alainfinger/iStock via Getty Images

Who would have dreamt of raunchy, pop singer Tom Jones matching up with rock-blues legend Janis Joplin? In late 1969, Jones, of It’s Not Unusual fame, headlined a popular tv show and asked Joplin to join him. The result was a most unique collaboration of Raise Your Hand, one of Joplin’s concert repertoires. Great Lakes Dredge & Dock (NASDAQ:GLDD) is as unique as the unlikely Jones-Joplin duet. Most investors would not think of dredging as an essential service mostly supported by the US Government. The need to maintain and expand navigable shipping channels is essential to ocean-going trade. The replenishment of barrier coastal areas due to natural and storm-induced erosion is critical for protection of coastal areas. The soon-to-be boom in US East Coast offshore wind power generation adds a new dimension to firms specializing in ocean bottom work. Great Lakes Dredge & Dock sits right in the middle of these opportunities.

Great Lakes Dredge & Dock is the largest provider of dredging services and the only publicly traded US dredging company. Dredging is the “simple” task of moving the sea bottom from Point A to Point B. The need to widen and deepen ports and navigable channels is rising as ocean-going trade utilizes wider and deeper-draft ships. In addition, the natural movement of sand and silt works against the need to keep channels open, creating a maintenance opportunity for dredging firms. The heightened severity of ocean storms causes coastal erosion to become a critical issue in coastal protection. These factors are expected to contribute to a steady growth of the US dredging market of 2% to 3% annually.

Funding for dredging projects mostly comes from the US Government, through the US Army Corps of Engineers ACE as they are authorized to manage harbors and coastal areas. In addition to annual appropriations, the federal government collects an import ocean-going harbor maintenance tax which funds dredging projects. Much like the Highway Trust Fund, the Harbor Maintenance Trust Fund earmarks ~$800+ million a year for maintenance dredging projects. The HMTF is under congressional direction to not only annually spend the incoming revenue but to work off its $9 billion surplus which had built up over the past 20 years.

According to its most recent investor presentation, Great Lakes Dredge & Dock believes it has realized a 3-yr average of 35% market share on a typical US bid pool of $1.8 billion annually and is more than 50% higher than the next largest competitor. The dredging market is split between inland lakes & rivers, such as the Mississippi River, and open-water harbors and coastal areas, such as Houston Ship Channel and beach restoration. GLDD specializes in harbor and coastal projects, mainly along the Gulf of Mexico and East Coast.

Great Lakes Dredge & Dock has a 130-year history in the dredging business. In the mid-2010s, the company attempted to expand into coastal environmental remediation and failed miserably. In 2017, there was a management change and CEO Lasse Petterson was hired to turn the company around. Since his hiring, Petterson has set out new corporate priorities, as outlined in a 2020 conference call:

#1 – Refreshing the fleet

#2 – Getting into markets that are very close to what we do, like offshore wind

#3 – Acquisitions

#4 – Dividends and share buybacks

Management has been buying new dredging ships and upgrading many of its vessels. In late 2017, Great Lakes Dredge and Dock took delivery of the $150 million Ellis Island vessel, a 15,000 cubic yard trailing suction hopper dredge. The Ellis Island has one of the largest capacity hoppers in the US. GLDD is also taking delivery in early 2023 of a new 6,500 cubic yard trailing suction hopper dredge, the Galveston Island. Last week, GLDD announced it was exercising its option for an additional hopper vessel which will be a sister ship to the Galveston Island, with delivery in early 2025. These two vessels will add to GLDD’s capabilities in harbor and channel maintenance assets.

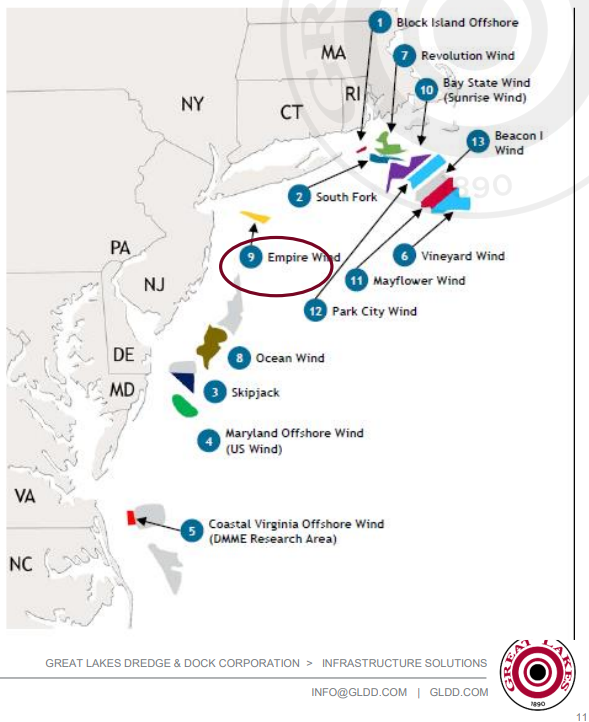

In addition, Great Lakes Dredge and Dock is expanding into new markets with the $197 million order for the first U.S.-flagged Jones Act compliant subsea rock installation vessel used in the construction of offshore wind turbine installation. As wind farms are constructed onshore and assembled offshore, the Jones Act requires a US-flagged ship to be utilized, and GLDD with have the first of its kind when delivered in late 2024. Just as with its new hopper dredgers, management has an option for a sister ship, which could be delivered in 2027. With the US firmly in place to build at least eleven large offshore wind farms, the additional capability to service this growth platform will continue to set GLDD apart from its peers. Below is a graphic of the opportunities management sees in this marketplace, also from GLDD most recent presentation.

