Marcus Lindstrom

Investment Thesis

GXO Logistics, Inc. (NYSE:GXO) is a contract logistics services business that is expanding its roots into the European Union and the United Kingdom with the recent acquisition deal and new contracts. I will analyze the effects of these factors on the company’s future growth. I believe this new expansion plan will act as a primary growth factor for the company in the coming years, and we can expect exponential growth for GXO.

Company Overview

GXO Logistics, Inc. offers pure-play contract logistics services such as warehousing and distribution, order fulfilment, e-commerce, reverse logistics, and other supply chain services. The business structure of the GXO is asset-light and focuses on high returns and strong free cash flow to expand into new verticals by investing in capacity and technological strengths. The company is well positioned in the industry to benefit from the tailwinds such as growth in customer demand for e-commerce and omnichannel retail and rising consumer demand for warehouse automation, which every player in the logistics industry is experiencing. The company is currently operating in 28 countries and has more than 900 warehouse locations. It has reported $7.9 billion in revenue in FY2021 with more than 200 million square feet of warehouse space. The company has a 90% client retention track record, and it has also added more than 11 new customers to its client list in Q1 FY2022, which will be $217 million in incremental revenue. GXO has many projects in the pipeline, out of which 70% are from E-commerce, omnichannel retail & consumer technology, 10% are from food and beverage, 6% are from consumer-packaged goods, and 14% are from industrial & other verticals. The company is also strengthening its position in new geographies by partnering with existing customers or by opening its warehouses.

Strengthening position in Europe

GXO is currently focusing on strengthening its position in all the verticals and geographies. To increase its hold in the UK market, the company has acquired Clipper Logistics plc, a Leeds-based company. This deal will integrate two logistics industry leaders with synergized service offerings, client portfolios, and footprints in the European Union and United Kingdom region. The acquisition of Clipper will help the company to enter Germany and Poland, and it will also increase its presence in life sciences, reverse logistics, and returns management, which is considered as a key growth factor for the company. The company has already announced its intention to expand its market share in the warehouse-related logistics market in Germany in the next five years. The logistics market of Germany is currently worth $20 billion in annual turnover with a growth rate of 3.5% per year. The combination also strengthens GXO’s position as an industry leader in ESG by incorporating Clipper’s developed reverse logistics and circular economy products as well as its steadfast internal aims to reduce waste and carbon emissions. I believe the company will experience cost synergy and enhanced productivity after 2-3 years. GXO has also entered France with the contract to manage the first distribution center of Fluidra in France. Fluidra is in the pool and wellness industry, and it is planning to use the GXO’s facility to enhance the service and quality of deliveries in France and Belgium.

I think this expansionary move by the company will be a big positive for the company in the coming years. I believe the company will continue strengthening its position in new geographies as it has a strong free cash flow position, which will be a significant advantage in the secular growth industry. I think these factors’ effects will be seen in the next two years.

