PM Images/DigitalVision via Getty Images

Introduction

When the calendar rolled over to 2022, it seemed that Green Plains Partners (NASDAQ:GPP) was set for a quiet year ahead, as my previous article discussed. Now that the end of the year is almost here, thus far this was the case with unitholders sitting back and collecting a very high distribution yield that is currently near 15%. As we begin looking at the year laying ahead, thankfully it seems that all indicators are looking up for 2023, as discussed within this follow-up analysis.

Coverage Summary & Ratings

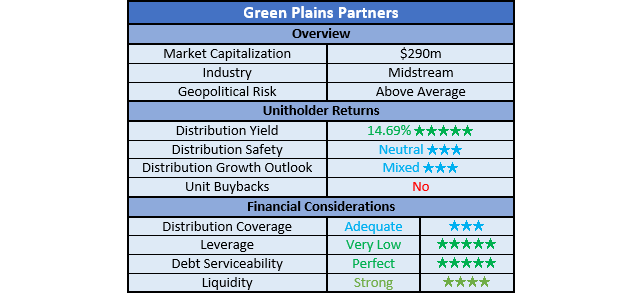

Since many readers are likely short on time, the table below provides a brief summary and ratings for the primary criteria assessed. If interested, this Google Document provides information regarding my rating system and, importantly, links to my library of equivalent analyses that share a comparable approach to enhance cross-investment comparability.

Author

Detailed Analysis

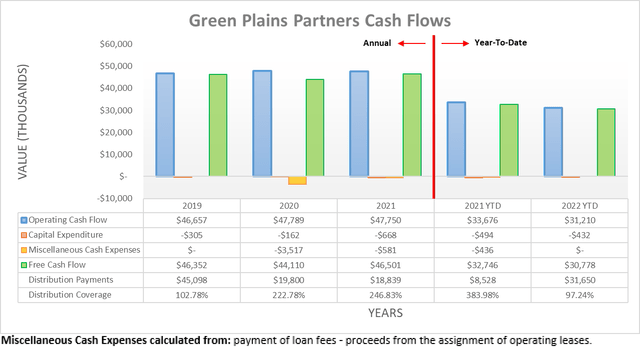

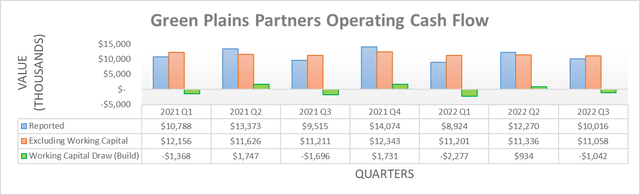

Despite the otherwise turbulent times during the last few years, they have once again provided steady cash flow performance during the first nine months of 2022 with their operating cash flow landing at $31.2m and thus only down slightly year-on-year versus their previous result of $33.7m during the first nine months of 2021. Whilst this technically saw their free cash flow of $30.8m during the first nine months of 2022 falling ever-so-slightly below their accompanying distribution payments of $31.7m, this minor $0.9m gap only resulted from a working capital build of $2.4m. This should reverse in the coming quarters, thereby once again providing adequate distribution coverage of slightly over 100% for their very high near 15% yield, albeit with only a thin difference.

When looking at their operating cash flow each quarter, the occasional influence of their working capital movements is more easily visible. Despite their reported result varying slightly quarter-to-quarter, their underlying results that exclude their working capital movements are stable, thereby only varying slightly around low-$11m and low-$12m points since the start of 2021. Whilst yes, this also means they did not capitalize on the global energy shortage during 2022 like some of their peers who provide different midstream services than their ethanol storage and railcar fleet, it should be remembered, they also did not suffer during the severe downturn of 2020.

Even though 2022 was a quiet year thus far, it does not mean they represent a simple set-and-forget investment. Especially considering the thin difference between their free cash flow and distribution payments and thus as a result, it is important to consider the outlook for their storage and railcar fleet business segments. Unlike the former, the latter sees its operating leases progressively roll off across the coming years, as per the quote included below.

“Of our current leased railcar fleet, 23.5%, 25.9%, 21.4% and 14.4% of the railcar volumetric capacity have terms that expire in the years ended December 31, 2022, 2023, 2024 and 2025, respectively, or approximately 85.2% of our total current railcar volumetric capacity during that time frame. If at the end of the terms under the lease agreements, we do not enter into new commercial arrangements with respect to rail transportation services, our revenues and cash flows could decline and our ability to pay cash distributions to our unitholders could be materially and adversely affected.”

-Green Plains Partners 2021 10-K.

This is not necessarily a new dynamic and historically, they have signed new leases as necessary, hence their steady cash flow performance. Although, the recent troubles of USD Partners (USDP) who also operate railway midstream assets came as a surprise, as discussed within my other article, which in turn, prompted this closer look at Green Plains Partners. Thankfully, unlike USD Partners whose future hinges on Canadian oil, Green Plains Partners operates within the ethanol industry and obviously, sees vastly different demand for their assets.

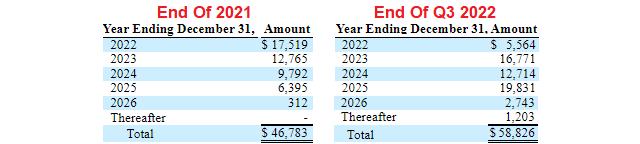

Admittedly, the ethanol industry is less transparent than the far larger oil industry, although given the information available, there is seemingly a positive outlook. The first indicator, their management did a remarkable job replacing their future operating lease revenue throughout 2022, as they actually increased its aggregate from $46.8m to $58.8m.