Location of Offshore Wind Farm Projects (GLDD Investor Presentation)

The new asset is classified as a subsea rock installation vessel which are widely used in the offshore construction industry to stabilize and to protect underwater pipelines, cables, and other structures at the sea floor. For the offshore wind industry, these vessels will also install a protective covering of rock around turbine foundations. More information on this type of vessel can be found at the ship designer website, Ulstein Design & Solutions B.V.

Great Lakes Dredge & Dock is in active discussions with several firms seeking to build offshore wind farms. Last month, GLDD announced a contract to provide services to Empire I and Empire II wind farms off the coast of New York. Empire Wind is a joint venture between Equinor (EQNR) and BP (BP). It should be of interest that Dominion Energy (D), an electric and gas utility with big plans for offshore wind power, has ordered its own wind farm specific, Jones Act compliant vessel to be used for the installation of the wind turbine towers. D’s investment runs a cool $500 million. Unlike in international offshore wind farm construction, the US market is strictly protected by the Merchant Marine Act of 1920. Known as the Jones Act, it shields domestic shipping-related enterprises by restricting water transportation of cargo between U.S. ports to American-built and -owned vessels crewed by U.S. citizens. Currently, these two vessels will be the first in their specialties to pass the requirements of the Jones Act and will put them in a priority position for construction contracts.

An example of Great Lakes Dredge & Dock opportunities is the recent start of Project 11, the $1 billion widening of Houston Ship Channel. Phase 1 is a $92 million contract, awarded to GLDD, to dredge and widen from 530 to 700 feet a 11½-mile portion of the channel. In addition to enlarging the channel, GLDD will also pump 1.6 million cubic yards of dredged material to beneficially construct a new island for bird habitat and oyster mitigation. Project 11 is an ambitious 5-yr plan to dredge and widen the 52-mile Houston Ship Channel.

Great Lakes Dredge & Dock is not covered by many on Wall Street. As a small-cap specialty construction firm, only 2 Street firms follow GLDD. According to SA’s Wall Street Sell Side Ratings, the firms covering the stock rate it as a Buy with a price target range of $17 to $20, for a 18% to 39% potential capital gain. During times of market volatility (read market declines), it is critical to evaluate how investments have performed against the “market”. Some websites list GLDD as having a beta of 0.88 while others calculate it at 0.70. Either way, the important aspect is that GLDD should move up and down less than the market percentage, which in a down market is a very good attribute in stock selection. SA lists the performance of GLDD as beating the S&P 500 Index (SPY) returns for 1-week, 1-month, 6-month, YTD, and 1-yr periods. In the 3-yr return period GLDD has equaled the SPY at 35.8% vs 36.3%.

I consider Great Lakes Dredge & Dock as a GARP selection – growth at reasonable price. While by nature earnings can be lumpy and depend somewhat on drydock maintenance scheduling which will temporarily reduce project work, overall GLDD should have a steadily expanding asset base which will drive revenue and earnings higher over the years. The US dredging market is considered robust by industry experts with line-of-sight opinions suggesting full speed ahead for the business.

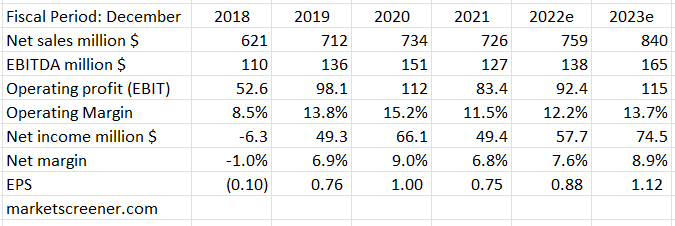

Below are Great Lakes Dredge & Dock financial results and forward estimates as published by marketscreener.com.

Financials for Great Lakes Dredge & Dock (marketscreener.com)

There is a lot to like about investing in Great Lake Dredge and Dock and is one of my long-term infrastructure stock selections. I have an average size position and plan on adding on a severe market downdraft. If I was not a current shareholder, I would definitely put GLDD on my radar screen as a long-term holding in the investment bucket titled: Equities Bought Primarily for Capital Gains.

Author’s Addendum: In the late 1960s, there were several musical tv shows highlighting top artist of the day. Tom Jones had his own show and invited Janis Joplin to appear and to sing a duet. The song chosen, Raise Your Hand, was one of Joplin’s concert repertoires. Joplin seemed to inspire Jones to new peaks of energy and managed to transform the sometimes-flat sound of tv’s live stage into one that was charged with electricity. Jones, now aged 82, had become one of the best-selling artists in history, selling more than 100 million records. Sadly, Joplin died in October 1970 from a drug overdose at the age of only 27, so her performance with Jones became one of her final swan songs. In 2004, she was ranked number 46 on Rolling Stone magazine’s list of the 100 greatest artists in history. Watching the video of this performance (search “Tom Jones & Janis Joplin – Raise Your Hand” in YouTube) is a real treat and, while a bit rough, is very worthy of your time to watch. The backup dancers are certainly something to behold and takes me back to late 1960s summer dances around the beach. Enjoy.

Be the first to comment