Petmal/iStock via Getty Images

Thesis: Headed For “Buy” Territory, But Not There Yet

Hannon Armstrong Sustainable Infrastructure (NYSE:HASI) is the duckbilled platypus of dividend stocks. Technically organized as a real estate investment trust (“REIT”), the company acts a bit more like a business development company (“BDC”) because of its loans to third-party green energy projects. Like the duckbilled platypus, HASI can look a little more like one thing or the other depending on which aspect is highlighted.

For the average investor, all that is necessary to know about HASI is that it makes green energy investments, mostly on the debt side. That is, it makes high-yield loans to businesses and governments associated with grid-connected and “behind-the-meter” green energy projects.

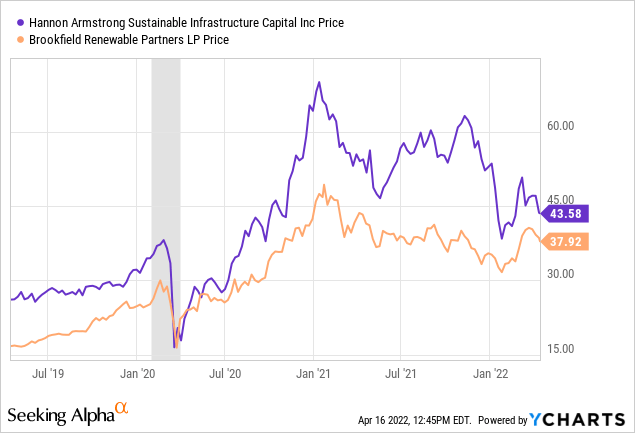

That makes HASI a different breed than Brookfield Renewable (BEP, BEPC), for instance, because the latter invests in green/renewable energy on the equity side. That is, BEP owns its own renewables projects. Even so, the market broadly treats both as “green energy” stocks, and thus the two tend to trade in correlation to one another.

Both stocks peaked shortly after the election of the renewables-friendly Joe Biden, but in lieu of any meaningful pro-renewables legislation to be passed thus far, both have trended downward as the fundamentals were never able to catch up to high valuations.

Today, HASI is priced at around 23.2x distributable earnings per share. That is down significantly from the over 30x multiple the stock sported just last Fall, but it is still pricey.

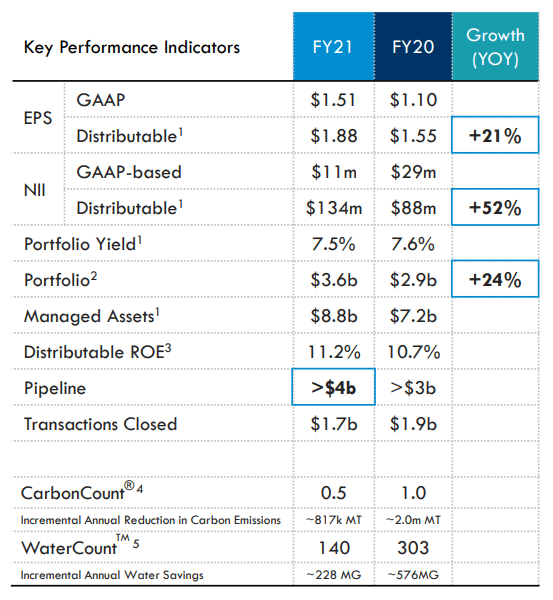

Then again, HASI has guided for distributable EPS growth of 10-13% from 2021 through 2024 relative to 2020’s baseline. That is an impressive growth rate that would seem to justify the high valuation.

Moreover, HASI expects to up its dividend by 5-8% per year through 2024. Comparing that to the current dividend yield of 3.44%, however, I believe HASI would need to give dividend raises averaging on the very high end of that range in order to make it an attractive dividend growth investment.

In what follows, I’ll provide a quick update on HASI’s business and the things I like about it, followed by a discussion of my “buy under” price in the conclusion.

Overview of HASI

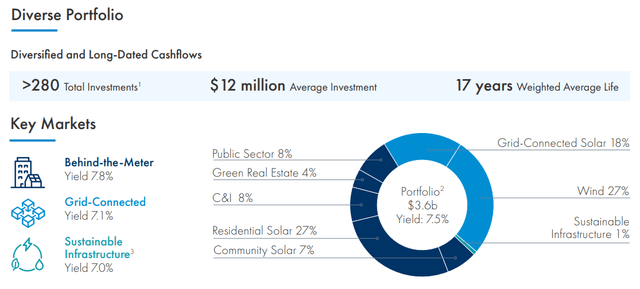

HASI provides loans for a wide variety of green energy projects. These projects can be “grid connected,” or feeding green power into the electrical grid from wind or solar facilities, or they can be “behind the meter.” This is a term that refers to green energy (or energy-saving) projects that do not feed into the broader grid.

For example, a manufacturer might want to install solar panels on the flat roof of its factory, using HASI as a financier for the project. The electricity produced will be used by the factory rather than being fed into the electric grid.

Another example is community solar, which is basically a small solar farm that powers a neighborhood or farm.

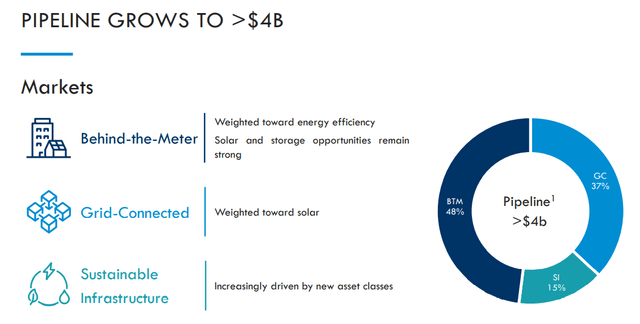

HASI’s portfolio is split roughly half and half between grid-connected and behind-the-meter investments. There are 280 loans, averaging $12 million apiece, with a 17-year weighted average remaining term.

