Ignatiev

U.K. dividend aristocrat Halma (OTCPK:HLMAF) has seen its share price slide. I continue to like the business a lot but still regard its shares as overpriced.

Halma Continues to have Strong Growth Prospects

Halma turned in another set of record results last year. The profit was a record for the 19th consecutive year, while the dividend was raised by 5% or more (in this case, 7%) for the 43rd consecutive year. That is a solid performance all round yet again and the management deserves credit for an excellent performance even though the company has made a habit of it.

I continue to think that the Halma business model is highly attractive. It is in an area with strong, durable consumer need and pricing power. It has honed its acquisition model over many years. It has excellent pricing power (its net margin last year was 16.3%).

Looking back over the past decade it has grown revenue 8% on a compounded annual basis and basic earnings per share at 10% compounded. Not only that, but the dividend growth has actually been slower though still solid. That helps explain why the dividend is currently covered a conservative 3.5 times by earnings.

|

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

CAGR |

|

|

Revenue (£m) |

619 |

677 |

726 |

808 |

962 |

1076 |

1211 |

1338 |

1318 |

1525 |

7.9% |

|

Pretax profit (£m) |

129 |

140 |

154 |

166 |

194 |

214 |

246 |

267 |

278 |

316 |

9.4% |

|

Basic EPS (P) |

25 |

28 |

27 |

29 |

34 |

41 |

45 |

49 |

54 |

65 |

10.0% |

|

Dividend (P) |

10.4 |

11.2 |

12 |

12.8 |

13.7 |

14.7 |

15.7 |

16.5 |

17.7 |

18.9 |

6.2% |

Table calculated and compiled by author using data from company annual reports (some figures have been restated)

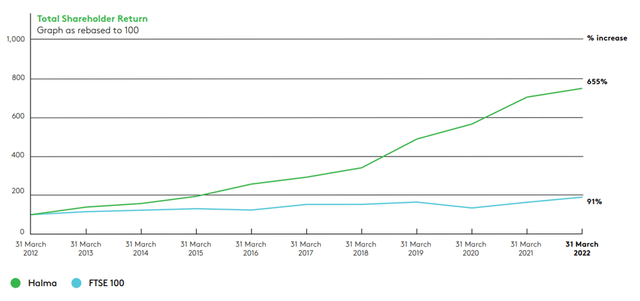

Unsurprisingly, this sterling business performance continues to be rewarding for long-term shareholders, as the following chart shows.

Halma shareholder return (company annual report 2022)

I think this model will continue to do well in the future. The end market should remain strong and Halma’s mix of brands, reputation, specialist services and repeat custom along with the necessity nature of the product should support ongoing profitability at an attractive level.

That does not mean there are not risks, though. Although the market for alarms and similar equipment is significantly driven by necessity, it could still well slow down amid an economic downturn as customers push back or cancel non-essential work.

The Dividend Story is Great but not Lucrative

As a dividend aristocrat, Halma gets a lot of attention. With a record of annual dividend increases stretching back over more than four decades, that is understandable.

But at the present share price, the dividend yield is only 0.9%. Even if the company continues to compound its dividend at the rate it has done over the past decade, the yield a quarter century from now will still only be 3.8%. A quarter of a century is a long time in which many things can go wrong, even for a dividend aristocrat. But even if they don’t, why wait 25 years for 3.8% yield when a number of blue chip FTSE 100 companies offer the same or better right now? Maybe the dividend reliability is lower than Halma (though maybe not: time will tell), but given what is available right now in the U.K. market, the Halma dividend yield just does not look attractive to me no matter how stellar the record of increases. That isn’t the company’s fault and I think management has done a great job at lifting the payout consistently. But at the current share price the yield does not seem attractive.

Valuation Still Looks Stretched

I wrote a year ago in Halma: Strong Performance Does Not Justify Current Valuation that the shares did not merit their valuation, since when the stock has fallen 29%.

After that fall and based on the most recent earnings, the current price-to-earnings ratio is now 34. I still consider that to be high even for a business of Halma’s quality and track record.

From here, where can the business go? Increasing revenues and earnings? It has done that very well over time and I think there is a high chance it will continue to do so in future. But will it step-change the growth rate? I see no reason for that. A P/E of 34 looks high to me for a growth story at the Halma level. I therefore see the shares as overvalued, hence my “sell” rating.

Be the first to comment