Financials

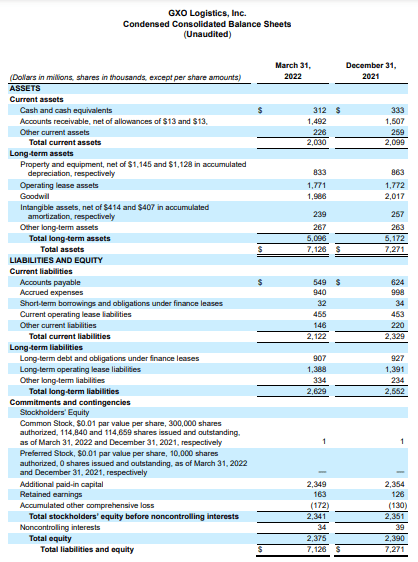

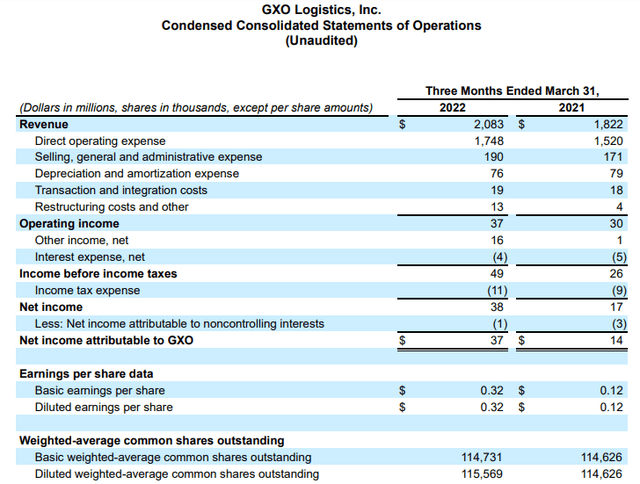

GXO reported strong quarterly results. The company reported total revenue of $2.08 billion, a jump of 14% compared to $1.82 billion in Q1 2021. The attractive part about this revenue growth is a 19% increase in organic revenue. As per my analysis, the main factor driving the revenue growth is the robust demand leading to high order pipeline. The selling, general, and administrative expenses increased 15% from $1.52 billion to $1.75 billion as a result of increased oil and labor cost. The operating income was reported at $37 million, a 24% increase over the last year’s operating income of $30 million. The total net income was reported at $38 million, a significant 124% increase from $17 million in the same quarter last year. The net income increase was majorly driven by other income segments’ increase from $1 million to $16 million. The company reported diluted EPS of $0.32, a solid 167% increase from the Q1 2021 EPS of $0.12. The company reported record levels of sales pipeline of $2.5 billion, a 20% increase from the corresponding quarter last year.

I believe the organic revenue increase is the biggest positive that we can take from Q1 2022 results, which reflects a consistent robust demand. The company raised the guidance for FY22 both in terms of revenue and EPS growth. The company raised the organic revenue growth to 11-15% y-o-y and adjusted diluted EPS to $2.70-$2.90, an effective 29-39% y-o-y increase. As per my analysis, the estimates are conservative, and we can see an even stronger FY22 given the company’s expansion in Europe and the United States.

Malcolm Wilson, Chief Executive Officer of GXO, stated,

Our stellar top- and bottom-line performance this quarter and record new business wins are a testament to the value of GXO’s game-changing solutions, the strength of our contractual business model and the accelerating demand for first-time outsourcing, especially from e-commerce and omnichannel customers. Across our business in the first quarter, we saw solid volumes and growth in all of our verticals. Looking to the remainder of 2022 and beyond, we continue to benefit from multi-year revenue visibility, exceptional growth opportunities with new and existing customers, and a predictable, contractual business model. Our new business wins, combined with our record sales pipeline and continued high revenue retention rate, allow us to raise our 2022 organic revenue growth guidance to 11-15% and introduce an adjusted diluted EPS guidance of $2.70-$2.90 for 2022 implying growth of between 29% and 39%.

SEC: 10Q GXO

The company has strong liquidity of $1.2 billion, including net debt of $939 million and cash and cash equivalent of $300 million. This will help GXO in expanding its operations through acquisitions and investments. To better understand the company’s position, let us look at the company’s net leverage. The company has net leverage of 1x. Basically, the net leverage is the company’s net debt divided by the 12 months trailing adjusted EBITDA. The ratio of 1x is average as per the industry standards.

Key Risk Factor

Increased labor and fuel prices: The company is facing a significant increase in operational costs primarily due to higher labor and fuel charges. The inflation has resulted in contracted profit margins for the firm. The further rise in labor or fuel cost can severely affect the company’s profit margins in the future. GXO has managed to mitigate this risk till now by increasing service charges for the customers.

Valuation

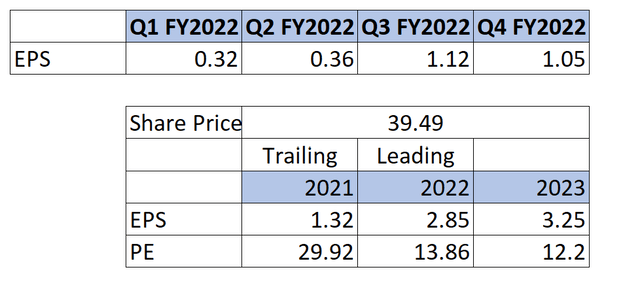

GXO has a market cap of $4.68 billion. The company is currently trading at a share price of $39.49, a YTD decline of 56%. GXO has seen a sharp decline in the share price over the past six months and looks attractive at the current price level. GXO is trading at a PE multiple of 13.86x with FY22 EPS estimates of $2.85, which makes the company undervalued at current price levels, and we can see a significant upside from current levels. The company has great growth prospects and a robust sales pipeline; considering these factors, I think the company can see a 30% upside with a target price of $52 and a PE multiple of 18x. I believe the company is a growth investment opportunity and hence it will trade at a higher PE multiple that its traditional PE multiple of 13.86x. Given the growth opportunity that the company presents I believe the company can trade at a 18x PE multiple in future.

Conclusion

GXO is on a consistent and stellar growth track with increasing organic revenue. The company also has a strong sales pipeline of $2.5 billion, which reflects the future growth potential of the company. The planned expansion in the European region will further boost revenue growth for the company. The company faces the risk of higher fuel and labor costs, but the company has successfully mitigated this risk till now. I believe the company has a favorable risk-reward ratio. I assign a buy rating for the stock after analyzing all these factors.

Be the first to comment