We’re finally through the Q4 earnings season for the gold miners (GDX) with a few names having later than usual reporting dates this year. One of these companies is Great Panther Mining (GPL), previously a silver producer that’s transitioned into a gold producer following the acquisition of the Brazilian gold mine, Tucano. Unfortunately, while this increased production profile has led to massive production growth, it’s done nothing to improve the company’s bottom line, with a massive net loss of $91 million for FY-2019. Worse, we’ve seen negative revisions in resources and reserves with the updated filings, suggesting the possibility for a shorter mine life than planned for at both the company’s mines. Based on Great Panther being a high-cost producer unable to generate positive annual earnings per share [EPS], even in a rising gold (GLD) price environment, I continue to see the stock as an Avoid.

(Source: Ausenco.com)

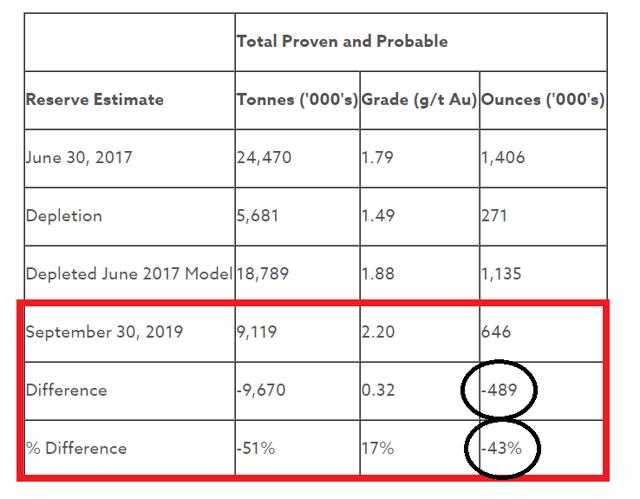

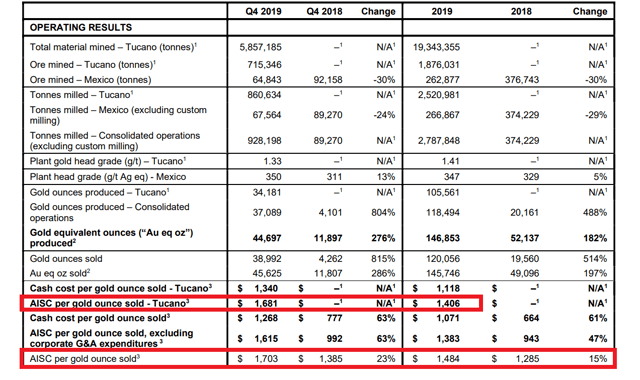

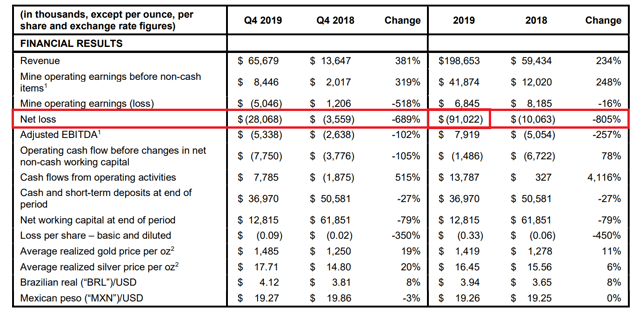

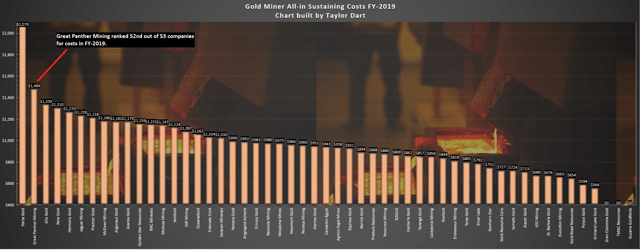

Great Panther is the most recent name to report its Q4 and FY-2019 results, and unfortunately, the underwhelming report has only added to the disappointing news dump we got earlier this month. For those that missed it, the company’s Tucano gold reserves were restated at 646,000 ounces, down from 1.13 million ounces in the prior report. This reduction of 489,000 ounces has shaved nearly four years off the mine life based on the current production profile (125,000 ounces per year) unless the company can replace thee ounces through exploration. As noted, the FY-2019 results weren’t anything special, with consolidated gold-equivalent ounce [GEO] production of 146,800 ounces at an all-in sustaining cost [AISC] of $1,484/oz. This cost figure is more than 50% above the industry average, suggesting that while the Tucano deal has been accretive to Great Panther’s production profile, it’s done little to help costs. Let’s dig into the company’s primary operations below:

(Source: Company News Release)

The company’s newest gold mine, Tucano, has had a challenging past several months, with a pit-wall failure at the Urucum South Central [UCS] pit last year, and a 40% reduction in reserves to start 2020. The mine, which was acquired from Beadell Resources, produced 105,500 ounces of gold in FY-2019, a massive boost to Great Panther’s production profile. However, AISC came in at $1,406/oz, 45% above the $950/oz industry average, leading to negligible margins for the mine last year despite a rising gold price. While FY-2020 guidance is pointing to a better year ahead with expectations for 125,000 ounces of annual gold production at a cost midpoint of $1,200/oz, this is still nothing to write home about.

