Charley Gallay/Getty Images Entertainment

I wear Hanes from Hanesbrands Inc. (NYSE:HBI). It truly is comfortable clothing (since 1901). I’m not terribly comfortable with the stock, even at a low $14 per share. There are too many prevailing downsides. Hold if you own or buy with caution.

I expect shares to move up to $17 as an average target price over the next 12 months because sentiment is more positive and the consensus among analysts is bullish. Some analysts are repositioning their recommendations, expecting the stock to outperform.

Mixed Signals

Wall Street analysts are recommending a buy of HBI. Credit Suisse Group (CS) pumped up its expectation for HBI to outperform, setting an average price target of $23-$26. Another analyst charts $45.85 per share as fair value for the stock. Two Seeking Alpha authors recommend a strong buy.

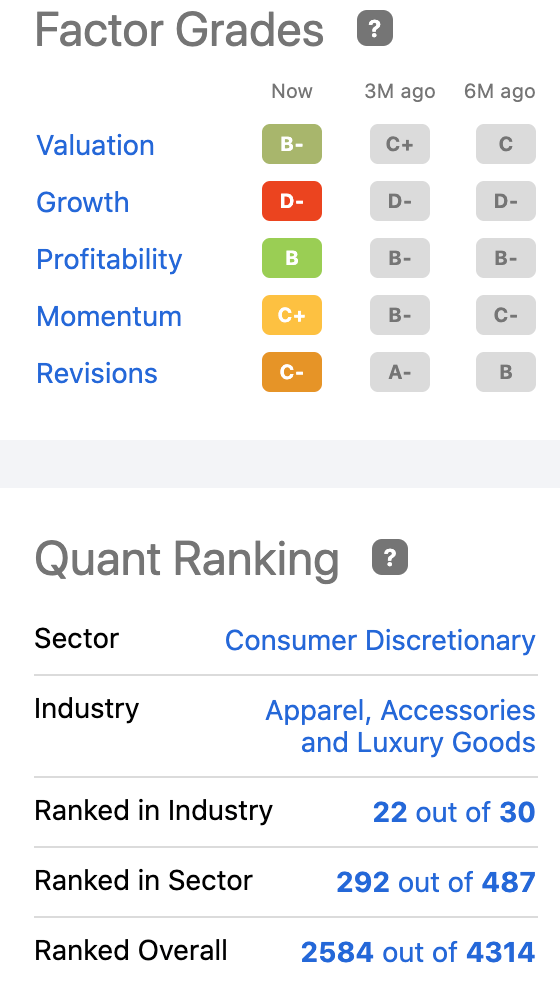

The SA Quant Rating, however, maintains a hold rating on the stock. I am inclined to agree. The sentiment turned positive recently following five years of uncertainty and share sell-offs. Insiders dumped shares in 2014-15. They began buying, particularly this year. Institutions bought a lot of shares in 2014-15, but institutional holdings have been on the wane since then.

There are a lot of mixed signals for retail value investors to contend with.

Corporate insiders bought nearly $600K worth of shares in the last three months. Hedge funds decreased holdings by 506.1K shares in the same period. Over the last five years, the price tumbled 33%. The share price is -27.5% over the last 12 months. The stock topped $22 last May but steadily slipped to a low $14.14 this month.

Short interest remains high at 9.3% and the PE is at 8.29. The Beta is 1.23. All this means the stock may fall faster than the market on any bad news.

Factor Grades/Quant Rating (seekingalpha.com)

The Company and Last Quarter

Hanesbrands Inc. designs, manufactures, sources, and sells basic apparel for men, women, and children. Company segments are Innerwear, Activewear, and International. Hanes underwear and activewear are well-known; it has home goods.

HBI licenses its Champion name for footwear and sports accessories. Other products sell under brand names including Maidenform, JMS/Just My Size, Bali, Polo Ralph Lauren, Playtex, DKNY, and more.

