Today, we will see why Halozyme Therapeutics (HALO) is an attractive pick in March 2020.

Company overview

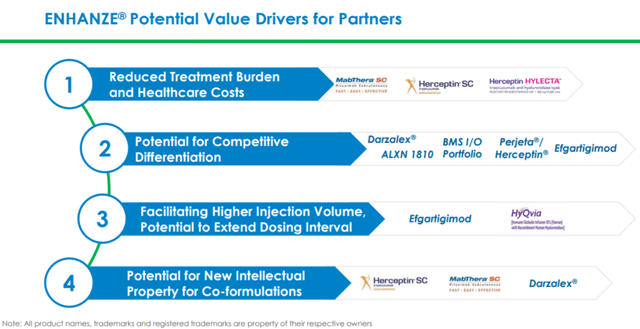

Halozyme Therapeutics is a biopharmaceutical company that is leveraging its Enhanze drug delivery technology in collaboration with other pharmaceutical companies to develop and commercialize novel oncology therapies. The company has partnered with leading players such as Roche (OTCQX:RHHBY), Pfizer (NYSE:PFE), Janssen, Baxalta, AbbVie (NYSE:ABBV), Eli Lilly (NYSE:LLY), Bristol-Myers Squibb (NYSE:BMY), Alexion (NASDAQ:ALXN) and argenx (NASDAQ:ARGX) for its Enhanze drug delivery technology. The company’s business model is based on recurring royalty revenues and milestone payments from partners and lean operating expense model. Headquartered in San Diego, the company was founded in 1998 and went public in 2009.

What is Enhanze drug delivery technology?

Enhanze is a drug delivery platform that allows for large volumes of up to 600ml of the drug to be administered in a single subcutaneous injection. Currently, three products deploying this technology have been already approved by the FDA, EMA, and other regulatory authorities.

The skin’s subcutaneous space consists of components such as collagen and elastin. HA (hyaluronan) is a naturally occurring glycosaminoglycan that forms a gel-like substance with water and fills the area between collagen and elastins in the subcutaneous space. These substances, however, create resistance to fluid flow in the extracellular matrix, thereby limiting the volume of drugs that can be administered subcutaneously. While the amount of HA in subcutaneous space remains relatively constant, around one-third is degraded by naturally occurring hyaluronidase enzymes. Enhanze works through a patented recombinant human hyaluronidase PH20 enzyme, rHuPH20. This enzyme works locally and transiently to degrade HA in the extracellular matrix at the local subcutaneous injection site. Degrading HA at the local injection site enables subcutaneous fluid flow, thereby allowing for effective dispersion and absorption of subcutaneously administered therapies. The HA at the local injection site recovers within 24-48 hours by the body’s natural HA turnover processes.

Enhanze technology can thus enable much higher subcutaneous injection volumes, thereby allowing for new co-formulations. It makes the dosing regimen easier for patients and can also reduce healthcare costs.

Restructuring of the company to focus on the Enhanze platform is the key growth driver for Halozyme

In November 2019, Halozyme announced that the combination of PEGPH20 (pegylated human hyaluronidase) and gemcitabine and nab-paclitaxel failed to meet the primary endpoint of the statistically significant improvement in the median OS (overall survival) in metastatic pancreatic cancer patients in Phase 3 trial, HALO-301 trial. The median OS in the patient arm that received gemcitabine and nab-paclitaxel alone was 11.5 months, higher than that in the PEGPH20 combination arm of 11.2 months. The missed opportunity in the highly underserved pancreatic cancer indication has been a big blow to the investors.

In the aftermath, the company swiftly repositioned its focus solely on the growth and profitability of Enhanze business. The company stopped the development of a metastatic pancreatic cancer drug. Halozyme reduced its headcount dramatically and now expects to reduce annual expenses by $65 million – $75 million by end of fourth quarter 2020. The company now expects flat expenses in the coming years based on the scalability of its operating model.

