Eoneren/iStock via Getty Images

Greenidge Generation Holdings Inc. (NASDAQ:GREE) recently received a lot of financing, and management informed that new facilities will be ready in 2022. If capacity continues to increase, and GREE grows like the cryptocurrency mining market, revenue growth and FCF will likely trend north. I dislike the way the company presented its adjusted EBITDA figures. In addition, I see several risks from regulators. With that, I believe that GREE will draw significant attention of investors, as recent news suggest that there is a growth potential in the company’s business model.

Greenidge Generation: New Financing And New Facility To Be Ready In 2022

Greenidge Generation Holdings Inc. runs an integrated cryptocurrency datacenter and power generation business model.

The company claims to be running a vertically integrated facility in upstate New York and a facility in South Carolina. In my view, management released very beneficial announcements about new investments in capital expenditures.

First, management reported a $264 million investment for developing a new facility in Spartanburg, South Carolina. In my opinion, investors will likely notice the investments in 2022, because management expects to have the first phase of the project to be closed in the second half of 2022. If sales pick up in the second half of 2022, the stock price could trend north:

The $264 million investment will create 40 new tech-sector jobs. Located on 175 acres in Spartanburg, Greenidge’s South Carolina operations will house some of the most advanced and efficient cryptocurrency mining computers commercially available. Greenidge expects the facility to have at least 100 megawatts of datacenter capacity when fully developed. The first phase of the project is expected to be online in the second half of 2022, with additional expansions to reflect this investment through 2025. Source: Greenidge Generation Closes Over $100 Million in New Financings to Fund Expansion Outside of New York | Greenidge Generation Holdings Inc.

Besides, Greenidge Generation explained a bit how the new facilities are going to be financed. In a recent press release, the company noted $108 million in new finacings to finance its 2022 growth initiatives. In my view, with fresh cash in hand and new projects, the demand for the stock in 2022 could increase:

Greenidge Generation Holdings Inc. has closed two financings for approximately $108 million in gross proceeds in order to provide the company with additional liquidity to fund its 2022 growth. Source: Greenidge Generation Closes Over $100 Million in New Financings to Fund Expansion Outside of New York | Greenidge Generation Holdings Inc.

Impressive Quarterly Results, But I Dislike The Calculation Of The Adjusted EBITDA

The most recent quarterly results were quite impressive. Greenidge produced 168% more BTC than that in the fourth quarter of 2020. The increase in the number of miners is also quite relevant. The company is talking about 17,300 miners, which is more than two times the number of miners in 2020. In my view, if future performance continues at the same level, both the sales growth and Greenidge’s valuation will increase:

For the three months ended December 31, 2021, Greenidge produced 609 BTC, an increase of 168% from the fourth quarter of 2020. For the year ended December 31, 2021, Greenidge produced 1,866 BTC. Greenidge ended the year with approximately 17,300 miners delivered with an aggregate hashrate of 1.4 EH/s. This compares to approximately 6,900 miners with an aggregate hashrate of 0.4 EH/s at the end of 2020. Source: Greenidge Generation Reports Production and Mining Results for December 2021 | Greenidge Generation Holdings Inc.

With regards to the numbers to be delivered for the year ended 2021, the guidance was also quite satisfactory. Including cryptocurrency mining revenue, power and capacity revenue, and services, the company expects to deliver 2021 sales of $107 million:

Cryptocurrency mining revenue is expected to be approximately $88 million, Power and capacity revenue is expected to be approximately $9 million, and Services and other revenue is expected to be approximately $10 million for the full year 2021. Source: Greenidge Generation Reports Production and Mining Results for December 2021 | Greenidge Generation Holdings Inc.

