio at present comes in at 11%. Some investors would state that such a low payout ratio presents an opportunity cost but again we would point towards the total return argument here. For example, with over $2 billion of cash on the balance sheet and with a market cap of just under $6 billion, shares are trading for under 3 times their cash position and just over six times their operating cash flow. Furthermore, with cash flow expected to increase once more in fiscal 2022, this invariably means that profitability will remain very strong in Harley-Davidson.

Leverage

Harley-Davidson’s debt to equity ratio came in at approximately 2.7 at the end of fiscal 2021 which was a sizable drop from the 5.22 number we witnessed at the end of fiscal 2020. Net interest expense of $24.3 million out of an EBIT tally of $837.7 million means the interest coverage ratio comes in at 34.47 presently. Suffice it to say, despite the company’s leverage, its elevated profitability has meant that leverage has not been impeding robust cash-flow generation in recent quarters. Dividend growth should certainly follow.

Projected Earnings Growth

Harley-Davidson returned $4.21 in earnings per share in fiscal 2021 and is expected to return $4.30 this coming year. This number is well above the forward dividend payout ($0.63) and takes into account ongoing supply chain headwinds as well as rising prices. Moreover, in line with the company’s long-term strategic Hardwire initiative where brand growth is paramount, management believes that there will be sufficient volume & margin growth in 2022 to compensate for the inevitable price increases across the supply chain on the front end.

Conclusion

To sum up, the below average yield in Harley-Davidson also points to below-average risk in this play for the following reasons. Profitability is on the rise with the company having ample cash-flow to keep on investing in hardwire goals. Furthermore, shares look cheap from a value standpoint and the technicals look poised to give a buy signal shortly. We look forward to continued coverage.

Be the first to comment