As of January 2, 2022, HBI operates 216 retail and direct outlet stores in the United States and Puerto Rico. Products sell in college bookstores, through mass retailers, 626 retail and outlet stores in Europe, Australia, Asia, Latin America, Canada, the Middle East, Africa, Mexico, and Brazil.

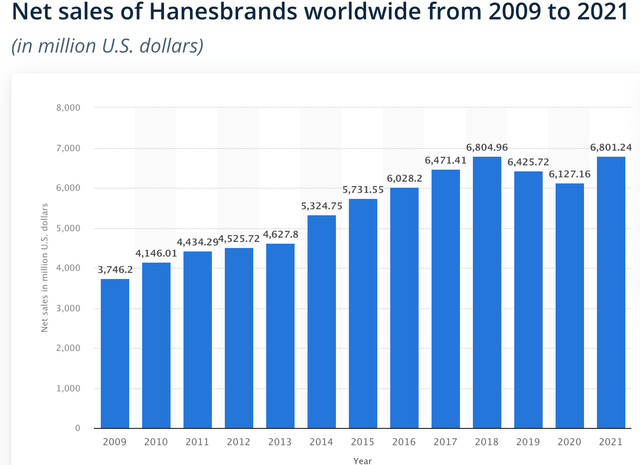

Revenue Worldwide (statista.com)

The company two months ago reported a good quarter:

- Net sales from continuing operations hit $1.75 billion, up 4% over fourth-quarter 2020, and up 9% on a constant currency basis.

- Net sales from continuing operations rose 15% over fourth-quarter 2019.

- GAAP EPS from continuing operations was reported as $0.19; adjusted EPS from continuing operations of $0.44, inclusive of a $0.02 per share impact from a higher than the expected tax rate.

- Global Champion brand sales are 10% higher over the prior year and 25% over the Q4 ’19.

- U.S. Innerwear sales +3% over the prior year, excluding PPE, and 19% over the Q4 ’19.

Positives

Between those numbers and exuberant guidance from management, the stock has gotten impetus. Full-year sales from continuing operations are expected to hit $7B. The GAAP EPS from continuing operations is forecast to be $1.50 to $1.67, while the adjusted EPS from continuing operations is forecast at $1.64 to $1.81. Potentially, revenue can top $8B over a few years. The cumulative three-year free cash flow has the potential to reach $1.6 billion.

The April uptick in share price is buoyed by the Board of Directors allowing a three-year $600 million share repurchase plan. The company dividend is a forward yield of 4.12%. Management also announced a self-funded, ambitious, Full Potential Plan for increasing momentum and growth investing “in brands and e-commerce.”