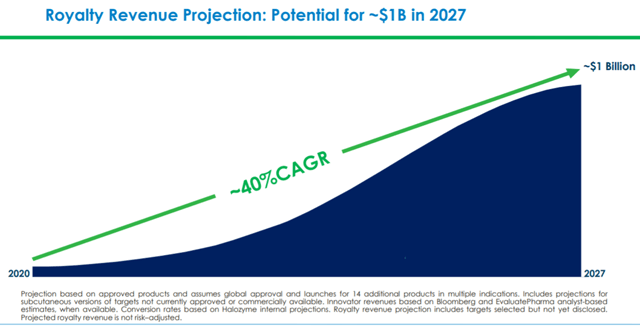

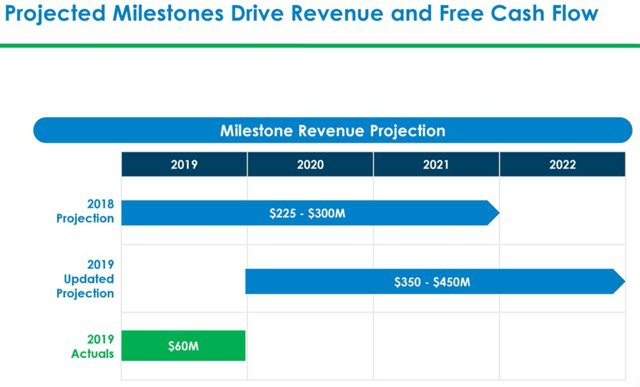

Halozyme now expects fiscal 2020 revenues to be in the range of $230 million to $245 million, a YoY rise of 17% to 25%. This will be driven by milestone payments, resulting from the strong projected partner development progress and new product commercialization. This does not include revenue contributions that can result from signing new deals for Enhanze. The company expects royalty revenues to reach up to $1.0 billion by 2027. The company has also guided for fiscal 2020 EPS of $0.60 to $0.75. The company is projecting positive net income starting the second quarter of 2020.

Halozyme expects a strong royalty and milestone payment stream from Johnson & Johnson (NYSE:JNJ) from the anticipated launch of Darzalex subcutaneous in 2020. The company also expects revenue streams from Roche Holdings associated with the potential launch of Perjeta/Herceptin FDC (fixed-dose combination) in late 2020 or early 2021. Besides, the company is also expecting increasing milestone payments from advancing pipeline products in late-stage development or towards commercial launch. Currently, Halozyme’s partners have advanced three new products in Phase 3 trials and 1 new product in the Phase 2 trial. Further, there are 10 phase 1 products deploying Enhanze technology which can potentially move into Phase 2/3 in 2021. Besides, there are five partnered products scheduled to enter Phase 1 in 2020. To date, the company has licensed rHuPH20 enzyme to nine leading pharmaceutical and biotech companies, covering over 50 potential drug targets.

Darzalex subcutaneous may report robust uptake in multiple myeloma indication

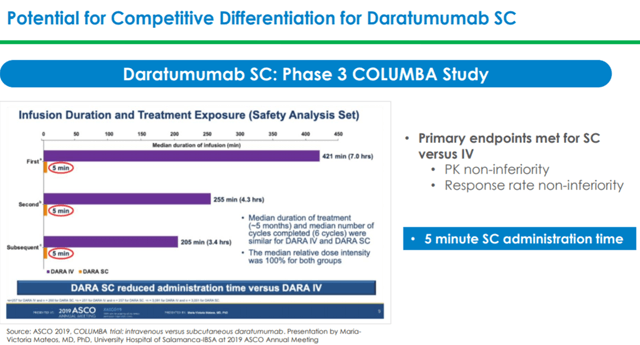

In July 2019, Johnson & Johnson submitted BLA (Biologics license application) and MAA (Marketing Authorization application) to FDA and EMA (European Medicines Agency) for approving Darzalex (Daratumumab) SC (subcutaneous) in MM (multiple myeloma) patients. These applications are based on results from the Phase 3 COLUMBA study where Darzalex SC was found to be non-inferior to Darzalex IV in relapsed/refractory MM patients.