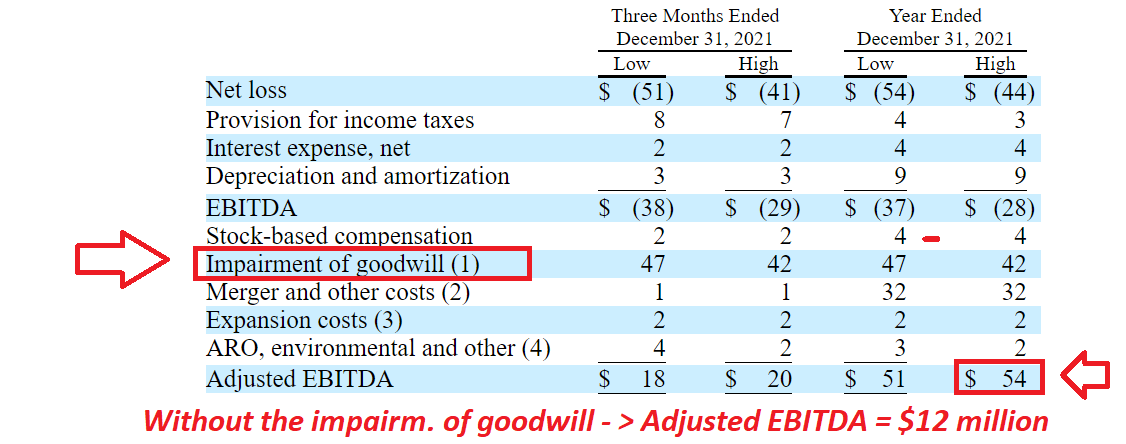

With that about Greenidge’s revenue growth, I dislike the way the company described its Adjusted EBITDA. In the year ended December 31, 2021, management believes that its EBITDA should be between -$37 and -$28 million. With that, Greenidge Generation gave a formula for its adjusted EBITDA, which included impairment of goodwill worth $47-$42 million, stock based compensations, merger costs, and other costs that I believe are extraordinary items. If we include these figures, the adjusted EBITDA stands at close to $54 million. The difference between the adjusted EBITDA and the EBITDA appears too large not to mention it:

8-K

“Adjusted EBITDA” is defined as EBITDA adjusted for stock-based compensation and other special items determined by management, including, but not limited to, acquisition related expenses, business development, fair value adjustments for certain financial liabilities (including asset retirement obligations), costs associated with debt and equity transactions, and impairment charges as they are not indicative of business operations. Source: 8-k

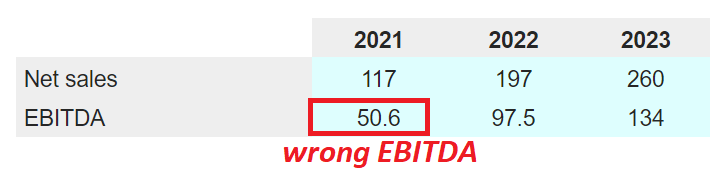

There is another mistake that is not at all related to the Greenidge Generation. Investment websites all over the internet are claiming that the company’s 2021 EBITDA is equal to close to $50 million. They fail to mention that the figure used is actually the adjusted EBITDA. If traders don’t do enough diligence, in my view, misinformation could lead to extremely overvalued marks.

Marketscreener.com

Valuation If Greenidge Grows Like The Cryptocurrency Mining Market

Under normal circumstances, Greenidge Generation will likely increase the number of cryptocurrency mining devices. Keep in mind that management expects to increase its capacity from the second half of 2022. Besides, mining efficiency may also increase, which will likely lead to more EBITDA margin:

This is a transformative year for Greenidge as we expect to more than triple our datacenter capacity to 4.7 EH/s, with the vast majority of the capacity expansion focused outside of the company’s original site in New York. Three months after commencing operations at our Spartanburg location, the facility represents more than 15% of the Greenidge’s aggregate hash rate. Source: Greenidge Generation Closes Over $100 Million in New Financings to Fund Expansion Outside of New York | Greenidge Generation Holdings Inc.

Under this case scenario, I also expect that Greenidge Generation will obtain sufficient liquidity to receive the mining machines ordered in 2022. Note that by the Q3 2022, management promised to receive 29,000 miners more:

Greenidge also doubled its recent order of S19j Pro mining machines from Bitmain to 22,500 units. This brings the firm’s total order with Bitmain to 29,000 miners, which are to be delivered by the third quarter of 2022. Source: Greenidge Generation to Expand Into Texas, Acquire South Carolina Site

Under the best case scenario, I assumed that Greenidge will report revenue growth close to that of the Cryptocurrency Mining Market, 28.5% CAGR. According to Brandessence Market Research, The Cryptocurrency Mining Market size reached $2285.4 million in 2021:

The Cryptocurrency Mining Market is growing at robust CAGR of 28.5%, and reach size of USD 5293.9 Million by end of Forecast 2028. Source: At 28.5% CAGR, Cryptocurrency Mining Market Size to hit USD 5293.9 Million to 2028.