Green Plains Partners 2021 10K & Q3 2022 10-Q

This means they did not only replace their railcar fleet leases that were contracted during the first nine months of 2022, but rather, they increased these heading forwards. Whilst there are many moving parts to their partnership, this is nevertheless a positive sign for their future demand as well as financial performance and thus, by extension, their distributions. If any readers are interested in further details or the exact source of the tables included above, they can be found quickly by searching for “amended rail transportation services agreement” within their previously linked 2021 10-K and Q3 2022 10-Q. As a second indicator, their parent company, Green Plains (GPRE) who is obviously also their primary customer, struck a positive tone when discussing the outlook for this partnership, as per the commentary included below.

“…with volumes now trending upward because of higher run rates at the parent, we expect volumes well above MVC levels. As a result, the partnership continues to support higher returns to unitholders…”

-Green Plains Q3 2022 Conference Call.

Elsewhere, as a third indicator, the United States ethanol industry carries a degree of political risk given Federal mandated blending requirements for fuels. On this front, the Biden administration is preparing to increase the amount of renewable fuel that oil refiners must blend into their gasoline and diesel for 2023 and beyond. Whilst too early to quantify the exact benefit for Green Plains Partners, a simple rule of thumb is that more demand for ethanol should equal more demand for their midstream assets, both within their railcar fleet and storage business segments, thereby in turn further enhancing their outlook. Perhaps this could open the door to see higher distributions, but their growth outlook is nevertheless mixed in my eyes, largely due to the non-existent margin of safety afforded by their current free cash flow.

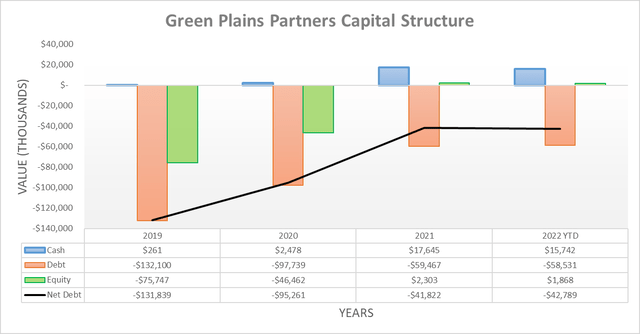

Following the analysis thus far, it should not come as a surprise their capital structure remains broadly unchanged after the first nine months of 2022. When looking at the most important element, their net debt, it remains effectively flat at $42.8m versus $41.8m at the end of 2021 with this minor increase obviously stemming from their working capital build. As a result, this makes it redundant to reassess their leverage or debt serviceability in detail because given these scant changes, by extension these are also not materially different versus the previous analysis. The same can also be said for their liquidity because their cash balance of $15.7m following the first nine months of 2022 is not materially different than its previous balance of $17.6m at the end of 2021.

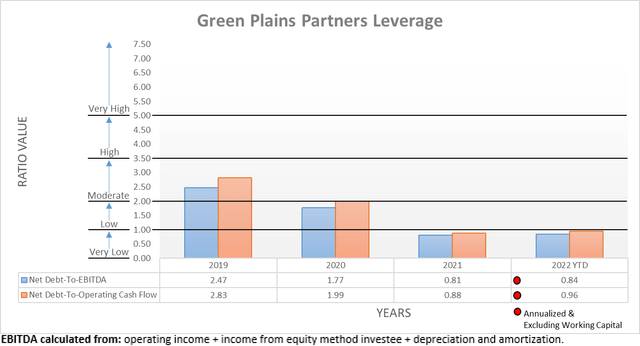

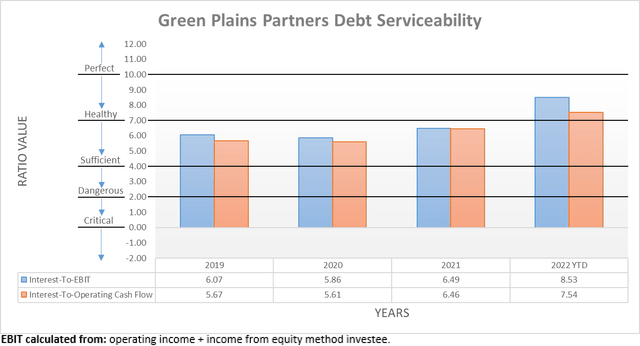

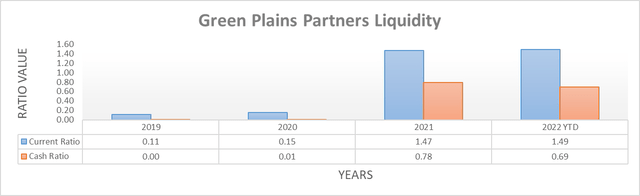

The three relevant graphs are still included below to provide context for any new readers, which shows their leverage remains within the very low territory with their net debt-to-EBITDA of 0.84 and net debt-to-operating cash flow of 0.96 both beneath the applicable threshold of 1.00. This also facilitates perfect debt serviceability with interest coverage of 8.53 and 7.54 if compared against their accrual-based EBIT and cash-based operating cash flow, respectively. Elsewhere, their liquidity remains strong with a current ratio of 1.49 and a cash ratio of 0.69, thereby making for a solid financial position. If interested in further details regarding these topics, please refer to my previously linked article.

Conclusion

Following a quiet and largely uneventful year during 2022, it seems that all indicators are looking up for 2023 with the Biden administration increasing ethanol blending requirements and management increasing the future operating lease revenue for their railcar fleet. Whilst positive, I am neutral regarding their distributions safety since on one hand, there is no reason to necessarily expect a cut but on the other hand, their free cash flow does not provide a margin of safety. Nevertheless, I am continuing to hold my units as I feel the reward of their very high near 15% distribution yield continues to outweigh these risks, and thus I still believe that my strong buy rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Greens Plains Partners’ SEC Filings, all calculated figures were performed by the author.

Be the first to comment