This is a very strong portfolio of conservative loan investments that can boast less than 20 basis points of cumulative credit losses since 2012. Only 1% of HASI’s recent loans are performing slightly below expectations, with 99% performing fully.

The quality of HASI’s loan book, with a very long remaining contract life of 17 years, is surely one reason why the REIT trades at a relatively high valuation.

Though sustainable infrastructure (e.g. desalinization plants, seawalls, expanding electric grid infrastructure, winterizing grid components, etc.) makes up only about 1% of the current portfolio, the pipeline includes many more of these potential projects.

What’s more, notice that the falling costs of solar plus battery storage are driving solar to become a larger segment of HASI’s overall portfolio.

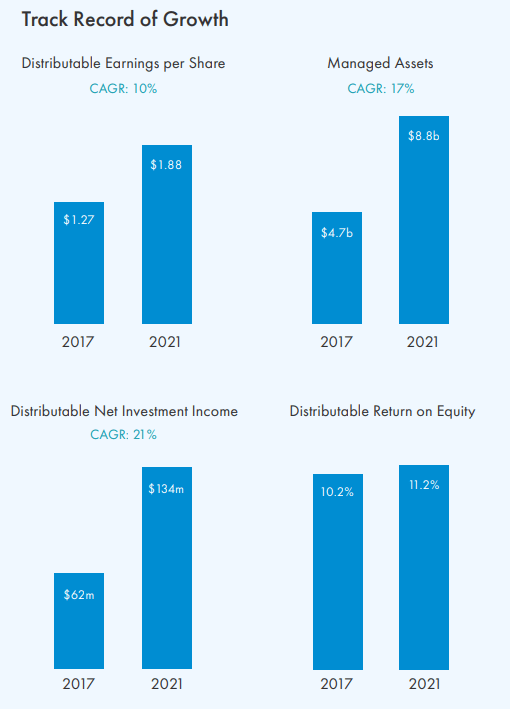

By focusing on a rapidly growing sector of the market like green energy, HASI has been able to grow quite rapidly in recent years.

HASI Fact Sheet

A distributable EPS compound growth rate of 10% is impressive, especially considering that investment opportunities in this space should only grow in the coming years.

From 2020 to 2021, for instance, HASI’s distributable EPS surged a remarkable 21% year-over-year, even while its portfolio yield compressed slightly. Moreover, the size of the investment pipeline grew from over $3 billion to over $4 billion.

HASI Q4 2021 Presentation

Distributable return on equity of 11.2% is around HASI’s highest level for that metric since going public. This means that HASI’s management is prudently using equity issuance (along with debt) to ensure that returns on equity remain strong.

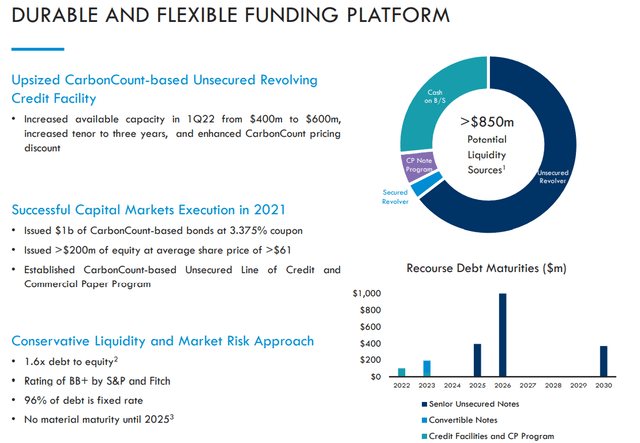

As for debt, like BDCs and mortgage REITs, HASI makes ample use of debt to fund its own loan investments, but with a BB+ rating and an average interest rate around 4.5%, the company’s crucial spread between investment yields and cost of capital is quite healthy.

Notice also that no bonds are maturing until 2025. By then, the recent rise in bond yields may have ended, and interest rates may have moderated. Even if interest rates do not fall from here, HASI has plenty of time to prepare for how to roll over its bonds and fund future investments.

Bottom Line

I like HASI as a business and have owned the stock in the past. When the stock price soared above $60, it simply made no sense to me to hold such an overvalued (from my perspective) green energy stock while other green energy stocks like BEP, NextEra Energy Partners (NEP), and Clearway Energy Inc. (CWEN, CWEN.A) were far cheaper and higher yielding.

But at what price would HASI begin to be a good buy again? Well, I approach this question from the perspective of a long-term dividend growth investor.

HASI’s forward dividend growth is expected to fall in the range of 5-8%. Let’s assume it falls in the very middle of that range, at 6.5% annually. Buying today at a 3.44% dividend yield, that average dividend growth would render a yield-on-cost of 6.46% after ten years.

Normally, for conservative dividend growth stocks, I like to target a 10-year YoC of at least 7%. So, what dividend yield would I need to buy HASI at in order to get at least a 7% 10-year YoC (assuming 6.5% average annual dividend growth)?

Answer: 4.75%, or a stock price of $40.

That is my “buy under” price for HASI. At that price, HASI’s price to distributable EPS would be 21.3x based on 2021’s earnings and 20.2x based on 2022’s estimated earnings.

Be the first to comment