AntonioSolano/iStock via Getty Images

A holding company must invest and divest at the right time. Griffon Corporation (NYSE:GFF) is a long-time holding company with a varying success rate over its long 54-year performance on the NYSE. Recently, dissatisfaction with the longstanding board of directors and management’s decision-making ability has been vocalised. Voss Capital, an activist investor, nominated and earned a spot on the board through a proxy contest in February 2022 by a landslide vote, of which 80% were non-insider shares. This catalyst for change has created uncertain but exciting times. The new independent board member aims to improve shareholder value through various strategic alternatives.

A small-cap stock at a $1.619 billion market cap, a strong performance in Q3 2022, an upward trend in stock price over the last six months, various analysts recommending the stock as purchase-worthy, and a high 1-year price target estimate 47.95% above the current stock price. There are indeed reasons to believe there is upside potential for GFF. Although unsure of the exact strategic changes, wary of increased supply chain and labour costs across subsidiaries, and cautious of the industry’s sensitivity to economic market uncertainty, investors may still want to take a bullish stance on this seemingly undervalued company.

Introduction

GFF, founded by businessman Helmuth W. Waldorf in 1959, is a holding company headquartered in New York City and trading on the NYSE since 1961. It operates by acquiring and developing diverse and wholly owned subsidiaries in various sectors. The focus areas have slowly changed over the years, but the leading sectors have been conglomerates, building products, aerospace, defense telecommunications, garage doors, and plastics. Although defense, telecommunications, and plastics previously grew the company, today, this is not the case. We saw the plastics section sold off in 2018, and most recently, its 60-year established telephonic subsidiary was discontinued and sold to TTM for $330 million in cash. It employs just over 4000 employees worldwide.

Residential, Industrial and Commercial Products (Griffon Presentation 2021)

The company currently has two principal subsidiaries:

Firstly, the Consumer and Professional Products (CPP) division is a top manufacturer and supplier of consumer tools, such as residential fans, storage, and products connected to indoor and outdoor lifestyle, and professional devices, such as industrial and commercial fans and other organizational products across North America. It has a portfolio of brands, including AMES, Hunter, True Temper, and ClosetMaid.

Secondly, there is the Home and Building Products (HBP) division that Clopay Corporation operates, founded in 1964, which focuses on garage doors and rolling steel doors for residential and commercial purposes. Home retail centres and dealers sell the products across North America. The portfolio of brands includes Clopay, Ideal, Holmes, and CornellCookson, acquired in 2018 specifically for rolling steel doors and grille products.

Revenue Divisions at Griffon (Griffon Presentation 2021)

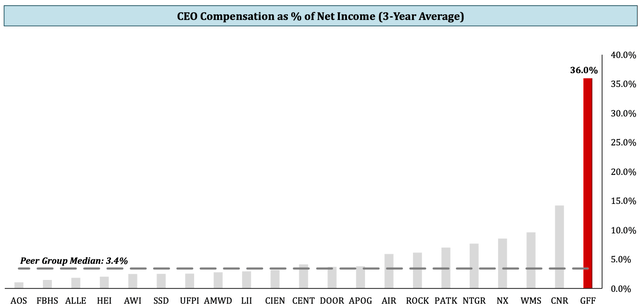

GFF has had a long-term and close-knit set of directors and managers. Executives receive well above industry average salaries and bonuses, especially compared to peer companies, as seen below in the table comparing CEO compensation across many different organisations.

CEO Compensation Across Peer Group (Voss Capital Presentation 2021)

There are signs of change, with a more independent board member pushing for shareholder value and willing to make significant strategic moves to achieve these.

Financials and Valuation

Since 2017 there has been a noteworthy strategic revival, with investors seeing yearly earnings per share grow by 65%. The company has a long-term and stable – although low – dividend payment, of which the most recent fiscal year was $0.36, an increase of 16% per annum since 2012. This year, pushed on by the current board changes, GFF is paying out a special dividend of $2 and has completed a debt prepayment of $300 million this past quarter.

To maximise shareholder value by all means possible. We have seen significant changes, including completing the sale of its 61-year-old ‘Telephonics’ business. The sale of Telephonics to TTM Technologies (TTMI) was for $330 million in cash in June 2022, improving the company’s cash flow. Furthermore, the company acquired Hunter Fan Company for $845 million, which was higher than 35% of its enterprise value at year-end 2021. The action was criticised as a poor management decision by Voss Capital and built momentum for a proxy vote in February 2022.