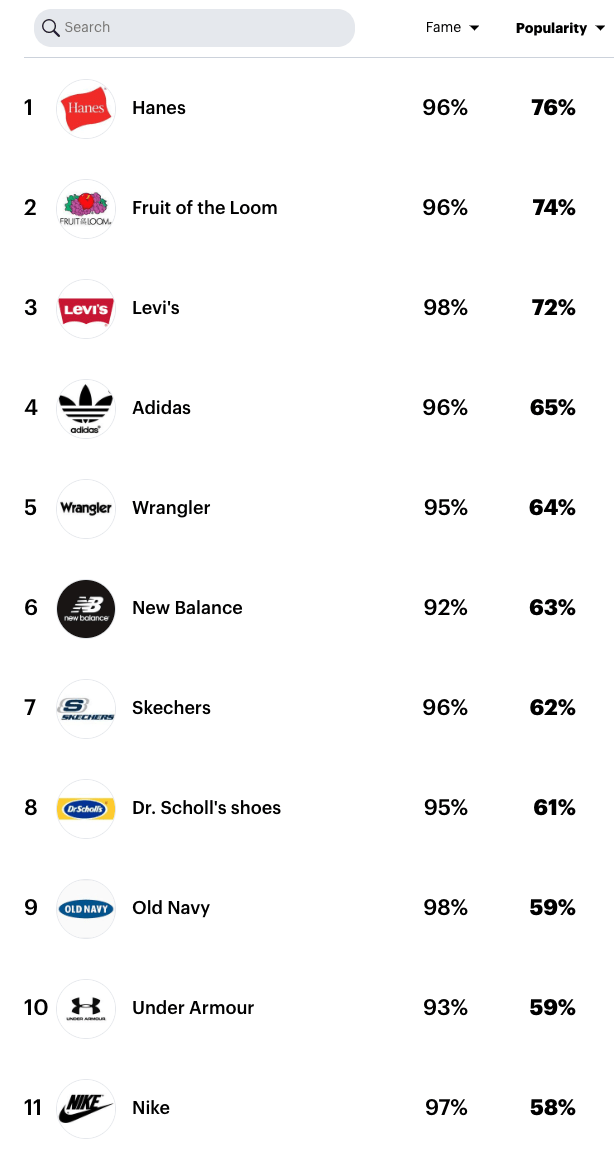

Hanes is not a company to give short shrift. 96% of people surveyed are familiar with the name. 76% like the products. 20% are neutral or buy other brands. YouGovAmerica claims Hanes is in the top 25 name brand companies in the world among all adults; that’s no small feat. In clothing and footwear, Hanes is the most popular brand, according to one survey:

Most Popular Clothing/Footwear (today.yougov.com)

Caveats

The halcyon nostrum lacks specifics. The Plan does not include useful information about the how and when. Long-term, consistent profitability has been elusive. HBI earnings declined 10.5% per year over the past five; whereas the luxury industry earnings growth topped 104% in the past year.

The net debt of $3.35B to equity of $702.5M ratio is a high +400%. The ratio increased over the last five years. Cash flow does not cover the debt. EBIT does not adequately cover HBI’s interest payments. Higher rates are a certainty.

I project the next EPS expected to be reported on May 5, ’22 will be down as much as ten cents from $0.39 EPS last year. Champion is the brand. Management is not releasing much detail on how it plans to spark greater interest in Champion brand clothing or online sales.

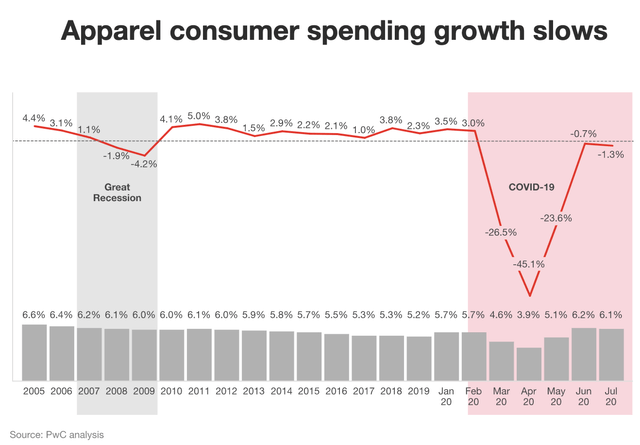

Higher interest rates on the horizon are likely to exacerbate HBI’s debt ratio. The Asian markets are finding consumers not quite ready to resume old spending behaviors; lockdowns persist in Asia, stymieing consumer spending. Workers in the garment industry face difficult working conditions. Hanes manufactures little, if anything, in the US, and product shortages, a slowdown in deliveries, and rising costs might dampen profits in 2022. The company does not say much about technology investments and online sales efforts in an age when direct sales are a key to success. Others in the industry are doubling down on digital investment.

Consumer apparel market (pwc.com)

Takeaway

Signals are mixed about HBI. One good quarter does not justify a trendy path to bullishness. I cannot enthusiastically recommend HBI to retail value investors. Hold back for now, in my opinion, or buy in moderation at around $14. Though the dividend yield and growth get an A and B+ respectively, the company gets low marks for the safety and consistency of the dividend.

There is not much information that inspires a potential opportunity for momentum and growth. However, with institutions holding nearly 90% of the shares and the average age at the top being 66 years, there is the potential exasperation that will set in. That always leads to impatience, frustration, and irritation in the board room. Who knows what will happen?

Be the first to comment