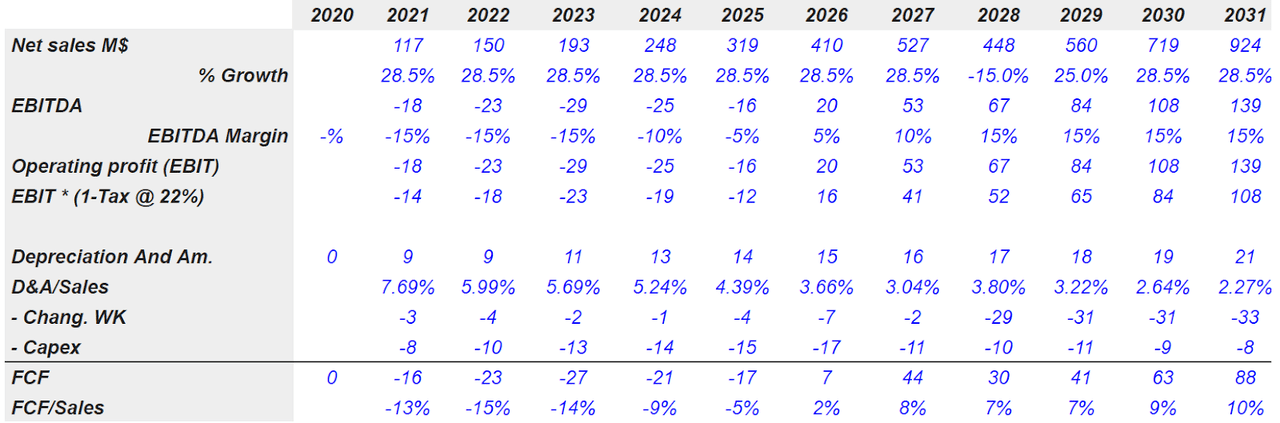

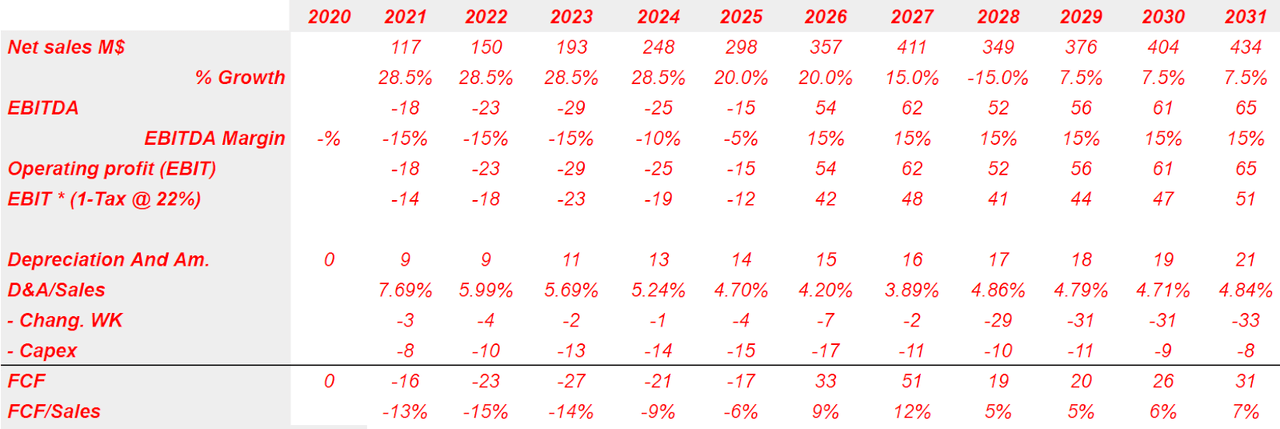

I also took a look at the peers and their sales growth and FCF margin to assess the future of Greenidge. In my view, in the best case scenario, Greenidge could grow at approximately 28.5% from 2022 to 2031, and report an EBITDA margin of 5%-15% from 2026 to 2031. If we also assume a D&A/Sales ratio of 7%-2% and conservative capital expenditures, the FCF margin could reach even 10% in 2031. My results include positive free cash flow from 2026 and almost $90 million in 2031:

Author’s Figures

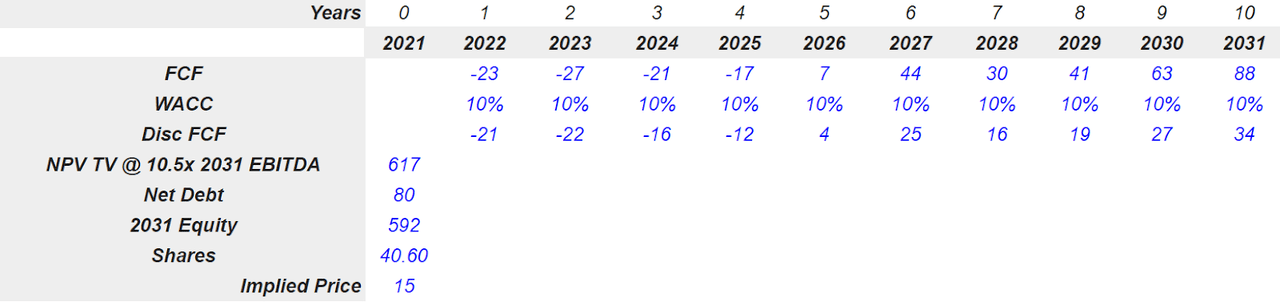

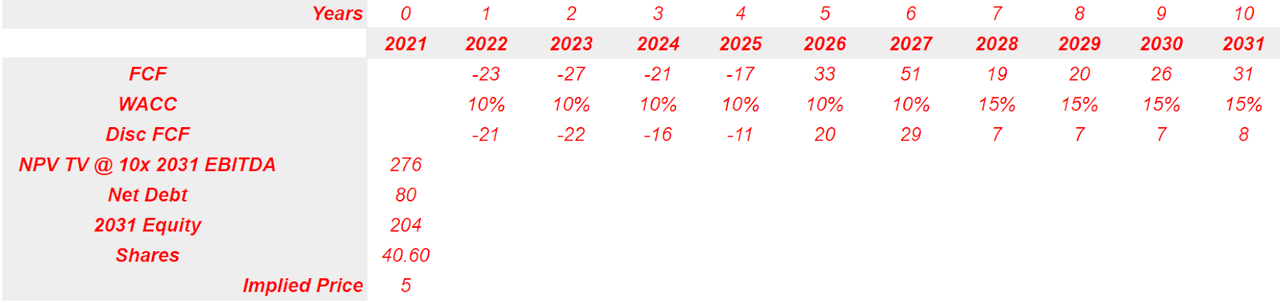

Under the previous satisfactory conditions, I also included a WACC of 10% and an exit multiple of 10.5x, which implied a valuation of $15. Yes, under the conditions depicted in this case scenario, the company would be a buy:

Author’s Figures

Regulatory Risks And Increase In Transaction Fees Would Imply A Valuation Of $5 Per Share

Greenidge Generation could suffer significantly if regulators commence passing new laws to control cryptocurrency mining. In the worst case scenario, I envision taxes on cryptocurrencies, or more pressure on the taxes paid by Bitcoin (BTC-USD) owners. As a result, the demand for cryptocurrencies could decline, which would lead to a decline in the valuation of BTC. In this case scenario, the demand for Greenidge Generation’s stock could diminish.

If the award of new digital assets for solving blocks declines, and transaction fees decline too, miners may decide to stop their activities. In that scenario, the company may report less miners, which would lead to a decrease in Greenidge’s revenue growth.

Greenidge Generation grew significantly after the acquisition of SPRT. Unfortunately, Greenidge had to report an impairment of goodwill because the transaction was not as profitable as expected. In the future, management may try to engage in new acquisitions. If they fail too, investors may decide to leave the company. The demand for the stock would decline, and the WACC will likely increase.

In the worst-case scenario, Greenidge Generation would enjoy sales growth of 28.5% for a few years, but then sales growth would decline rapidly. I assumed sales growth of 7.5% y/y from 2029 to 2031. Also, with an EBITDA margin of 15%, 2031 NOPAT should be close to $50 million, and 2031 FCF should be $30 million:

Author’s Figures

If the company delivers less sales growth than peers, Greenidge will see an increase in its cost of equity as investors may sell some shares. I used a WACC of 10% from 2022 and 15% from 2028 to 2031. With an exit multiple of 10x, the implied equity would be almost $205 million, and the implied price should be $5:

Author’s Figures

Dual Class Equity Structure

Notice that in my calculation, I used the share count obtained from summing both the class A shares and the class B shares. Let’s say that class B stockholders receive ten votes per share, and class A shareholders receive only one vote. It appears clear that minority shareholder will not be able to change the composition of the Board of Directors or the management if the company does not perform:

As of November 12, 2021, the registrant had 11,605,205 shares of Class A common stock, $0.0001 par value per share, outstanding and 29,040,000 shares of Class B common stock, $0.0001 par value per share, outstanding. Source: 10-Q

Holders of Greenidge’s class A common stock are entitled to one vote per share. Holders of class B common stock are entitled to ten votes per share. Class A and class B shares issued and outstanding as of September 30, 2021 are 9,627,705 and 29,040,000, respectively. Source: 10-Q