In the COLUMBA trial, Darzalex SC demonstrated a much lower administration time of three to five minutes as compared to three to four hours required for the IV formulation. Darzalex SC also demonstrated a lower rate of infusion-related reactions reported at approximately 13% compared with approximately 35% for the IV formulation. Johnson & Johnson expects Darzalex SC to enable increased penetration of the drug in community settings and to ease drug administration by moving from a fixed-dosing to weight-based dosing.

Darzalex IV is expected to report sales of $3.4 billion in 2020 and $6.7 billion in 2024. These numbers represent the conversion opportunity for Darzalex SC. Piper Sandler analyst, Joseph Catanzaro, now expects Darzalex SC to witness rapid and near-complete conversion from Darzalex IV. He expects almost 75% of patients to switch from IV to SC formulation of the drug just one-year post-approval of Darzalex SC.

The fixed-dose combination of Perjeta and Herceptin is the next potential growth driver for Halozyme

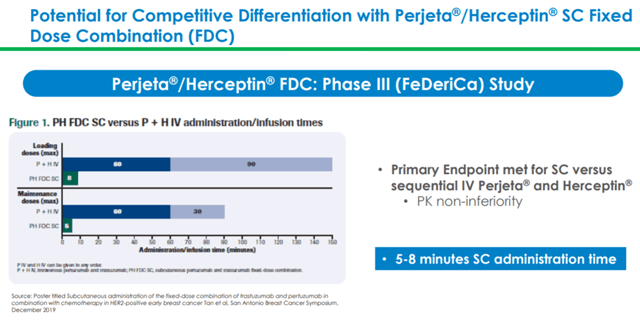

In February 2020, Halozyme Therapeutics announced FDA acceptance of the BLA for fixed-dose combination of Perjeta and Herceptin for subcutaneous administration using Enhanze drug delivery technology in combination with IV chemotherapy for eligible patients with HER2-positive early breast cancer. FDA has decided to announce its decision by October 18, 2020. Roche has also completed MAA submission to EMA. These applications are based on positive results from the Phase 3 FeDeriCa trial.

Analysts expect Perjeta to report revenues of $4.2 billion in 2020 and more than $5 billion in 2024. This is indicative of the growth potential of a fixed-dose combination of Perjeta and Herceptin subcutaneous formulation.

Investors should be wary of these risks

The growth prospects of Halozyme are tied intricately to the royalty and milestone payments associated with the Enhanze platform. The revenue growth rate will depend on new drugs advancing into the late-stage of clinical development as well as the company entering into new licensing deals. This, in turn, depends on the clinical and commercial success of the already partnered products. The company is thus exposed to a high degree of business concentration and R&D failure risk.

What price is right for the stock?

According to finviz, the 12-month consensus target price for Halozyme is $24.20. On February 5, Piper Sandler analyst, Joseph Catanzaro upgraded the company from “Neutral” to “Overweight” and increased the target price from $18 to 27. On January 27, Cantor Fitzgerald analyst Charles Duncan reiterated Overweight rating and increased the target price from $27 to $35. On January 9, BMO Capital analyst Do Kim upgraded the company from “Market perform” to “Outperform” and increased the target price from $17 to $24. On January 8, Goldman Sachs analyst Graig Suvannavejh initiated coverage of the company with a Buy rating and target price of $24.

The failure of the HALO-301 trial was definitely a jolt for the company. However, the pace at which Halozyme Therapeutics is restructuring itself towards profitability and cash flow growth is admirable. The company has recapitalized itself and now holds cash worth $421.3 million on its balance sheet. The company is now focusing on returning value to shareholders through share repurchases, a rarity in the biotech world. Halozyme Therapeutics has completed $200 million share repurchases in 2019 and is planning to complete $350 million of additional share repurchases under the $550 million three-year share repurchase program authorized by the company’s Board of Directors in November 2019.

In this backdrop, I believe that $24 is a fair target price for the company. The stock can thus be a good pick for retail biotech investors with above-average risk appetite and an investment horizon of at least one year.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment