Donald Bowers/Getty Images Entertainment

One avenue for investors who are looking to generate attractive returns is to consider buying into companies that focus on owning and growing quality food or beverage brands. When consumers love a product like they love some of their favorite foods, it can result in attractive growth or, at least, attractive cash flows. One company that has not performed particularly well on the growth side but that has demonstrated the ability to improve its bottom line is a firm called The Hain Celestial Group (NASDAQ:HAIN). With a market capitalization of just $3.14 billion as of this writing, Hain Celestial is small enough that it could achieve attractive upside if the stars align. Having said that, the fundamental history of the company is complex and shares, at best, are fairly priced. Because of this, while the company may offer some upside, it’s likely that investors could find better returns elsewhere for the foreseeable future.

Taking a bite out of Hain Celestial

The name ‘Hain Celestial‘ may not mean much to most consumers. However, it is likely that you have tried or at least seen one of their brands. According to management, the company produces and sells organic and natural food products to various companies such as specialty and natural food distributors, supermarkets, natural food stores, through online channels, and elsewhere. Operationally, the company sells its products to customers in over 80 countries globally. Though it is worth noting that 56% of its revenue still comes from North America.

The brands that Hain Celestial produces include, but are not limited to, Celestial Seasonings, Clarks, Cully & Sully, Earth‘s Best, Ella‘s Kitchen, Frank Cooper‘s, Gale‘s, and many more. Specific product categories here include tea, snacks, and grocery products. Collectively, its tea products make up about 7% of revenue. Snacks comprise 16%. Meanwhile, the big category would be grocery products, representing 67% of sales last year. On top of this, the company also sells personal care products under brands like Alba Botanica, Avalon Organics, JASON, Live Clean, and Queen Helene. All combined, these personal care products make up about 10% of the company’s sales.

At first glance, the operating history of Hain Celestial is anything but great. Between 2019 and 2021, for instance, sales of the company declined, dropping from $2.11 billion to $1.97 billion. Many investors might chalk this up to weakness caused by the pandemic. However, declines for the firm have continued into the 2022 fiscal year. During the first six months of the year, sales came in at just $931.8 million. That represents a decline of 9.3% compared to the $1.03 billion generated one year earlier. Despite this weakness, management has said the overall revenue for 2022 should increase by the low single-digit rate. Though it seems likely that one driver of this expansion will be the company’s recently completed acquisition of That‘s How We Roll, the parent company of ParmCrisps and Thinsters. That business cost investors $259 million but generated $108 million in sales in the 12 months ending September 30th of 2021. On top of that, that business had been generating sales growth in the mid-teens.

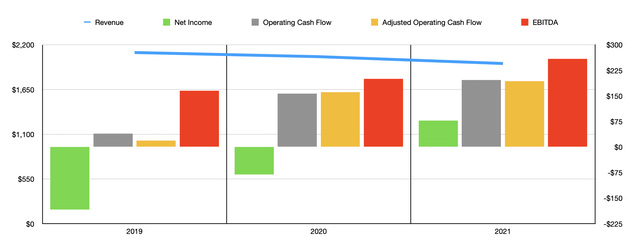

Where things get interesting is on the company’s bottom line. Even though revenue has been on a constant decline, profitability for the company has largely improved. The company went from generating a net loss of $183.3 million in 2019 to generating a profit of $77.4 million in 2021. To square this circle, we should dig a bit deeper into the numbers. What you find is that, if you exclude restructuring spending and impairments, operating profits for the company have been growing. This adjusted operating profit figure was $71.4 million in 2019. By 2021, it expanded to $183.6 million. As a percent of sales, the improvement was from 3.39% to 9.32%. Digging deeper still, we see that this improvement was the result of more attractive gross margins and lower selling, general, and administrative costs relative to sales. Naturally, this spilled over into other profitability metrics for the company. Operating cash flow went from $39.3 million to $196.8 million. If we adjust for changes in working capital, the improvement was even greater, with the metric expanding from $19.2 million to $193.6 million. Meanwhile, EBITDA for the company grew from $165.1 million to $258.9 million.

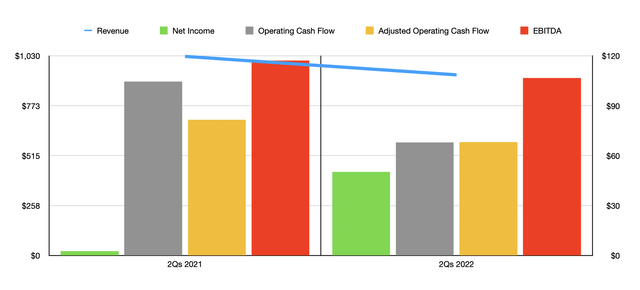

In one respect, this improvement continued into the 2022 fiscal year. Net profits for the first six months of the year came in at $50.3 million. That compares to the $2.6 million generated one year earlier. Other profitability metrics, however, did suffer. Operating cash flow dropped from $104.5 million to just $68 million, while the adjusted equivalent of this went from $81.6 million to $68.1 million. Finally, EBITDA for the business declined from $117.1 million to $106.6 million. So far this year, the company has seen its gross margin decline and experienced a rise in selling, general, and administrative costs. Some of these changes can be chalked up to supply chain issues, inflation, rising labor costs, and other related items. However, management also said that transactions costs associated with its M&A activities is also part of the issue.

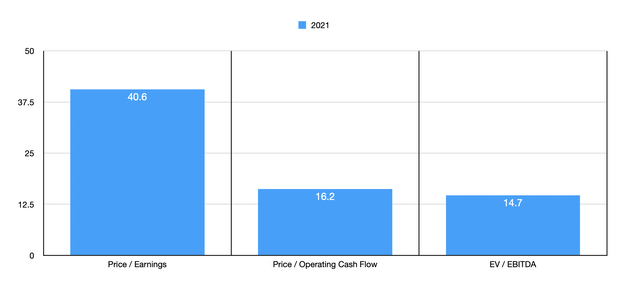

Management has not provided any guidance for the 2022 fiscal year. But to be generous, let us assume that financial performance will recover in the second half of the fiscal year, resulting in flat profits relative to 2021. Even in this generous scenario, shares of the company don’t look much better than fairly valued. On a price-to-earnings basis, the company is trading at a multiple of 40.6. In this respect, shares are incredibly expensive. But as we saw already, net profits are improving in 2022. In other ways, shares just look fairly priced, with a price to adjusted operating cash flow multiple of 16.2 and an EV to EBITDA multiple of 14.7. To put this in perspective, I decided to compare the company to five similar firms. On a price to operating cash flow basis, these companies ranged from a low of 4.7 to a high of 89.1. Meanwhile, using the EV to EBITDA approach, the range was from 3.5 to 43.3. In both cases, two of the five companies were cheaper than our prospect.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| The Hain Celestial Group | 16.2 | 14.7 |

| Cal-Maine Foods (CALM) | 89.1 | 43.3 |

| Sanderson Farms (SAFM) | 4.7 | 3.5 |

| Hostess Brands (TWNK) | 15.8 | 16.2 |

| Pilgrim’s Pride Corporation (PPC) | 19.0 | 14.5 |

| Mondelez International (MDLZ) | 21.7 | 17.8 |

Takeaway

Truth be told, if Hain Celestial were trading at the multiples that it is but experiencing consistent and steady revenue growth and we weren’t seeing the weakening in cash flows the company is experiencing in the current fiscal year, I would rate this a ‘buy‘ prospect. But even though management is improving the company’s profitability, I am unsettled by the continued decline in revenue. This, combined with the renewed pain caused by supply chain and other issues, leads me to be more neutral on the business, ultimately resulting in a ‘hold‘ rating from me at this time.

Be the first to comment