Nonetheless, the Q3 2022 results are promising for the changes that have taken place, and the management team is confident for the rest of the year, announcing that a full year revenue of – at minimum – $475 million EBITDA before unallocated costs is realistic. Furthermore, management believes leverage will be under 3.0 times net debt to EBITDA. GFF increased its revenue by 31% compared to the prior year’s third quarter to $768.2 million. The acquisition of Hunter added $105.8 million to this total. Income from continuing operations was $0.98 per share, which was 350% of that of the prior year. Adjusted EBITDA of continuing operations increased by 124% to $134.8 million YoY.

If we have a look at the results per segment:

1. Consumer and Professional products (CPP)

CPP revenue is the second largest division with $362.6 million, an increase of 12% YoY. The most significant growth is from the Hunter acquisition at $105.8 million. Adjusted EBITDA decreased by 3% to $28.4 million. If we remove Hunter, EBITDA decreased by 61%. The reason is the reduction in sales volume and increased supply chain, material, and labour costs. However, the company has benefited from the mix of products and higher prices. Mention-worthy is that Q3 2022 saw $6.5 million in costs related mainly to Hunter because of COVID and global supply chain disruptions.

2. Home and Building Products (HBP)

HBP is the largest division by revenue and increased by 56% to $405.5 million. The reason for this is the increase in pricing and the mix of residential and commercial products. This division increased; however, supply chain disruption and labour difficulties offset the benefits. Q3 2022 HBP Adjusted EBITDA increased you by 184% to $119.8 million. As said above, EBITDA again benefited from the increased revenue but was negatively impacted by an increase in material, labor and transportation expenses.

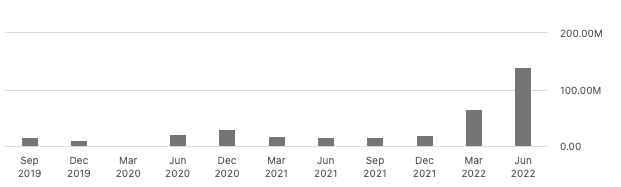

We can see in the table below that GFF’s net income has been on an upward path since December 2021, in line with the company’s forward-moving strategic actions. Earnings per share have also beat expectations for the last three quarters.

Griffon Corp Quarterly Net Income (Seeking Alpha)

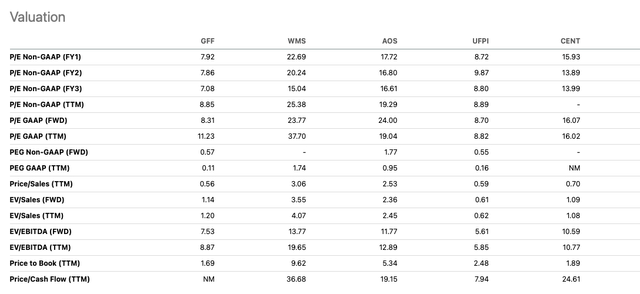

GFF rated as a Strong Buy by various Wall Street investors, a Buy by Seeking Alpha’s Quant Rating, and a Strong Buy rating on Zacks. It also appears to be undervalued if we compare it to some of its peers in the table below. We see a low price-to-sales ratio of 0.56. The EV/EBITDA also indicates the company’s value, especially for a holding company, to take in the equity and debt elements. It is undervalued compared to the majority of its competitors.

Relative Valuation Compared to Peers (Seeking Alpha)

Risks

Some of the risks we should be aware of are the following. Firstly, GFF relies on very few large customers for most of its revenue. For example, Home Depot accounted for approximately 19% of consolidated revenue at fiscal year-end 2021. Secondly, as a global company, supply chain disruption due to international political and other factors has impacted all of the subsidiaries and is expected to continue impacting margins; until now, the company has benefited from its pricing and mixed offerings. Thirdly, economic uncertainty is impacting consumer and business spending. GFF is linked to the housing and commercial property market, which is sensitive to changes in the market. Lastly, the company has a high debt to repay ratio. Although it has lowered the leverage to 2.8 net debt to EBITDA at fiscal year-end 2021, the numbers remain higher than the industry average and impact the ability to invest in the future.

Future and Final Thoughts

We have seen a change in the mindset of GFF over the last few years from a decentralised holding company to what can be seen more as a strategic purchaser and grower of businesses. With Voss Capital adding a gentle push for GFF to stay aligned to shareholder value, it looks like there are exciting times ahead for this long-term established company. With a solid and upward trending performance and management’s confidence in reaching the end of the year’s targets, I believe investors may want to take a bullish stance on this company.

Be the first to comment