(Source: Management Discussion & Analysis, Sedar.com)

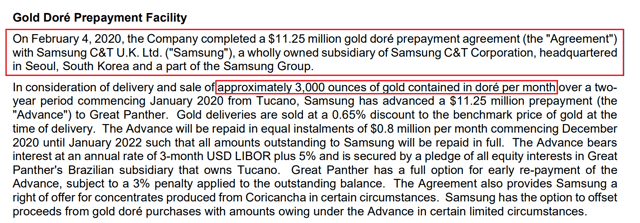

Even if the company can meet guidance, this improved cost figure is still more than 25% above the industry average and is quite ambitious in my view for a mine that has had its challenges. It’s worth noting that the company will only benefit from roughly 90,000 ounces of gold production at Tucano, as 3,000 ounces per month are going to Samsung C&T UK Limited. This is as part of a gold-ore pre-payment in exchange for the US$11.25 million payment to bolster Great Panther’s balance sheet. Therefore, while gold production is expected to grow year-over-year from 105,000 ounces at Tucano to 125,000 ounces, Great Panther will only see revenue on roughly 90,000 food ounces, after subtracting the 3,000 ounces per month payment.

(Source: Management Discussion & Analysis, Sedar.com)

Moving over to the Guanajuato Mine Complex [GMC], Great Panther saw annual silver-equivalent production of 1.5 million ounces at $13.21 all-in sustaining costs, providing some room for margins given that silver spent most of 2019 above $15.50/oz. However, we also got negative resource news from GMC, as the company’s measured & indicated resources at San Ignacio came in at just 5 million silver-equivalent ounces. This was a drop of 6.4 million ounces from the prior report. While 3.8 of the 6.4 million silver-equivalent ounces were reduced due to depletion through mining, the company saw a reduction in 2.6 million ounces due to narrower wire-frames for the resource model, and an increase in the net-smelter royalty [NSR] cut-off. The previous NSR cut-off was too conservative at US$71.00/tonne and has since been revised higher to US$100.00/tonne. Unfortunately, this 2.6 million ounce reduction has more than offset the added 1.5 million ounces of resources at Guanajuato, resulting in a net resource reduction of 1.1 million silver-equivalent ounces.

(Source: Mining-Journal.com)

Looking ahead to FY-2020, the company expects annual silver-equivalent production of 1.3 million ounces at all-in sustaining costs of $13.50/oz. Given the sharp drop in the price of silver over the past couple weeks, this will likely lead to margin contraction in FY-2020 compared to FY-2019. This is because costs are rising by 2.5% year-over-year, but we have a much weaker silver price. Based on this, the company has little margin for error at GMC in FY-2020 if the mine hopes to be profitable. Let’s take a look and see how this translated to the company’s bottom-line:

(Source: YCharts.com, Author’s Table)

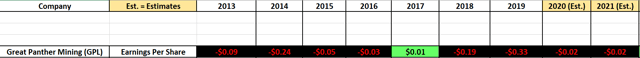

As we can see, the net losses keep coming for Great Panther, with the company being one of the few miners posting net losses per share in a year when gold made a run at new multi-year highs. For FY-2019, the company reported mine operating earnings of $6.8 million, but a net loss of $91 million for the company. If we unpack this $91 million net loss, we can see that it stemmed from a goodwill impairment at Tucano of $38.7 million, G&A expenses of $17.6 million, and exploration, evaluation & development expenses of $24 million. Therefore, while the company’s lines operated at a minuscule profit, the company was nowhere profitable for FY-2019. The only silver lining is that the company will benefit from no goodwill impairment in FY-2020 after we already saw a significant reduction in reserves at Tucano. Therefore, net losses should narrow in FY-2020, but any company operating at a net loss per share at $1,500/oz gold is undesirable, in my opinion, as an investment.

(Source: Management Discussion & Analysis, Sedar.com)

As we can see from the FY-2020 and FY-2021 annual EPS estimates, analysts aren’t all that optimistic either, with forecasts pointing to more net losses per share going forward. Given that more than 80% of gold producers reported annual earnings per share for FY-2019, it makes little sense to own a company that cannot operate at a profit. This is especially true when the gold price rose has lowered the bar significantly for companies to achieve profitability, as it has jumped from $1,250/oz to over $1,500/oz.

(Source: Author’s Chart & Data)

Based on the fact that Great Panther remains a cost laggard with net losses per share expected to continue in FY-2020, I continue to see the stock as an Avoid. The company may look cheap at a market cap of just over $100 million based on 312 million shares outstanding, but it is cheap for a reason, as there’s no clear path to profitability. The company’s margins continue to be nearly non-existent compared to industry average gross margins of over 20%, and this weighs on any investment thesis here. There are too many gold producers with exceptional costs and strong projects in Tier-1 jurisdictions to bother owning the laggards like Great Panther. Therefore, I see no reason to go bottom-fishing here, and I would view rallies to the $0.55 level as selling opportunities.

Disclosure: I am/we are long GLD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.

Be the first to comment