Balance Sheet

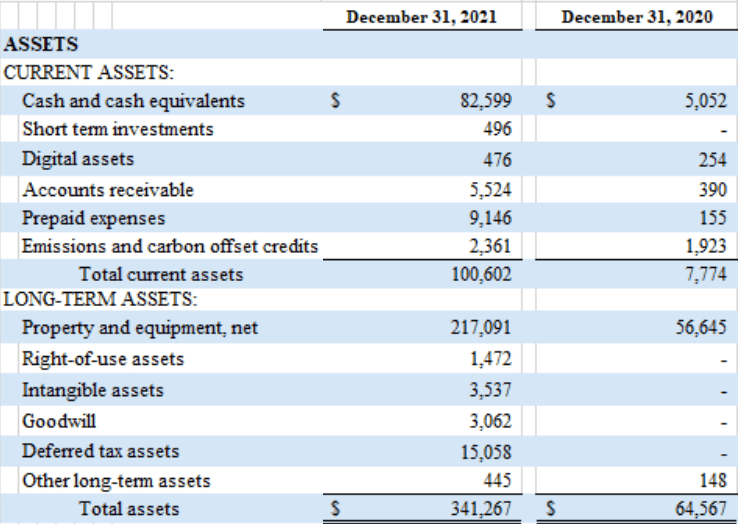

In December 2021, Greenidge Generation’s asset/liability ratio was equal to more than 2.6x. Greenidge also managed to receive a loan of $81 million very recently, so I believe that financial actors believe in the solvency of Greenidge Generation:

On March 21, 2022 the Company entered into a Master Equipment Finance Agreement with NYDIG ABL LLC, as lender, whereby NYDIG agreed to lend to the Borrowers approximately $81,000,000 under loan schedules that were partially funded on March 21, 2022 and will continue to be funded to finance the acquisition of certain bitcoin miners and related equipment. Source: Press Release

Most Recent Quarterly Report

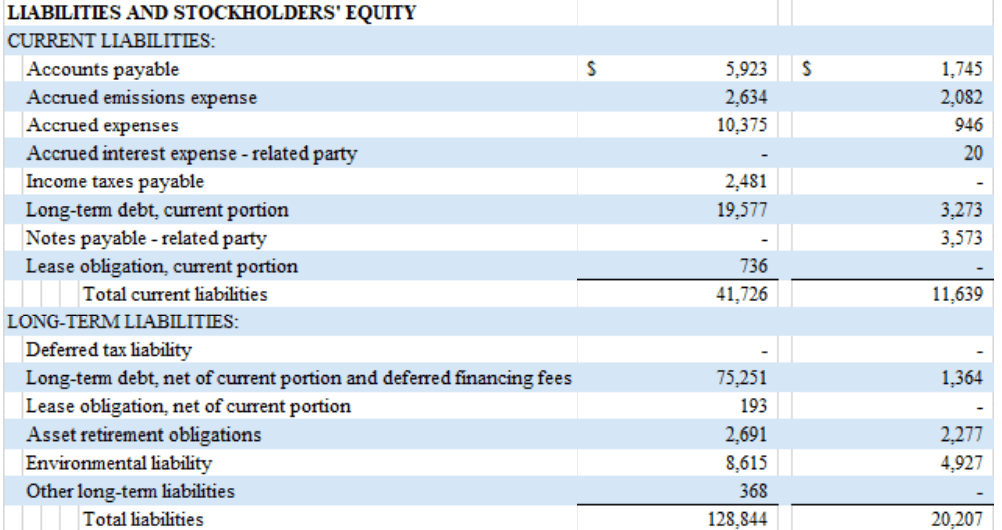

In December 2021, the liabilities were equal to only $128 million, and Greenidge reported debt worth approximately $94.7 million. In my opinion, what matters here is not whether the company will be able to pay its debt financing. What matters is whether the company will be able to sell sufficient equity to make its cryptocurrency mining business deliver FCF in the future:

Most Recent Quarterly Report

Conclusion

With new financing obtained from bankers, and new facilities expected to be ready in 2022, in my view, many investors will have a look at Greenidge. The company’s EBITDA is right now negative. However, with the cryptocurrency mining market growing at more than 28.5%, in my opinion, Greenidge Generation will likely deliver sales growth and free cash flow in the coming years. Under my DCF model, in the best case scenario, the company is worth $15. With that, the company is not for everybody. We could be waiting for a long time to see positive FCF margins, and the stock price could be extremely volatile. In my view, the stock is not for conservative individuals.

Be the first to comment